When communicating with investors in your fundraising funnel you will need to make sure you are telling a compelling story as to why they should invest in you.

Pitch decks are a powerful tool that can help you tell that story. Different investors will have different opinions about pitch decks. Some investors might want to receive them before the meeting, some might only want them sent via PDF or link, and some investors might not care if you have a pitch deck at all.

Through all of the noise one idea we have seen emerge is having a send away (or email deck) founders can share with investors before a meeting. Brett Brohl of Bread & Butter Ventures recommends a 4 or 5 slide deck that can be easily shared with potential investors.

While there is no prescriptive pitch deck template that will work for every startup, here is a 5 slide example email deck we have seen work well for founders (or check out the example deck directly in Visible here):

Slide 1 — Title Slide

Pro tips:

- Make sure your logo is high quality and easy to read

- Feel free to include a one sentence description of what your company does

- Want to use this template? Download here.

Slide 2 — Problem Slide

Pro tips:

- Clearly articulate your problem

- Use data to demonstrate how big the problem is

- Use stories and pain points to build empathy from investors

- Want to use this template? Download here.

Slide 3 — Solution Slide

Pro tips:

- Clear overview of what your solution is

- Use data and stories from customers to help investors understand why your solution is best

- Want to use this template? Download here.

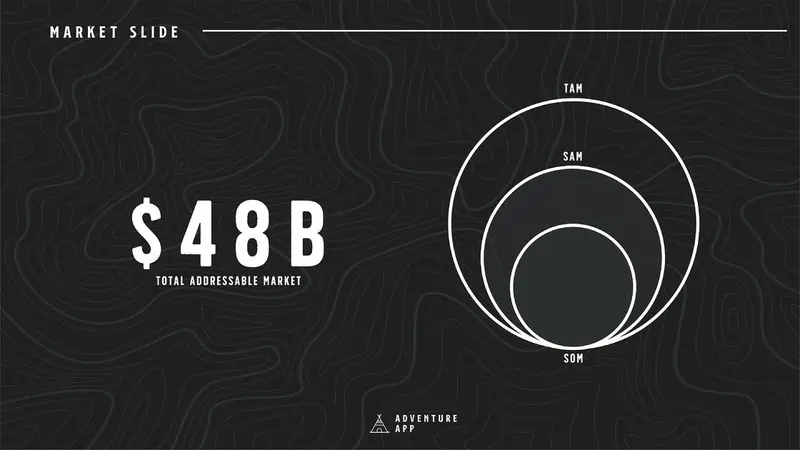

Slide 4 — Market Slide

Pro tips:

- Make sure to use a bottoms up approach when modeling TAM (more from Gale Wilkinson here)

- Show the market in dollars

- VCs need huge exits — demonstrate why you can win your market

- Want to use this template? Download here.

Slide 5 — Team Slide

Pro tips:

- High quality headshots for key teammates

- Include relevant experience and skills

- Want to use this template? Download here.

Related Resources:

- Visible Connect, our investor database

- Building Your Ideal Investor Persona

- How to Build an Investor List with Gale Wilkinson of Vitalize

- All Encompassing Startup Fundraising Guide

- Investor NPS: How likely are you to refer your current lead investor to fellow founders?

- Some Advice Before You Hit the Fund Raising Trail