Content Hub

Thrive Through Connection

Thrive Through Connection is your go-to resource for building relationships that drive your business forward—because fundraising isn’t just about capital, it’s about connection.

Latest Posts

See More See MoreHow to Raise Venture Capital in Latin America: Top VCs and Resources

Fundraising

Operational Excellence in VC: Behind the Curtain with Screendoor

Operations

Fundraising Feedback, Slide by Slide

Product Updates

Categories

Discover all the categories and find the content you're looking for about Visible.

Blog Content

Insights and stories for founders and investors.

Podcast Episodes

Conversations that shape the founder-investor journey.

Fundraising Roadmap

An in-depth fundraising course to go from deck to check.

YouTube

Videos that bring founder and investors stories to life.

Thrive Through Connection

Get the fundraising answers you need from top investors and founders who’ve been there.

Topics

- Finding the Right Investors about Finding the Right Investors

- Investor Outreach about Investor Outreach

- Pitching VCs about Pitching VCs

- Fundraising Pipeline Management about Fundraising Pipeline Management

- Negotiation Terms about Negotiation Terms

- Closing the Round about Closing the Round

- Now You Have Investors about Now You Have Investors

The Role of AI in Startups and Venture Capital + Top VCs Investing in AI

Fundraising

The 12 Best VC Funds You Should Know About

Fundraising

60+ Active Seed Stage SaaS Investors & Fundraising Tips

Fundraising

Top NYC Venture Capital Firms: The 2026 Founder's List

Fundraising

The Role of AI in Startups and Venture Capital + Top VCs Investing in AI

Fundraising

The 12 Best VC Funds You Should Know About

Fundraising

60+ Active Seed Stage SaaS Investors & Fundraising Tips

Fundraising

Top NYC Venture Capital Firms: The 2026 Founder's List

Fundraising

All Encompassing Startup Fundraising Guide

Fundraising

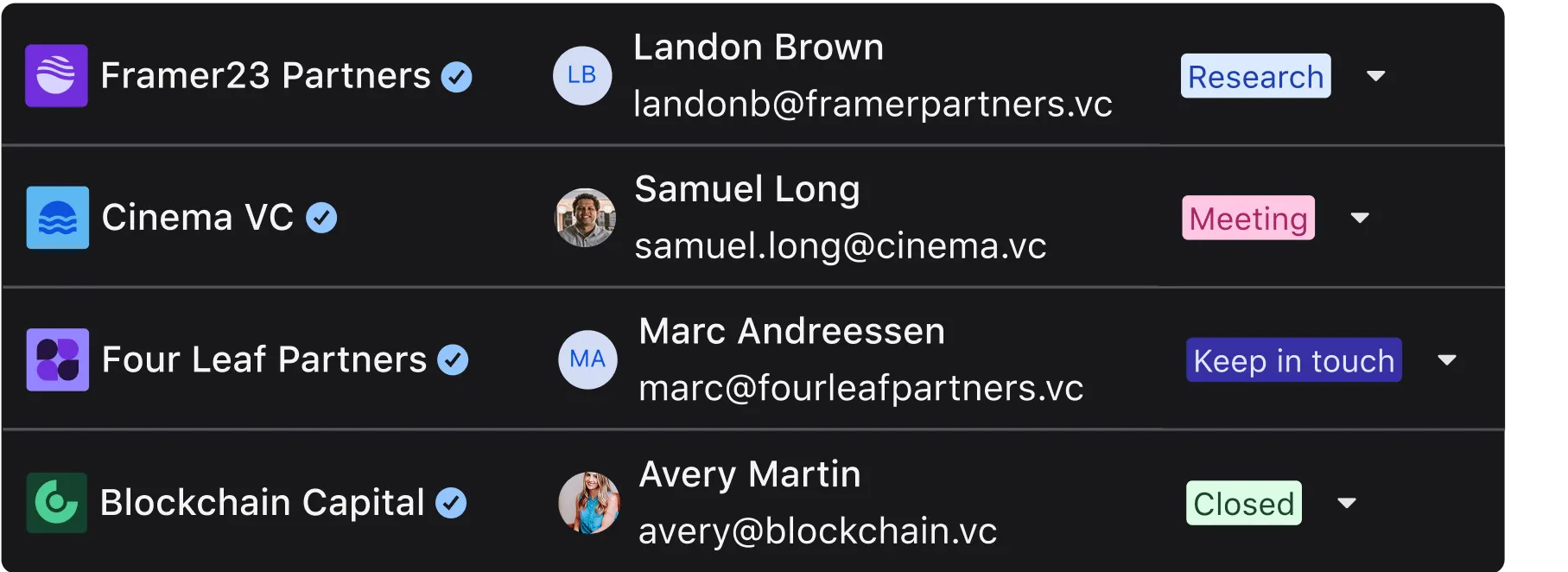

CRM For Fundraising

Fundraising

Investor Outreach Strategy: 9 Step Guide

Fundraising

How to Cold Email Investors in 2026 (Templates + Tips)

Fundraising

The Startup Metrics That VCs Want to See

Metrics and data

23 Pitch Deck Examples

Fundraising

Pitch Deck 101: How Many Slides Should My Pitch Deck Have?

Fundraising

Tips for Creating an Investor Pitch Deck

Fundraising

The Most Popular Data Room Folders

Fundraising

What to Include in a Data Room for Investors: Essential Guide for Startups

Fundraising

A Step-By-Step Guide for Building Your Investor Pipeline

Fundraising

How to Cold Email Investors in 2026 (Templates + Tips)

Fundraising

6 Components of a VC Startup Term Sheet (Template Included)

Fundraising

How to Get Your Startup Ready for Investors’ Operational Due Diligence

Operations

The Startup's Handbook to SAFE: Simplifying Future Equity Agreements

Operations

Navigating Your Series A Term Sheet

Fundraising

SAFE Fundraising: When to Consider & Benefits

Fundraising

How to Write a Cover Letter for Your Data Room

Fundraising

The Most Popular Data Room Folders

Fundraising

What to Include in a Data Room for Investors: Essential Guide for Startups

Fundraising

How to Create a Board Deck (with Template)

Reporting

Investor Reporting for Startups: A Practical Guide to Building Trust and Raising Capital

Reporting

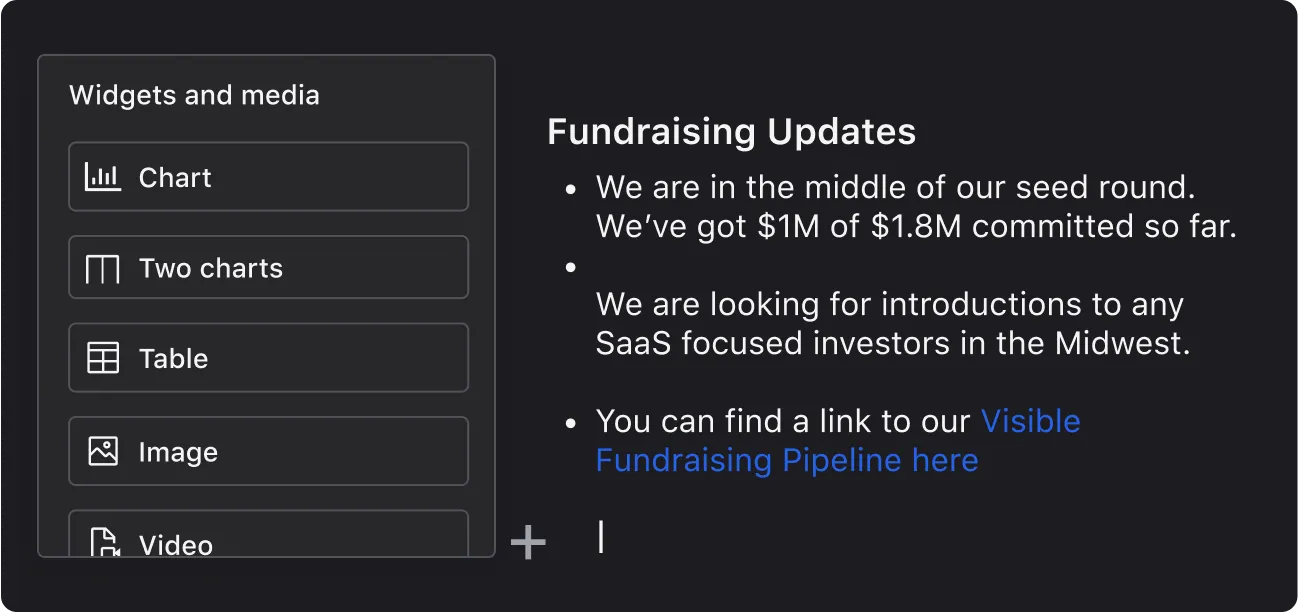

The Most Common Update Content Blocks

Reporting

How To Write the Perfect Investor Update (Tips and Templates)

Reporting