Key Takeaways

-

Discover top VC firms in New York City that fund startups across fintech, health tech, media, and more, ideal for founders seeking early-stage to growth capital.

-

Gain an edge in NYC’s competitive venture capital market with practical tips on pitching, building local traction, and standing out to investors.

-

Tap into New York’s deep talent pool and global financial network to scale faster with access to seasoned operators, strategic partners, and media opportunities.

-

Learn how leading VC firms invest, from seed to Series C and beyond, with clear insights into check sizes, industries, and investment strategies.

-

Explore actionable fundraising strategies tailored to New York’s fast-paced startup ecosystem to help you secure funding and accelerate growth.

New York City remains the world’s second-largest venture capital ecosystem by deal volume, trailing only the Bay Area. For 2026, the region is characterized by a mature concentration of Fintech, Enterprise SaaS, and Digital Health investors shifting capital toward efficient growth models. Median Seed valuations in NYC currently hover between $10M–$12M (post-money), with investors prioritizing clear unit economics over top-line velocity.

While the city historically leaned toward media and commerce, the current active funds are increasingly thesis-driven around AI application layers and vertical SaaS. Founders raising here must demonstrate not just a "New York presence," but a capital efficiency strategy that aligns with the higher cost basis of operating in the city.

NYC Fundraising at a Glance

- Primary Hubs: Flatiron, SoHo, Chelsea, DUMBO.

- Dominant Sectors: Fintech, Proptech, Enterprise SaaS, Digital Health.

- 2026 Market Shift: Decreased Series B deployment; increased competition for Seed/Series A leads.

- Average Seed Check Size: $2M – $4M (Multi-fund rounds).

Why Raise Venture Capital in New York City?

For startup founders, raising venture capital in New York City brings unique advantages beyond funding. The city’s rich network of seasoned industry players, many of whom are leading experts across sectors like finance, media, health, and technology, creates an unparalleled environment for networking and mentorship. Founders who connect with New York investors can gain valuable insights, establish critical partnerships, and access a wealth of business connections that can accelerate their company’s growth.

New York City also offers a large and highly skilled talent pool, particularly in fields essential to scaling high-growth startups, such as software engineering, data science, and digital marketing. This concentration of expertise, alongside a multicultural and entrepreneurial workforce, enables founders to put together strong teams and leverage top-tier talent.

The city is also a global media hub, giving startups unique opportunities for exposure. A New York presence can help founders tap into PR channels, digital media, and industry events that draw attention to their company’s mission, products, and innovations. For startups aiming to build brand awareness, a NYC-based investor network can be a gateway to high-impact media opportunities that support long-term growth.

Related Resource: How to Find Venture Capital to Fund Your Startup: 5 Methods

The New York Venture Capital Landscape

New York City’s venture capital ecosystem is renowned for its fast-paced growth and sector diversity, making it one of the most attractive destinations for startup founders seeking investment. The city’s well-established financial roots have paved the way for a robust fintech scene, with startups focusing on digital payments, blockchain, and financial inclusivity solutions. Health tech is also flourishing, driven by New York’s world-class medical institutions and a push for innovation in areas like telemedicine, digital health records, and personalized medicine. Media and advertising technology also hold a significant share, leveraging the city’s longstanding position as a global media hub. With ample resources, industry expertise, and access to investors and early customers, New York’s vibrant VC scene offers unique advantages for startups across these and many other sectors.

VC Firms in New York Investing in Startups

1. Union Square Ventures

According to their website, “Union Square Ventures is a venture capital firm focused on early-stage, growth-capital, late stage, and startup financing.”

Investment Range

Union Square Ventures invests in a large range of companies. Looking at their website and you’ll find that they invest in anywhere between Series A and Series D stages.

Industries

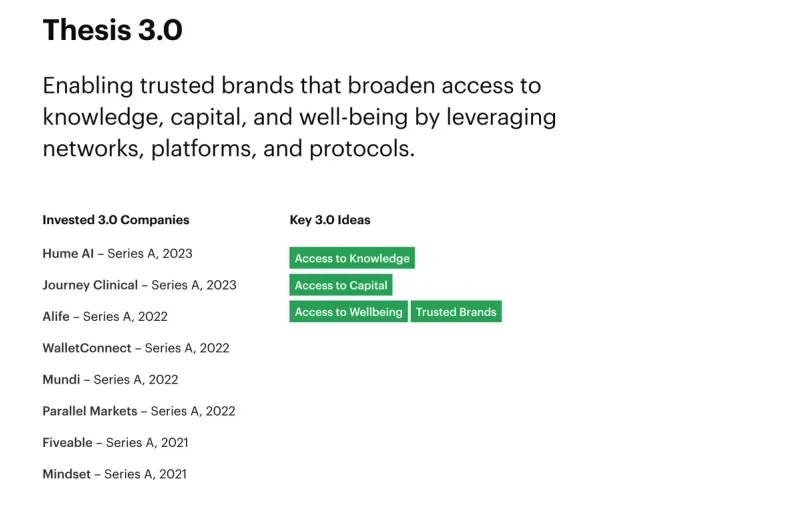

Union Square is self-described as a “thesis-driven” investor. They are currently investing off of their Thesis 3.0: “Enabling trusted brands that broaden access to knowledge, capital, and well-being by leveraging networks, platforms, and protocols.”

Check out more about their Thesis 3.0, recent investments, and key ideas below:

2. Insight Partners

According to the Insight Partners website, “Insight accelerates revenue and profit in software companies. Our obsession with software has produced a habit of success. We recognize industry patterns, emerging tech markets and software trends. We’ve accumulated the knowledge to understand the strategies needed to win.”

Investment Range

Insight Partners will invest across every stage but their bread and butter are “scale-up” companies. Insight will invest anywhere from pre-seed to series C and beyond stages — generally with a check size between $10M and $350M.

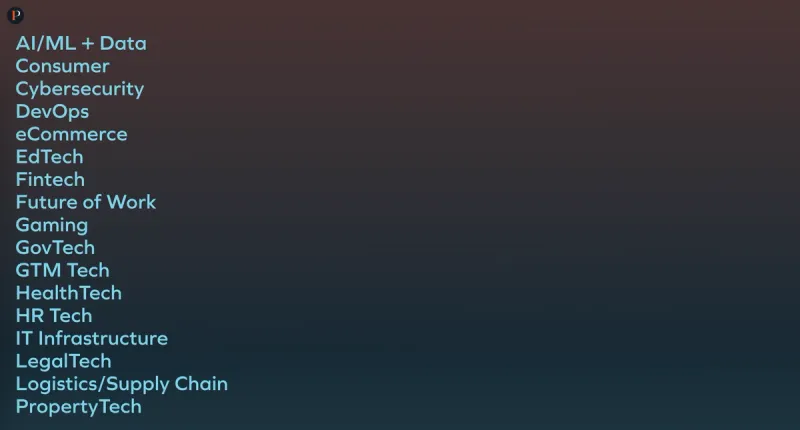

Industries

Insight is focused on software companies. However, they invest in a number of different sectors that you can find here (or below):

3. Scout Ventures

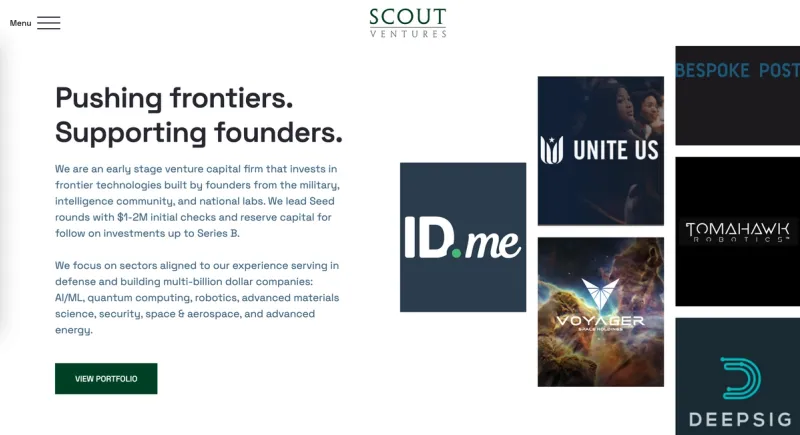

According to the Scout Ventures website, “Scout Ventures is an early-stage venture capital firm that invests in frontier and dual-use technologies built by veterans, intelligence leaders, and premier research labs. By leveraging our network of professional investors, operators, and experienced entrepreneurs, Scout can effectively execute every aspect of our investment thesis. We’re also paving the way for military veterans and intelligence professionals to access hundreds of millions in government grants and non-dilutive capital. The firm has three locations: Austin, New York City, Washington, DC.”

Investment Range

Scout Ventures writes checks anywhere between $100,000 and $3M. According to their website, “We lead Seed rounds with $1-2M initial checks and reserve capital for follow-on investments up to Series B.”

Industries

According to the Scout website, “We focus on sectors aligned to our experience serving in defense and building multi-billion dollar companies: AI/ML, quantum computing, robotics, advanced materials science, security, space & aerospace, and advanced energy.”

4. Greycroft

According to their website, “Greycroft is a venture capital firm that focuses on technology start-ups and investments in the Internet and mobile markets.”

According to the team at Greycroft, “Greycroft typically makes initial investments from $500,000 at the seed stage to up to $30 million from the growth stage. We are an active Series A investor and typically invest between $1 million and $10 million.

The growth fund targets investing $10 to $30 million on an initial basis and may reserve up to double that amount over time. The growth fund focuses on later-stage companies with proven unit economics, annual revenue growth in excess of 50%, and a management team that is prepared to scale.”

Industries

On the Greycroft website, you’ll find that they invest in a number of different industries — ”We invest across a broad range of Internet sectors. We currently group our portfolio into four verticals: Consumer Internet, Fintech, Healthcare, and Enterprise Software.”

5. RRE Ventures

RRE Ventures has been funding software startups since the 90s. According to their website, “RRE Ventures is a New York-based venture capital firm that offers early-stage funding to software, internet, and communications companies.”

Investment Range

The team at RRE invests in a variety of early-stage tech and software companies. According to their Visible Connect profile, they invest in Series A and B companies with an average check size between $4M and $15M.

Industries

According to their website, “RRE invests in early-stage, technology-enabled companies across all sectors and across the country. We back credible teams executing against incredible ideas to build category-defining businesses.” Check it out here or learn more below:

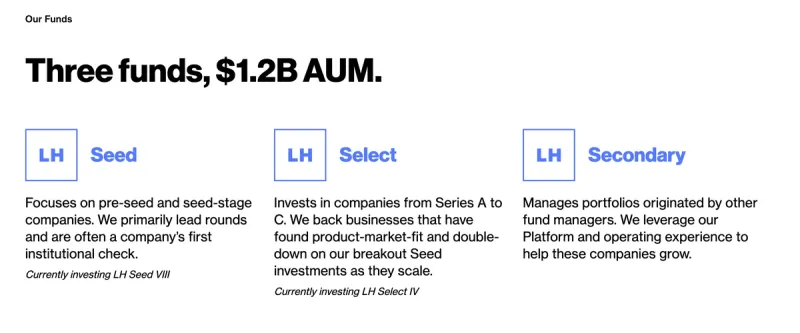

6. Lerer Hippeau

According to their website, “Lerer Hippeau is an early-stage venture capital fund founded and operated in New York City. We invest in good people with great ideas who redefine categories — and create new ones entirely.”

Investment Range

The team at Lerer Hippeau has 3 funds that invest in pre-seed to Series C and beyond companies.

Industries

The team at Lerer Hippeau is industry-agnostic and will invest in any company — including enterprise and consumer landscapes.

7. Starta

According to their website, “Starta is a venture ecosystem to find, foster, and fund early-stage talent in tech.

Our mission is to provide opportunities to:

- International startups who want to scale globally and raise capital

- Aspiring industry leaders, seeking professional training

- Investors who believe in long-term growth potential and a strong connection with the community

Starta values inclusivity and diversity. Having worked with over 200 startups from all over the world, we intensively focus on bringing equal opportunities and support to the ecosystem.”

Investment Range

Like many of the other firms on this list, Starta has multiple funds that invest in many stages. Starta operates both an accelerator and early-stage fund intended for seed and series A companies.

Industries

The Starta team has a focus on international startups that are looking to expand and scale their US presence.

8. FirstMark

FirstMark is an early-stage venture capital firm headquartered in New York City. As put by their team, “We are proud to back the ambitious founders of the most iconic companies in the world.”

Investment Range

According to their Visible Connect profile, the team at FirstMark writes checks anywhere between $500k and $15M.

Industries

The team at FirstMark invests in companies of a variety of industries and sectors. They have major focus areas of Enterprise, Consumer, and Frontier companies.

9. Hypothesis

According to the Hypothesis website, “We build and fund companies. We’re a startup studio and seed fund that launches, funds, and scales exceptional companies.”

Investment Range

As a startup studio, Hypothesis focuses on finding successful founders and co-founders and helps them launch and scale businesses. In addition to capital, Hypothesis portfolio companies receive resources and help with sales and marketing, hiring, product development, follow-up funding, etc.

Industries

The team at Hypothesis will invest in companies across many industries and are focused on “mission-driven” companies and founders.

10. Interlace Ventures

According to the team at Interlace Ventures, “Investing in early-stage commerce- and retail-technology companies gives us unparalleled access to the latest technological innovations and trends across commerce and retail.

We leverage this access by partnering with global brands and retailers to support their innovation efforts.

We do this through a variety of methods, all of with are tailored after each partner’s individual needs and priorities.”

Investment Range

The team at Interlace invests in pre-seed to series A-stage companies. According to their Visible Connect Profile, they will write checks anywhere between $150k and $600k.

Industries

Interlace has a focus on commerce and retail companies.

11. FJ Labs

FJ Labs is a prominent venture capital firm based in New York City, renowned for its extensive network and hands-on approach to investing. Founded by experienced entrepreneurs Fabrice Grinda and Jose Marin, FJ Labs focuses on creating value for founders and investors. The firm leverages its deep industry expertise and global connections to support startups in achieving their growth potential. FJ Labs is particularly noted for its collaborative ethos, working closely with portfolio companies to navigate the complexities of scaling and market expansion.

Investment Range

FJ Labs typically invests in pre-seed to Series A rounds, with investment amounts ranging from $50,000 to $500,000. Focusing on early-stage investments, FJ Labs provides critical funding enabling startups to develop their products, gain market traction, and prepare for subsequent funding rounds. Their flexible investment strategy allows them to tailor their support to the unique needs of each startup, ensuring that founders receive the resources necessary to succeed.

Industries

FJ Labs has a diverse investment portfolio, strongly emphasizing marketplaces and network effects businesses. They are particularly interested in industries such as e-commerce, real estate tech, fintech, and mobility. FJ Labs seeks out startups that leverage technology to disrupt traditional markets and create new growth opportunities. Their broad industry focus enables them to identify innovative business models and support visionary entrepreneurs across various sectors.

12. VentureOut

VentureOut is a unique venture capital firm and accelerator based dedicated to bridging the gap between international startups and the US market. With a focus on helping startups expand globally, VentureOut offers a comprehensive suite of services designed to support international entrepreneurs in scaling their businesses in the US. The firm combines investment with an accelerator program that provides mentorship, networking opportunities, and strategic guidance, making it an ideal partner for startups looking to make a significant impact in the American market.

Investment Range

VentureOut typically invests in early-stage companies, with investment amounts ranging from $50,000 to $250,000. Their funding is often coupled with participation in their accelerator programs, which offer startups additional resources to refine their business models, develop go-to-market strategies, and establish a presence in the US. This dual approach of investment and acceleration helps startups gain the momentum they need to succeed in a competitive market.

Industries

VentureOut focuses on various industries, with a particular emphasis on technology-driven sectors. They are especially interested in software, fintech, health tech, and enterprise tech startups. By concentrating on these high-growth areas, VentureOut aims to support innovative companies that have the potential to transform industries and drive technological advancements. Their industry focus and international expertise position VentureOut as a valuable partner for startups seeking to expand their reach and impact in the US market.

13. FirstMark

FirstMark is a distinguished venture capital firm known for its commitment to backing visionary entrepreneurs. With a track record of successful investments, FirstMark partners with startups that have the potential to revolutionize their industries. The firm is dedicated to providing not only capital but also strategic support and access to an extensive network of industry leaders. By fostering close relationships with their portfolio companies, FirstMark helps founders navigate the challenges of scaling their businesses and achieving long-term success.

Investment Range

FirstMark typically invests in seed and early-stage companies, with investment amounts ranging from $500,000 to $10 million. This substantial range allows FirstMark to support startups at various stages of their development, from initial product launches to significant growth phases. Their flexible investment approach ensures that each startup receives the appropriate level of funding to meet its unique needs and objectives.

Industries

FirstMark has a broad investment focus with a strong emphasis on technology and innovation. They are particularly interested in sectors such as enterprise software, consumer technology, fintech, healthcare, and emerging technologies like AI and blockchain. FirstMark seeks out startups that are poised to disrupt traditional markets and create new growth opportunities. By investing in a diverse array of industries, FirstMark aims to support the next generation of transformative companies and help shape the future of technology and innovation.

14. New York Angels

New York Angels is a prominent angel investment group based in New York City, dedicated to providing early-stage funding and mentorship to innovative startups. Comprising a diverse network of seasoned entrepreneurs and business leaders, New York Angels offers a wealth of experience and strategic insight to help young companies grow and succeed. The organization is known for its collaborative approach, working closely with founders to refine their business models, develop market strategies, and connect with additional resources and expertise.

Investment Range

New York Angels typically invests in seed and early-stage companies, with investment amounts ranging from $250,000 to $1 million. By focusing on the crucial early stages of a startup's development, New York Angels provides the necessary capital to help companies validate their business ideas, build their initial products, and gain market traction. Their investment approach is designed to offer startups the financial support they need to reach critical milestones and prepare for subsequent funding rounds.

Industries

New York Angels has a broad investment focus, with a particular interest in technology-driven sectors. They frequently invest in industries such as software, fintech, health tech, consumer products, and media. This diverse industry focus allows New York Angels to support a wide array of innovative startups, fostering growth and innovation across multiple sectors. By backing companies that leverage technology to create new solutions and disrupt existing markets, New York Angels aims to contribute to the advancement of the entrepreneurial ecosystem in New York City and beyond.

15. New York Venture Partners

New York Venture Partners (NYVP) is a leading venture capital firm based in New York City, focused on supporting early-stage startups with a combination of capital, mentorship, and strategic resources. Known for its hands-on approach, NYVP aims to help founders build scalable businesses by providing more than just funding. The firm's extensive network and industry expertise enable it to offer valuable insights and connections, making NYVP a vital partner for startups looking to navigate the complexities of growth and market entry.

Investment Range

New York Venture Partners typically invests in seed and early-stage companies, with investment amounts ranging from $100,000 to $1 million. This investment range is designed to provide startups with the essential funding required to develop their products, refine their business models, and achieve early market traction. NYVP's focus on early-stage investments ensures that startups receive the support they need during the critical phases of their development.

Industries

NYVP has a diverse investment focus, particularly on technology and innovation-driven sectors. They are especially interested in industries such as artificial intelligence, machine learning, digital media, consumer internet, and enterprise software. By targeting these high-growth areas, New York Venture Partners aims to back startups that have the potential to disrupt traditional markets and introduce groundbreaking technologies. Their broad industry focus allows them to identify and support promising startups across a wide range of fields, fostering innovation and entrepreneurial success in the New York City area and beyond.

16. Primary

Primary is a prominent venture capital firm based in New York. It is dedicated to investing in early-stage startups and helping them grow into market leaders. Known for its data-driven approach and hands-on involvement, Primary provides comprehensive support to its portfolio companies. The firm leverages its deep industry knowledge and extensive network to offer strategic guidance, operational expertise, and valuable resources. Primary's commitment to building long-term partnerships with founders makes it a trusted ally for startups navigating the challenges of scaling and achieving sustainable growth.

Investment Range

Primary typically invests in seed and Series A rounds, with investment amounts ranging from $1 million to $5 million. This substantial investment range allows Primary to provide the necessary capital for startups to develop their products, expand their teams, and accelerate their go-to-market strategies. By focusing on early-stage investments, Primary ensures that founders receive the financial support they need during the critical phases of their company's development.

Industries

Primary has a strong focus on technology-driven sectors, particularly those with the potential for significant market disruption. They are especially interested in industries such as SaaS, e-commerce, fintech, health tech, and proptech. Primary seeks out startups that leverage innovative technologies to solve complex problems and create new market opportunities. Their industry focus allows them to identify and support high-potential startups across various fields, fostering innovation and driving growth in the New York City startup ecosystem.

17. AlleyCorp

About: AlleyCorp is an early stage venture fund and venture builder that founds and funds transformative companies in New York.

18. C2 Ventures

About: We are a specialized early-stage venture capital firm that invests exclusively in robotics and B2B SaaS companies that apply artificial intelligence for the dirty, dull, and dangerous industries. We believe the next wave of enterprise value creation will emerge not from flashy consumer apps but from practical solutions to real-world problems in overlooked sectors: construction tech, manufacturing, logistics, proptech and similar industries where work is hard and software adoption remains low.

19. XRC Ventures

About: XRC Ventures is a New York–based pre-seed and seed fund focused on technologies that shape and are shaped by consumer behavior - a massive, rapidly evolving market that drives 70% of U.S. GDP yet remains largely overlooked by most venture investors.

20. Third Sphere

Aboout: Third Sphere works for founders transforming global systems. We’ve made over 100 investments in notable firms like Cove Tool, OneWheel and Bowery Farming. We’re usually a pre-customer investor and offer traditional venture as well as credit finance, along with coaching and connections to over 12,000 customers, investors focused on re-imagining our planet. Our team is ranked in the 99th percentile of climatetech investors on NFX Signal, and Techcrunch named us one of the top 10 VCs founders love the most. We know that climate is about more than carbon—it’s also about force multipliers like asset finance and distribution. We believe the best climate solutions don’t look like climate solutions at all, just better, faster, and cheaper products and services. We prefer rapid deployment that will get us close to 1.5C in warming while upgrading our systems to make them more resilient. But we’ll also look at moonshot opportunities because we know we need a plan B. [VC] A real investment is about more than capital. We invest at the earliest stages, usually pre-customer, stay close to our founders, and work with them from the inception of our relationship so they can build relationships with other founders, investors, and customers.

21. Activate Venture Partners

About: Activate Venture Partners provides Venture Capital equity financing to Seed & Series A companies, with emphasis on the Digital Health and Applied Technology sectors. The AVP legacy funds have led the financings for nearly 100 technology-enabled companies, creating over $10 billion in enterprise market value upon exit. Our investment team leverages decades of venture investing experience, as well as successful backgrounds in financial services, start up and public company executive roles, and practicing clinical medicine. We focus on customer-driven and sales focused entrepreneurs with domain experience and a capital efficient mindset.

Active New York City Angel Investors

As multi-stage funds move upstream, "Pre-Seed" has become the domain of Angel Groups. Unlike individual angels who write $10k checks, these groups aggregate capital to write institutional-sized checks ($100k+). Below are the groups actively deploying capital in 2026.

New York Angels

- Status: Very Active (The largest group in NYC).

- 2026 Check Size: $100k – $1.5M (Often leads rounds).

- The Process: They use Gust for applications. Screening meetings occur monthly.

- Insider Note: Do not treat this like a "casual coffee." You are pitching to a committee of 100+ former executives. Expect a rigorous 30-day diligence process similar to a VC fund.

37 Angels

- Status: Active / Rolling Admissions.

- Focus: Diverse leadership (gender gap focus) but invests in all genders.

- 2026 Cycle: Pitch forums held every two months (Next: April & June 2026).

- Check Size: $50k – $200k.

- Why Apply: Speed. They are known for a transparent, efficient process that gives a "Yes/No" faster than most groups.

Pipeline Angels

- Status: Active (Bootcamp & Pitch Summits).

- Focus: Trans women, cis women, nonbinary, two-spirit, agender, and gender-nonconforming founders.

- Model: They run a "Pitch Summit" model where graduating angel investors pick winners.

- Ideal For: Social impact and consumer goods founders who are often overlooked by traditional tech VCs.

Empire Angels

- Status: Active.

- Focus: Young professionals investing in young founders (Millennial/Gen Z focus).

- Check Size: Typically ~$100k syndicates.

- Differentiation: High support for B2C and FinTech. They often help with "hiring" as their members are active operators in NYC tech companies.

2026 NYC Tech Event Calendar: Where to Find Investors

In New York, cold outreach has a low conversion rate. The most efficient path to a term sheet is a "warm intro" generated at high-signal industry events. Below is the curated calendar of events where NYC investors actively scout for deal flow in 2026.

Q1 2026: AI & Infrastructure

- Brooklyn Tech Expo (Feb 11)

- Focus: AI & Everyday Tech Solutions.

- Target: Early-stage founders in Brooklyn/DUMBO looking for co-founders and initial traction.

- DataDriven 2026 (Feb 23–25)

- Focus: Enterprise Data & Modern Architecture.

- Why Attend: Hosted by Reltio. This is a primary gathering for "Infrastructure" founders to meet CIOs and potential enterprise pilots.

Q2 2026: The "Super Bowl" Season

- NY Tech Week (June 1–7)

- Focus: Generalist / Ecosystem-wide.

- Strategy: This is the highest-density week of the year. Do not just buy a ticket to the main stage. Volunteer at the smaller "satellite events" hosted by firms like a16z and Primary to bypass the velvet rope.

- InsurTech Insights USA (June 3–4)

- Location: Javits Center.

- Focus: Insurance Technology & Fintech.

- Why Attend: NYC is the global hub for InsurTech. This event is heavily attended by CVCs (Corporate Venture Capital) looking for strategic pilots. Note: Dates updated to June for the 2026 cycle.

Q3-Q4 2026: Proptech & Industry Summits

- CREtech New York (Oct 20–21)

- Location: Javits Center.

- Focus: Proptech & Real Estate Tech.

- Why Attend: With NYC's real estate market in flux, landlords are aggressively looking for tech solutions to increase yield. A prime hunting ground for B2B contracts that validate your seed round.

Best Monthly NYC Tech Meetups for Founders

- Data Driven NYC (Monthly)

- Host: FirstMark Capital.

- Why: The reliable monthly meetup for data/AI founders to demo products directly to FirstMark partners.

- Startup Grind NYC (Monthly)

- Why: Ideal for peer-to-peer intros and finding early employees/co-founders.

The Public Stack: Non-Dilutive Capital & Grants

Before you dilute your cap table with VC dollars, leverage New York’s robust state-funding ecosystem. In 2026, these programs are actively deploying capital to keep high-growth startups in the state.

NY Ventures (Direct Equity)

- What it is: The investment arm of the state. They don't just give grants; they invest equity (Series A/B) alongside private VCs.

- The Strategy: Use them to fill out a round. If you have a lead investor but are $500k short, NY Ventures can close the gap.

- 2026 Focus: Climate Tech, Healthcare, and Enterprise SaaS.

Excelsior Jobs Program (Tax Credits)

- The Benefit: Refundable tax credits for job creation (up to 6.85% of wages).

- The Math: If you hire 10 engineers at $150k/year, this program can effectively subsidize ~$100k of your burn rate annually.

- Eligibility: You must apply before you hire. It is performance-based, meaning you get the credit after the hires are verified.

START-UP NY (Tax-Free Zones)

- The Deal: Operate 100% tax-free (no income, business, or sales tax) for 10 years.

- The Catch: You must locate on or near a partner university campus (e.g., CUNY, NYU, Cornell) and align with their academic mission.

- Verdict: High friction to set up, but for a bootstrapped B2B SaaS team, the 10-year tax holiday is effectively a non-dilutive Series A.

How to Approach New York City Venture Capital Firms

Founders can gain a competitive edge by demonstrating local traction or partnerships within the NYC ecosystem. Whether securing early customers in the area or collaborating with local industry leaders, evidence of a New York footprint can be highly appealing to investors. Founders should also remain persistent and adaptable, following up with VCs respectfully and iterating on their pitch based on feedback. With preparation, a solid network, and a clear presentation, founders can better capture the attention of New York City’s top venture capitalists.

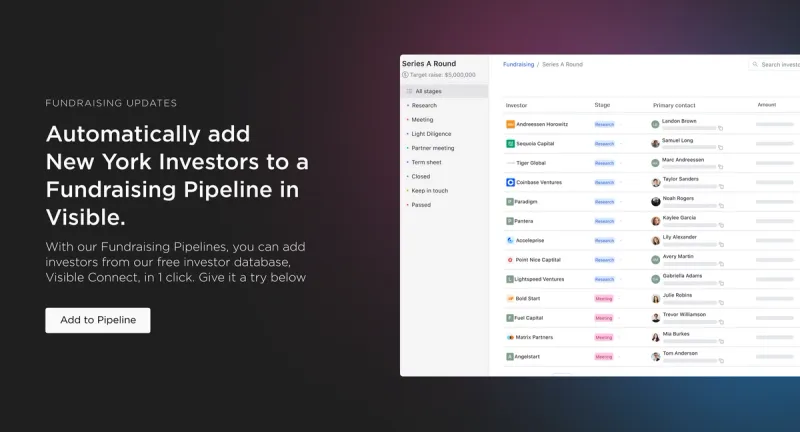

Connect with Investors in New York With Visible

At Visible, we often times compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

- Find investors at the top of your funnel with our free investor database, Visible Connect

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.

Related Resource: The Top 10 VC Firms for Startups in the Greater New York Area

Related Resource: Private Equity vs Venture Capital: Critical Differences

Related Resource: The 12 Best VC Funds You Should Know About

Related Resource: 11 Top Venture Capital Firms in Boston

Frequently Asked Questions

What makes VC firms in New York City attractive to startup founders?

VC firms in New York City provide unparalleled access to capital, industry expertise, and a dense network of investors and partners. Founders benefit from the city’s diverse sectors—fintech, health tech, media, and more—plus a rich talent pool and global financial hub that accelerate growth and market reach.

How do I pitch to VC firms in New York City?

To pitch VC firms in New York City, prepare a concise, data-driven presentation highlighting your traction, market fit, and revenue potential. NYC investors value early proof of growth and a scalable business model. Establish local partnerships or customers to demonstrate relevance within the competitive New York ecosystem.

Which industries do New York City VC firms invest in most?

VC firms in New York City invest across a wide range of industries, with particular strength in fintech, healthcare technology, media, e-commerce, and enterprise software. The city’s status as a financial and media hub fosters innovation in these areas, attracting investors eager to fund high-growth, disruptive startups.

What funding stages do VC firms in New York City typically support?

Most VC firms in New York City back startups from seed to Series B and beyond. While many specialize in early-stage funding, growth-focused firms also write large checks for Series C or later. Founders should research each firm’s investment range to target those aligned with their current stage.

Are VC firms in New York City open to out-of-state or international startups?

Yes, many VC firms in New York City actively invest in out-of-state and international startups. Demonstrating a plan to establish local traction, such as New York-based customers or partnerships, can strengthen your appeal. Firms value scalable ideas and strong teams, regardless of where a company is initially based.

How competitive is it to raise funding from VC firms in New York City?

Raising capital from VC firms in New York City is highly competitive due to the city’s dense startup landscape. Founders need a compelling pitch, clear differentiation, and evidence of early traction. Preparation, persistence, and a strong network within the NYC ecosystem significantly improve chances of securing funding.