Getting connected with potential investors for your fundraise is laborious. Quite often it feels like you are playing a massive game of inside baseball and thought leaders tell you that the only way in is to have a warm introduction. The reality is that investors are open to cold pitches and well known companies like Box were funded through a cold email.

We equate a fundraising process to that of a B2B Enterprise sale. Any great B2B sales team leverages cold emailing as a channel to set meetings. The same principles that apply to B2B cold emailing also apply for your fundraise.

Remember… an investors job is to find the needle in the haystack, your job is to create signal amongst all of the noise. Below we’ll provide some tips, common mistakes and templates to level up your fundraising game.

Target the Appropriate Investors

Make sure you are reaching out to investors who are at the right stage, sector and investment geography for your startup. p.s. Visible Connect makes this process 100x easier as we let you sort by stage, check size, sector geography and more.

If you are a life sciences startup don’t email investors about your E-commerce DTC brand. Absolutely email investors if you fit their thesis/stage/traction requirements and bonus points if they have mentioned it recently on Twitter or a blog post.

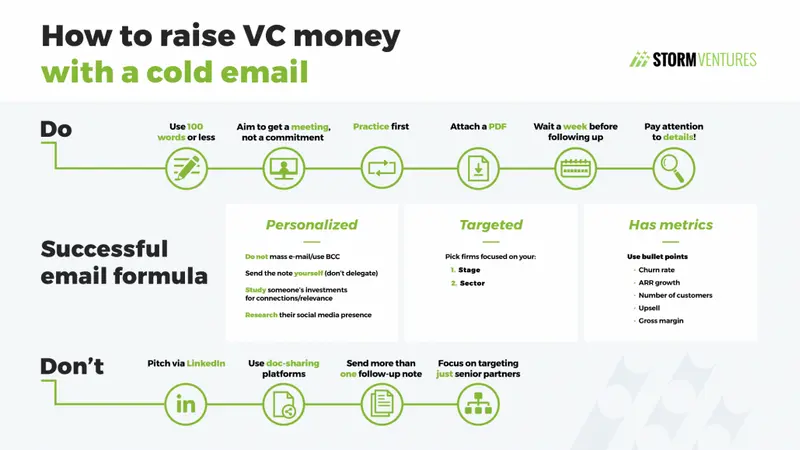

Ryan Floyd from Storm Ventures has a great section in his post on how to target your email appropriately.

If you are mass emailing investors you’ll be wasting your precious time. Never bcc multiple investors, this will be obvious. Personalize your email to maximize responses and make sure it comes from your email (never outsource, use an alias, etc).

Write Concise Emails

Keep it simple yet significant. 50-200 words is all you need. Most of the articles link to in this post believe 100 words is the sweet spot. The template provided below comes in under 100 words.

For the past months I have reviewed about 10-20 “cold” emails per day and there is a clear pattern for those emails that stand out from the crowd ->

5 characteristics of great cold emails below:

— Beata Klein ? (@axeliaklein) August 11, 2020

Beata Klein from Creandum includes this data point in a great thread about reaching out cold.

Your goal when reaching out cold is to get a reply, that’s it. You are not trying to get them to write you a check on the spot because of some brilliant 10,000-word email you have put together. No investor will read a long-winded pitch that includes your manifesto, the biographies of all founders, and ten years of financial projections you have zero chance of hitting. You are reaching out cold. Just like sales, you want to create a path to the next thing (meeting, term sheet, etc). In this part of the funnel, you just want a reply to hopefully set an intro call.

Be Specific in the Body of the Email

The body of the email should quickly describe what makes your startup different, unique and worthy of a meeting. We have found the common tips to work well.

Be Clear and Specific

This post in Hackernoon gives a great example for subject lines:

“When I was fielding pitches as a writer, a subject line that read “we’re disrupting furniture” was much less likely to earn a write-up than “We manufacture chairs made of human hair.” What is the unique aspect of your company or product? You should probably lead with that attribute.”

Name Drop

Have a well-known angel? Were you written up by the press? Do you have widely known customers? Did your teamwork at a top-tier tech company? Did you win a big pitch competition (e.g TechCrunch Disrupt)

You should use this social proof and draft big brand names when possible. This helps you bring some credibility to your unknown startup and de-risk it a touch (you are reaching out cold remember).

Share Your Best Metrics

Include 1-2 key metrics about your startup that create some sizzle. Some examples depending on your business:

- $20k in MRR and growing 30% MoM

- Net Dollar Retention is 130% comprised of customers like Unilever and Amex.

- Payback is period of 2 months with a CAC of $180.

- Repeat order rate of 50%

- 30,000 active users growing 30% each month

Related Resource: 6 Metrics Every Startup Founder Should Track

Use Clear Formatting

Avoid a wall of text that will be glanced over. Make the email easy to scan, including bullets and appropriate line spacing.

Include the Deck Upfront

You are reaching out cold and don’t want to create more friction. Remove anything that might be sensitive but you can attach your deck as a link or PDF. Upload your pitch deck and share it with Visible here.

Related Resource: Our Teaser Pitch Deck Template

Investor Outreach Email Template

Want some inspiration and help getting started? Use our template below to give you a jumpstart. Enter your email below to make a copy of our template so you can cold email investors.

How to Use Visible’s Investor Outreach Email Template

Of course, crafting the message is a small part of the battle. To improve your odds of booking a meeting or moving an investor to the next step, you will need to have a strategy in place for your outreach. Check out a few of our tips for using the investor outreach email template below:

Find the Right Contact Email

First things first, you need to make sure you are reaching out to the correct person. Fundraising is a long process so you want to make sure you are spending your time speaking with the right people. A few tools to help include LinkedIn, Clear Bit, and AnyMail Finder.

Related Resource: How To Find Private Investors For Startups

Draft a Concise First Draft Using our Template

To help you get started, we’ve put together a template. Every business is different so be sure to edit the template for what best suits you and your business. Download the template below:

Related Resource: How to Write the Perfect Investment Memo

Lead with Strength

Jonah Midanik, GP at Forum Ventures, believes founders should always lead a cold email with their strengths. Your strength could be you were employee #3 at Facebook, you had a consulting business in the domain, a specific metric, etc. Check out more of Jonah’s advice below:

Emphasize Why You Are an Intriguing Investment

Investors are receiving hundreds of pitches so standing out is a must. On top of an intriguing business, we suggest including some emphasis and personalization in your email. Investors want to know you are intelligent and targeted with your outreach.

Provide Data on Your Startups Growth

Investors want to invest in businesses that are growing and show signs that they can grow into a company capable of a huge exit.

Related Resource: 6 Metrics Every Startup Founder Should Track

Always Follow-up

As we mentioned earlier, investors are receiving countless emails and pitches so odds are some emails will slip through the cracks. Make sure you have a game plan in place to follow up with potential investors you have yet to hear from.

Related Resource: Investor Outreach Strategy: 9 Step Guide

Other Helpful Outreach Tips

- Use LinkedIn for research, not for pitching.

- Don’t email everyone at the same firm. That will get you an instant strike and you won’t get a reply.

- Include your startup name in the subject line.

- Pay attention to details. Spell names correctly, avoid typos, etc.

- Practice and iterate. Continue to test and practice your cold emails.

- Don’t be afraid to follow up. Elizabeth Yin, has a great post on how to do this well.

- Investors will assume you are the founder. Don’t frontload that info or your name.

Related Resource: How To Write the Perfect Investor Update (Tips and Templates)

Use Visible to Kick Off Your Fundraising Process

Remember, the tactics shared above are in the context of cold emailing. Depending on your channel, the tactics & rules above may not apply. Take what feels right to you — while researching this I found plenty of conflicting advice from investors.

At the end of the day, cold emailing should be something you put in your toolkit and a skill you should sharpen over time (both for investors and customers). If it didn’t work there wouldn’t be countless articles, resources and stories shared every day.

Andrew Reed from Sequoia published the following Tweet:

Easiest business arbitrage: the risk/reward of a well-written cold email is so wildly favorable, and yet so few people will actually send one

— Andrew Reed (@andrew__reed) September 14, 2020

Use Visible to kick off your fundraising process. Find the right investors, manage your raise, and keep all parties involved with Updates. Give it a try for free here.