About Laurel & Hampr

Laurel Hess is the CEO and Founder of hampr. hampr is a peer-to-peer, on-demand laundry app that provides magical wash-and-fold service at the push of a button!

As the hampr website states, “The idea for hampr came after a chaotic weekend with kid sports games and 3 birthday parties. On top of that, there was still grocery shopping, cleaning the house, and oh, spending meaningful time with the family. Laurel was over it. So she thought “Hold on, why can’t laundry be as easy as ordering groceries with a tap of your phone?” And just like that, bam! hampr was born in 2020.”

Quick facts:

- Founded Year: 2020

- Headquarters: Lafayette, Louisiana

- Total Funding Amount: $9.7M

- Notable Investors: Techstars,VILLAGEx

Learn more about hampr and give it a try yourself here

The Power of Investor Updates for Laurel

Investor updates can be a powerful tool for startup founders. Most VCS only hear from 10-50% of their portfolio companies on a regular basis. This is a major arbitrage opportunity for founders. Investor updates can help you stay top of mind with investors and secure help with fundraising, hiring, closing customers, strategy, etc — all in just an hour or less.

As Laurel Hess wrote in her LinkedIn Post, “It boggles my mind how many founders don't do regular company updates to stakeholders (and potential investors!). So many people I know treat this as a chore - when it can be the highlight of your month (like it is mine!).

Taking the time to review your business with your stakeholders is actually a really great opportunity for growth - if you view it that way, there is a ton of potential to unlock.

I have gained the following from my regular updates:

- Intros to potential investors

- Additional capital for a round I'm working on

- Intros to new verticals for expansion

- Advice on strategy for a problem we are working on

- Intros to new mentors/advisors to unlock the next phase of growth

Allllll this for just 1 hour of my time each month? That is the definition of no-brainer."

Laurel’s Investor Update Template

Sticking to a template and format can help build regular investor updates into your monthly rhythms. Laurel shared her monthly template that she uses in Visible via a LinkedIn Post, you can check it out below as well:

“I have used Visible to manage my updates almost since the beginning. I love this company - they make it SO EFFORTLESS to send really factual, data-driven updates.

SO, using Visible, this is how my monthly updates are typically structured:

1. Overview - this is a high-level, personal letter from me about the high notes and low notes of the update. Basically a TL/DR section.

2. Asks - I don't always have these but when I do, I have them right after my summary so it's high on the scroll.

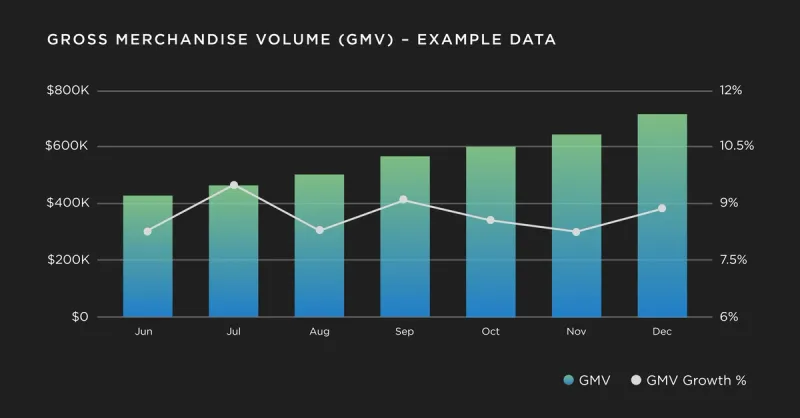

3. Performance - I add charts on GMV growth month-over-month followed by membership KPIs in a chart (growth, churn and renewal). Then I add a summary with my insights/thoughts on each chart. Check out an example of a Visible chart below:

4. What we are excited about: A section on 1 or 2 things that the team is working on that we are really excited about - usually with a photo.

5. What we are Improving/Exploring: This is a realness section of challenges and concerns that we have and what we are doing to actively improve on them.

AND THAT'S IT! It gives a super high-level overview of where we are, what our focus is, and how we are unlocking new opportunities. It's skimmable, it's concise and it's easy for everyone. AND because I use Visible.vc, it automatically ports in the numbers I need for my charts each month so all I have to do is replicate the previous month's email and then go to town. I can get a very thoughtful email out in 1 hour or less - and it gives me so much more in return.”

Check out Laurel's template and add it to your Visible account below:

Send Your Next Investor Update with Visible

Join Laurel and the 3,300+ founders that use Visible to update their investors every month. Try Visible free for 14 days.

Not sure where to get started? Check out our Update Template Library.