Blog

Visible Blog

Resources to support ambitious founders and the investors who back them.

Product Updates

Product Update: Turn Emails Into Insights With Visible AI Inbox

Structured data. The holy grail of business intelligence.

Structured data unlocks a realm of possibilities, from setting benchmarks to enhancing decision-making processes. Yet, in the venture capital landscape, accessing reliable, structured data remains a formidable challenge. This is precisely why we created the Visible AI Inbox.

With unique features like automated metric detection and file parsing, the Visible AI Inbox stands out as a pioneering solution for portfolio monitoring. Discover how it can transform your data strategy by meeting with our team.

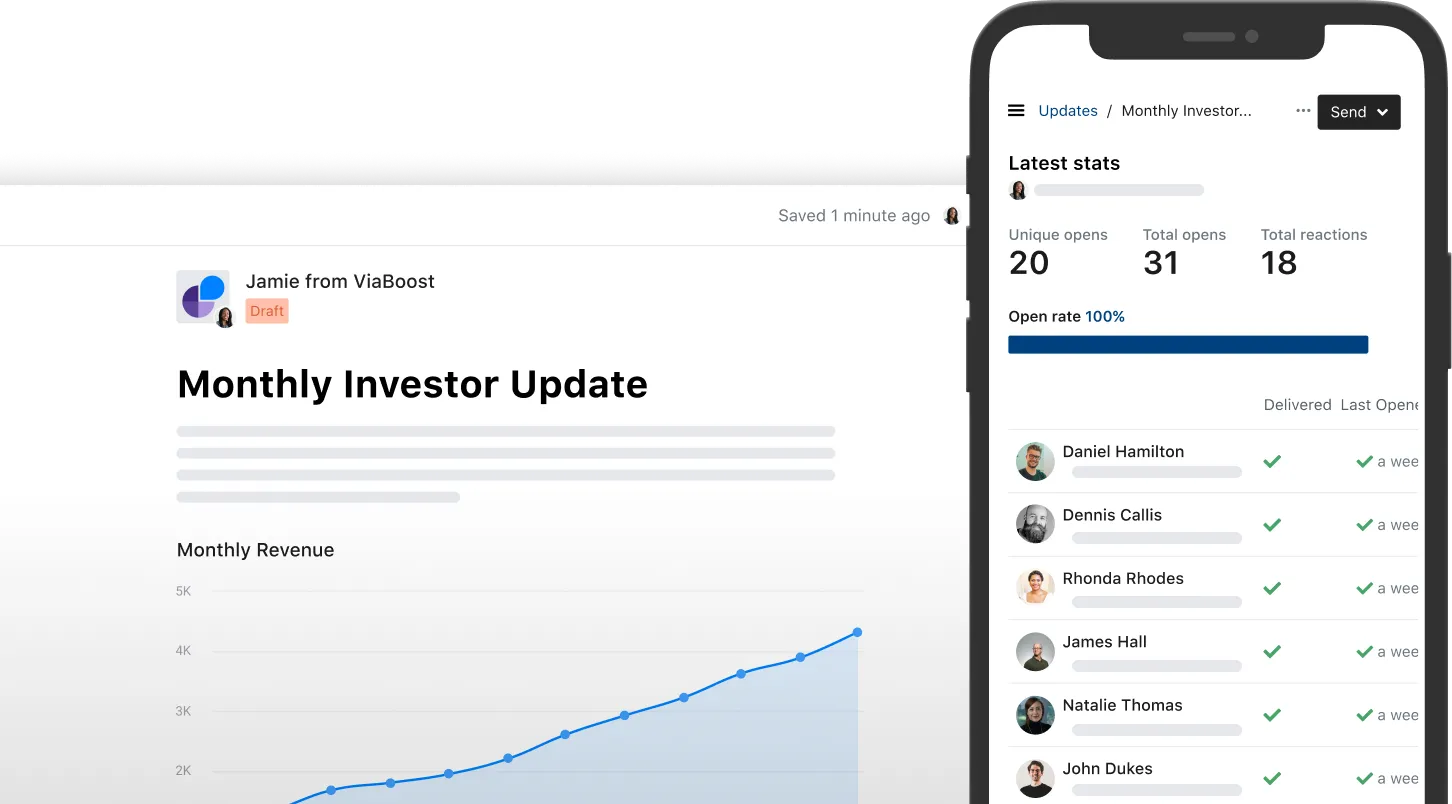

Turning email into insights

We believe that investors should spend time sourcing new deals and helping founders, not manually copying and pasting data from email 🙂.

The AI Inbox helps aggregate insights that exist siloed in data, files, and updates across a venture firm. Updates from founders often stay stuck in one team member's inbox because it's too time-consuming to extract and enter the data and files into a more centralized repository. Visible AI Inbox makes this possible within seconds.

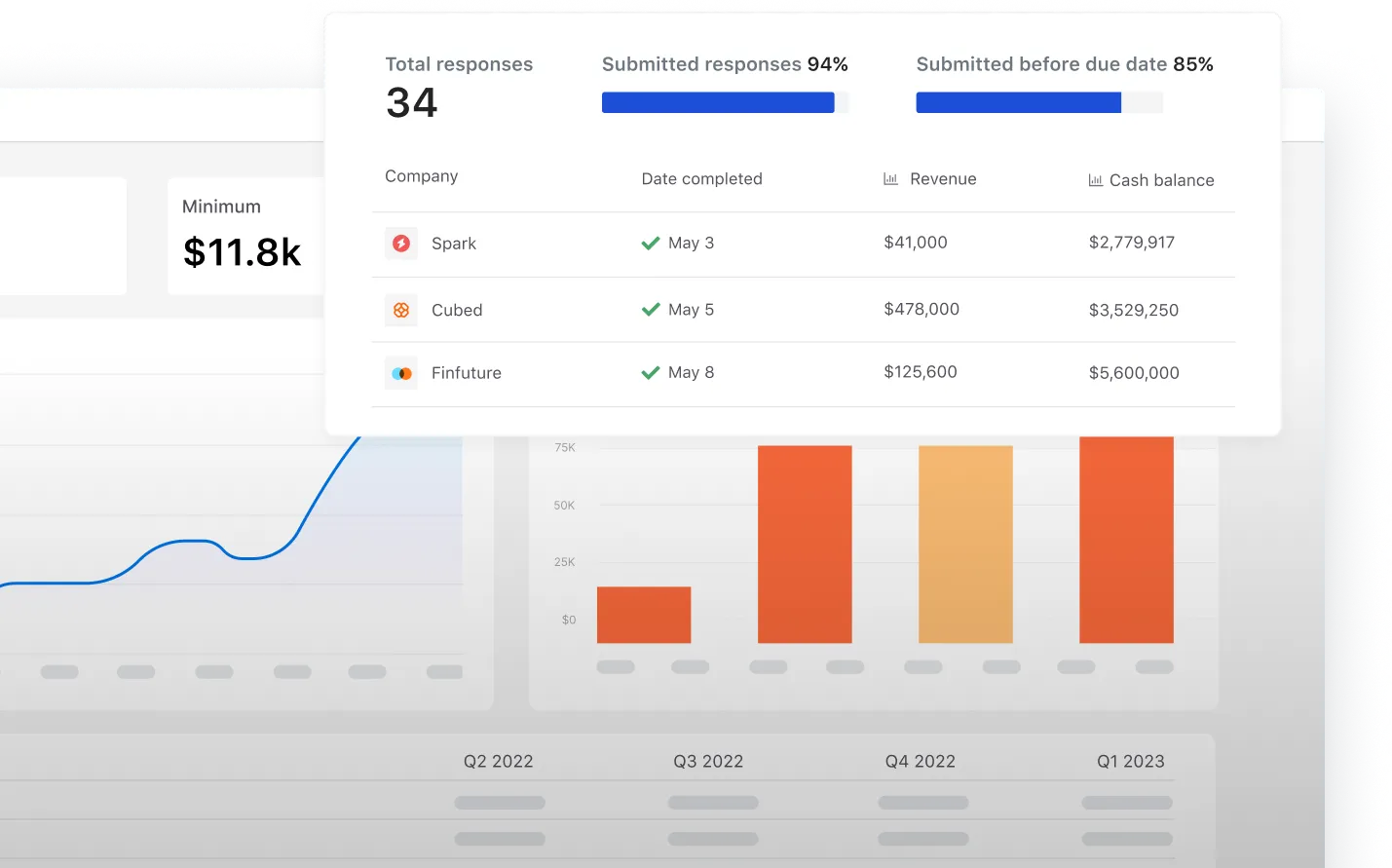

Requests + AI Inbox = A Complete Picture

The addition of the AI Inbox continues to advance our market-leading portfolio monitoring solution. The pairing of Requests + the AI Inbox will give investors a holistic view of portfolio company performance across a fund.

Visible continues to be the most founder-friendly tool on the market. We’ll continue to build tools in existing workflows where both founders and investors live every day.

How Does it Work?

Visible AI Inbox works in three simple steps.

Forward emails to a custom AI inbox email address

Visible AI automatically maps data and files to portfolio companies

Investors can review and approve content before it is saved

From there, dashboards, tear sheets, and reports are all automatically updated on Visible.

Learn more about how Visible AI Inbox can streamline workflows at your firm by meeting with our team.

FAQ

Will this be available on all plans?

Visible AI Inbox is only available on certain plans. Get in touch with your dedicated Investor Success Manager if you want to explore adding this to your account.

How is Visible addressing privacy and security with Visible AI Inbox?

No data submitted through the OpenAI API is used to train OpenAI models or improve OpenAI’s service offering.

Visible AI Inbox leverages OpenAI GPT 4 and proprietary prompts to extract data in a structured way and import it into Visible.

If you’re uncomfortable with utilizing OpenAI to optimize your account, you can choose not to utilize this feature. Please feel free to reach out to our team with any further questions.

These processes adhere to the guidelines outlined in Visible’s privacy policy and SOC 2 certification.

Visible AI Inbox Best Practices

We'll be sharing best practices for how investors are leveraging Visible AI Inbox in our bi-weekly newsletter, the Visible Edge. Stay in the loop with best practices and product updates by subscribing below:

Metrics and data

[Webinar] VC Portfolio Data Collection Best Practices

Customer Stories

Case Study: How Moxxie Ventures uses Visible to increase operational efficiency at their VC firm

Operations

How to Start and Operate a Successful SaaS Company

Fundraising

View all

founders

8 Startup Valuation Techniques and Factors to Consider

Understanding the value of your startup is critical, whether you're securing funding, forming partnerships, or planning an exit. Startup valuation is a complex process; getting it right can make all the difference in your journey. In this article, we’ll explore eight essential valuation techniques and the key factors influencing investors' assessment of your startup’s worth. By using the proper methods and focusing on the right metrics, you can maximize your chances of success. Let’s dive into what every founder needs to know about valuing their startup.

Related resource: 409a Valuation: Everything a Founder Needs to Know

What Is a Startup Valuation?

A startup valuation is the process of determining the monetary worth of a startup at a given point in time. It’s essential for startups at every stage of growth, especially when raising capital, attracting partners, or planning an exit. Valuation takes into account multiple factors, including the startup’s market potential, product development, team, revenue, and growth projections. For investors, the valuation reflects the perceived risk and potential return on investment. Ultimately, a well-calculated valuation can open doors to funding, partnerships, and strategic opportunities that help a startup thrive.

The Importance of Startup Valuation

A proper startup valuation is more than just a number- it’s a critical tool that impacts key decisions for both founders and investors. Accurately valuing your startup allows you to secure the right level of funding, ensuring you give up an appropriate amount of equity for the capital you receive. Investors rely on valuations to gauge the risk and potential reward of backing your business. Additionally, a well-supported valuation can help you attract strategic partners and set the stage for future exit opportunities, such as mergers, acquisitions, or IPOs. A precise valuation is essential for setting your startup on a course for long-term success.

Related resource: Discounted Cash Flow (DCF) Analysis: The Purpose, Formula, and How it Works

8 Valuation Techniques for Startups to Know

Valuing a startup isn’t a one-size-fits-all process. Different methods take into account various factors, such as the stage of the company, revenue, market conditions, and potential for growth. By understanding the key valuation techniques, founders can better navigate conversations with investors and ensure they are presenting their startup in the most favorable light. Below are eight essential valuation techniques every startup founder should know to determine the true value of their business.

1. Berkus Approach

The Berkus Approach is a simplified method that assigns value to a startup based on its progress in key areas like product development, market size, and management team. It’s particularly useful for early-stage startups without revenue, as it values the business based on qualitative factors rather than financial data.

2. Comparable Market Approach

The Comparable Market Approach evaluates a startup’s value by comparing it to similar companies that have been recently valued or sold. This method is effective when there are enough comparable businesses in the same industry or market, making it easier to estimate a reasonable valuation based on market trends.

3. Discounted Cash Flow (DCF) Method

The DCF method values a startup based on its projected future cash flows, adjusted for the time value of money. By forecasting future revenue and then discounting it back to its present value, investors can estimate the long-term financial potential of a startup, making this method ideal for businesses with predictable cash flow.

4. Cost-to-Duplicate Approach

This method calculates the startup’s value based on how much it would cost to replicate its assets from scratch, including intellectual property, infrastructure, and other resources. It’s commonly used for startups with valuable technology or physical assets, but it often overlooks the potential market or future growth.

5. Risk Factor Summation Method

The Risk Factor Summation method adjusts a base valuation by considering various risk factors, such as management risk, market competition, or political instability. The final valuation is adjusted up or down depending on the degree of risk involved, making this approach useful for investors assessing high-risk ventures.

6. First Chicago Method

This hybrid method combines both optimistic and pessimistic scenarios to provide a range of possible valuations for a startup. Investors use this technique to consider the best, worst, and most likely financial outcomes for a business, offering a more comprehensive picture of the startup’s potential.

7. Venture Capital Method

The Venture Capital Method is used by investors to calculate their potential return on investment (ROI). It focuses on estimating the future exit value of the company and working backward to determine how much equity the investor should demand based on the initial investment and desired ROI.

8. Book Value Method

The Book Value Method values a company based on the net asset value recorded on its balance sheet. It’s typically used for more mature businesses, but for startups, it can be useful in industries where assets like intellectual property or inventory hold significant value.

Key Factors That Impact a Startup Valuation

While valuation techniques provide a framework, there are several underlying factors that can significantly influence a startup’s value. Investors evaluate a wide range of elements, from market size and revenue projections to the strength of the founding team and the startup’s product. Understanding these key factors can help you present your business in the best possible light and justify your valuation to potential investors. Let’s take a closer look at the most critical factors that impact a startup’s valuation.

Related resource: What is Pre-Revenue Funding?

Market Size and Opportunity

The size of the target market and the growth potential it represents are crucial factors in a startup’s valuation. Investors want to know that your product or service has a large enough market to scale and generate significant returns. A larger addressable market suggests more room for growth, which can justify a higher valuation. Startups operating in industries with rapid growth, such as AI, climate tech, or fintech, often receive higher valuations due to the potential for market expansion. A compelling market opportunity shows investors that your startup has the potential to capture substantial market share and achieve long-term success.

Revenue and Growth Projections

A startup’s current revenue and its projected growth are critical in determining its valuation, especially for investors seeking a return on their investment. Consistent revenue growth demonstrates that there is demand for your product or service, which reduces perceived risk. Startups with solid revenue streams and clear growth projections are typically seen as safer investments, leading to higher valuations. Investors also consider the scalability of the business model—if a startup can rapidly increase revenue while managing costs, it becomes an attractive proposition. Revenue projections that show a clear path to profitability can further strengthen the startup’s valuation.

Funding Stage

The stage of funding a startup is in—whether seed, Series A, or beyond—has a direct impact on its valuation. Early-stage startups, such as those in the seed or pre-seed stages, typically have lower valuations because they are still proving their business model and may not yet have significant revenue or traction. As startups progress through Series A, B, and later rounds, they usually have more validated business models, larger customer bases, and stronger financials, leading to higher valuations. Investors at later stages have more concrete data to assess, which reduces risk and increases confidence in the startup’s potential, allowing for larger capital infusions and higher valuations.

Traction and Customer Base

Having strong traction or a growing customer base is a powerful indicator of market demand, and it plays a significant role in boosting a startup’s valuation. Investors view traction as proof that your product or service resonates with the market, reducing uncertainty about whether the business can succeed. Metrics such as customer acquisition rates, retention rates, and user engagement show that there is genuine interest in what you offer. A solid customer base signals that your startup has established market credibility, making it a safer bet for investors, and ultimately driving a higher valuation.

Founding Team and Management

A strong, experienced founding team is one of the most critical factors in a startup’s valuation. Investors place significant value on a team’s ability to execute its vision, pivot when necessary, and navigate challenges. A team with a proven track record, industry expertise, and complementary skills can inspire confidence in investors, as they are more likely to lead the startup to success. Moreover, a capable management team can attract top talent, secure partnerships, and foster strategic growth. Startups with experienced leadership often receive higher valuations because they reduce the perceived risk for investors and increase the likelihood of long-term profitability.

Product or Technology

A unique or innovative product, particularly one backed by proprietary technology, can serve as a strong competitive advantage, significantly increasing a startup’s valuation. Investors are keen on startups that offer something difficult for competitors to replicate, as this suggests a sustainable market position. Whether it’s a cutting-edge solution or a patented technology, these assets demonstrate a startup’s potential to disrupt the market and capture a large customer base. Additionally, proprietary technology can create barriers to entry for competitors, further securing the startup’s growth prospects. Startups with standout products or technologies often attract higher valuations because they offer long-term value and scalability.

Profitability and Cash Flow

A startup’s ability to generate profit or maintain healthy cash flow, even at an early stage, is a key factor in determining its valuation. Investors look for startups that demonstrate financial stability and the potential for long-term profitability. Consistent cash flow, even if minimal, signals that the business can sustain itself without relying solely on external funding. It also shows that the startup has an efficient cost structure and a viable path to profitability. Startups with solid cash flow management are viewed as lower-risk investments, which can drive up their valuation. Ultimately, demonstrating the ability to generate profit enhances investor confidence and positions the startup for future growth.

Best Practices to Get Your Startup Valuation Right

Achieving an accurate and compelling valuation requires more than just applying the right techniques. Founders must also take into account a set of best practices to present their startup in the best possible light to investors. From understanding your business model and market to demonstrating traction and using multiple valuation methods, these strategies will help you justify your valuation and secure investor confidence. Let’s explore the best practices every startup should follow when determining its valuation.

Understand Your Business Model and Market

Having a deep understanding of your business model and target market is essential for arriving at an accurate and realistic valuation. Investors want to see that you have a clear grasp of how your business generates revenue, scales, and fits within the broader market landscape. A well-defined business model shows that you can not only make money but also sustain and grow that revenue over time. Similarly, understanding your target market—its size, customer needs, and competitive dynamics—enables you to present a compelling case for how your startup can capture market share. Without a solid understanding of these factors, it becomes difficult to justify a valuation that aligns with your startup's true potential.

Use Multiple Valuation Methods

Relying on just one valuation method can result in a skewed or incomplete picture of your startup’s worth. Each valuation technique emphasizes different aspects of the business, whether it’s market potential, financial projections, or asset value. By using multiple methods, you gain a more comprehensive and balanced view of your startup’s true value. For instance, combining approaches like the Discounted Cash Flow (DCF) method and the Comparable Market Approach allows you to consider both future revenue potential and current market trends. This not only gives you a well-rounded perspective but also provides more credibility when discussing valuation with investors, helping you justify your numbers from multiple angles.

Focus on Traction

Demonstrating solid traction—whether through user growth, customer acquisition, or market demand—is one of the most effective ways to boost your startup’s valuation. Traction provides tangible proof that your product or service resonates with customers and has the potential to scale. Metrics such as increasing sales, growing user numbers, or high retention rates give investors confidence that your startup can succeed in the market. Strong traction not only validates your business model but also reduces perceived risk for investors, making them more likely to assign a higher valuation to your startup. The more evidence you can provide of real market demand, the stronger your position in valuation discussions.

Showcase Your Team

Highlighting the expertise and strength of your founding team is crucial to enhancing investor confidence and improving your startup’s valuation. Investors look for teams with the experience, skills, and vision necessary to lead the company through growth and challenges. A team that has a track record of success, deep industry knowledge, or complementary skills can significantly reduce the risk for investors. Showcasing key members of your team and their achievements can demonstrate that your startup has the leadership in place to execute its business strategy effectively. By emphasizing your team’s strengths, you can build trust with investors and position your startup for a higher valuation.

Forge Strong Investor Connections with Visible

Valuing your startup accurately is essential for attracting the right investors and securing the funding you need to grow. You can confidently navigate the fundraising process by understanding key valuation techniques and the factors that impact your business’s worth. Remember to focus on demonstrating traction, showcasing your team, and using multiple methods to ensure a well-rounded valuation.

To build stronger relationships with investors and streamline your fundraising efforts, Visible offers powerful tools for managing investor updates and tracking your progress. Give it a free try for 14 days here.

founders

Startup Due Diligence: What Every Founder Needs to Prepare For

Raising capital is an exciting milestone for any startup, but it comes with the critical process of due diligence. Investors need to thoroughly evaluate your business before committing to funding, and being well-prepared can make all the difference. In this article, we’ll explore the key areas of focus during startup due diligence, outline the role founders play in this process, and provide actionable steps to ensure you're fully prepared for investor scrutiny. By the end, you’ll know exactly what it takes to navigate due diligence smoothly.

What Is Startup Due Diligence?

Startup due diligence is the thorough investigation and evaluation process investors undertake to assess the viability of a business before committing to funding. This involves reviewing all aspects of the startup, including financial performance, legal standing, operations, and market position. Investors conduct due diligence to confirm that the company is as it appears and to identify any potential risks or liabilities. For founders, this process provides an opportunity to showcase the strength of their business and address any concerns investors may have. A successful due diligence process can lead to a smooth investment deal, while any red flags could delay or derail potential funding.

Related resource: The Investor Due Diligence Checklist: How to Treat New VCs Like Business Partners

What Is the Role of the Founders in the Due Diligence Process?

Founders play a central role in the startup due diligence process, as they are responsible for providing all the necessary information and documentation investors need to evaluate the business. This includes financial statements, legal contracts, intellectual property details, and any other materials that showcase the startup’s operations and future potential. Beyond organizing documents, founders must be prepared to answer investor questions and provide clarification on critical areas like market strategy, competition, and risk management. A founder’s ability to communicate clearly and transparently during due diligence can significantly influence the outcome of the process and establish trust with potential investors.

When Do Investors Carry Out Due Diligence?

Investors typically carry out due diligence after they have expressed serious interest in a startup but before finalizing the investment. This phase occurs once initial conversations, pitch meetings, and negotiations have taken place and both parties have reached a preliminary agreement on the terms of the deal. Due diligence is one of the last steps before a formal investment commitment, allowing investors to verify that the startup is financially sound, legally compliant, and capable of executing its business plan. The process ensures that there are no hidden issues or risks that could affect the investment's success.

Areas of Focus in Startup Due Diligence

Due diligence is a comprehensive process that covers several critical aspects of a startup’s business. Investors want to ensure that they are making a sound investment by analyzing key areas that reflect the company's overall health, sustainability, and potential for growth. Each area of focus, from financial performance to operational efficiency, provides valuable insight into the startup's strengths and weaknesses. By understanding these focal points, founders can better prepare for the scrutiny that comes with the due diligence process and present their business in the best possible light.

Financial Performance

One of the first areas investors focus on during due diligence is a startup’s financial performance. Reviewing financial health is crucial for determining the company’s long-term viability. Investors will carefully assess revenue growth, expenses, cash flow, and profitability to understand the startup’s financial stability and scalability. Key documents such as profit and loss statements, balance sheets, and cash flow statements provide a snapshot of the business’s current performance and its potential to generate sustainable returns. Founders must be prepared to explain any fluctuations or challenges in their financials and show how they plan to achieve profitability or maintain healthy financial growth.

Legal Structure and Compliance

Investors pay close attention to a startup’s legal structure and compliance during due diligence, as any legal issues could pose significant risks to the investment. This involves examining the company’s incorporation documents, contracts with employees, suppliers, and partners, and any intellectual property (IP) like patents, trademarks, or copyrights. Ensuring the startup’s regulatory compliance, including licenses and permits, is also crucial, especially in highly regulated industries. A clear and sound legal foundation gives investors confidence that the business can operate without facing legal disputes or disruptions and that its intellectual property is protected from competitors.

Market and Competition

Assessing the market size, competition, and industry trends is a key part of the due diligence process, as it helps investors gauge a startup’s growth potential and strategic positioning. Investors will look at the overall size of the target market to determine whether there is enough demand to support future expansion. They’ll also evaluate the competitive landscape, identifying direct and indirect competitors and how the startup differentiates itself. Additionally, industry trends and shifts provide insight into the startup’s ability to adapt and thrive in a changing market. A clear understanding of market dynamics enables investors to assess whether the startup is well-positioned for long-term success.

Operational Due Diligence

Operational due diligence is essential for evaluating the internal workings of a startup and ensuring that the business is set up for smooth and scalable growth. Investors will review the startup’s core processes, including day-to-day operations, supply chain management, and overall efficiency. The goal is to assess whether the startup has the necessary infrastructure in place to support growth without significant operational disruptions. A well-organized operation shows investors that the startup can scale effectively, handle increasing demand, and continue delivering on its promises without sacrificing quality or performance. Founders should be prepared to demonstrate the strength and adaptability of their operational systems during due diligence.

Technical Due Diligence

Technical due diligence is a critical part of the process for startups with a technology-driven product or service. Investors will closely examine the startup’s technology stack, including the software, hardware, and infrastructure that power the product. This review helps assess the viability and scalability of the technology. Investors also evaluate security measures to ensure that sensitive data is protected and the product is resilient to cyber threats. Additionally, future development plans are scrutinized to gauge how well the startup can innovate and stay competitive in its industry. Demonstrating a strong, secure, and scalable technical foundation gives investors confidence in the startup’s ability to deliver long-term value.

Steps for Preparing Your Startup for Due Diligence

Preparing for due diligence requires founders to be proactive and organized. Investors will request access to a wide range of documents and information to assess every aspect of the business. To ensure a smooth process, founders must compile all relevant materials, anticipate potential questions, and demonstrate their startup’s readiness for growth. The following steps outline how to efficiently prepare for due diligence, helping you present your business in the best possible light while minimizing delays or issues that could arise during the review.

1. Organize Your Documentation with a Data Room

A secure data room is essential for streamlining the due diligence process. A data room is a centralized, virtual space where you can store and organize all key documents needed for investor review, including financial statements, legal agreements, intellectual property records, and more. By having a well-structured data room, you can easily grant investors access to critical information without delays. It also ensures that sensitive data is protected and only shared with authorized parties. Visible offers data rooms tailored to founders, allowing you to securely manage and share key documents with investors. A clear and organized data room saves time and demonstrates professionalism and preparedness, giving investors confidence in your ability to manage the business.

Related resource: What to Include in a Data Room for Investors: Essential Guide for Startups

Related resource: Manage Every Part of Your Fundraising Funnel with Visible Data Rooms

2. Conduct a Legal Review

A thorough legal review is critical for ensuring that all contracts, agreements, and compliance documentation are in order before investors begin their due diligence. This includes reviewing employment contracts, supplier agreements, partnership deals, and intellectual property ownership documents. Any inconsistencies or legal issues could raise red flags for investors, delaying or even jeopardizing the deal. It's also essential to confirm that the startup is in compliance with relevant laws and regulations, especially in regulated industries. By addressing any legal gaps or discrepancies early on, founders can present a legally sound business that builds investor trust and avoids potential complications down the road.

3. Prepare Your Financial Projections

Providing clear and well-supported financial projections is crucial for demonstrating your startup’s growth potential and financial health during due diligence. Investors rely on these projections to understand how your business plans to scale and generate returns over time. Your financial forecasts should cover key areas such as projected revenue, expenses, profit margins, and cash flow for the next several years. Additionally, it’s important to base your projections on realistic assumptions, backed by market data and historical performance, to build investor confidence. Accurate and transparent financial projections show that you have a solid plan for achieving profitability and are prepared to manage the financial challenges of scaling a business.

4. Prepare Your Cap Table

Having an accurate and up-to-date cap table is essential for giving investors a clear understanding of your startup’s equity structure, ownership, and shares. The cap table outlines who owns what percentage of the company, detailing all founders, investors, and employees with equity stakes, as well as any convertible notes or options. A well-organized cap table helps investors assess their potential ownership stake and understand how future rounds of funding may impact dilution. Transparency in your cap table also demonstrates that you have a solid grasp of your company’s financial structure, which is critical for building investor trust and ensuring a smooth due diligence process.

Related resource: What is a Cap Table & Why is it Important for Your Startup

5. Secure Your Intellectual Property (IP)

Securing and verifying ownership of all intellectual property (IP) is crucial before entering due diligence. Investors will want to see that your startup has legally protected its valuable assets, including patents, trademarks, copyrights, and any proprietary technology or processes. This verification ensures that your business owns the rights to its innovations and is not at risk of legal disputes or infringement claims. If IP ownership is unclear or unprotected, it could significantly reduce the value of the business or deter investment altogether. By securing your IP early, you protect your competitive advantage and demonstrate to investors that your startup has safeguarded its core assets.

6. Document Your Business Processes

Providing clear documentation of your startup’s internal processes and workflows is essential for demonstrating operational efficiency and scalability during due diligence. Investors will want to see that your business has well-established systems in place to manage daily operations, production, customer service, and supply chain management. Documenting these processes shows that your startup can operate efficiently today and is ready to scale smoothly as demand grows. A well-organized business with clear workflows indicates that your startup is prepared to handle increased operations without disruptions, giving investors confidence in your ability to meet future growth targets.

7. Prepare Leadership and Team Information

Showcasing your leadership team's experience, qualifications, and roles is critical in building investor confidence during due diligence. Investors want to know that the team driving the startup has the expertise and capability to execute the business plan and navigate the challenges of scaling. Highlight the background of key team members, including their relevant industry experience, track record of success, and any unique skills that set them apart. Demonstrating that you have a strong, well-rounded leadership team reassures investors that your startup has the talent needed to grow and achieve long-term success.

8. Anticipate Investor Questions

Preparing for common investor questions is a key part of demonstrating transparency and readiness during due diligence. Investors will likely ask about your business strategy, growth projections, competitive landscape, and potential risks. Founders should be prepared to explain how they plan to achieve market penetration, handle competition, and manage challenges like regulatory hurdles or scaling operations. By anticipating these questions and providing thoughtful, data-backed responses, you show investors that you’ve thoroughly considered all aspects of the business and are ready to tackle future obstacles. This level of preparation can help foster trust and accelerate the due diligence process.

Related resource: Deal Flow: Understanding the Process in Venture Capital

Prepare for Startup Due Diligence Best with Visible

Preparing for due diligence can be a complex process, but by organizing your documentation, securing your legal and financial information, and anticipating investor questions, you can position your startup for success. Investors want to see a well-prepared, transparent business with a solid plan for growth and scalability.

Using tools like Visible can help simplify the process by providing data rooms, financial tracking, and investor relations management, ensuring you’re ready when due diligence begins. Give it a free try for 14 days here.

founders

10+ Foodtech Venture Capital Firms Investing in 2024

When starting a venture capital for a fundraise, it is important to stay focused on the right investors for your business. This means sticking to investors that fund companies in your industry, stage, geography, etc.

In order to best help founders find the right investors for their business, we’ve laid out 10 investors that are funding FoodTech startups below:

Quick Overview of the Food Tech Industry

As written by the team at Bread and Butter Ventures, “Food technology includes tech-enabled companies operating anywhere in the food value chain. From on farm to supply chain and manufacturing to restaurants and grocery. “Tech” can be software, hardware, bio sciences, or any combination of the three.”

Food and agriculture is a major aspects of the economy. Many venture capitalists and entrepreneurs find that there are inefficiencies in the food and agriculture sector and can be improved by funding innovative companies.

Related resource: Top 12 Industry Events and Trade Shows for Food and Beverage Startups (2024 - 2025)

Challenges in Foodtech

As put by the team at Blue Horizon in their post, The US food industry is facing a labor crisis and needs technology solutions to help solve it, “The food industry is strained from multiple forces, including heightened expectations from both customers and employees (e.g., wage increases, gig economy) as well as macro-economic pressures (e.g., inflation, supply chain constraints).”

Related Resource: The 16 Best Startup Newsletters

Related Resource: VCs Investing In Food & Bev Startups

1) Better Food Ventures

Location: Menlo Park, CA

Funding stage: Early-stage, seed stage

According to the team at Better Food Ventures, “Our investments in food and agriculture technologies span the value chain — from seed, soil, supply chain, store, supper to stomach— to support the digitization of today’s food system, and form the building blocks necessary to meet our food supply needs in 2050.”

According to their Visible Connect Profile, the team at Better Food Ventures typically writes checks anywhere between $250k and $10M. Some of Better Food Ventures most popular investments include:

Milk Moovement

Love with Food

Byte

2) 1st Course Capital

Location: Redwood City, CA

Funding stage: Early-stage, pre-seed, seed

As the team at 1st Course Capital puts it, “1st Course Capital is an early stage venture capital firm investing in innovative business models and technologies changing how we grow, produce, and distribute food.”

Some of 1st Course Capital’s most popular investments include:

BlueCart

Farmshelf

Gooder Foods

3) Nucleus Capital

Location: Berlin

Funding stage: Pre-seed and seed stage

As put on their website, “Nucleus Capital is a new venture capital firm supporting purpose-driven founders.

We believe that entrepreneurial innovation is necessary to tackle global threats to planetary health.

We deeply respect the entrepreneurial process and partner with founders at the nucleus of their journey, investing at the Pre-Seed & Seed stage.

We are most excited by mission-driven teams with relentless ambition, deep domain expertise and creative ideas.”

Nucleus is focused on pre-seed and seed stage investments. Some of Nucleus Capital’s most popular investments include:

Planet A Foods

Juicy Marbles

Yuri

4) Tet Ventures

Location: Berlin, Germany

Funding stage: Early-stage

As put on their Visible Connect Profile, “We are one of the most active global foodtech VCs, investing in teams and technology building a better food system.”

Tet Ventures typically writes check anywhere between $50k and $250k. They look to fund companies anywhere in the world at the earliest stages.

Some of Tet Ventures most popular investments include:

Farmstead

Maven

Gather Made

5) Bread and Butter Ventures

Location: Minneapolis, MN

Funding stage: Seed stage

As put by the team at Bread and Butter Venturese, “Bread and Butter Ventures is an early stage venture capital firm based in Minnesota, the Bread and Butter State, investing globally while leveraging our state and region’s unparalleled access to strong corporate connections, commercial opportunities, and industry expertise for the benefit of our founders.”

You can learn more about Bread and Butter in our podcast with Brett Brohl below:

The team at Bread and Butter typically writes checks anywhere between $100k and $400k. They traditionally focus on Food Tech, Health Tech, and Enterprise SaaS companies.

Some of Bread and Butter Venture’s most popular investments include:

Alchemy

Dispatch Goods

Omnia Fishing

6) FoodHack

Location: Lausanne, Switzerland

Funding stage: Pre-seed to Series A

As written by the team at FoodHack, “Where Food & FoodTech professionals come to get the inside scoop on industry news and meet partners, friends, mentors, investors – and everything in between.

From our weekly newsletter, to our ambassador run Meetups and our annual FoodHack Summit – our goal at FoodHack is to make it easier for purpose driven food founders to access the funding, network and knowledge they need to successfully launch and scale their business.”

7) Bluestein Ventures

Location: Chicago, IL

Related Resource: Chicago’s Best Venture Capital Firms: A List of the Top 10 Firm

Funding stage: Early-stage — typically between seed and series A

As put by the team at Bluestein Ventures, “We look for that magic combination of strategic vision + flawless execution. We’re inspired by visionary entrepreneurs that challenge the status quo – purpose-driven teams that are hungry to change the paradigm – and translate that into action. Entrepreneurs are our focus. As experienced investors, we know the journey isn’t easy. That’s why we’re here to partner with you to help you succeed.”

Check out some of Bluestein’s most popular investments below:

Cultured Decadence

Meati

New Culture

8) AgFunder

Location: San Francisco, CA

Funding stage: Seed to Series B

As put by their team, “AgFunder is an online Venture Capital Platform based in Silicon Valley. AgFunder invests in exceptional and bold entrepreneurs who are aiming to build the next generation of great agriculture and food technology companies.”

The team at AgFunder has written checks anywhere between $50k and $900k in a round. They invest in companies across the globe. Some of AgFunder’s most popular investments include:

Atomo Coffee

Alpha Foods

FieldIn

9) S2G Ventures

Location: Chicago, Boston, and San Francisco

Funding stage: Anywhere from seed to growth stage

As written by the team at S2G, “Our strategy reflects a growing appetite for investment that combines financial returns with positive long-term social and environmental effects. S2G has identified tough tech sectors that are ripe for change and is building a multi-stage portfolio of seed, venture, and growth stage investments and flexible solutions including debt and infrastructure capital.”

The team at S2G will invest across many stages and are focused on companies that benefit the environment and society. Check out a few of S2G Venture’s most popular investments below:

AppHarvest

Ripple

Beyond Meat

10) Blue Horizon

Location: Zurich, Switzerland

Funding stage: Seed to Series B

As written by the team at Blue Horizon, “Blue Horizon is accelerating the transition to a Sustainable Food System that delivers outstanding returns for investors and the planet. The company is a global pioneer of the Future of Food. As a pure play impact investor, Blue Horizon has shaped the growth of the alternative protein and food tech market. The company invests at the intersection of biology, agriculture and technology with the aim to transform the global food industry.”

Check out some of the most popular Blue Horizon investments below:

Eat Just

Impossible Foods

Planted

11) Synthesis Capital

Location: London, England

Funding Stage: Series A, Series B, Series C

Synthesis Capital invests in game-changing founders, whose companies are transforming the food system through the synthesis of food technology and modern biotechnology.

Secure venture capital for your food tech startup with Visible

At Visible, we oftentimes compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

Related Resource: A Quick Overview on VC Fund Structure

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

Find investors at the top of your funnel with our free investor database, Visible Connect

Track your conversations and move them through your funnel with our Fundraising CRM

Share your pitch deck and monthly updates with potential investors

Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.

Metrics and data

View all

founders

Service Obtainable Market: What It Is and Why It Matters for Your Startup

Understanding your startup's potential for growth is crucial in determining how to allocate resources, set goals, and attract investors. One of the key metrics to evaluate is your Service Obtainable Market (SOM)—the portion of the market your company can realistically capture. In this article, we will break down what SOM is, how it differs from other market metrics like total addressable market (TAM) and Serviceable Available Market (SAM), and why it is essential for building a focused, sustainable strategy. You'll also learn how to calculate your SOM and how it helps refine your projections and increase investor confidence.

Related resource: How to Model Total Addressable Market (Template Included)

What is Service Obtainable Market (SOM)?

The Service Obtainable Market represents the portion of your total addressable market that your startup can realistically capture based on its current resources, capabilities, and competitive positioning. It is a refined market segment that takes into account the realities of your business—such as sales capacity, distribution channels, and brand recognition. While other metrics like TAM and SAM offer a broader view of market potential, SOM gives a grounded estimate of what’s achievable. For startups, this figure is crucial in shaping strategy, defining target customers, and setting realistic revenue expectations.

Factors of Service Obtainable Market

Several factors influence your Service Obtainable Market, helping you determine the most realistic portion of the market you can capture. These include:

Market Size and Reach

The size of the total addressable market (TAM) sets the foundation for calculating Service Obtainable Market. However, your actual reach depends on your geographic footprint, target demographics, and ability to effectively penetrate the market.

Related resource: Bottom-Up Market Sizing: What It Is and How to Do It

Product

The uniqueness and quality of your product will impact how much of the market you can capture. A product that meets specific needs or offers a strong value proposition can help you stand out and gain a larger share of the market.

Competition

The level of competition in your industry will directly affect your SOM. A highly competitive market may limit your share, while a niche market or one with fewer competitors can increase your potential capture.

Historical Performance and Research

Your past sales data and market research are valuable in estimating Service Obtainable Market. Trends in customer acquisition, product adoption, and overall performance provide a realistic basis for forecasting future growth within the obtainable market.

Understanding SOM, SAM, and TAM

To grasp the full scope of your startup’s market opportunity, it’s essential to understand three key metrics: TAM, SAM, and SOM. While TAM represents the total market demand for your product or service, SAM narrows it down to the portion you can serve based on your business model. SOM refines this even further, focusing on the market you can realistically capture given your resources and competitive positioning. Let’s explore these differences in more detail.

Related resource: Total Addressable Market: Lessons from Uber’s Initial Estimates

Service Available Market (SAM) vs. Service Obtainable Market (SOM)

Service Available Market (SAM) refers to the portion of the total market that your business can serve, based on factors such as your product offering, geographic reach, and target audience. It reflects the customers you could potentially access with your current business model.

On the other hand, Service Obtainable Market is a smaller, more realistic portion of SAM. It takes into account not only your ability to serve the market but also your competitive landscape, internal resources, and operational constraints. In essence, SOM is the market share you can realistically expect to capture in the short term.

Total Addressable Market (TAM)

Total Addressable Market (TAM) is the broadest metric of the three. It represents the total market demand for your product or service, assuming no competition or barriers to entry. TAM reflects the largest possible revenue opportunity available, but it often includes customers or segments beyond your reach or interest.

While TAM gives you a big-picture view of the entire market, SAM and SOM help you zoom in on the more actionable portions, with SOM being the most precise estimate of what your startup can capture in the near term.

Related resources:

Total Addressable Market vs Serviceable Addressable Market

What Is TAM and How Can You Expand It To Grow Your Business?

How to Calculate Your Service Obtainable Market

Calculating your Service Obtainable Market (SOM) is essential for setting realistic business goals and crafting an effective market strategy. While TAM and SAM provide a broader view of potential opportunities, SOM focuses on what your startup can actually capture in the market based on your resources and competitive strengths. To calculate Service Obtainable Market, you'll need to break down your market step by step, narrowing from the largest possible market to the portion you can truly serve. Let’s walk through the process of calculating SOM and how each step contributes to a precise understanding of your market opportunity.

Step 1: Define Your Total Addressable Market (TAM)

The first step in calculating your Service Obtainable Market is to define your Total Addressable Market the largest possible market for your product or service. To identify your TAM, you’ll need to evaluate the full demand for your offering across all potential customer segments, without considering competition or operational limitations.

Start by answering these key questions:

Who are your potential customers? Identify all possible user groups or industries that would benefit from your product.

What is the overall market size? Research the total number of customers or the revenue potential in your market globally or within your target regions.

How big is the need or demand for your product? Assess the pain points your product addresses and the number of customers affected by these challenges.

By combining industry data, market reports, and demographic insights, you can estimate the maximum revenue potential of your product or service in its ideal conditions—this is your TAM.

Step 2: Narrow to Your Serviceable Available Market (SAM)

Once you’ve defined your Total Addressable Market (TAM), the next step is to narrow it down to your Serviceable Available Market (SAM)—the portion of the market that you can realistically serve, based on your business model, product offering, and geographic reach.

To assess your SAM, consider the following:

Business Model: Which customers can you effectively serve with your current sales, distribution, and operational models? Some markets might be out of reach due to logistical or operational constraints.

Product Fit: Focus on the customer segments where your product or service directly addresses specific needs or problems. Not every customer in the TAM will find your solution relevant.

Geographic Limitations: Evaluate the regions where your business operates or where you plan to expand. Factors like local demand, regulations, and shipping constraints can limit which parts of the TAM are accessible to you.

By refining your TAM with these considerations, your SAM represents the subset of customers that you have the capability and infrastructure to reach and serve.

Step 3: Identify Your Competitive Edge

To determine your Service Obtainable Market (SOM), you need to identify your competitive edge—the unique advantages that set your startup apart from others in the market. This step involves analyzing your differentiators, understanding market barriers, and assessing your competition to pinpoint your realistic market share.

Consider the following:

Differentiators: What makes your product or service stand out? This could be superior technology, pricing, customer experience, or unique features that competitors lack. Your ability to leverage these differentiators will help capture a larger portion of the market.

Market Barriers: Identify any barriers to entry, such as high development costs, regulatory requirements, or brand loyalty to existing competitors. These barriers can limit your market access and must be factored into your SOM calculation.

Competitors: Analyze your competitors' market share, customer loyalty, and positioning. Understanding their strengths and weaknesses will help you identify untapped opportunities where your startup can outperform or gain a foothold.

By combining these insights, you’ll be able to estimate the portion of the SAM that you can realistically capture, giving you a clear picture of your Service Obtainable Market.

Step 4: Calculate SOM

Now that you’ve identified your competitive edge and assessed the market, it’s time to calculate your Service Obtainable Market. To do this, you'll need to apply real-world factors such as sales capacity, market penetration, and your ability to reach customers within your Serviceable Available Market.

A simple formula to calculate Service Obtainable Market is:

SOM = SAM × Market Penetration Rate

For example, if your SAM is valued at $10 million and your startup's estimated market penetration rate is 10%, your SOM would be:

SOM = $10,000,000 × 0.10 = $1,000,000

This means that, based on your current resources and competitive position, you can realistically expect to capture $1 million of the $10 million available market. The market penetration rate can be influenced by factors like your sales team’s capacity, marketing effectiveness, and brand awareness.

By using this formula, you can calculate a more grounded estimate of your startup’s revenue potential within the Serviceable Available Market (SAM).

Why Service Obtainable Market Matters for Startups

Understanding your Service Obtainable Market is more than just a calculation—it’s a key element in shaping your startup’s strategy and ensuring sustainable growth. For startups, having a clear view of SOM allows for smarter decision-making, from resource allocation to revenue forecasting. By focusing on a realistic portion of the market, founders can set achievable goals, secure investor confidence, and avoid overextending their business too early. In the following sections, we’ll explore the specific ways SOM impacts your startup’s strategy, projections, and long-term success.

Focused Strategy

Knowing your Service Obtainable Market helps your startup stay focused by clearly defining the portion of the market you can realistically target. Instead of spreading your resources too thin trying to capture an overly broad audience, Service Obtainable Market allows you to concentrate on the most relevant customer segments. This focus ensures that your marketing, sales, and operational efforts are directed toward the right customer base—those who are most likely to convert. By avoiding the trap of overextending into markets where your resources, product fit, or brand presence are lacking, you can optimize your efforts and build sustainable growth more effectively.

Realistic Revenue Projections

Your Service Obtainable Market provides a solid foundation for creating accurate sales forecasts and revenue models. By focusing on the market you can realistically capture, SOM allows you to project revenues based on achievable goals rather than overly optimistic estimates. This level of precision is critical when presenting your business to potential investors, as they expect realistic financial models backed by data. Accurate revenue projections help ensure that your growth planning is sustainable and aligned with your current resources, making it easier to set clear milestones and secure the funding you need to scale.

Resource Allocation

Identifying your Service Obtainable Market enables your startup to allocate resources more efficiently across marketing, sales, and operations. By understanding exactly which portion of the market you can realistically capture, you can focus your efforts on the most promising opportunities. This targeted approach ensures that marketing budgets are spent on channels with the highest conversion potential, sales teams can prioritize leads most likely to close, and operational resources are scaled according to actual demand. Instead of spreading your team and resources too thin, SOM helps you streamline efforts to maximize impact and achieve better results with fewer resources.

Investor Confidence

Having a clear Service Obtainable Market (SOM) is a strong signal to investors that your startup has a realistic and achievable market strategy. Investors are looking for startups that understand their market deeply and have a plan that balances ambition with practicality. By demonstrating that you’ve calculated your SOM based on data-driven insights and realistic assumptions, you show investors that your growth projections are grounded in reality. This boosts their confidence in your ability to execute your business plan, allocate resources wisely, and achieve sustainable growth, making it easier to secure the funding needed to scale your operations.

Connect with Investors with Visible

Understanding your Service Obtainable Market is essential for shaping your startup’s strategy, creating realistic revenue projections, and efficiently allocating resources. By focusing on the market you can realistically capture, you position your business for sustainable growth and build investor confidence.

As you refine your market approach and seek funding, having the right tools to engage with investors is critical. Visible can help you manage your investor relationships and provide the insights you need to stay on top of your fundraising efforts.

Track key metrics, send investor Updates, and track the status of your next fundraise with Visible. Give it a free try for 14 days here.

founders

Lead Velocity Rate: A Key Metric in the Startup Landscape

In the fast-paced world of startups, tracking the right metrics is crucial for success. Among these, Lead Velocity Rate (LVR) stands out as a key indicator of business growth. LVR quantifies the increase in qualified leads over time, offering insights into future revenue potential. Unlike metrics that reflect past performance, LVR provides a forward-looking view, helping startups refine their strategies and predict future sales. By consistently monitoring LVR, startups can gauge their market traction, enhance their marketing efforts, and attract investor confidence, making it an indispensable tool for sustained growth and success.

What is Lead Velocity Rate (LVR)?

LVR is a metric that measures the growth rate of qualified leads over a specific period, typically month-over-month. It calculates the percentage increase in the number of qualified leads, providing startups with a clear picture of their lead generation efforts and potential future sales.

LVR is significant because it acts as a predictive indicator of future revenue. While metrics like Monthly Recurring Revenue (MRR) and overall revenue reflect past performance, LVR offers insights into future growth by highlighting trends in lead generation. By tracking LVR, startups can understand their market traction, evaluate the effectiveness of their marketing strategies, and make informed decisions to drive future growth.

For example, if a startup had 200 qualified leads last month and 250 this month, the LVR would be calculated as follows:

LVR = (250−200) / 200 x 100 = 25%

This 25% increase indicates a positive trend in lead generation, suggesting that the startup’s marketing and sales efforts effectively attract more potential customers.

LVR helps startups predict future sales growth, assess their current marketing strategies, and make data-driven decisions to optimize their lead-generation processes. Tracking LVR regularly allows founders to stay ahead of the curve, ensuring sustained growth and success.

Lead Velocity Rate vs. Customer Lifetime Value (CLV)

LVR and Customer Lifetime Value (CLV) are both critical metrics for startups, but they serve different purposes and provide distinct insights.

Lead Velocity Rate (LVR) measures the growth rate of qualified leads over a specific period, typically on a month-over-month basis. It calculates the percentage increase in the number of leads that meet predefined criteria for quality, such as those who have shown a strong interest in the product or service. LVR is a forward-looking metric, offering predictive insights into future revenue potential by indicating how effectively a startup is generating new leads. Essentially, it helps startups understand the momentum of their lead generation efforts and anticipate future sales growth.

Customer Lifetime Value (CLV), on the other hand, assesses the total revenue a customer is expected to generate over the entire duration of their relationship with a business. It considers the average purchase value, purchase frequency, and customer lifespan to estimate the overall financial contribution of a customer. CLV is a backward-looking metric that focuses on the value derived from existing customers, providing insights into customer retention, satisfaction, and long-term profitability. It helps startups understand the financial impact of their customer base and make strategic decisions regarding customer acquisition and retention efforts.

Why Lead Velocity Rate is an Important Metric for Startups

LVR is one of the most important metrics for startups to track because it provides a clear and actionable insight into a company’s growth trajectory. Unlike historical metrics such as MRR and overall revenue, LVR is a forward-looking indicator that measures the growth of qualified leads over time. This makes it a crucial tool for predicting future revenue and assessing the effectiveness of marketing strategies.

Lead Velocity Rate is not just a metric; it is a vital tool that enables startups to predict growth, optimize marketing efforts, and secure investor interest. By tracking LVR regularly, startups can ensure they are on the right path to sustained growth and success.

Measuring Growth Momentum

Lead Velocity Rate provides a clear and quantifiable measure of a startup's growth momentum by tracking the increase in qualified leads over time. This metric allows startups to see how well their lead generation efforts are working, offering a tangible indicator of market traction. By regularly monitoring LVR, startups can identify trends in lead growth, adjust their marketing strategies, and ensure they are continually attracting new potential customers. A rising LVR indicates that the startup’s efforts are translating into more qualified leads, which is a strong sign of growing market interest and business momentum.

Predictive Power

LVR is a powerful leading indicator of future revenue and business performance. Unlike historical metrics, which only show what has already happened, LVR provides a forward-looking perspective by measuring the growth of new leads. This allows startups to predict future sales more accurately, as an increasing LVR suggests a robust pipeline of potential deals. By understanding and leveraging LVR, startups can forecast their revenue more effectively, align their sales and marketing efforts with anticipated growth, and make proactive decisions to sustain or accelerate their upward trajectory.

Financial Health

Assessing the financial health of a startup is crucial for long-term success, and LVR plays a key role in this evaluation. A high LVR indicates that a startup is successfully generating a growing number of qualified leads, which is essential for sustaining revenue growth. This metric helps startups understand whether their lead generation strategies are effective and whether they have a strong foundation for future financial stability. By tracking LVR, startups can ensure they are building a healthy pipeline that supports continuous revenue generation and overall business health.

Investor Confidence

LVR serves as a powerful tool for attracting investors by demonstrating that a startup is on an upward growth trajectory. Investors look for startups with strong growth potential, and a consistently increasing LVR is a clear indicator of this. It shows that the startup is effectively generating new leads and has a promising outlook for future revenue. By presenting a high LVR, startups can enhance their credibility and appeal to investors, showcasing their ability to grow and succeed in a competitive market. This metric can significantly boost investor confidence and increase the likelihood of securing funding.

Related resource: Why Revenue Per Lead is Really Important to Track

How to Calculate Lead Velocity Rate

Calculating LVR is straightforward and provides valuable insights into your startup’s growth potential. Understanding how to measure LVR enables startups to track the effectiveness of their lead-generation strategies and predict future sales. The process involves comparing the number of qualified leads from one month to the next, clearly showing how well your marketing and sales efforts are performing. By consistently calculating LVR, startups can make informed decisions to optimize their growth strategies and ensure sustained success.

Lead Velocity Rate Formula

The formula for calculating Lead Velocity Rate is simple and easy to apply. Here’s the basic formula:

LVR = (Number of Qualified Leads This Month − Number of Qualified Leads Last Month) / Number of Qualified Leads Last Month × 100

To illustrate, if a startup had 200 qualified leads last month and 250 this month, the calculation would be:

LVR = (250 − 200) / 200 × 100 = 25%

This 25% increase in qualified leads indicates a positive trend in lead generation, suggesting that the startup’s efforts to attract potential customers are effective. By regularly calculating and monitoring LVR, startups can track their growth momentum, anticipate future sales, and refine their marketing strategies to maximize lead generation.

Related resource: Developing a Successful SaaS Sales Strategy

Challenges and Considerations for Tracking LVR

While Lead Velocity Rate is an invaluable metric for startups, accurately tracking and utilizing it involves overcoming several challenges and considerations. Ensuring the reliability of LVR requires a focus on data accuracy, timeliness, and a holistic evaluation of metrics. Understanding these factors is essential for leveraging LVR effectively and making informed strategic decisions.

Data Accuracy and Consistency

LVR relies heavily on the accuracy and consistency of data. Accurate LVR calculations depend on precise and complete data regarding the number of qualified leads. Any inaccuracies or inconsistencies in data collection can skew LVR results, misrepresenting a startup's growth trajectory. Therefore, startups must implement rigorous data collection and validation processes to ensure that the information used for LVR calculations is reliable and consistent over time.

Timeliness of Data

Timely data collection and reporting are crucial for accurate LVR measurements. LVR calculations require up-to-date data on qualified leads to accurately reflect the current state of lead generation. Data collection and reporting delays can result in outdated or irrelevant LVR calculations, which may not align with real-time decision-making needs. Startups must establish efficient data collection systems and workflows to ensure LVR calculations are based on the most current available data.

Holistic Metrics Evaluation

While LVR is a powerful metric, it should not be viewed in isolation. LVR should be considered alongside other KPIs such as Customer Acquisition Cost, Customer Lifetime Value, and Monthly Recurring Revenue for a comprehensive understanding of business performance. A holistic evaluation of these metrics provides a more complete picture of a startup's financial health, growth potential, and overall business performance. Balancing LVR with other KPIs allows startups to make more informed and strategic decisions.

Related resource: Your Company’s Most Valuable Metric

Secure Investor Interest with Visible

Lead Velocity Rate is a critical metric for startups, providing valuable insights into growth momentum, future revenue potential, and overall financial health. By accurately calculating and consistently tracking LVR, startups can measure their lead generation effectiveness, predict business performance, and attract investor confidence. Addressing challenges related to data accuracy, timeliness, and holistic metrics evaluation ensures that LVR serves as a reliable and powerful tool for driving strategic decisions.

To maximize the benefits of LVR and other key performance indicators, consider using Visible’s all-in-one platform to track and visualize your startup’s metrics - create your account here!

We want to hear from you. What is your Most Valuable Metric? Tell us here and we will share the results with the contributors!

Want to be alerted of our new blog posts? Subscribe to our email list.

Some more great posts about LVR

http://saastr.com/2012/12/12/why-lead-velocity-rate-lvr-is-the-most-important-metric-in-saas

http://www.revenify.com/important-metric-saas-lead-momentum-description-lead-velocity

http://www.referralsaasquatch.com/how-to-calculate-saas-growth

founders

The Only Financial Ratios Cheat Sheet You’ll Ever Need

Understanding your business's financial health is crucial for making informed decisions and driving growth. Our comprehensive cheat sheet covers essential financial ratios, from profitability to valuation, providing clear formulas, practical examples, and insightful applications. This guide will help you decode complex financial data, compare performance with industry peers, and make strategic adjustments. Whether you're assessing liquidity, efficiency, or profitability, this cheat sheet is your go-to resource for confidently navigating financial analysis. Dive in and empower your business with the insights needed to thrive.

Profitability Ratios

Profitability ratios are crucial indicators of a company’s ability to generate profit relative to its revenue, assets, and equity. These ratios are widely used by founders, investors, analysts, and creditors to assess a business's financial health and operational efficiency. They help identify how well a company is performing in terms of profit generation and provide insights into areas where improvements can be made.

Gross Profit Margin

Gross Profit Margin measures how efficiently a company is producing and selling its goods. A higher margin indicates better efficiency and profitability. It is particularly useful for comparing companies within the same industry to gauge operational efficiency.

Formula:

Gross Profit Margin = Revenue − Cost of Goods Sold (COGS) / Revenue

Components:

Revenue: Total sales generated by the company.

Cost of Goods Sold (COGS): Direct costs attributable to the production of goods sold by the company.

How to Solve:

Calculate the gross profit by subtracting COGS from revenue.

Divide the gross profit by the revenue.

Multiply the result by 100 to get the percentage.

Operating Profit Margin

This ratio indicates the total revenue left after covering operating expenses. It helps assess the core business efficiency, excluding non-operational factors. A higher operating margin suggests better management of operating costs.

Formula:

Operating Profit Margin = Operating Income / Revenue

Components:

Operating Income: Revenue minus operating expenses (excluding interest and taxes).

How to Solve:

Calculate operating income by subtracting operating expenses from revenue.

Divide the operating income by the revenue.

Multiply the result by 100 to get the percentage.

Net Profit Margin

Net Profit Margin provides the bottom line profit relative to sales. It is a key indicator of overall profitability and is used to compare performance with competitors. A higher net profit margin indicates a more profitable and financially healthy company.

Formula: Net Profit Margin = Net Income \ Revenue

Components:

Net Income: Total profit after all expenses, including taxes and interest, have been deducted from revenue.

How to Solve:

Calculate net income by subtracting all expenses from revenue.

Divide the net income by the revenue.

Multiply the result by 100 to get the percentage.

Return on Equity (ROE)

ROE measures the return generated on shareholders' investments. It is crucial for investors to evaluate how effectively a company uses equity to generate profits. A higher ROE suggests a more efficient use of equity capital.

Formula:

ROE = Net Income / Shareholders’ Equity

Components:

Net Income: Total profit after all expenses.

Shareholders’ Equity: Total assets minus total liabilities.

How to Solve:

Divide the net income by the shareholders’ equity.

Multiply the result by 100 to get the percentage.

Return on Assets (ROA)

ROA indicates how efficiently a company uses its assets to generate profit. It is particularly useful for comparing companies in capital-intensive industries. A higher ROA means better utilization of assets.

Formula:

ROA = Net Income / Total Assets

Components:

Net Income: Total profit after all expenses.

Total Assets: Sum of all assets owned by the company.

How to Solve:

Divide the net income by the total assets.

Multiply the result by 100 to get the percentage.

Return on Capital Employed (ROCE)

ROCE assesses the efficiency and profitability of a company's capital investments. It is essential for evaluating long-term profitability and comparing across industries. A higher ROCE indicates more efficient use of capital.

Formula:

ROCE = Earnings Before Interest and Tax (EBIT) / Capital Employed

Components:

EBIT: Earnings before interest and taxes.

Capital Employed: Total assets minus current liabilities.

How to Solve:

Divide EBIT by the capital employed.

Multiply the result by 100 to get the percentage.

Solvency Ratios

Solvency ratios are vital for assessing a company's ability to meet its long-term obligations. These ratios provide insights into a business's financial stability and leverage, which are crucial for founders, investors, creditors, and analysts. By evaluating solvency ratios, stakeholders can determine the risk level associated with the company’s financial structure and its capability to sustain operations in the long run.

Debt-to-Equity Ratio

The Debt-to-Equity Ratio indicates the relative proportion of shareholders' equity and debt used to finance a company's assets. It is an essential measure for assessing financial leverage and risk. A higher ratio suggests that a company is more leveraged and may be at higher risk of financial distress. Conversely, a lower ratio indicates a more stable financial structure with less reliance on debt.

Formula:

Debt-to-Equity Ratio = Total Liabilities / Shareholders’ Equity

Components:

Total Liabilities: The sum of all debts and obligations the company owes.

Shareholders’ Equity: The net assets of the company, calculated as total assets minus total liabilities.

How to Solve:

Add up all the company's liabilities to get the total liabilities.

Calculate shareholders’ equity by subtracting total liabilities from total assets.

Divide total liabilities by shareholders’ equity.

Equity Ratio

The Equity Ratio measures the proportion of a company's assets financed by shareholders' equity. This ratio provides insights into the financial stability and capitalization structure of the business. A higher equity ratio indicates a more financially stable company with less dependence on debt, making it more attractive to investors and creditors.

Formula:

Equity Ratio = Shareholders’ Equity / Total Assets

Components:

Shareholders’ Equity: The net assets of the company, calculated as total assets minus total liabilities.

Total Assets: The sum of all assets owned by the company.

How to Solve:

Calculate shareholders’ equity by subtracting total liabilities from total assets.

Divide shareholders’ equity by total assets.

Multiply the result by 100 to get the percentage.

Debt Ratio

The Debt Ratio measures the extent to which a company is financed by debt. It provides insights into the company's leverage and financial risk. A lower debt ratio indicates that the company relies less on debt to finance its assets, reducing financial risk. Conversely, a higher ratio suggests higher leverage and potential vulnerability to financial distress.

Formula:

Debt Ratio = Total Liabilities / Total Assets

Components:

Total Liabilities: The sum of all debts and obligations the company owes.

Total Assets: The sum of all assets owned by the company.

How to Solve:

Add up all the company's liabilities to get the total liabilities.

Divide total liabilities by total assets.

Multiply the result by 100 to get the percentage.

Efficiency Ratios

Efficiency ratios evaluate how well a company utilizes its assets and liabilities to generate sales and maximize profits. These ratios are critical for founders, managers, and investors as they provide insights into operational efficiency, resource management, and overall business performance.

Asset Turnover

Asset Turnover measures how efficiently a company uses its assets to generate sales. A higher ratio indicates better utilization of assets. This ratio is particularly useful for comparing companies within the same industry to understand relative efficiency. For instance, a company with a higher asset turnover is considered more efficient in using its assets to produce revenue.

Formula:

Asset Turnover = Revenue / Total Assets

Components:

Revenue: Total sales generated by the company.

Total Assets: The sum of all assets owned by the company.

How to Solve:

Identify the total revenue from the company's income statement.

Determine the total assets from the balance sheet.

Divide the total revenue by the total assets.

Inventory Turnover

Inventory Turnover measures how often inventory is sold and replaced over a period. A higher turnover indicates efficient inventory management and strong sales, while a lower turnover may suggest overstocking or weak sales. Comparing this ratio to industry benchmarks can provide insights into inventory management practices.

Formula:

Inventory Turnover = Cost of Goods Sold (COGS) / Average Inventory

Components:

COGS: Direct costs attributable to the production of goods sold by the company.

Average Inventory: (Beginning Inventory + Ending Inventory) / 2.

How to Solve:

Calculate COGS from the income statement.