Why share a cover letter with your data room

Organizing and structuring a data room is important. As Elizabeth Yin of Hustle Fund wrote, “Impressive companies have everything organized, easy to find:

- All documents are filed in the correct folders

- All important documents are included

- Everything is clearly labeled and easily searchable”

In addition to the contents of your data room, investors will use your data room to evaluate your organizational skills. To make sure investors can navigate and understand your data room, you need a clear structure and need to give investors the context they need to understand the contents.

A cover letter is a great way to introduce investors to your data room and explain its content and structure. Check out a cover letter template to get you started on your next data room below.

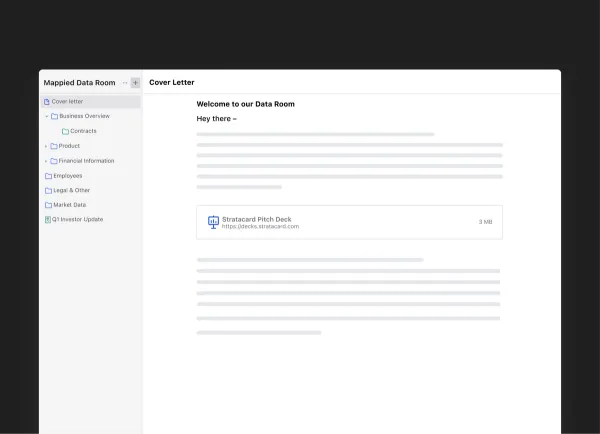

Cover letter example for your data room

Hello — Welcome to our seed stage data room! The purpose of this cover letter is to help you navigate our data room. As always, feel free to email me directly at [Email Address] or text me at [Phone Number.]

The video below should be a good starting point:

[Embedded 1-3 minute video explaining the layout and format of data room]

You’ll notice we have our data room broken down into X major folders:

- Overview — This page, our most recent pitch deck, and other high level information.

- Financials — Historical financial documents, statements, and projections for the next 12 months.

- Cap Table and Financing Information — Our current cap table, founder stock purchase agreements, options plans, 409a valuation, etc.

- Market Data — Market sizing activities and competitive landscape.

- Incorporation Docs — Our bylaws, articles of incorporation, and more.

- Team and Stakeholders — Current employee contracts, relevant experience, and info on current board members.

- Milestones & Past Investor Updates — Take a look at our last 12 investor updates to see how we’ve grown and communicated the past year.

- Product — A recent video recording of our product and a few testimonials from customers.

Thank you and let me know if you have any questions!

[Name]

Build and share your data room with Visible

At Visible, we oftentimes compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors. Throughout each of those stages, you need to leverage data room software to stay efficient and organized.

Beyond DocSend: Exploring Innovative Document Sharing Platforms for Modern Teams

Deciding on the best data room provider can be tough, but with the introduction of Visible Data Rooms, you can now manage every aspect of your fundraising funnel with Visible.

- Find investors at the top of your funnel with our free investor database, Visible Connect

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.