Top Virtual Data Rooms

Discover the Power of Visible for Founders

Trusted by Thousands of Founders

The Top Virtual Data Rooms for Startup

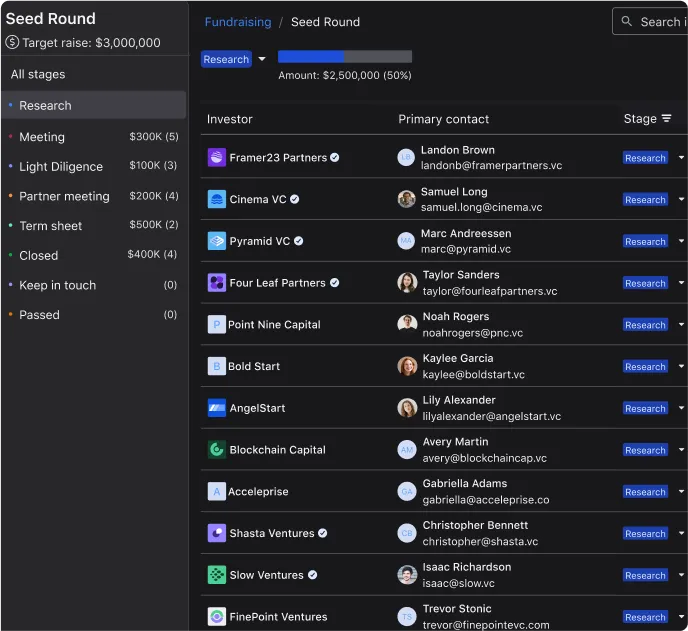

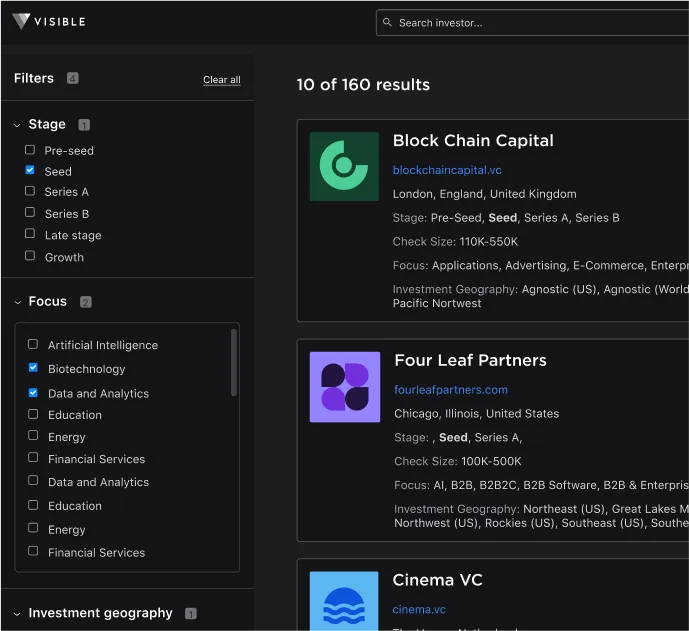

For venture-backed startups, staying organized and investor-ready is critical. Whether you’re raising your next round, managing investor relations, or preparing for an acquisition, a virtual data room (VDR) helps streamline document sharing, enhance security, and build trust with investors. With numerous options available, choosing the best data room for startups requires careful consideration of features, security, and pricing.

In this post, we’ll break down everything you need to know about virtual data rooms for startups—including why they matter, what features to look for, and how to choose the best option for your business. We will also explore the differences between free and paid virtual data rooms, as well as what to look for in top virtual data rooms in 2025.

Why Startups Need a Virtual Data Room

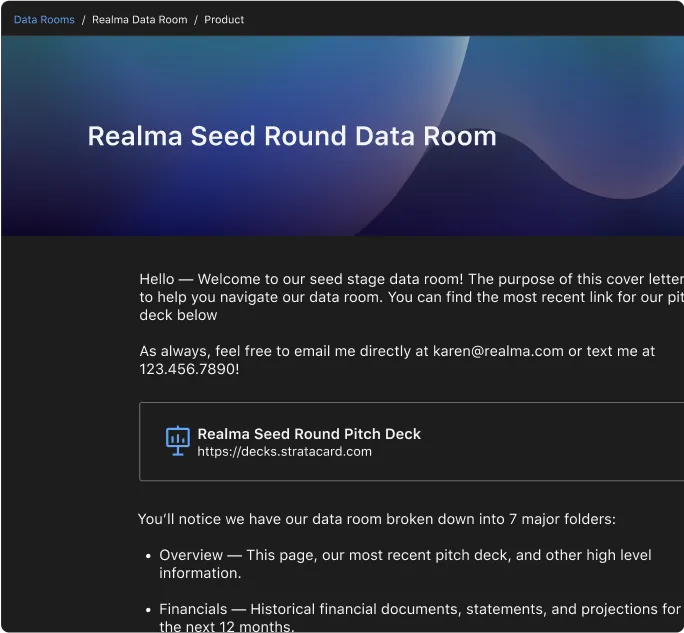

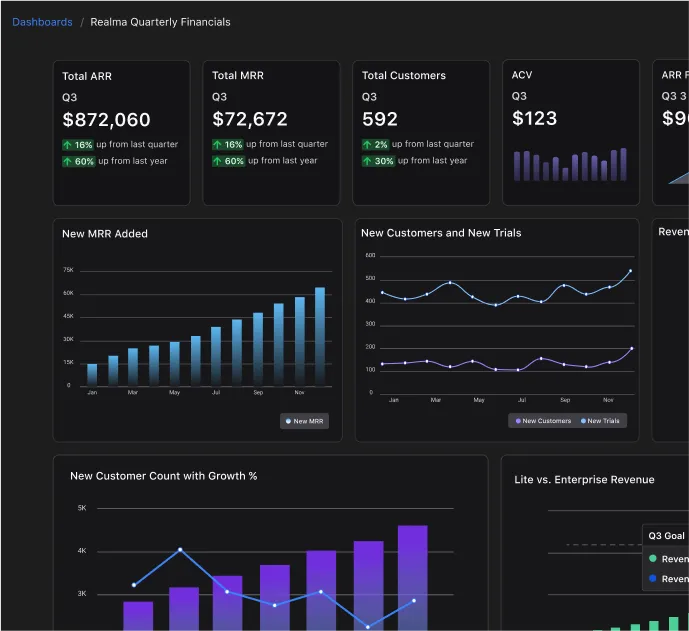

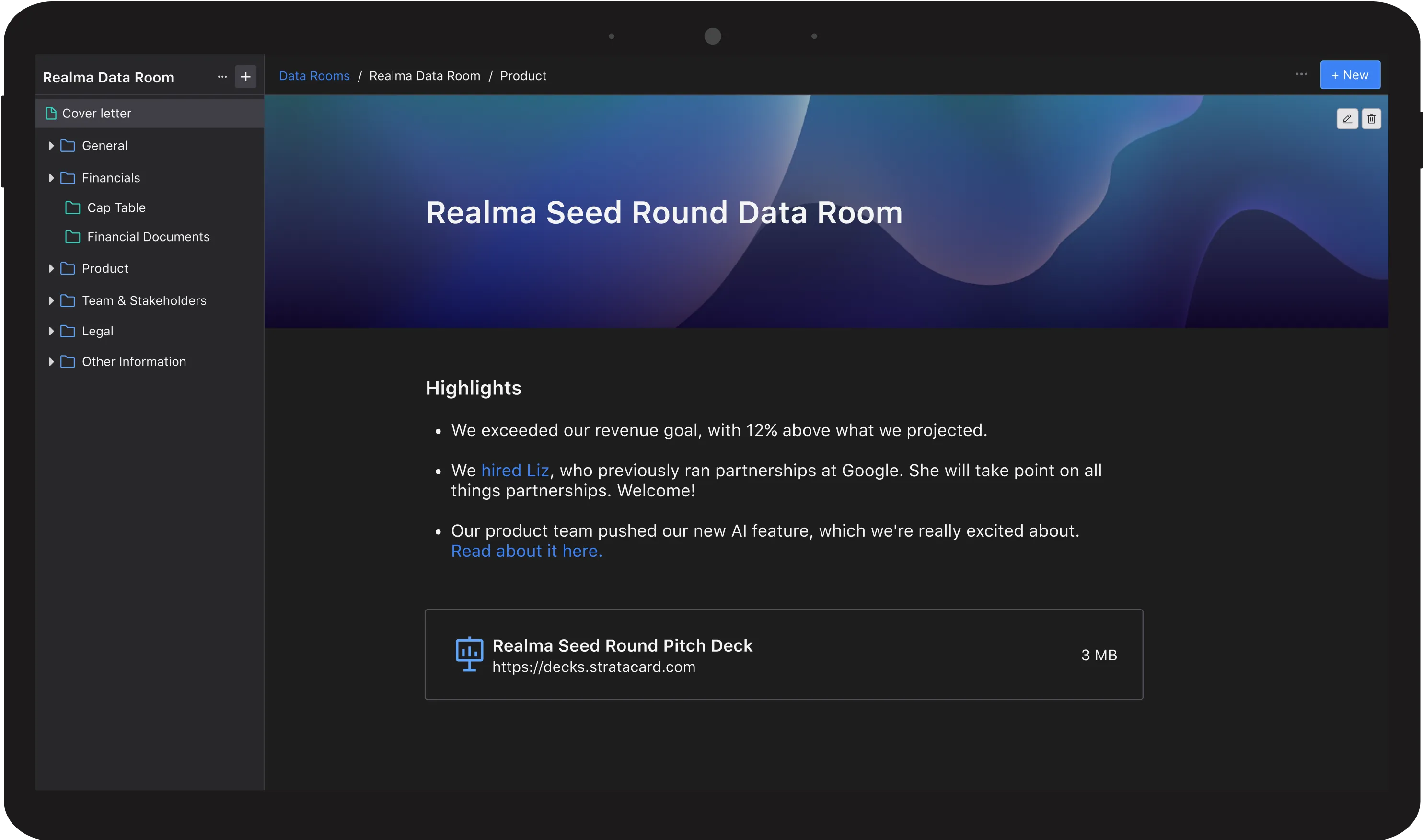

A virtual data room is a secure online repository for storing and sharing confidential information with investors, legal teams, and stakeholders. Founders should consider using one because investors expect quick access to key documents like financials, cap tables, and pitch decks. A well-organized VDR allows you to keep investors updated with reports, KPIs, and board materials. Startups considering an acquisition or exit need a VDR to handle due diligence and streamline negotiations. A data room that’s structured and up-to-date shows professionalism and can speed up fundraising.

Startups often look for the best virtual data room for startups that balances cost, security, and usability. Discussions on platforms such as Reddit highlight common pain points like hidden fees, difficult interfaces, and limited storage capacity. The best virtual data room for startups free options can be attractive, but they often come with significant trade-offs.

Key Features to Look for in a Virtual Data Room

Not all data rooms are created equal. When evaluating options, consider security and compliance, ensuring features like end-to-end encryption, role-based permissions, and access controls. Ease of use is another factor, with features like drag-and-drop uploads, intuitive folder structures, and a mobile-friendly interface. Collaboration tools, such as real-time document tracking, investor Q&A features, and team access controls, are crucial. Pricing and scalability should also be taken into account, ensuring affordable options for early-stage startups with the ability to scale as the business grows.

The best virtual data rooms prioritize security and ease of access, enabling startups to confidently share their sensitive information. The best data room for startups should also integrate seamlessly with investor workflows and legal due diligence processes. A comprehensive data room for investors checklist can help ensure that all essential documents are prepared in advance.

How Much Does a Virtual Data Room Cost?

VDR pricing varies based on many factors, which could include storage, security features, and the number of users. Free data rooms are good for early-stage startups but often come with limitations such as storage caps and fewer security features. Some providers offer flat-rate pricing based on storage and users, while others have usage-based pricing, charging based on data volume or the number of users accessing the platform. As you scale, expect to transition from free solutions to a more robust paid option.

For startups evaluating virtual data room pricing, it’s important to consider the long-term needs of the business. While a free data room for startups may work for early fundraising rounds, companies that are preparing for larger rounds or M&A transactions will likely need additional security and advanced features. M&A data room providers typically offer tailored solutions for later-stage companies navigating complex due diligence processes.

Best Practices for Setting Up a Data Room for Fundraising

If you’re raising capital, an investor-ready data room is a must. To set one up, organize your documents by categorizing files into folders like Financials, Legal, Metrics, and your Team. Manage permissions by controlling who can view, edit, or download sensitive documents. Keeping it updated is essential, regularly updating metrics, financials, and investor reports. Ensure your data room includes financial statements, a cap table, legal agreements, customer metrics, and investor presentations.

Founders searching for the best data room for startups free options should prioritize platforms that allow easy sharing and version tracking. Setting up a secure, well-organized VDR makes a strong impression on potential investors and improves the efficiency of the fundraising process.

Virtual Data Rooms for M&A: What to Look For

If you’re preparing for an acquisition, you’ll need a VDR that supports due diligence and secure document sharing. Key considerations include advanced security features such as two-factor authentication, watermarking, and NDAs. Due diligence tools that allow tracking who has viewed or downloaded files are essential. A streamlined communication system with Q&A functionality helps answer buyer inquiries securely.

Top virtual data rooms for M&A provide enhanced security and organizational tools designed to streamline the transaction process. Many M&A data room providers focus on compliance and regulatory features that ensure a smooth acquisition process. Startups should carefully evaluate the level of support and service each provider offers.

Free vs. Paid Virtual Data Rooms: Which One Is Right for You?

Free data rooms are ideal for startups with limited documents but often lack security and scalability. Paid data rooms offer stronger security, better investor collaboration tools, and scalability for growth-stage startups. If you’re raising venture capital, a well-structured, secure VDR is worth the investment.

The decision between free and paid data rooms often depends on the stage of the business and the specific needs of the startup. The best data room for startups free options may work in early rounds, but as compliance and security requirements increase, upgrading to a professional VDR solution is often necessary.

How to Choose the Best Virtual Data Room for Your Startup

With so many options available, here’s how to find the right VDR for your startup. Consider your stage, as early-stage startups may prioritize affordability, while growth-stage startups need scalability and compliance. Evaluate security needs, ensuring encryption, permissions, and compliance with data protection standards. Compare pricing models to find transparent pricing that aligns with your budget. Test the user experience to ensure a frictionless setup, allowing investors and team members to easily access documents.

The best virtual data room provider for your startup should align with your company’s growth trajectory. Virtual data room for startups cost considerations should include both the short-term affordability of free options and the long-term benefits of a premium solution. Top virtual data rooms in 2025 will likely continue to emphasize ease of use, automation, and advanced security measures.

The Top Data Room Can Elevate Your Startup

A virtual data room is more than just a file storage solution—it’s a strategic tool for fundraising, investor relations, and M&A. Choosing the right VDR ensures that your startup is well-prepared, professional, and investor-friendly. If you’re in the process of raising capital or preparing for an exit, investing in the right virtual data room will save you time and accelerate your success.

As discussions on best data room for startups in Reddit threads suggest, selecting the right platform depends on usability, pricing, and security. Whether opting for a free data room or a premium solution, having a structured and investor-ready data room is essential for long-term success.