Portfolio reviews are crucial for venture capital firms to make informed decisions, support portfolio companies, and communicate fund performance to LPs. Whether you’re an experienced Visible user or a first-time VC looking to streamline these sessions, proper preparation and effective use of Visible can transform your reviews into actionable, insightful conversations.

In this post, we’ll cover:

- Pre-review steps to ensure accurate, actionable data

- A link to a standard portfolio review agenda with VC best practices

- How to use Visible during the meeting to capture insights and create a lasting record

Pre-Review: Setting the Foundation for Success

An effective portfolio review starts well before everyone sits down. Here’s how to prepare with Visible:

1. Gather Structured Data with Requests and AI Inbox

Consistent, structured data is the backbone of your review. Create a repeatable data request process to collect the 5–15 key metrics quarterly that move the needle the most for your portfolio companies. Additionally, it’s common to ask for qualitative updates from companies as well to ensure you have a holistic view of how a company is performing.

With Visible AI, founders can upload files directly to your request, and the platform parses and prefills the data automatically to minimize manual entry and make it a seamless experience for your founders.

You’ll likely still receive updates via email from some founder, and the AI Inbox is the answer. Simply forward emails to Visible’s AI Inbox to parse and upload the data directly to the portfolio company's profile in your Visible account.

Learn more about building a scalable data collection workflow →

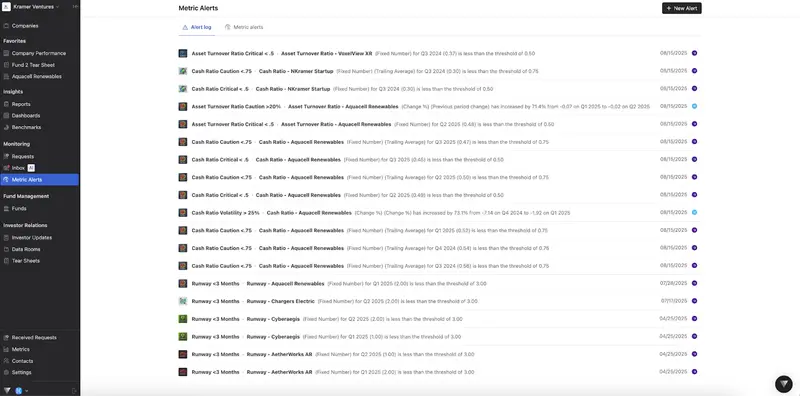

2. Set Up Metric Alerts

Metric alerts will notify you when a company’s metrics hit predefined thresholds, allowing you to flag risks or opportunities before the meeting.

You can view all alerts in the alerts log to see which portfolio companies require immediate attention.

How to set up metric alerts for investors →

3. Update Investment Data

Accurate investment records ensure fund-level metrics (like IRR, TVPI, DPI) reflect reality. With Visible, you can: Add rounds and transactions individually (guide) or bulk upload them (guide).As your position values change over time, mark up the Fair Market Values (FMVs) directly in Visible (guide). When you exit a position, follow the native workflow (guide) to record the correct holdings in the portfolio company. Finally, add any manual fund-level inputs to ensure your fund-level metrics remain accurate

Fund and company investment data definitions →

4. Design Dashboards and Tear Sheets

Dashboards make data actionable during your VC portfolio reviews. Visible supports four dashboard types:

- Flexible Dashboards: Track multiple companies, fund data, or a single company with no space restrictions

- Tear Sheets: One-page export-friendly summaries (tear sheet guide)

- Fund Performance Dashboard: Auto-generated template displaying your fund data (guide)

- Benchmark Dashboard: Compare portfolio companies by a single metric (guide)

Use dashboard templates to scale views across your portfolio (template guide).

Define the Portfolio Review Agenda

A clear and organized agenda is important to ensure focus, alignment, and productive discussion. By outlining objectives, key topics, and expected decisions, it helps participants prepare and engage effectively. Here is a sample agenda to run an effective portfolio review.

Why it works:The flow from fund performance review to company deep dives and strategic planning supports informed decision-making. Then, ending with clear action items, responsibilities, and timelines promotes accountability and follow-through, to help turn discussion into measurable results.

Using Visible During the Portfolio Review

To make the review actionable and leave a lasting record, add qualitative notes and commentary.

Use Visible Notes to document discussion points, action items, and strategic decisions directly in each company’s profile.

Add custom properties to dashboards for qualitative data and the change log will help you track how these inputs evolve over time (view change log guide).

Review Outstanding Metric Alerts

During the meeting, open the metric alerts log to address flagged issues in real time. Add any necessary context to notes and custom properties for continuity in future reviews.

Navigate Dashboards Seamlessly

- Use dashboard templates to quickly switch between companies

- Reference tear sheets for concise summaries

- Compare metrics side-by-side in the benchmark dashboard

This structured approach keeps discussions focused and ensures nothing falls through the cracks.

Final Thoughts

By following these steps and leveraging Visible’s features, your portfolio reviews can shift from being status updates to strategic decision-making sessions backed by accurate data and actionable insights.

For Non-Visible Users

Not using Visible yet? Book a personalized demo to see how our platform can transform your portfolio reviews.

For Current Visible Customers

Already a Visible customer? Connect with your Customer Success Manager to design a tailored strategy and unlock the full potential of Visible for your next portfolio review session.