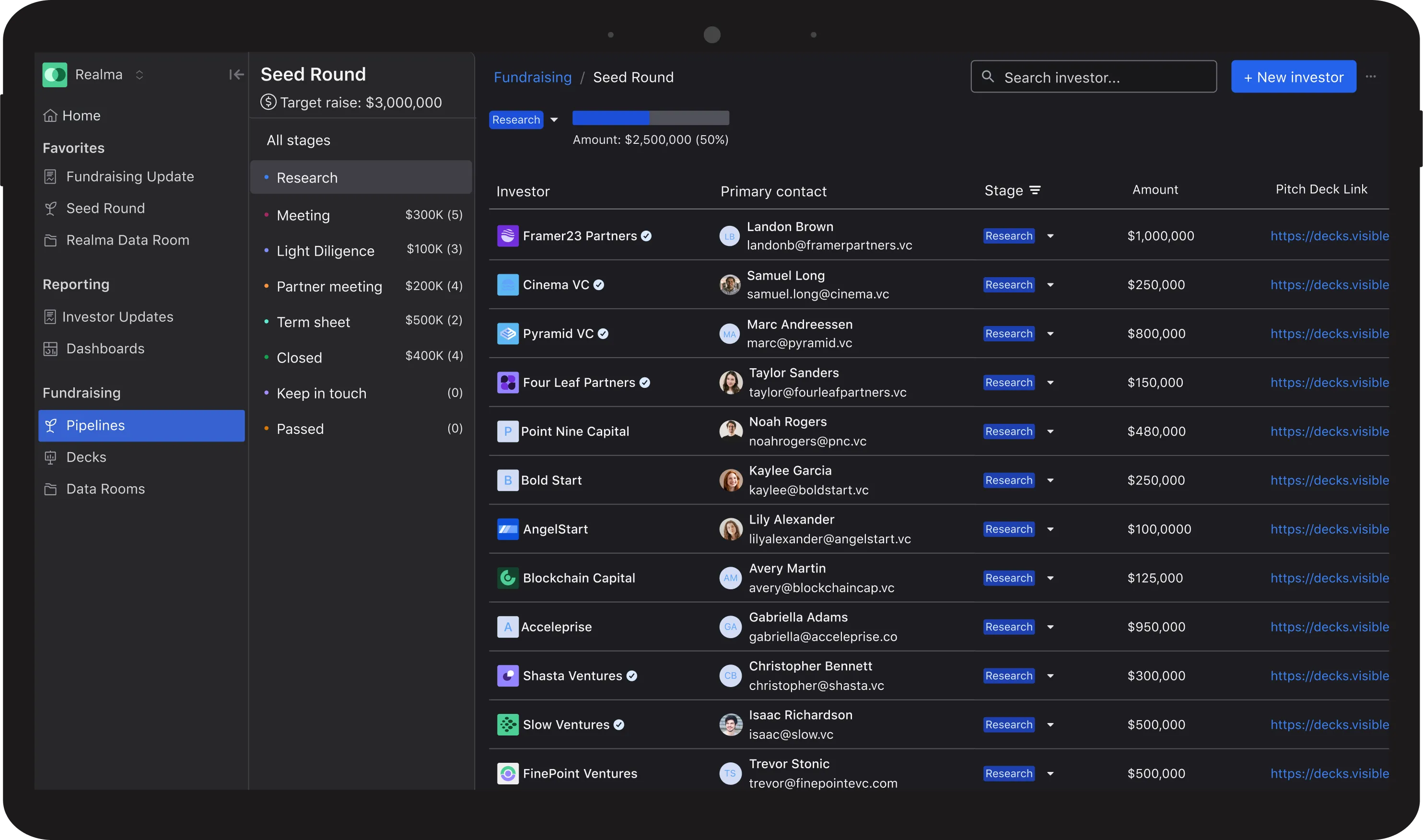

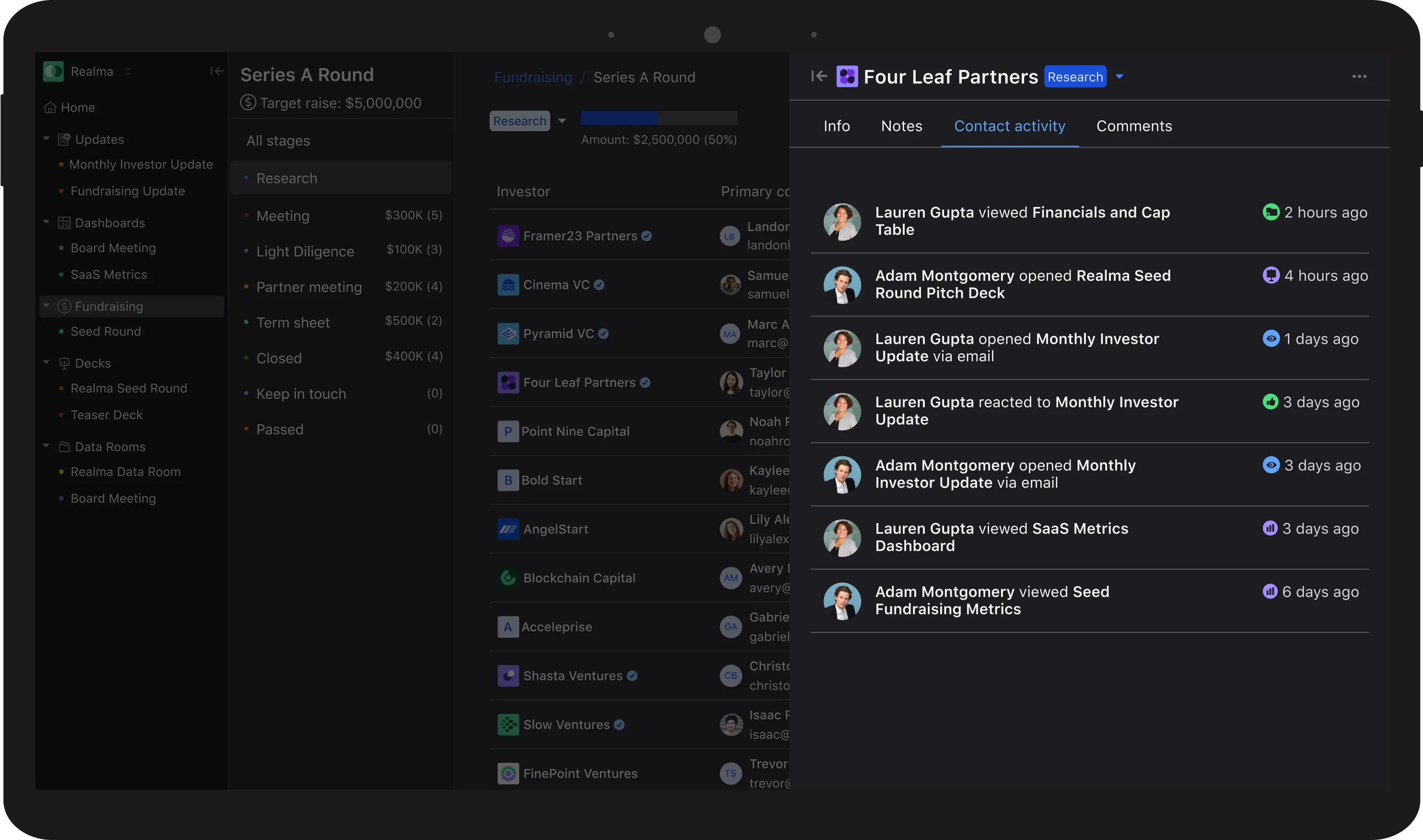

Pipelines

Understand how investors engage with your email, updates, decks, and data rooms to move your relationships forward.

Trusted by Over 6,100 Founders

Purpose-Built for Your Most Expensive Relationships

Fundraising often mirrors a traditional B2B sales and marketing funnel. Just as a sales and marketing team have dedicated CRMs, we believe founders should have the same when managing their most expensive asset, equity.

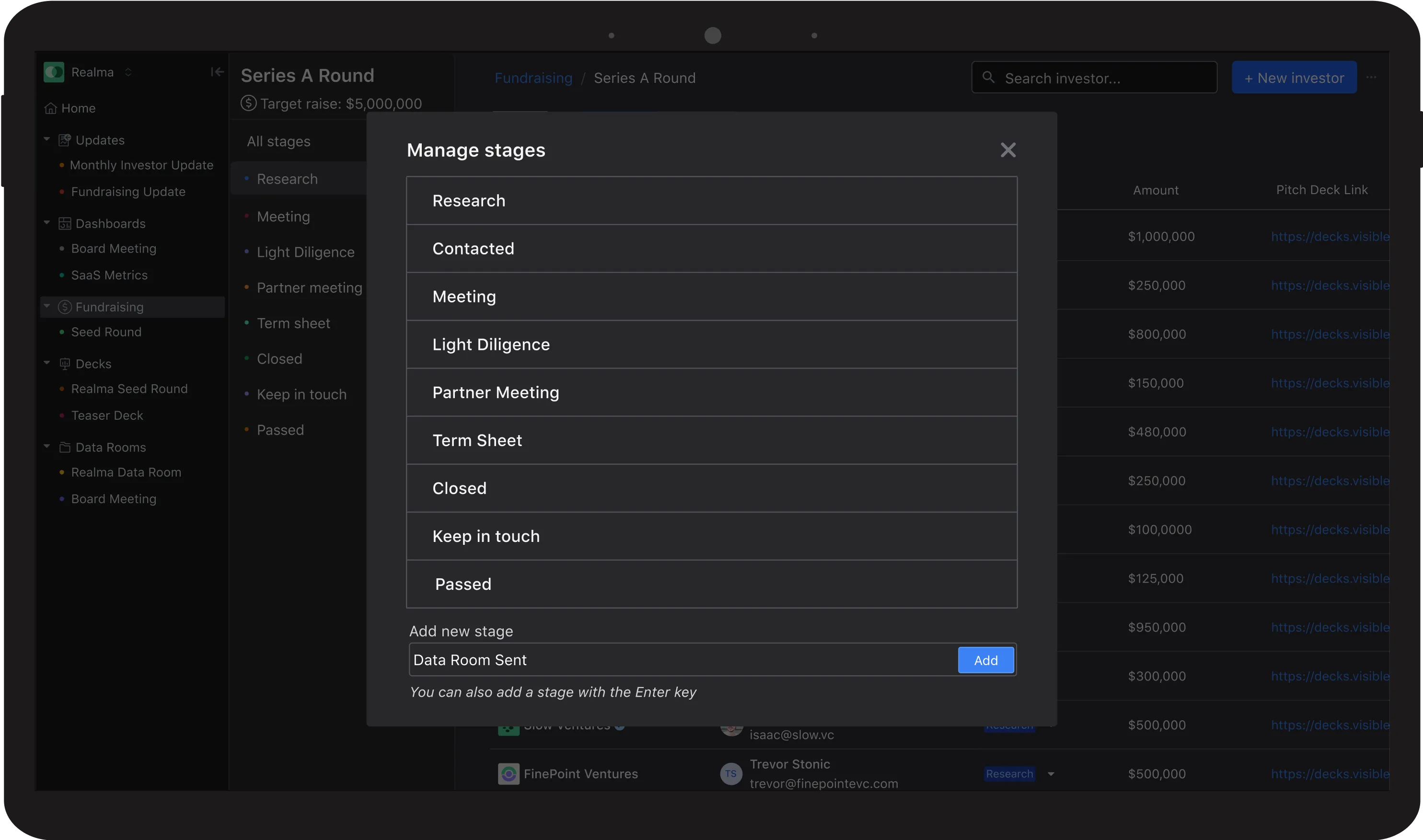

Personalize Your Fundraising Efforts

Create custom stages, properties, and pipelines specific to your investor relationships.

- Create custom properties to track your most important information

- Move investors down your funnel with custom stages

- Take notes and set follow-up reminders

Insights That Help Power Capital Raises

Gain insight into how investors are engaging with your content.

- Track engagement with your Visible Updates, Decks, Dashboards, and Data Rooms

- Sync external emails for a comprehensive communication overview

- Analyze engagement trends to identify active investors

Jumpstart Your Capital Raise with Our Investor Lists

Add one of our curated Visible Connect investor lists to your fundraising pipeline or browse our database yourself

Trusted by Thousands of Founders

Manage Your Capital Raise From Deck to Check

Visible is your command center for your capital-raising efforts. Manage your capital raise from start to finish with our investor database, investor pipelines, data rooms, and pitch deck sharing.

Questions About Fundraising Pipelines

Check out some common questions and answers we regularly receive about fundraising pipelines below:

How do I run a fundraising process?

At Visible, we like to treat fundraising as a traditional B2B sales & marketing process. At the top of your funnel you’re bringing in new potential investors, in the middle you’re nurturing them with updates, meetings, etc., and at the bottom you are ideally closing them as new investors. Learn more about running a fundraising process.

What is a fundraising pipeline for startups?

Just as a sales team has the tools and resources in place to help them sell, the same should be true for a founder fundraising. A fundraising pipeline is a way for founders to centralize and track the status of their ongoing investor conversations and fundraises.

How many investors should be in a fundraising pipeline?

The average founder using Visible has 48 investors in their pipeline. Most investors recommend targeting anywhere from 50-100 investors to kick off your fundraise. Learn more about building an investor list and pipeline.

What stages are in a fundraising pipeline?

The stages for a capital raise will depend on the business. However, we commonly see founders use the following stages when setting up their fundraising pipeline — Research, Contacted, Meeting, Light Diligence, Partner Meeting, Term Sheet, Closed, Keep in Touch, Passed.

How do I find investors for my startup?

Building an investor list typically starts by determining youre ideal investor. This includes their investment focus, stage focus, check size, geographic location, etc. From here you can use databases to help build your list. Learn more about our free investor database, Visible Connect.

Manage Investor Relationships like a Pro with Visible

Get Visible Free