Best Data Room for Startups

Discover the Power of Visible for Founders

Trusted by Thousands of Founders

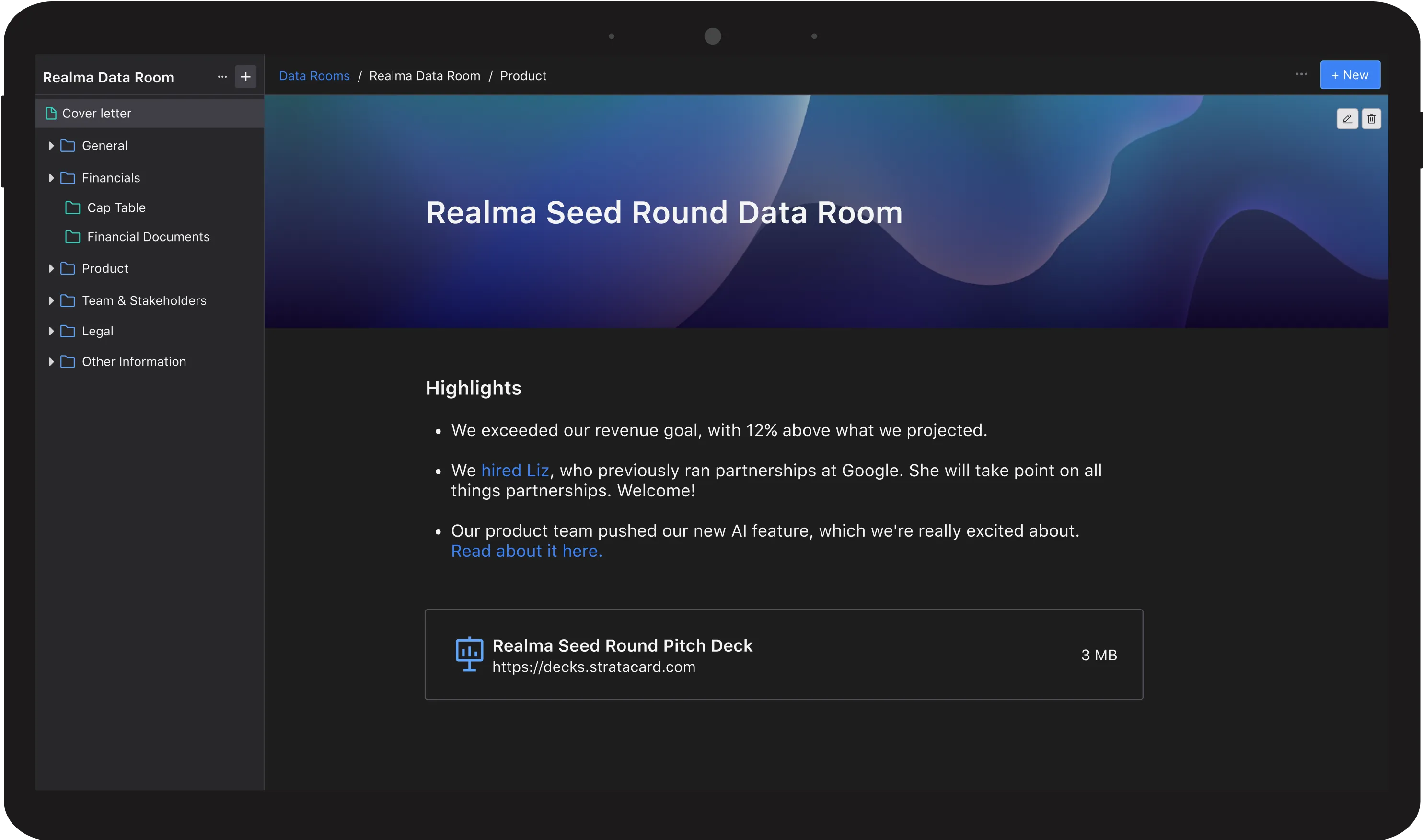

A well-organized data room is essential for startups seeking investment, managing due diligence, and securely sharing company documents. Whether preparing for a pre-seed round or scaling to Series A, having the right virtual data room for startups streamlines the fundraising process and builds trust with investors. This guide will help founders understand how to choose the best data room for startups, explore free and paid options, and ensure all necessary documentation is included.

What Is a Data Room for Startups?

A data room for startups is a secure online space where companies store, manage, and share key documents with investors, legal teams, and other stakeholders. These virtual data room platforms enhance security, improve efficiency, and ensure smooth due diligence processes.

Traditional data rooms were physical spaces where confidential documents were reviewed, but today’s virtual data room for startups provides a more flexible, cost-effective, and accessible solution. It allows founders to organize critical business information, ensuring that potential investors have everything they need to make informed decisions.

Why Startups Need a Virtual Data Room

From early-stage funding to later rounds, a well-structured startup data room plays a crucial role in securing investment. Having all necessary documents in one place builds credibility with investors, allowing them to quickly assess the startup’s financial health, legal structure, and growth potential. This level of transparency makes the due diligence process smoother and faster, reducing friction in funding negotiations.

A virtual data room for startups also simplifies document management by eliminating the need for back-and-forth emails and scattered file sharing. Instead of searching for important contracts, cap tables, or financial statements, founders can provide investors with a single, well-organized repository. Security is another critical benefit, as data room products come equipped with encryption, user permissions, and access tracking, ensuring that only authorized individuals can view sensitive information.

Data Room for Investors Checklist

A well-prepared data room for investors checklist ensures that founders present the right documents in an organized manner. Startups should begin with a comprehensive company overview that includes their mission, vision, pitch deck, and business model. These materials help investors quickly understand the startup’s value proposition and market potential.

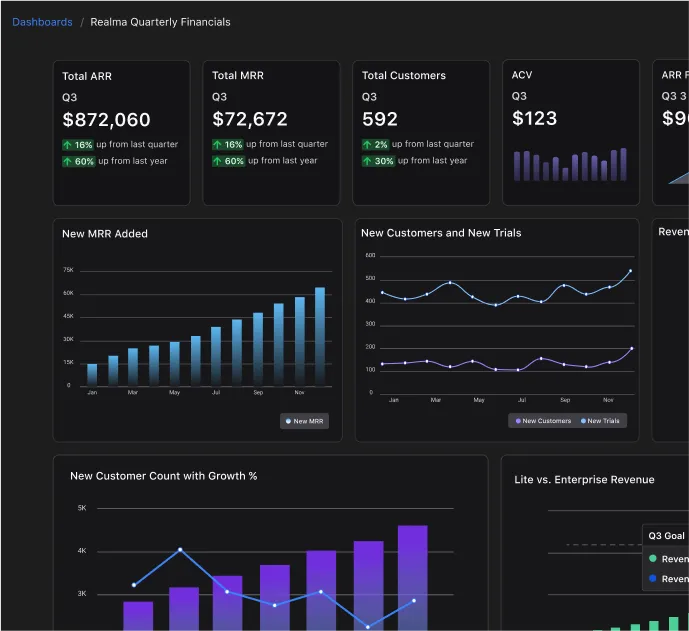

Financial information is another crucial component. Revenue projections, balance sheets, and profit-and-loss statements offer investors a clear picture of the company’s financial health. Without these documents, investors may struggle to assess the startup’s long-term viability.

Legal documents must also be included to establish the startup’s compliance and ownership structure. Founders should upload cap tables, incorporation papers, and shareholder agreements to avoid any confusion about equity distribution and legal standing. Intellectual property, such as patents, trademarks, and licensing agreements, should also be included to demonstrate competitive advantages.

Customer and sales data provide insights into market traction. Startups should include customer contracts, case studies, and key performance metrics that showcase growth and adoption. By using a data room for investors checklist template, startups can ensure they have all essential documents in place before presenting to investors.

Best Data Room for Startups: Features to Look For

Selecting the best data room for startups requires evaluating specific features that can enhance document security and accessibility. Strong security measures, such as encryption and two-factor authentication, ensure that sensitive data remains protected. The platform should also provide user-friendly navigation so that investors and stakeholders can access documents efficiently.

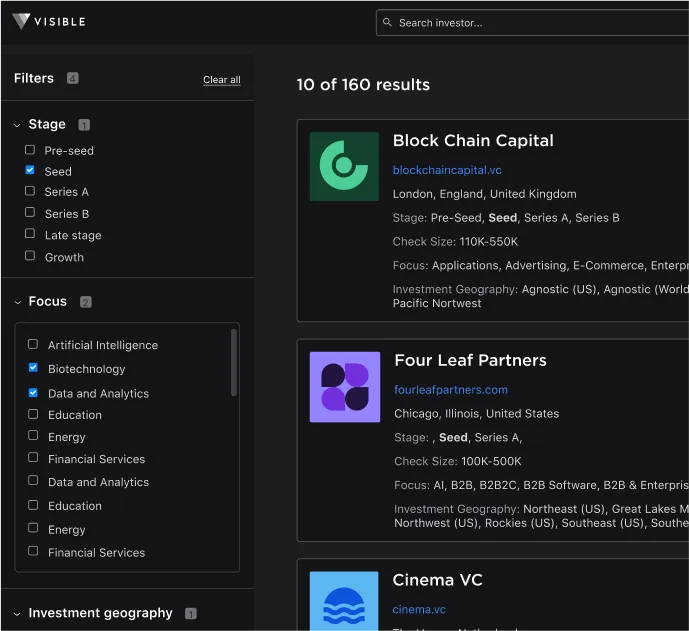

Collaboration tools, including commenting and file-sharing capabilities, are also important. These features facilitate communication between founders and investors, allowing for real-time discussions and feedback. Scalability is another consideration, as startups will require more storage and advanced features as they progress from pre-seed to Series A and beyond. By comparing best data room providers, founders can find a solution that aligns with their needs.

Best Free Data Room for Startups: Are Free Options Worth It?

Many early-stage founders seek the best free data room for startups to save costs while preparing for funding rounds. Free virtual data room free solutions can be useful, but they often come with limitations. While these platforms may provide basic storage and sharing capabilities, they typically lack the advanced security, compliance, and collaboration features found in premium data rooms.

For pre-seed startups, a free data room for startups may be sufficient for organizing essential documents. However, as the company grows, upgrading to a paid data room with investor-friendly tools, such as permissions management and audit logs, becomes necessary. A free option can serve as a short-term solution, but founders should plan for an upgrade as they scale.

Due Diligence Data Room Checklist

A due diligence data room checklist is essential for startups undergoing an investment review. This checklist ensures that all necessary documents are readily available, reducing delays and increasing investor confidence. Corporate governance documents, such as board meeting minutes and internal policies, help establish a startup’s compliance with legal and operational standards.

Financial reports must be detailed and accurate, including profit-and-loss statements, cash flow reports, and revenue projections. These documents provide investors with insights into the company’s financial health and growth potential. Legal and compliance records, such as partnership agreements, intellectual property filings, and regulatory certifications, are also necessary to demonstrate the startup’s adherence to industry standards.

Investor relations materials, such as previous funding rounds and a cap table, show how equity has been distributed over time. Having a structured due diligence data room checklist allows startups to present a well-organized and transparent case to potential investors.

Pre-Seed and Series A Data Room Essentials

The pre-seed data room focuses on fundamental company documents, including the pitch deck, early financials, and basic legal paperwork. At this stage, investors are primarily interested in the startup’s vision, market opportunity, and early traction.

As startups progress to later funding rounds, the Series A data room checklist becomes more complex. Founders must include financial projections, customer acquisition metrics, and detailed hiring plans. Investors at this stage require deeper insights into revenue streams, scalability, and operational efficiency. Using a pre-seed data room template ensures that startups organize their documents effectively from the start, making it easier to scale the data room for later rounds.

Data Room Examples and Best Practices

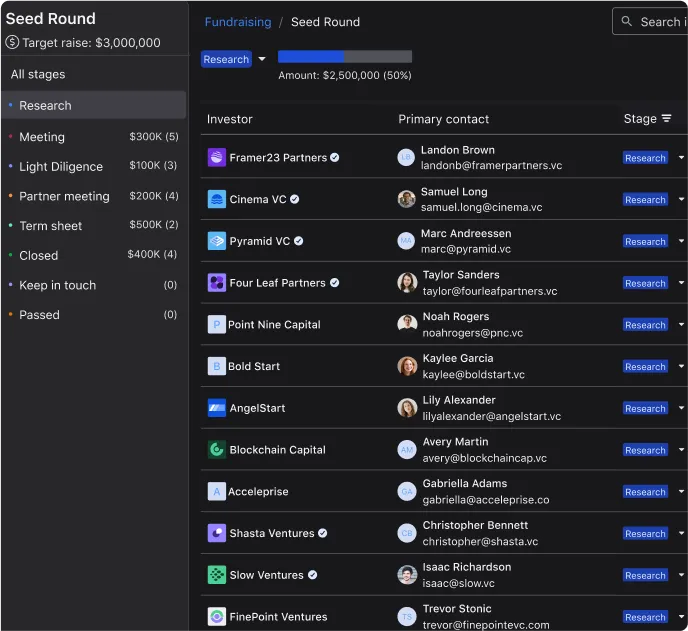

Looking at data room examples from successful startups can help founders structure their own startup data room effectively. A well-organized data room for investors example typically includes clearly labeled folders, making navigation easy for investors. Consistently updating documents ensures that financials and legal agreements remain accurate.

Security best practices include limiting access to only relevant stakeholders and using permissions-based controls to restrict document visibility. By following these best practices, startups can create a professional and investor-ready virtual data room for startups.

Choosing the Best Data Room Providers

When evaluating best data room providers, startups should consider pricing, security, and integration capabilities. The ideal virtual data room providers offer scalable solutions that grow with the company. Security compliance, such as SOC 2 or GDPR certification, is critical for protecting sensitive data. Integration with existing tools, such as CRM software and cloud storage, can also improve workflow efficiency.

Selecting the right virtual data room for startups ensures that founders can manage fundraising, due diligence, and investor relations with confidence. By investing in a reliable data room, startups can streamline operations, secure funding faster, and maintain transparency with investors.