Pitch Decks are put together by startup founders when they are seeking a round of investment funding to back their business. A Pitch Deck tells the story of your company, the problem it solves, why it matters, and most importantly why a potential investor should care and want to donate thousands if not millions of dollars. Every investment a venture fund or private investor makes is a calculated risk and a strong pitch deck is often the key tool a founder has to showcase the risk is worth it.

Investors care about how they are going to make their money back plus a profit and want to see in your pitch deck how this will be possible for them. However, According to TechCrunch, investors only spend on average only 3 minutes and 44 seconds reviewing a pitch deck. Other sources have found that time to be less than 2 minutes. Its a safe bet to assume you have less than 5 minutes of an investor’s time to articulate why your company deserves their backing so taking the time to build a pitch deck that packs a punch in 5 minutes or less is critical.

Communicating all that you need to in a pitch deck, to summarize why your business is worth a big investment, is much easier to do in concept than in practice. A strong pitch deck should be simple and clear but still compelling. Building a strong pitch deck is a skill founders should take time to learn as early on as possible to ensure every 5 minutes or less spent on their deck by VCs gives the best chance for investment and future success. To assist, we’ve built out a step-by-step guide to help you build a quality pitch deck for your business.

Related Resources: 23 Pitch Deck Examples for Any Startup

1. Choose the Right Tools

Let’s take it from the beginning – choosing the right presentation tool to build your pitch deck. This may seem like a small decision, but in reality, there are pros and cons to building your pitch deck on different presentation solutions.

Keynote

This might be the best tool if you’re going to have a brand or product designers working on your deck. Keynote comes installed on all Mac computers and has tools and functionality that is a bit more detailed and flexible allowing trained designers to create custom, clean, original designs and layouts. If you’re not a designer or don’t have design resources available for your deck creation, Keynote may not be a strong choice as it can be a bit hard to navigate and collaborate on without the knowledge and eye for all of its features.

Google Slides

Google Slides is a strong free option for crafting simple decks. Anyone can use Google Slides and collaboration is seamless. If you’re a solo founder or an extremely lean, cash-strapped team without design resources, Google Slides will allow you to build a super clean deck that’s easily shared. Past a certain level of company maturity, however, Google Slides may not be a strong option due to its lack of customization on the design side – it’s much harder to demonstrate the product and brand design in Google Slides.

PowerPoint

Another good free option, PowerPoint can be used on the web for free by anyone with a Microsoft account. Similar to Google slides, this can be a good simple, clean option for early founders without design resources. The paid version of PowerPoint is a bit more robust and can allow for a more mature, established design (even without design resources). The one main con of using PowerPoint for your pitch deck is that the presentation experience can often be clunky and the shared version isn’t as friendly to access as a Google slides or Keynote for non-Microsoft users.

Canva

For established startups with a clear brand and product aesthetic, Canva can be a great option as it provides more customization and design options than Google Slides and PowerPoint. Even the free version of Canva allows you to access many strong Canva-specific templates for customized pitch decks. Because Canva is a web-hosted platform that can make it challenging to present in some circumstances and doesn’t allow for as smooth off-line presentations, however, Canva is a strong design-centric option that is easy to use for founders and not as technical as Keynote.

Later on, we will dive into the specifics of pitch deck design, but once you select your pitch deck creation tool, you can start exploring templates and popular deck flows that successful startups have used. Here at Visible, we recommend starting with these free pitch deck templates to generate some ideas.

2. Craft Your Message

Knowing your pitch deck will most likely only get 5 minutes or less of review, crafting a clear message that tells the story of your company and a clear business plan including details like financial models and product roadmap is critical. Crafting your message can feel overwhelming knowing the window of review will be so small.

There are many formats and philosophies you can use to craft a strong pitch deck. A popular methodology that many founders follow is Guy Kawasaki’s 10/20/30 rule – 10 slides that are readable in 20 minutes or less (aim for less here!) and use a 30 point font. This is a good structure for framing the flow and digestibility of your content. For the actual content, the message of this 10 slide deck, we suggest thinking about the message in 3 distinct parts: The Company Purpose, Problem, and Solution.

Company Purpose

This is the most important part of your message to keep simple. Articulate, ideally in 1 slide and only 1-2 sentences, why your company exists. The company’s purpose is often well articulated as a mission statement. With the company purpose, you are leading into the problem but not particularly addressing the problem just yet. You are simply sharing why your company exists. A few examples from successful companies on the market:

- Twitter: To give everyone the power to create and share ideas and information instantly, without barriers.

- PayPal: To build the Web’s most convenient, secure, cost-effective payment solution.

- Tesla: To accelerate the advent of sustainable transport by bringing compelling mass-market electric cars to market as soon as possible.

The Company Purpose should articulate in a simple way, why your business exists. Establish a clear, strong mission statement that articulates this and the rest of the deck will be built off of that articulated goal.

Problem

Now that you’ve established the company’s purpose, establish the problem that the company will be solving. This section shows not only the problem that exists, but the opportunity for the company or solution that can solve said problem.

To ensure you are keeping the problem section clear yet powerful, lean on as much data as you can to validate the impact of the problem at hand. If there is a certain number of people or businesses that are impacted by this problem, paint that picture. If there is a cost associated with this problem or money currently being spent in the space the problem exists in, articulate that as well.

According to TechCrunch, 73% of successful pitch decks include a breakdown of the market size and opportunity and 46% address “why now” or why this problem should be addressed at this point in time. Another way to think about articulating the Problem is to think about articulating the scope of the opportunity – ie, if the problem is this big, this is the opportunity that exists to solve it and this is why now is the right time to do so. Similar to the Company Purpose, keep the Problem explanation brief – 2-3 slides is our recommendation for tackling the Problem section.

Solution

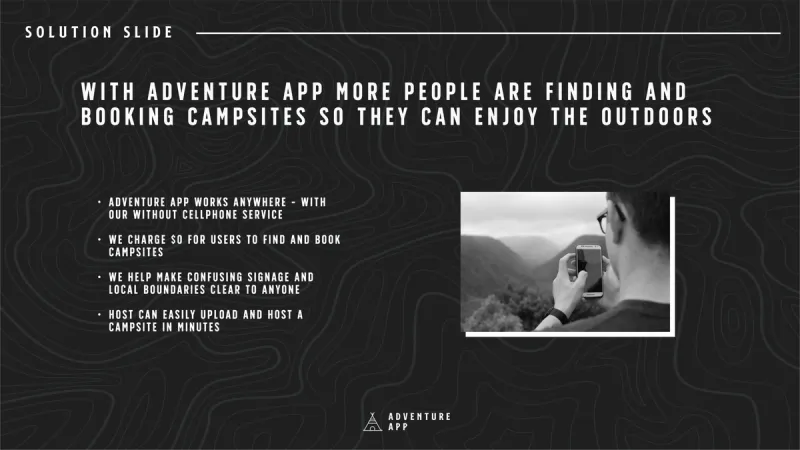

The Solution section of your pitch deck should be the most comprehensive. In theory, your solution is your comprehensive offering from your product or service to your marketing and customer success. At the end of the day you want investors to be able to answer, “What is their competitive advantage or “secret” sauce?”

Because of this your solution might fall into a few slides but oftentimes you can still create a specific single solution slide the example below:

Why Now?

Investors are oftentimes incentivized to collect as much data as possible during a raise. You need to give them the information they need to move quickly and invest today. Using market data and your own display why now is the right time for them to invest.

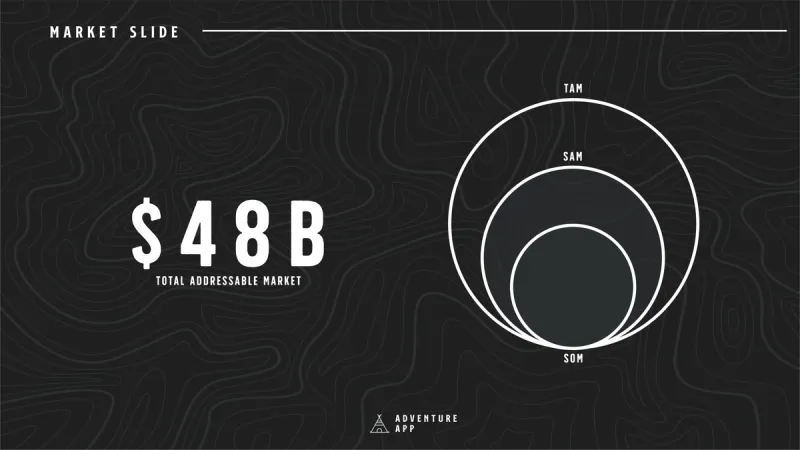

Market Size and Opportunity

Venture capital follows a power law curve. Investors are looking for startups that are poised to dominate a market or take a solid percentage of a massive market. In order to help win over investors, demonstrate that your company can become large enough to create significant returns to their investors (Uber is a great case study in how to properly model your market).

Related Resource: How to Model Total Addressable Market (Template Included)

Product

This is the slide where you introduce your company’s product and how it solves the problem at hand. While investors will certainly have questions about the technical aspects of the product down the line, for the sake of a concise deck try to keep the product slide high level and easy to understand. Make this slide as visual as possible including product screenshots or even a light click-through animation.

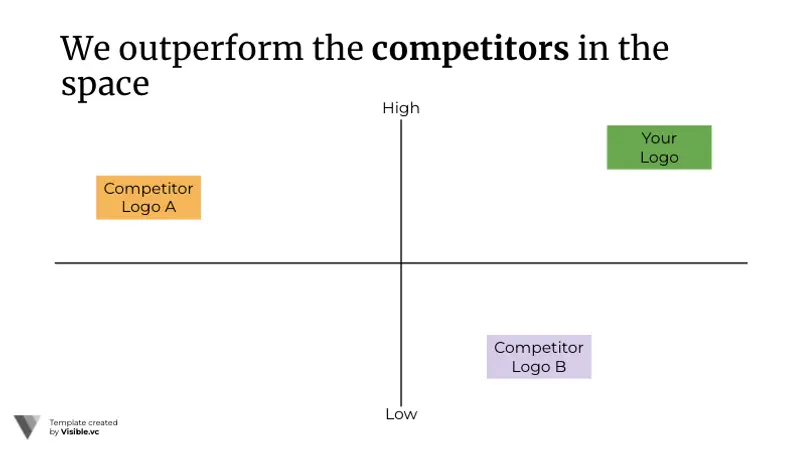

Competitive Landscape

A big question for investors if they like the fiscal opportunity of the problem at hand is an understanding of who else is trying to solve this problem. Don’t shy away from highlighting competitors.

Competitors validate that there is an appetite in the market. As you highlight other competitors in the space, be sure to highlight how your product and company are different and better for the problem at hand and also call out where there is missed opportunity in the market that your company can cover (this is especially important in a crowded space like marketing technology).

Business Model

Now that you’ve shown the opportunity in the market and what your solution is to address the problem, it’s important to talk through your plan to take this product to market or how you are currently taking it to market as well as how you plan to acquire customers. Check out our deep look at the Customer Acquisition pitch deck slide to ensure you capture all elements of your business model for investors.

Financials and Metrics

Even if investors like your idea, at the end of the day their choice to invest in your business is a financially motivated one. The Financials and Metrics Slide is a key slide to win over the support of a potential investor. Highlight how much money you have raised to date, your key growth metrics over the lifespan of the business so far, and your plan for the investment round in question. To ensure all key startup metrics are addressed in the Financials Metrics slide, take a look at our overview of key startup metrics.

Related Resource: Important Startup Financials to Win Investors

Team

Use the Team Slide as a final push of confidence that an investment in your business is a good one. Highlight the folks on your executive team and what they bring to the table. For example, highlight the past successful companies they have been a part of and helped build, any relevant industry-specific experience, or any unique skills that they bring to the table that give your company a competitive advantage. The Team slide is also a great way to humanize the company and connect with your potential investors by putting faces to name.

Additional Slides to Consider

If you have room in your deck, consider adding a slide that highlights the product roadmap (especially if this furthers the financial opportunity and “why now” argument for your company). Any existing partnerships that you have in your company that add to the fiscal attractiveness of your business may be worth a slide after you highlight your business Model as well. Finally, if the round you are raising is for a later stage round and you can see an exit trajectory insight, it may be prudent to highlight your exit plan on a slide when you discuss financials and metrics to show a more accurate picture of the type of return your potential investors could see sooner rather than later.

3. Level Up Your Pitch Deck With These Tips

After you’ve spent time designing a well-thought-out and clear pitch deck that articulates the company’s purpose, problem, and solution and have built a version you feel confident in, take the time to consider ways to take your pitch deck to the next level before taking it into the boardroom.

Tailor The Pitch to Your Audience

Personalization goes a long way. Make sure you find simple but powerful ways to tie in your pitch to fit the audience you’re talking to. Prior to making your rounds looking for an investment, do your research on the possible meetings you could have. Organize a list of VCs or investors by tiers based on who you would most like to work with. Additionally, take the time to understand each group’s investing philosophy. Prior to any pitch, make sure to tailor your opening talk track and ask “why now” to fit their specific investment philosophy and showcase why this opportunity would be a great one for their firm specifically. Our Visible Connect network is a great database of VCs that will aid in this process.

Be Transparent, Accurate, and Data-Forward

Don’t leave anything out. If your company has had a period of setbacks or pivots, don’t shy away from highlighting that. Additionally, take out any fluff from your presentation that could be seen as opinion or too high-level and instead back up every point you plan to make with hard data. Show, don’t tell. Numbers are the clearest way to give a transparent, credible view of your business and the opportunity at hand.

Read and Revise (Now Do it Again!)

Remember that you’re going into each meeting asking for thousands if not millions of dollars in support. This is a serious ask and you’d hate for a great opportunity to be jeopardized due to some simple errors. Once you think your pitch deck is in its most perfect state, read and revise it again. Now do it again. Take every possible second you can to look for spelling and grammar errors, design and presentation errors, and ensure it’s as clear as possible for any type of investor to process. Practice the pitch to peers and existing partners and employees as many times as possible to get multiple sets of eyes on it for review and revision.

Related resource: Our Guide to Building a Seed Round Pitch Deck: Tips & Templates

4. Follow Pitch Deck Design Best Practices

Once the content is perfect, take the time to ensure the deck design is up to par. A few best practices on Pitch Deck design to consider:

- Use a Consistent Visual Style: This will keep the presentation looking clean, easy to follow, and straightforward. Simple is always better so settle on a design theme and format for your slides and stick to it.

- Consider Bullet Points: Too many words on a slide can make an investor’s (or anyone’s) eyes glaze over. Minimize the amount of text on each slide by bulleting out the key points. These will be easier for the investors to remember and remove any unnecessary fluff from your deck.

- Keep Graphics simple: If you are going to include graphics or visual elements alongside your bulleted text, make sure they are valuable and not elements that are distracting from the purpose of the deck. Keep visual elements simple and make sure they serve a purpose. For example, product screenshots or data graphs are a good way to present information in a different but still valuable way.

For more pitch deck design best practices, check out YCombinator’s guide on best practices from the thousands of pitches they see every year.

Related Resource: Pitch Deck Designs That Will Win Your Investors Over

5. Prepare to Deliver Your Pitch

Even the most perfect pitch deck won’t stand a chance without the right delivery. Practice makes perfect so ensure you have a clear plan in place and spend the time preparing to deliver your pitch. Determine who on the team is best to present. Pitches can be done by one leader with the strongest presentation skills or divided up across the team. The perks of multiple folks presenting ensure that there is coverage on different elements of the business and provide a good natural change to keep interested throughout the pitch. Regardless of who decides to pitch, make sure they are mock pitching and rehearsing as many times as possible. Get feedback from existing investors, partners, or peers and practice daily.

In addition to preparing to deliver your pitch in person, make sure the way you are going to digitally deliver your pitch is glitch-free, clean, and easy to digest. Check out our template for sharing your pitch deck with potential investors here.

Additionally, Visible can be a helpful platform for managing all elements of the fundraising pitch deck process. Use Visible to track and manage potential investor relationships and report out to existing and future investors as your business grows. Learn more here.

6. Share Your Pitch Deck with Visible

Just as a sales team has dedicated tools for their day-to-day, founders need dedicated tools for managing the most expensive asset they have, equity. Our community can now find investors, track a fundraise, and share a pitch deck directly from Visible and completely integrated.

Want to see a Deck hosted on Visible in action? Take a look here. Manage your fundraise from deck to check with Visible. Give it a try here.

Related resource: Business Plan vs Pitch Deck: The Differences and When You Need Them