Our Guide to Building a Seed Round Pitch Deck: Tips & Templates

Raising venture capital is challenging. On top of building a product, hiring a great team, and scaling revenue — seed-stage founders are responsible for raising capital.

Throughout a seed stage fundraise, different investors will want to see different assets and data points. One thing that founders can expect most if not all, investors to see is a seed round pitch deck.

Learn more about how to build a pitch deck for your seed stage funding below:

What is a Seed Round Pitch Deck?

A seed round pitch deck is a presentation designed to share your vision, business plan, metrics, and other insights to help raise capital from investors.

Ultimately, the goal of a pitch deck is to move investors down your fundraising funnel and to improve your odds of raising capital. Learn more about crafting your seed round pitch deck below:

What Investors Want To See in Seed Round Pitch Decks

Companies that are raising funds for the first time are going to be in need of a seed round pitch deck to entice and share their story with investors. Usually, companies raise anywhere up to 2 million (the average is 2.2 million but can be up to 5 million) for their seed round from either angel investors, friends & family, or venture capitalists.

In a (pre) seed round it’s common to raise from angel investors, startup accelerators, or friends and family. With the explosion of pre-seed stage and seed-stage investors, venture capital is becoming a more approachable first round of capital. You can find a global list of the top active seed-stage investors here.

No matter who you’re pitching though, there are certain expectations for an early-stage/seed-stage startup to present in their pitch deck. Founders should tailor and adjust their pitch based on who they’re reaching out to, but great seed round pitches come down to a few core things: a succinct but exciting story, an exceptional team, product potential or traction, and a growth plan.

A Succinct but Exciting Story

You’ll need a clean, clear narrative and to show you have a vision and/or plan for the future of your company since things are still in development. Try to not only excite but inspire as well. Make your audience want to invest in you, your vision, and your company’s purpose.

An Exceptional Team

Most VCs will tell you that having a rock star team is one of the most important things to them. What you’ll want to do in this slide is establish credibility, demonstrate expertise, build trust in the idea and company.

Product Potential or Traction

If you have proven some product-market fit, gathered user/customer metrics, or generated revenue make sure to share this as a proof of concept. Going into your first round of capital, investors will also understand that you may have limited or no data to start.

A Growth Plan

Even if you may not have a product built or know the exact business model yet you still need to show an understanding of the market/customers, business, and scalability.

Startups should make their stories and decks as data-driven as possible to drive home the point and bring credibility to what is being shared. Check out our guide, “Building A Startup Financial Model That Works,” to help model your company’s future.

Check out Visible Connect, our free investor database, to filter and find the right investors for your business at any fundraising stage.

Our Step-by-Step Seed Round Pitch Deck Template

Seed-stage startups should approach their first pitch deck differently than they would in other later rounds because they usually won’t have very many stats or users to go off of. This is why storytelling is key as well as finding elements to focus on like the team and competitive advantages so that the investor can understand the future value of the company, since there might not be much else to base it off on at this stage in your company. Download our free pitch deck template here or below:

Cover/Title

This slide introduces your company so you can keep it simple and just include any important information such as your logo, company name, contact information, and a one-liner.

The Team

The team is one of the most important factors to VCsseed investors when considering investing in a seed round since it is one of the keys to a company's success. Highlight how each person brings a unique and beneficial aspect to the team, and role, and if it applies the companies mission, the problem you’re trying to solve and/or competitive advantage. This lays a good foundation for the rest of the presentation so investors know who they’re speaking with and gives more credibility to what is being said.

The Problem

Make investors understand how the problem impacts the world/ people and why there is a need for something about it to be fixed.

The Solution

State that the right solution for this problem hasn’t been solved yet or can be improved upon. Then how were you able to innovatively come up with a way to fix the problem, why will it benefit customers, and why you are the best company to do so. This is in essence your elevator pitch and should be kept short, compelling, and to the point (30 seconds is a good rule of thumb).

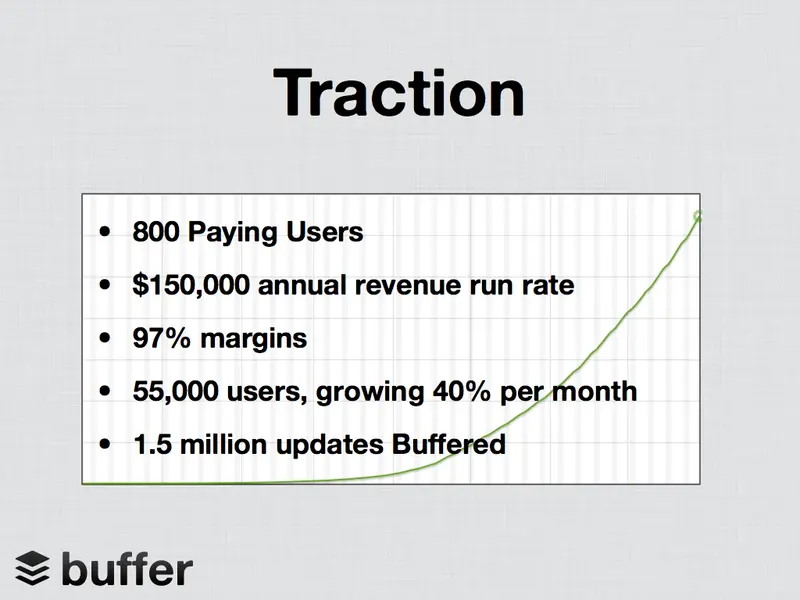

Traction

This slide can also focus on the product if you haven’t already collected any metrics which validate relevant company or user information. If you already have data and are tracking KPI’s this is where you want to add it!

With Visible, you can track and automate your startup’s key metrics and build beautiful charts and dashboards for your seed-round pitches.

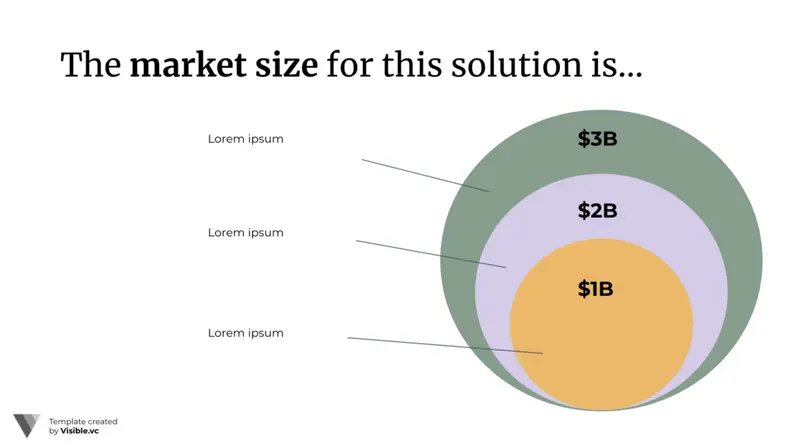

Market Size and Opportunity

Here you will include all relevant information on the opportunity you’re looking to take advantage of and what the size of that market may be. Something important to note is the importance of tackling a niche market first and investors won’t mind if the market size is small if you are planning on dominating the space.

“Sequencing markets correctly is underrated, and it takes discipline to expand gradually. The most successful companies make the core progression—to first dominate a specific niche and then scale to adjacent markets—a part of their founding narrative.” – Peter Thiel, Zero to One

Read more on How to Model Total Addressable Market (template Included as well) where we share:

- What is Total Addressable Market (TAM)?

- How to Calculate TAM

- The Free Visible Total Addressable Market Template and Evaluation Model

- Where Does Your Total Addressable Market Start (and End)?

- Why Knowing Your Total Addressable Model is Important

- Building Your Total Addressable Market Model

Competition Analysis

Just because you have competitors doesn’t mean it’s not a business you should start but rather you need to have a clear understanding and plan on what your advantage is. If there are existing companies in the space it can validate there is a need but investors and customers will need to understand why you are the better choice.

Financials/Metrics

Here you want to be able to prove profitability as well as share what the hypothetical financial future (3-4 years) of your company will look like. At the seed stage, this will be more high-level information as you again don’t have much to go off of as of now but do include revenue and user/ customer projections.

Why Now/Why Me?

This is another place for you to pitch yourself and your team’s expertise, and the company's secret sauce. What makes this combo unique, what’s your competitive advantage, and strategy.

Timing is also one of the essential factors that can make or break a company. Justify why you’ve decided to enter the market at this very moment and either explain how this will help you, or how you expect to defeat the hurdles of being early. If you are early then end by making it clear that you will be the first which will allow you to win the market. If you’re late in the game then you’ll want to explain what your competitive advantage will be and how you can utilize learnings and data that is available because of this. Every disadvantage can also be advantageous in its own way as well.

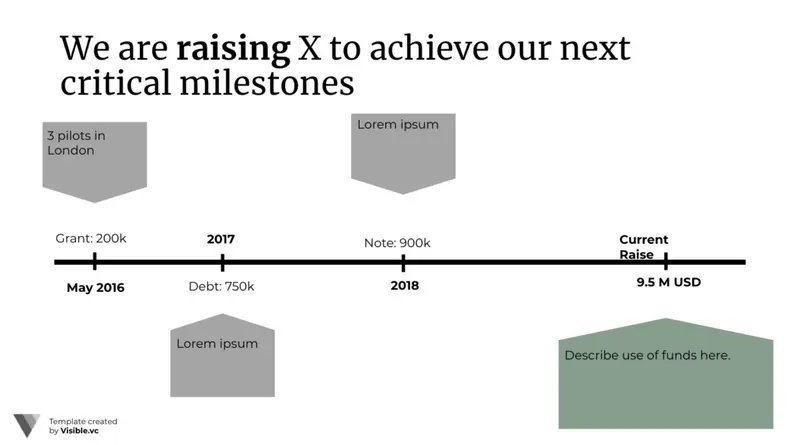

The Ask

The ask can often be an underutilized section in investor updates and founders might also not realize it’s also something great to include in a pitch deck as well. An investor shouldn’t only be seen as a capital resource but also as a knowledge and connection resource. For investors (especially in this stage) it is also good for them to know where you need help and allows them (and you) to see if they are in a position to do so. If they do decide to invest it is in their best interest to do what they can to help and contribute to the success of the business.

Want some inspiration? Check out our article 18 Pitch Deck Examples for Any Startup or download our free pitch deck template below:

Related Resource: Pitch Deck Design Cost Breakdown + Options

The Best Seed Funding Pitch Deck Examples

There are thousands of other founders and startups that have successfully raised a seed round in the past and shared the deck they used. Check out a few of our favorite pitch deck examples below:

Airbnb Pitch Deck

Well before their publicly traded stock and catchy design, Airbnb, or AirBed&Breakfast, was pitching investors to raise $600k to get things off the ground. The Airbnb seed round deck is focused on storytelling and hooking potential investors

Uber's Original Pitch Deck

Like Airbnb, Uber has humble beginnings and a different name, UberCab. Their original pitch deck showcases the importance of keeping your pitch deck to the point. It is focused on facts and data, not fluff.

Buffer's Seed Round Pitch Deck

Buffer is a social media toolkit for small businesses. They raised a $500k seed round and shared the deck (and their breakdown) on their blog. The Buffer seed round deck does a great job of focusing on traction. The Buffer team reached out to 200+ investors, sat 50 meetings, and ultimately had 18 investors.

How to Pitch Seed Stage Investors

Once your deck is finished the pitching process begins. Firstly you’ll want to find investors to reach out to which you can do on our Connect Investor Database. For tips on emailing your first investors check out 5 Strategies for Cold Emailing Potential Investors. Save your time and theirs by only reaching out to investors who match crucial factors such as the industry they’re looking to invest in, funding amount, stage, and geography. These are factors that can also be filtered on our connect database and once you’ve found a good match you can have their profile added to our fundraising CRM.

Once you start reaching out and giving your first pitches you’ll start receiving feedback which should be seen as a gift and immediately implemented back into your deck. See it as a work in progress and change where needed. For instance, take notice of which slides are grabbing investors’ attention and maybe move those to the beginning or take aspects from it to add to other slides.

In terms of giving a good compelling pitch in person- being a confident and a good storyteller goes a long way. Investors should also feel your passion, energy, and ability to drive the company forward. To enhance these qualities people have found that taking a stand-up comedy or public speaking class has been helpful. Also researching what makes good storytelling can be advantageous.

How Visible Helps Startups Raise Capital

There is no one-size-fits-all pitch deck solution these points are meant to help guide the process but you should also see what makes sense for your company. Fundraising can be boiled down to storytelling.

We believe a VC fundraise mirrors a B2B sales motion. The fundraising process starts by finding qualified investors (top of the funnel) and building relationships (middle of the funnel) with the goal of them writing a check (bottom of the funnel).

Just as a sales team has dedicated tools for their day-to-day, founders need dedicated tools for managing the most expensive asset they have, equity. Our community can now find investors, track a fundraise, and share a pitch deck, directly from Visible.

Easily upload your deck, set your permissions, and share your deck with potential investors via a unique link (check out an example deck here). In return, we’ll surface the analytics that matter most so you can better your odds of closing a new investor. Try Visible here.