Key Takeaways

-

Data room software provides a secure online space for startups to organize and share sensitive documents with investors, buyers, and partners.

-

It streamlines fundraising, M&A, and due diligence, reducing delays and ensuring that confidential data remains protected.

-

Key features—such as encryption, access controls, audit trails, and real-time collaboration—help founders maintain professionalism and investor trust.

-

Free tools can work for very early stages, but scalable, full-featured platforms become essential as a startup grows and handles more complex investor communications.

-

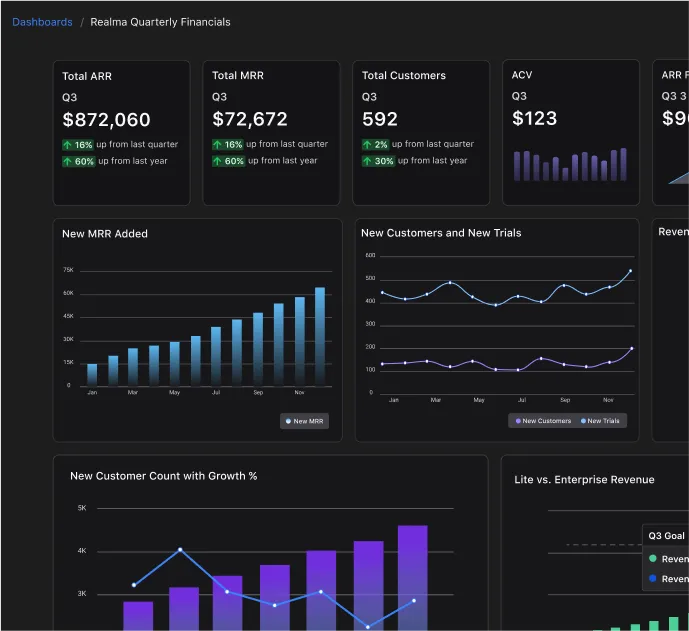

Integration with accounting, CRM, and project management systems ensures efficient workflows and accurate, up-to-date reporting.

-

A well-organized data room signals readiness for investment and accelerates decision-making, giving startups an edge in competitive funding environments.

Data Room Software: A Complete Guide for Founders

In the fast-paced world of venture-backed startups, securely sharing sensitive information with investors is crucial. This is where data room software comes into play. Whether you’re searching for the best data room for startups, comparing free data room options, or evaluating virtual data room providers, finding the right solution can make all the difference in fundraising, M&A activities, or day-to-day document organization.

What Is a Data Room and Why Do Startups Need It?

A data room—or virtual data room—is a secure online repository for storing and sharing sensitive documents. It allows startups to streamline investor communications, protect confidential information, and simplify due diligence processes. For first-time founders, understanding data rooms is key to building investor trust and ensuring compliance during fundraising rounds or acquisitions.

Benefits of Using a Data Room:

- Centralized document storage for easy access.

- Advanced security features to protect sensitive data.

- Seamless collaboration with investors and stakeholders, making it the best data room software solution for startups.

- Improved organization and professionalism, which can make a strong impression on potential investors and partners.

- Faster deal cycles by reducing delays caused by document-related inefficiencies.

- Enhanced transparency with investors, fostering trust and confidence in your startup.

Common Scenarios Where Data Rooms Are Essential:

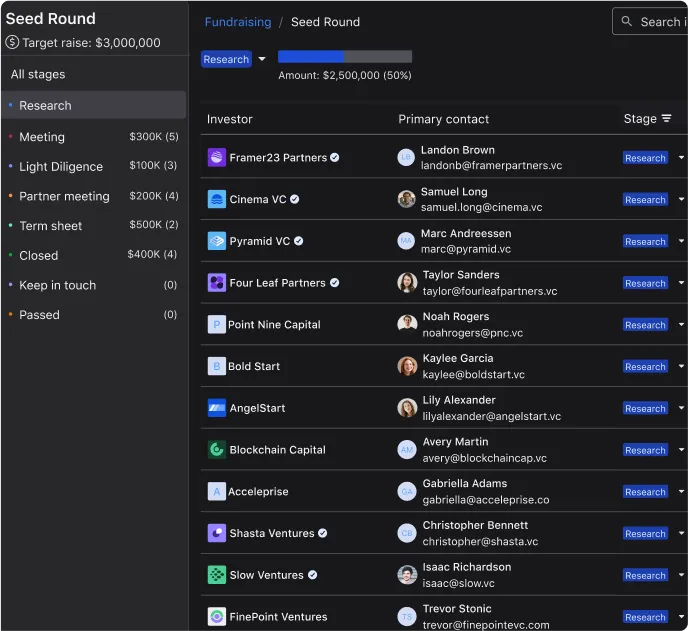

- Fundraising: Sharing financials, pitch decks, and other sensitive documents with potential investors.

- M&A Activities: Facilitating secure due diligence processes during mergers or acquisitions.

- Partnerships: Providing a secure environment for negotiating and finalizing strategic alliances.

- Internal Operations: Organizing critical business documents for audits, compliance, or operational clarity.

Key Features of the Best Data Room Software for Startups

Secure Document Sharing and Access Control

Security is non-negotiable when sharing sensitive company data. Features like encryption, two-factor authentication, and granular access controls make virtual data room software an essential tool for startups. For budget-conscious founders, exploring free data room for startups options is a good starting point, but often miss out on this key feature set.

User-Friendly Interface

A simple and intuitive interface is crucial for busy founders and investors. Platforms offering user-friendly designs often rank as the best virtual data room for startups. Free virtual data room providers can provide a smooth user experience for early-stage companies, but are often limited in features.

Advanced Collaboration Tools

Top data room software provides features like real-time document editing, Q&A sections, and activity tracking to enhance collaboration between startups and their investors or partners. These tools streamline communication and ensure that all parties stay aligned.

Cost-Effectiveness for Startups

For many startups, cost is a key factor. Affordable virtual data room pricing and even free data room software options are available to ensure you can share your documents without overspending. Evaluate providers that offer scalable plans, allowing your data room capabilities to grow alongside your business.

Scalability and Customization

Startups grow quickly, and their needs change just as fast. The best data room providers offer scalable solutions that can be tailored to your company’s specific requirements, from adding new users to integrating with existing tools like CRM or project management software.

Audit Trails and Reporting

Tracking document access and modifications is essential for accountability. Leading data room platforms provide detailed audit trails, ensuring transparency and helping startups monitor investor engagement.

AI and Automation Features

Some of the most innovative data room software solutions now incorporate AI-driven insights and automation. These tools can analyze document interactions, identify areas of investor interest, and even flag potential issues in shared documents, saving founders valuable time and effort.

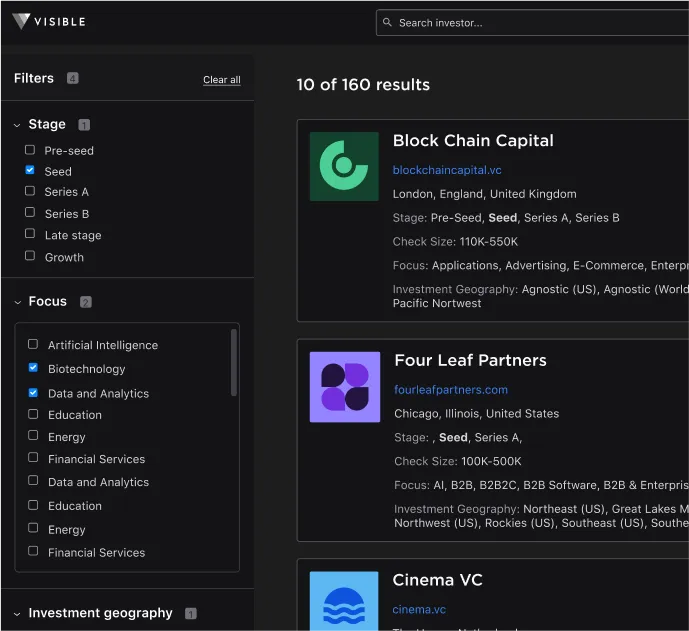

Choosing the Best Virtual Data Room Providers

Comparing Top Providers

With so many options, selecting the best virtual data room providers can be daunting. Focus on platforms designed for startup needs, offering a balance of security, usability, and cost. Many of the top M&A data room providers also cater to startups, ensuring scalability as your business grows. Look for user reviews and detailed comparisons to guide your decision.

Free and Open-Source Data Room Options

If you’re just starting out, free data room solutions like Google Drive can act as a virtual data room. However, these options often lack the advanced security features found in the best data room software paid plans. Weigh the trade-offs to find a solution that meets your needs. Free tools can be a great stepping stone but should be replaced by more robust solutions as your startup matures.

Evaluating Each Providers’ Reputation

Research each provider’s reputation in the startup community. Platforms recommended on forums like Reddit or by trusted startup advisors often indicate reliability and effectiveness. Check for case studies or testimonials from companies in a similar stage or industry as yours.

Importance of Customer Support

Excellent customer support is a vital factor when selecting a data room provider. Startups often operate under tight deadlines, and having access to prompt, knowledgeable support can make a significant difference.

Integration with Existing Tools

For maximum efficiency, choose a data room provider that integrates seamlessly with your existing tools, such as Slack, Zoom, or project management software. This integration ensures smoother workflows and minimizes disruptions.

“The global virtual data room market size was estimated at USD 2.5 billion in 2024 and is projected to reach USD 5.6 billion by 2029, at a CAGR of 18.1%.” -MarketsandMarkets.

This rapid growth shows that more and more founders are adopting data room software, and its use is only accelerating, making it essential for startups to keep pace with evolving investor expectations and

Creating a Data Room for Investors

What to Include in Your Investor Data Room

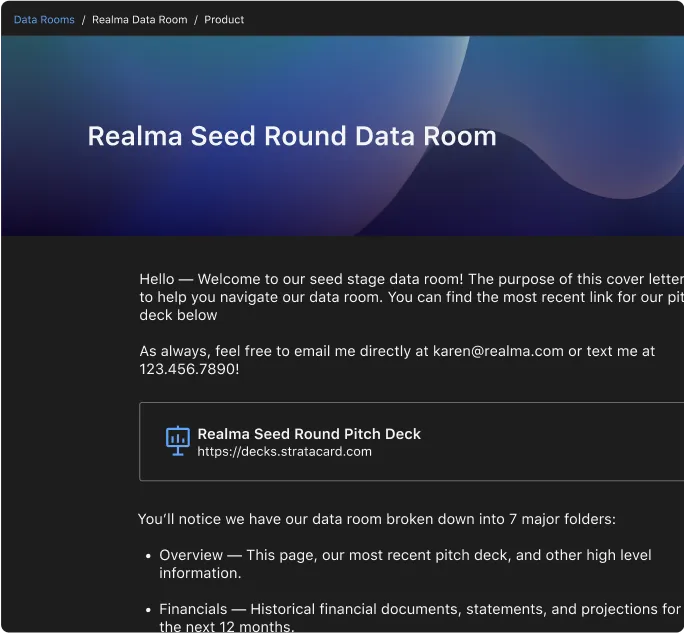

Your data room should be a comprehensive, organized repository of documents that investors need to make informed decisions. Include financial statements, business plans, a cap table, and legal documents—a startup data room checklist is essential to ensure no critical information is missed.

Industry-Specific Documents

Depending on your industry, you may need to include specialized documents. For example:

- Tech Startups: Source code repositories, product roadmaps, and patent filings.

- Healthcare Startups: Clinical trial data, regulatory approvals, and compliance certifications.

- E-Commerce Startups: Inventory management reports and supply chain details.

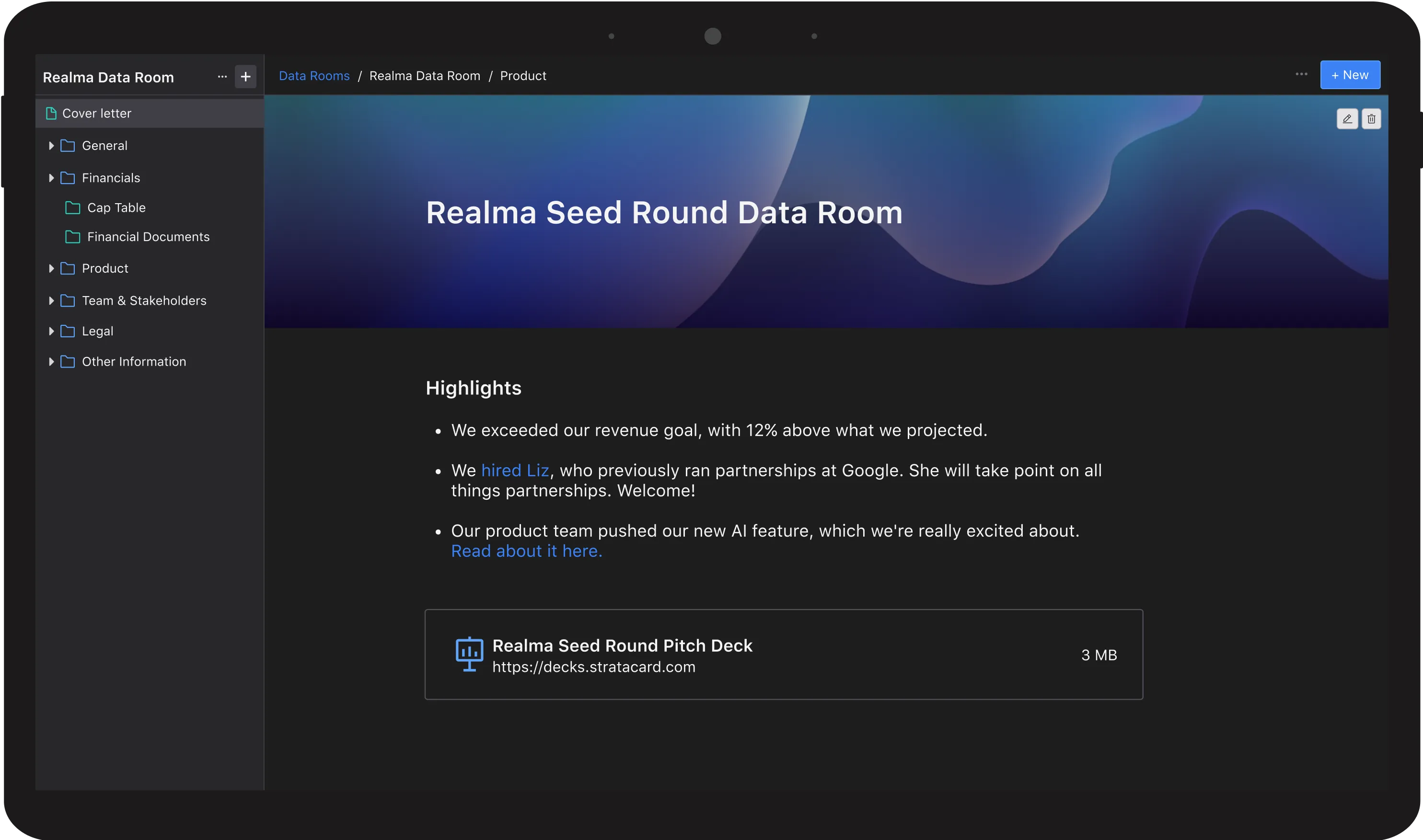

Examples of Investor Data Rooms

A well-structured investor data room not only builds confidence but also accelerates decision-making. Use templates or examples from top investor data room software to organize your documents effectively. Consider adding a cover letter or introductory section to guide investors through your data room and highlight key sections.

Preparing for Investor Questions

Investors will likely have questions after reviewing your data room. Be prepared to discuss your financials, business model, market strategy, and growth plans. Anticipating and addressing these questions within your data room can streamline the process and boost investor confidence.

Offering an Interactive Experience

Some modern data room platforms allow for interactive features, such as embedded videos, live chats, and real-time updates. These additions can make your data room more engaging and provide investors with a richer experience.

Common Mistakes to Avoid When Setting Up Your Data Room

Setting up a data room isn’t just about uploading files. Avoid these pitfalls:

- Poor organization: Use clear folder structures and labels to make navigation intuitive.

- Missing key documents: Ensure all critical files from your investor data room checklist are included.

- Insufficient security: Choose platforms with robust protections offered by the best virtual data room providers.

- Overloading with unnecessary files: Include only relevant and well-organized information to prevent overwhelming investors.

- Neglecting regular updates: Outdated information can erode investor trust. Keep your data room current as your company evolves.

- Failing to provide context: Add explanatory notes or summaries where necessary to help investors quickly understand complex data.

- Lack of a backup plan: Ensure your data room has redundancy systems in place to prevent data loss or downtime during critical periods.

Conclusion: Unlock the Power of Data Rooms for Your Startup

Data room software is a must-have for any startup looking to scale, secure funding, or navigate an acquisition. By choosing the right platform—whether a free virtual data room or a premium solution—you’ll safeguard sensitive information and streamline communications with investors. Evaluate your options today to find the best data room for startups, tailored to your needs and ready to grow with you.

With the right data room software, you’ll not only build stronger investor relationships but also position your startup for long-term success. Start exploring your options now and unlock the full potential of secure, efficient data sharing for your business.

Remember, a well-prepared data room not only reflects your startup’s professionalism but also demonstrates your readiness to tackle the challenges of scaling and investment. Make your data room a strategic asset that propels your startup forward. Take the first step today and see how the best virtual data room providers can help transform your investor relations and operational efficiency.

Frequently Asked Questions

What is data room software and why do startups need it?

Data room software is a secure online platform for storing and sharing sensitive documents with investors, buyers, or partners. It streamlines fundraising, simplifies due diligence, and protects confidential information during critical events like funding rounds or acquisitions, helping startups present a polished, investor-ready image.

What features make the best data room for startups?

The most effective data room software combines strong security, encryption, two-factor authentication, granular permissions, and audit trails, with an intuitive interface for quick setup. Real-time collaboration, automated investor updates, and smooth integrations with accounting, CRM, and portfolio tools keep fundraising and reporting efficient as the company grows.

Are there free data room software options for startups?

Yes. Free solutions can handle basic document sharing for very early-stage teams, but they often lack advanced security, automated reporting, and investor engagement tools. As a startup scales and handles more sensitive data, moving to a professional-grade platform becomes essential to maintain trust and efficiency.

How do virtual data rooms support fundraising and M&A?

Virtual data rooms enable startups to securely share financial statements, legal documents, and pitch materials with investors or buyers. Features like permission controls, activity tracking, and automated reporting streamline due diligence, reduce back-and-forth communication, and help close deals more efficiently.

What documents should be included in an investor data room?

An investor data room should include financial statements, a cap table, legal agreements, business plans, and key market research. Depending on the industry, additional items, such as product roadmaps, intellectual property records, or regulatory approvals, help investors evaluate opportunities with confidence.

How can startups compare virtual data room providers?

Founders should look for strong security standards, ease of use, reliable customer support, and the ability to integrate with existing tools such as communication or project management platforms. Demos, user reviews, and a clear understanding of pricing and scalability help identify the best fit.

What are common mistakes to avoid when setting up a data room?

Common pitfalls include poor folder organization, missing essential documents, and relying on platforms without robust security. Startups should avoid overwhelming investors with unnecessary documents and keep all information up to date to maintain credibility and expedite due diligence.

How does a virtual data room improve investor relations?

A well-managed data room provides investors with real-time access to organized, up-to-date information. Detailed audit trails and activity logs show who viewed specific documents, building transparency and trust while allowing founders to gauge investor interest throughout the fundraising process.