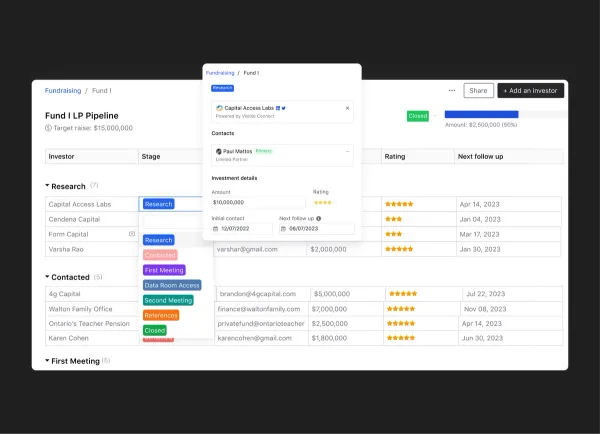

Last week we covered how many investors founders need in their fundraising pipeline. When communicating with 50+ investors during a fundraise, founders need a system to track and manage their ongoing investor conversations.

Default Properties

At Visible, we help founders do just this with our Fundraising CRM. Like any CRM, we offer default properties for investor contacts (e.g. potential investment amount, star rating, contact date, follow up date, etc).

Popular Custom Properties

In addition to the default properties, founders are using custom properties to match their fundraising efforts — check out the most common custom properties below to see how other founders are keeping tabs on their pipeline:

- Min & Max Check Size — In addition to our default check size property, we are seeing founders track min and max check size amount to get a more accurate look at where their round stands.

- Connection — Warm introductions are valuable when fundraising. Founders are tracking who made/can make an introduction.

- Data Room Shared — If a founder is moving an investor down their fundraising funnel, chances are a data room will be shared. In order to keep track of who has access, founders are creating a yes/no property to track who has access.

- Investor Type — We are seeing founders track the type of investor to have a better look at the mix of investors in their pipeline — e.g. strategic, existing, lead, etc.

- Will They Lead — Finding a lead investor is a must for a fundraise. Keeping an eye on lead investors is a surefire way to help founders stay focused on the right investors.

Of course, these are just a few of the custom properties founders are using — we’ve even seen a few founders track an investor’s favorite sports team or personal interests. Learn more about our Fundraising CRM and give it a try below:

Reading List

Level up Your Fundraising Process with Email Syncing

In order to best help founders stay on top of their raise, we recently launched a BCC tool to help founders sync emails from outside Visible to the respective investor record in Visible. Read more

A Guide to Seed Fundraising

The team at Y Combinator shares an in-depth guide covering the ins and outs of raising a seed round. Read more

Seamlessly Manage Relationships with an Investor CRM

On the Visible blog, we break down what founders should look for in an investor CRM and fundraising tracking tool. Read more