Virtual Data Room Software

Trusted by Thousands of Founders

Virtual Data Room Software for Founders

Raising capital or navigating an acquisition? You’ll need a virtual data room (VDR) to manage the process efficiently. Virtual data room software enables startups to securely share sensitive documents with investors, buyers, and stakeholders. From early-stage fundraising to mergers and acquisitions (M&A), the right VDR ensures security, transparency, and a smooth due diligence process.

For founders of VC-backed startups, choosing the best data room for startups can make a big difference. This guide will cover what a virtual data room for startups is and why startups need one, key features of the best virtual data room software for M&A, pricing models and cost comparisons, free vs. paid VDRs, how to select the best virtual data room provider for M&A, and a data room for investors checklist.

What Is a Virtual Data Room?

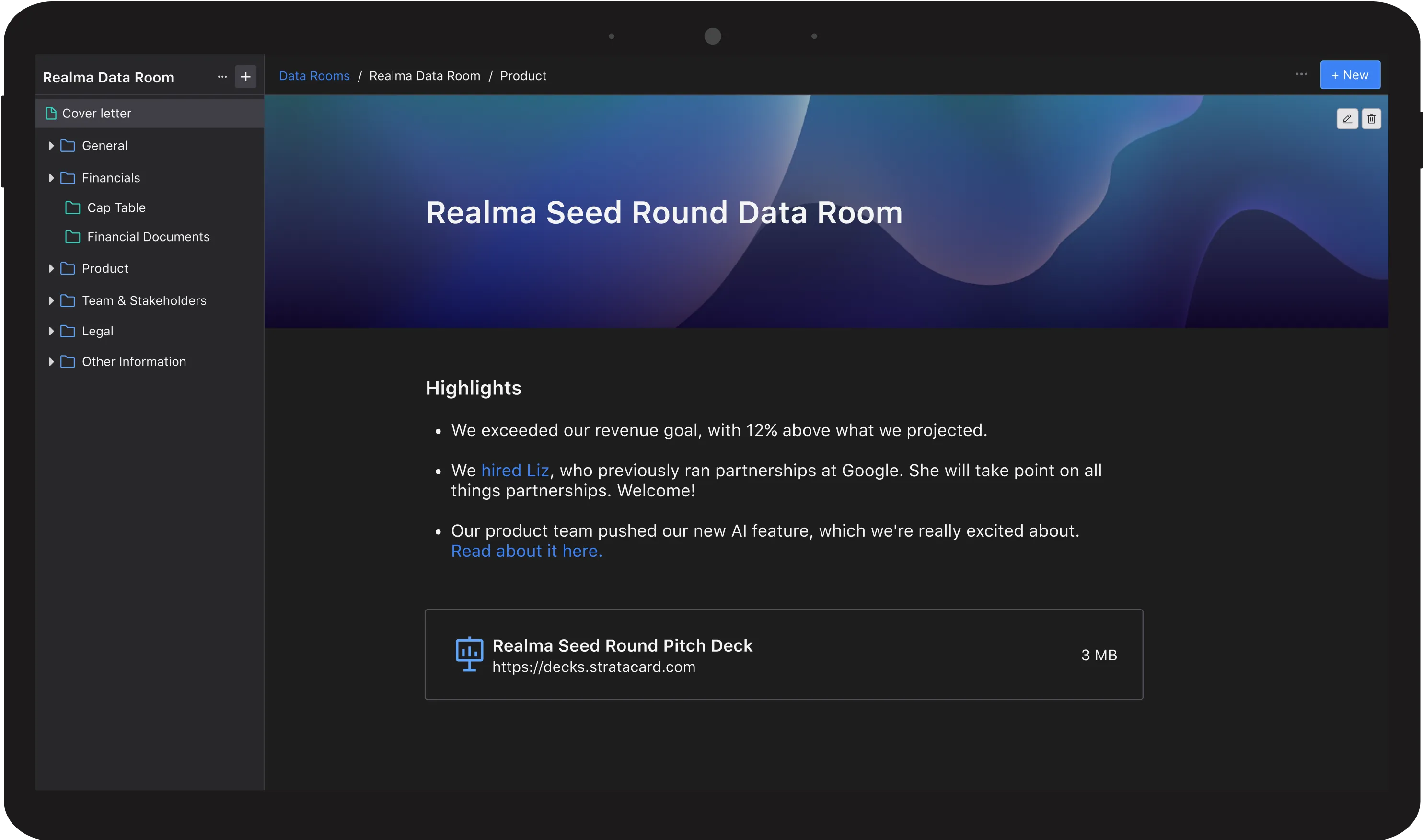

A virtual data room for startups is a secure online platform for storing, organizing, and sharing confidential business documents. Unlike basic cloud storage solutions, VDRs offer advanced security, access controls, and document tracking—essential for investor due diligence and M&A.

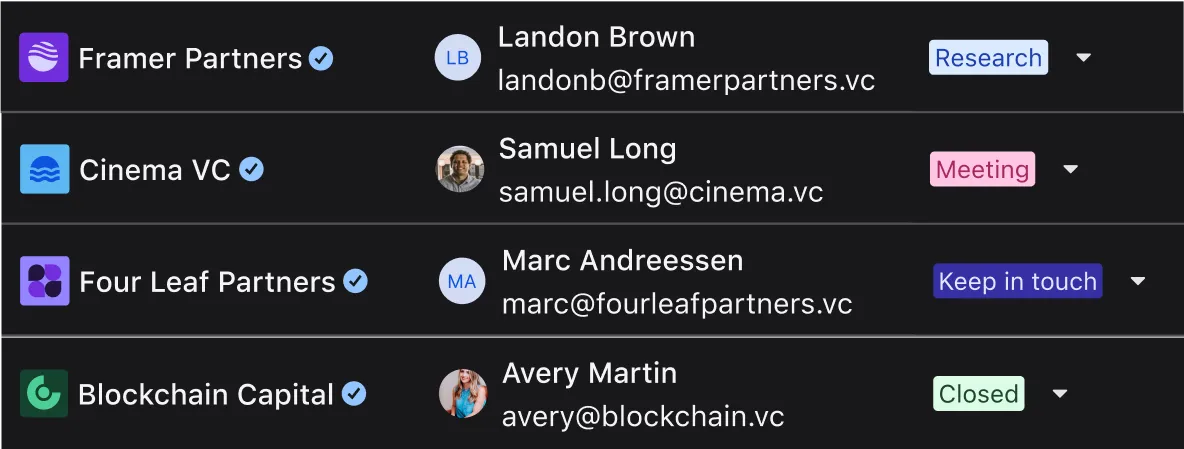

Startups use the best virtual data room for startups for multiple purposes. During fundraising, they provide a secure way to share financials, cap tables, and legal documents with investors. In M&A transactions, VDRs facilitate structured access to company records for potential buyers. For ongoing investor relations, they keep key stakeholders informed with organized reporting. Compared to general file-sharing services, virtual data room software is designed specifically for high-stakes transactions, ensuring both security and compliance.

Why Startups Need a Virtual Data Room

For founders, raising capital involves managing investor conversations, due diligence requests, and document exchanges. A well-organized VDR streamlines this process, helping startups build credibility and move faster.

The best data room for startups enables faster due diligence by allowing investors to quickly review financials, contracts, and growth metrics in one secure place. It improves organization by consolidating important documents in an easy-to-navigate structure. Having a well-prepared data room signals to investors that a startup is organized and ready for funding. VDRs also enhance security by offering advanced access controls that prevent unauthorized access and data leaks. Founders raising a pre-seed round should set a pre-seed data room early to avoid scrambling for documents later.

Key Features of the Best Virtual Data Room Software

Not all virtual data rooms are created equal. When selecting the best virtual data room for startups, security and compliance should be a top priority, including encryption, multi-factor authentication, and regulatory compliance. Access controls and permissions should allow different levels of access for investors, legal teams, and internal staff. Document tracking and audit logs help founders monitor who has accessed files and what actions were taken.

A well-designed virtual data room provider M&A should also be easy to use, with an intuitive interface that allows users to find and manage files efficiently. Collaboration tools, such as built-in Q&A features, comments, and investor communication options, can further streamline interactions during due diligence.

Virtual Data Room Pricing: What Founders Should Expect

Pricing for virtual data room software varies widely. Some providers charge per user, meaning costs increase as more investors and team members gain access. Others charge based on the number of documents stored in the VDR, which can become expensive in M&A or late-stage fundraising. Many providers also offer flat monthly or annual pricing models, which can be a cost-effective option for startups needing continuous access.

When buing a virtual data room for startups, cost is a key consideration. For M&A, expect higher costs due to additional compliance features. Understanding virtual data room pricing per month and virtual data room pricing M&A can help founders budget accordingly and avoid unexpected costs.

Free vs. Paid Virtual Data Rooms: What’s the Right Choice?

The best data room for startups for free may work for early-stage fundraising, but it often comes with limitations. While free solutions provide basic document sharing without upfront costs, they typically lack essential security features, audit logs, and scalability. File size limits and restrictions on the number of users may also create challenges as a startup grows.

For serious fundraising or M&A, upgrading from the best virtual data room software free versions ensures professionalism, security, and investor confidence. Founders should assess their needs and determine when to transition from a free tool to a more robust VDR solution.

Virtual Data Room Providers: How to Choose the Best Fit

Choosing the right virtual data room provider M&A depends on a startup’s needs. Security and compliance should be a top consideration, ensuring encryption, secure file access, and regulatory compliance. Usability is also key, as a complex interface can slow down due diligence. A scalable VDR should grow with the company and accommodate increased document storage and user access over time.

Reliable customer support is important, especially when navigating investor due diligence. Finally, founders should compare virtual data room price comparison with must-have features to determine which provider offers the best value. For M&A deals, specialized M&A data room providers may offer additional compliance tools tailored to complex transactions.

Data Room Checklist: What Founders Should Include

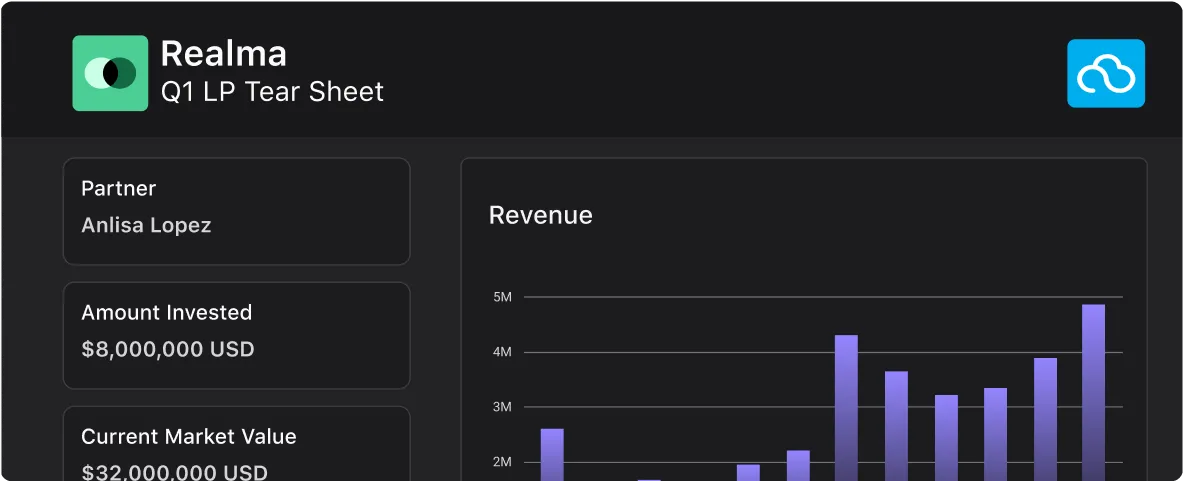

Before sharing a virtual data room for startups, founders should ensure they have all necessary documents organized and ready. A well-structured VDR should include a company overview with the pitch deck, executive summary, and vision and mission statements. Financial documents such as profit and loss statements, balance sheets, and revenue growth metrics should be included to give investors a clear picture of the company’s financial health.

Legal documents, including incorporation records, founder agreements, and cap tables, are essential for due diligence. Investor updates, such as monthly or quarterly reports, help maintain transparency. Customer and market data, including user traction, customer testimonials, and market research, provide additional insights into the company’s growth potential. Keeping these documents updated ensures a smooth and efficient due diligence process.

The Right Data Room Software Can Elevate Your Startup

A virtual data room for startups is a must-have for any startup navigating fundraising or M&A. The right VDR can make the process more efficient, secure, and investor-friendly. Founders raising capital should choose the best data room for startups that balances cost, security, and ease of use. Early-stage startups may be able to use the best virtual data room software for free, but as they grow, upgrading to a paid solution is often necessary. For M&A or later-stage fundraising, security, compliance, and advanced access controls should be top priorities.

The next steps for founders include comparing virtual data room price comparison, evaluating virtual data room pricing per month, and setting up a data room for investors checklist before it becomes an urgent need. By taking a proactive approach, startups can be well-prepared for investor interactions and due diligence, ensuring a seamless fundraising or exit process.