From working with hundreds of customers and users, we get a lot of questions around ‘what kind of information should I be including updates to my investors?’

We break this down to 4 different sections.

- Financial

- Key Growth Metric

- Industry/Market Standards

- Investor/Advisor/Board suggested

1. Financial

– Money money money. Finances are the lifeblood of a company, you can tell how well a company is growing, how smart they are spending, how healthy they are, or how many more months they have left before they disappear.

-Look at any standard Cash Balance Sheet and Income Statement, you should have the major line items of this for your investors.

-Depending on what kind of product you sell, there could be some important ones to highlight like gross margin or wages or marketing expenses. Always highlight the items that affect the company the most.

2. Key Growth Metric

– There are lots of things that accrue a company’s growth, but there is normally just one or two numbers that you look at for showing your growth and success. We talk about how to find your ‘Most-Valuable-Metric’ and the best way to tell your company’s story in The Ultimate Guide to Startup Data Distribution

-This can be a numeric or monetary amount, and it changes for each company/business plan/industry. For SaaS, this could be MRR, for a messaging app, it could be number of users, average messages per user.

Main Point: This metric(s) is(are) they key segment(s) that needs to grow to continue your success to Unicorn Ranch.

3. Industry/Market Standards

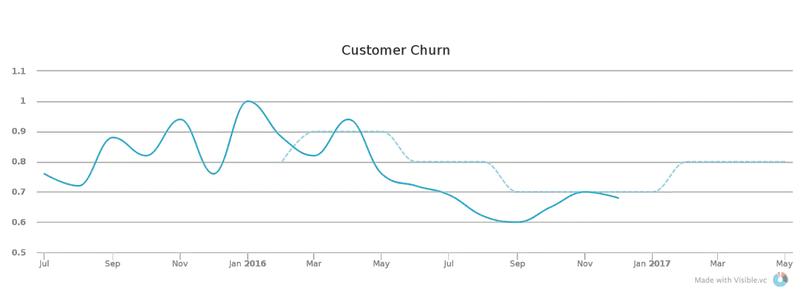

– Don’t reinvent the wheel. When you’re growing a company in a specific industry or market, there are always benchmark numbers and stats people talk about. Use these for your own reporting so you can have your stakeholders look at the market, their experiences or expertise, and your company (aka – make them work for that equity they bought/earned). For SaaS (I’m in SaaS so I talk SaaS), this would be items like Churn Rate, Average MRR Value, Total ARR, Cost per Acquisition, Lifetime Value, etc.

4. Investor/Advisor/Board Suggested

– Your key stakeholders (investors, advisors, board members), if you picked them right, will have experience, knowledge, connections, and more to help you become even more successful. From speaking with them, they’ll probably find a few metrics not already covered that they want you to focus on or track. This only helps leverage them in the future and allow them to be proactive towards that ten-figure exit.

Checkout Visible’s list of Most-Valuable-Metric and see if there is something you have been missing.

Enjoy Your Day, Go Create Something, and Make Someone Smile

Nate Morris