What is a Portfolio Review Meeting in Venture Capital

A portfolio review meeting in the context of Venture Capital is a dedicated time for the investment and operational team members at an investment firm to align on recent updates across the portfolio. Other purposes of this meeting are to exchange cross-functional insights and coordinate the best ways to support portfolio companies. Check out this sample agenda that is similar to what is used by Visible customers.

Who Typically Leads Portfolio Review Meetings?

Portfolio review meetings can be led by anyone at the firm but since the meetings are largely focused on updates about portfolio companies, it is often led by the person responsible for collecting and synthesizing updates from portfolio companies on a regular basis. At a smaller firm, this person may be a Partner, and at a larger VC firm, this person often has the title of Platform Manager, Director of Portfolio Operations, or someone in finance. Ultimately, it should be led by someone with a wide-lens view of what is going on across the portfolio.

Related Resource –> Portfolio Data Collection Tips for VCs

Portfolio Review Meeting Frequency

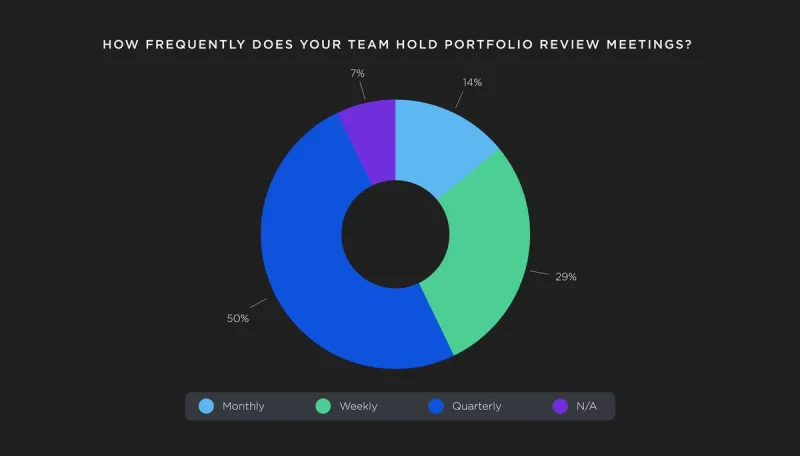

According to a poll led by Visible, 50% of VC’s are hosting Portfolio Review Meetings on a quarterly basis, followed by 29% weekly, and 14% monthly.

The frequency of this meeting largely depends on the size of your portfolio company and how hands-on you are with your companies.

A quarterly frequency makes sense for most VC firms because 70% of investors are collecting structured data from their companies on a quarterly basis. (Source data is aggregated usage data on Visible’s portfolio monitoring platform used by 660+ VC funds).

How Investors Are Leveraging Visible to Enhance Portfolio Review Meetings

Visible makes it simple to centralize your fund and portfolio company performance so you can conduct your Portfolio Review Meetings in the solution! For a step-by-step resource on how to run your portfolio review meeting in Visible, refer to this guide.

VKAV’s Portfolio Company Dashboards

Verod-Kepple Africa Ventures (VKAV), a long-term Visible user, hosts a formal Portfolio Review Meeting on a quarterly basis. During this meeting, Portfolio Review Committee members join to review the performance of the portfolio companies during the quarter. Additionally, VKAV’s investment team holds an internal Portfolio Review Meeting every other week. Right now, the purpose of this meeting is mostly to check the status of action items (either for VKAV or the portfolio company). VKAV keeps track of open action items directly on a company’s dashboard in Visible so that it is linked to the broader context of how the company is performing.

How Emergence Capital Uses Visible for Portfolio Review Meetings

Emergence Capital has transformed its portfolio review process by embracing Visible’s powerful KPI tracking and portfolio monitoring tools. As Andrew Crinnion, Emergence’s Director of Portfolio Analysis, puts it, “Visible streamlines our data collection process, providing a centralized source for all portfolio information,”. By pulling consistent, timely data from their companies, they enter meetings with clarity and agility, minimizing manual prep, elevating transparency, and enabling sharper, data-informed discussions with LPs. Visible’s seamless workflow turns what used to be hours of spreadsheet wrangling into strategic storytelling grounded in metrics.

Check out how Emergence Capital turns portfolio data into their advantage.

01 Advisors Approach to Portfolio Review Meetings

01 Advisors a San Francisco-based venture firm utilizes Visible’s Request feature to streamline the way they collect data from companies on a quarterly basis. The team meets 1-2 times per quarter for an internal Portfolio Review meeting. Check out their meeting agenda outline below.

01 Advisors Portfolio Review Meeting Agenda

- Investment Strategy

- Portfolio Company Categorization

- Reserve Allocation Strategy

- Portfolio Company Support

Learn more about how 01 Advisors uses Visible for the internal portfolio review meetings in this video.