Building a startup is difficult. On top of building products or services, hiring top talent, and acquiring customers, founders need to secure funding for their business. This oftentimes comes via customer revenue (bootstrapping), angel investors, venture capital, or debt financing.

Related Resource: How to Find Investors

For founders pursuing venture capital or equity financing, building a system or process around your raise can help speed up the process so you can spend more time on what matters most — building your business.

Learn how you can create an investor pipeline for your next fundraise below:

Tips for Improving Your Investor Pipeline

At Visible, we compare a fundraising process to a traditional B2B sales process (more on this below). Just as a sales team has the tools and resources in place to help them sell, the same should be true for a founder fundraising. Learn more about building an investor pipeline for your next fundraise below:

Treat fundraising like you treat sales

At the end of the day, raising venture capital is selling equity in your business. You will need to have many conversations and share assets along the way to help improve your odds of raising (selling equity).

As we mentioned above, we compare a fundraising process to a traditional B2B sales process. You can break down the similarities between the 2 below:

- Top of the funnel — At the top of your fundraising funnel you need to bring in “leads” (AKA qualified investors) for your business. Chances are a small % will go through to write a check so it is important to have a large list — this can come from cold outreach, inbound interest, or warm introductions.

- Middle of the funnel — In the middle of a fundraising funnel, you are working on moving investors toward the bottom of your funnel. This likely means the investor has some interest and you are actively pitching them or sharing different fundraising assets (investor updates, pitch decks, etc.).

- Bottom of the funnel — At the bottom of your fundraising funnel, you are working through due diligence with the goal of “closing” a new investor. This generally involves data rooms, reference calls, partner meetings, etc.

Related Resource: 6 Helpful Networking Tips for Connecting With Investors

Adjust your strategy according to your company

As fundraising oftentimes mirrors a sales process, it is important to make sure that you are targeting the right investors (AKA qualified leads). When building a list and targeting investors, it is important to look at the fields and characteristics that matter most to your business. A few suggestions for characteristics to consider:

- Location/Geography

- Industry Focus

- Stage Focus

- Current Portfolio

- Motivators

- Deal Velocity

Related Resource: Building Your Ideal Investor Persona

Filter and find the right investors for your business with our free investor database, Visible Connect. Give it a free try here.

Solidify your fundraising goal

Going into a fundraise it is important to have goals in mind. This will help you frame different conversations and your pitch. For example, if you are going to raise $1M, what are your goals and how are you going to spend the capital?

It can also be broken down into goals for your actually fundraising process. For example, how many investors do you want to email a week? How many investor meetings do you want in a week? Etc.

Go big

Investing in startups is a risky investment. Most investors are incentivized to take their time with the process and will only invest in a handful of companies in a given year. In order to help make sure you maintain momentum in your fundraise, it is important that you have a solid number of investors at the top of your funnel to reach out to over the course of a raise.

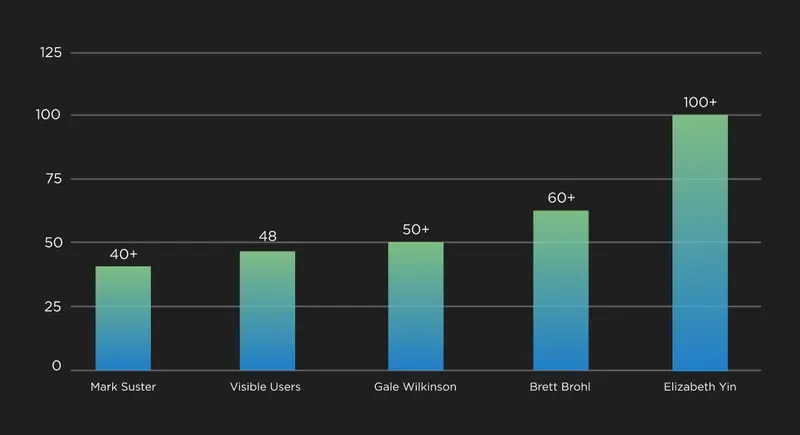

Between our own data and data from famous investors, we have found that most founders should expect to communicate with 50+ investors over the course of a raise. Check it out below:

Step-by-Step Guide for Building Your Investor Pipeline

If you are ready to build a pipeline for next fundraise, check out our quick steps and tips below.

Related Resource: 9 Tips for Effective Investor Networking

1) Create a list of potential investors

As we mentioned above, it is important for founders to have a healthy list of investors. We recommend starting with a list of 50 investors and scaling up from there if needed. It is important to consider the characteristics you are looking for in an investor and use free tools (like Visible Connect) to help you find those investors.

Related Resource: How Startups Can Use an Investor Matching Tool to Secure Funding

2) Upload your list to your pipeline

Compile your list of investors in a spreadsheet (or dedicated tool like Visible). You can upload this list to Visible to start tracking your pipeline and fundraising stages. For example, when you upload your investors, they will all likely be in a “Researching” stage. As you start to reach out to investors and have conversations, you can move them further down your funnel.

Check out an example of a Visible Pipeline here.

Related Resource: Tailoring Your Fundraising Efforts

3) Use tools to research investors in the pipeline

Once you have an initial list of potential investors in place, it is important to do your research. To start, find the person at the firm that you would like to reach out to and see if have any mutual connections. A warm introduction is always ideal, but don’t be afraid to reach out cold if an investor is a good fit (more on this below).

It is also worth doing further research on the actual firm. Double-check that you are a fit for their fund and there are no competitors of yours in their portfolio already.

Related Resource: How to Write the Perfect Investment Memo

4) Create an introduction email

Once you have done your research, it is time to start reaching out to potential investors. As we mentioned above, warm introductions are generally preferred.

If you are seeking a warm introduction, make sure you are making it as easy as possible as the person making an introduction (always double opt-in). The introduction email should include a brief introduction of your company, any major milestones or metrics, and why they are a good fit.

On the flip side, cold email works as well. To learn more about cold emailing potential investors, check out our post below:

Related Resource: 3 Tips for Cold Emailing Potential Investors + Outreach Email Template

5) Track and monitor your pipeline communication

As you will be balancing many conversations, it is important to have a place to track and monitor ongoing conversations. This can be helpful when determining what investors you need to spend time on and setting up a rhythm for follow-ups.

With Visible, you can track conversations from outside of Visible, send investor Updates, and share your pitch deck so you can fully understand how investors are engaging with your fundraising materials.

Fund Your Startup With Visible

With Visible, you can manage every stage of your fundraising pipeline:

- Find investors at the top of your funnel with our free investor database, Visible Connect

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.