Why Every Startup Needs a Dataroom Document Checklist

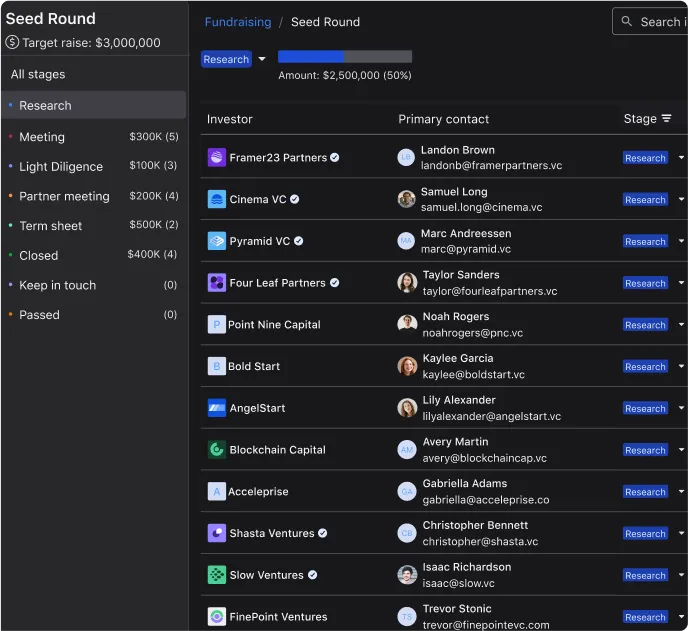

Raising venture capital is both exciting and stressful. One of the most overlooked ways to simplify the process is creating a dataroom document checklist. A well-prepared data room helps founders stay organized, build trust with investors, and move through due diligence more quickly.

Think of it this way: every investor you pitch will want to review the same types of information about your business. If you provide it in a clear, structured format from the start, you reduce friction and demonstrate professionalism. A data room is not just about storing documents — it is about making a strong impression and signaling that your team is ready for growth.

This guide covers everything founders need to know about setting up a data room, from structure to best practices, so you can approach fundraising with confidence.

What Is a Data Room for Startups?

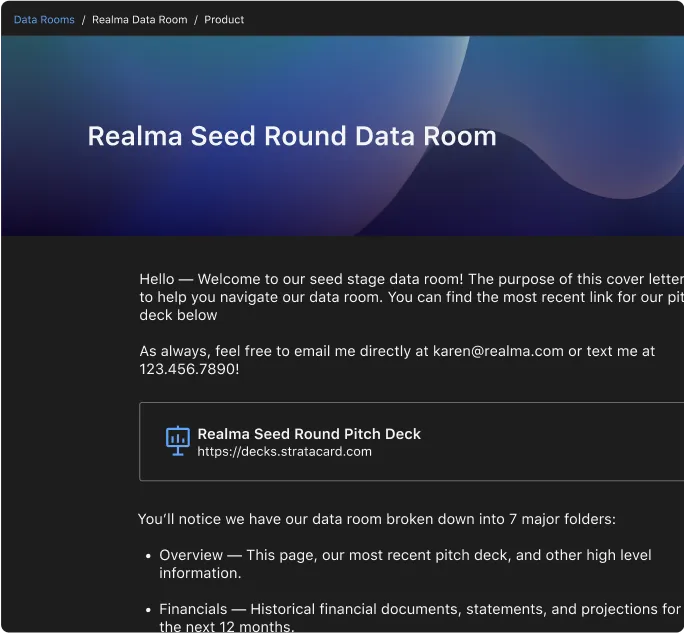

At its core, a data room is a secure online space where startups organize and share fundraising materials with potential investors. Think of it as a digital filing cabinet that houses financials, legal documents, contracts, and other essential files.

A virtual data room for startups makes it easy to control who has access to sensitive information. A startup data room also creates a single source of truth during fundraising, ensuring that investors see the most up-to-date details. When done right, a data room for investors signals professionalism and transparency.

Benefits of Using a Dataroom Document Checklist

A dataroom document checklist is more than just a to-do list. It ensures you don’t overlook critical materials, speeds up the investor review process, and minimizes back-and-forth. Most importantly, it shows investors that your team is organized and prepared — qualities that can build confidence before any money changes hands.

Consider the perspective of an investor. They may review dozens of companies at the same time. If your data room is well-structured and easy to navigate, you immediately stand out. On the other hand, if it’s messy or incomplete, investors may question whether your team is ready for the responsibility of managing outside capital. A data room can therefore be a subtle but powerful advantage when you are competing with other startups for investor attention.

VC Data Room Checklist: What Investors Expect

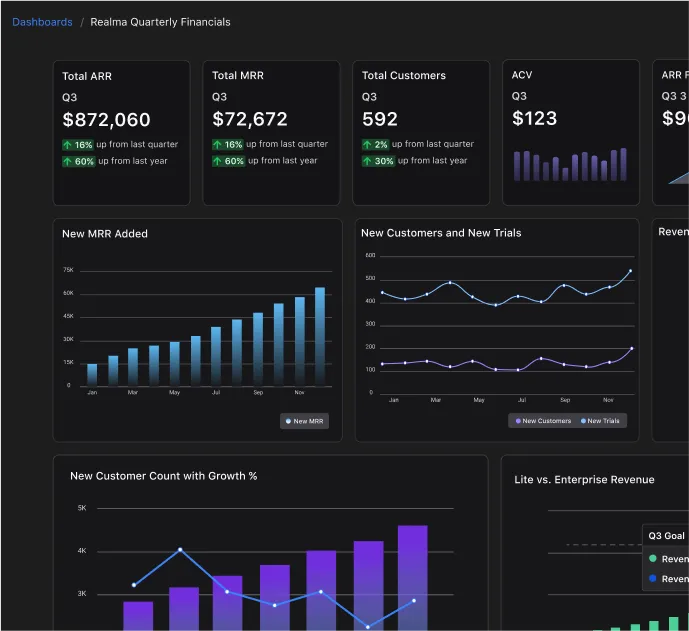

Investors often want to see the same categories of documents across different deals. A vc data room checklist typically includes financial statements and forecasts, cap tables, customer contracts and revenue metrics, legal documents such as incorporation paperwork and intellectual property, team bios and organizational charts, and product roadmaps and traction data.

Founders can also use a vc data room checklist template to guide preparation, customizing it for their unique industry and stage. For example, a SaaS company may include churn data and customer cohorts, while a hardware startup might highlight supply chain contracts and prototypes. Tailoring your checklist to the type of business you run shows investors that you understand what matters most.

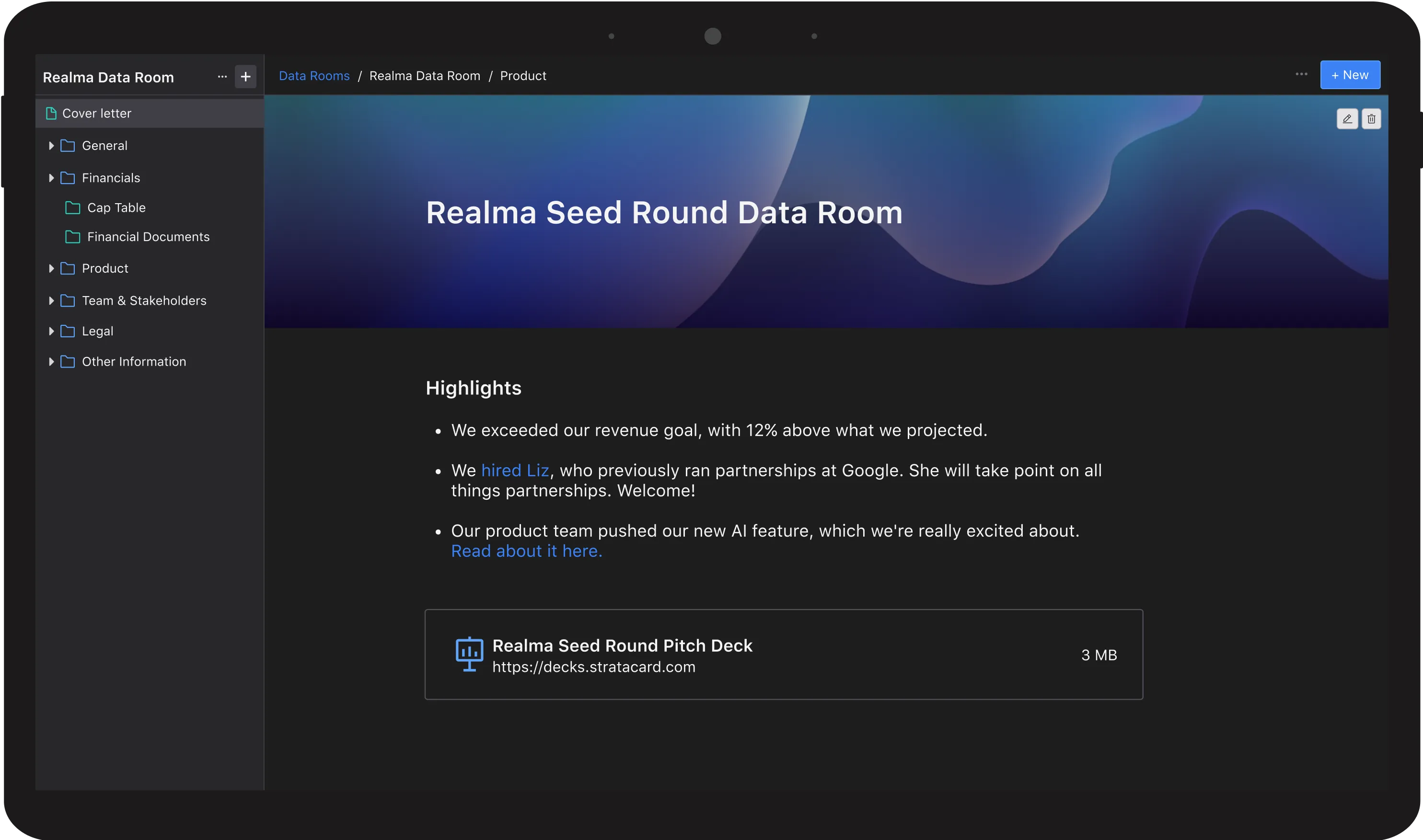

Data Room Structure: How to Stay Organized

A clear data room structure makes navigation easy for investors. Group documents into logical folders such as financials, legal, product, and team. Avoid clutter by keeping file names simple and consistent.

Using a data room index template can help founders set up categories in advance. This reduces confusion and ensures every investor sees the same information in the same place. Think of your data room like a story — each section should flow naturally into the next, giving investors a complete picture of your company without forcing them to dig.

Data Room Best Practices for Founders

Founders should follow a few data room best practices to keep the process smooth. Update the room regularly as metrics change, share only with serious investors, avoid overloading the room with unnecessary files, and use clear naming conventions.

Treat your data room startup process as an ongoing effort rather than a one-time setup. Investors will often revisit the data room multiple times throughout the process. By keeping documents current, you ensure they always have the most accurate view of your business.

Due Diligence Data Room Checklist

When investors move into the due diligence phase, requirements get more specific. A due diligence data room checklist often includes audited financials, detailed contracts, compliance documents, and intellectual property filings.

This stage can feel intense for founders, but preparation makes a huge difference. Rather than scrambling to gather documents after a term sheet is signed, have them organized in advance. The ability to respond quickly and accurately during diligence can shorten your fundraising timeline and keep momentum on your side.

How to Set Up a Data Room for Investors

The good news is that learning how to set up a data room is straightforward. Start by choosing a secure platform, then create your folder structure, upload essential documents, and test access controls.

When thinking about how to set up a data room for investors, make sure your permissions allow the right level of transparency without exposing sensitive information too broadly. For example, some investors may only need read-only access to high-level financials, while lead investors may require access to more detailed contracts.

Free and Affordable Options for Startup Data Rooms

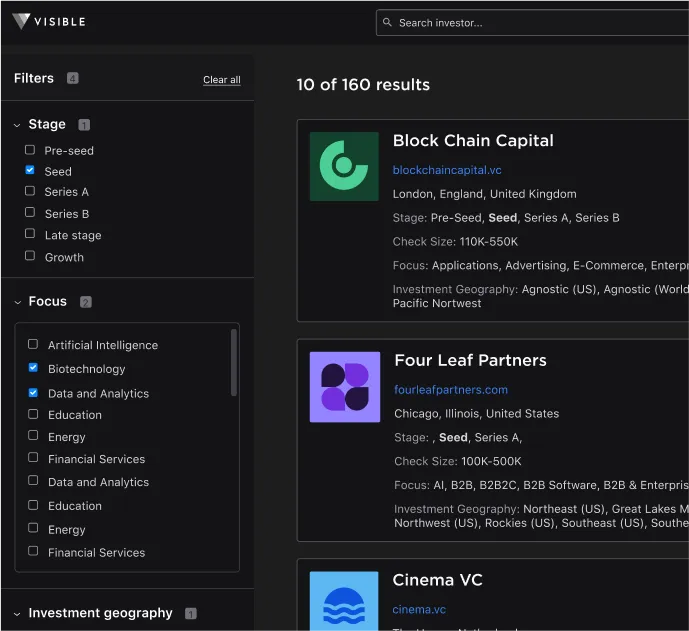

Not every founder has the budget for advanced tools. That’s why many look for the best data room for startups that balances affordability and features. Early-stage teams may experiment with the best data room for startups free options, though these often lack advanced security.

A free data room for startups can work in the earliest stages of fundraising, but as diligence deepens, most founders upgrade to more robust platforms. Think of it as an investment — the cost of a professional data room is small compared to the size of a typical venture capital round.

Data Room Templates and Resources for Founders

If you’re unsure where to start, using a data room template can help. Templates outline common folder structures and required documents so you don’t miss critical details.

When founders search for a visible data room or other easy-to-use template, they’re usually looking for a way to get organized quickly without reinventing the wheel. Starting with a framework saves time, and as your business grows, you can adapt the template to include additional documents relevant to your stage and sector.

Final Thoughts: Building Confidence with a Complete Startup Data Room

Your data room is more than a fundraising formality — it’s a reflection of how prepared and professional your company is. A well-structured startup data room not only makes investors’ lives easier but also strengthens your credibility as a founder.

Taking the time to organize your documents with a proper checklist is one of the simplest, most effective steps you can take toward securing funding. It shows that you respect investors’ time, understand the diligence process, and are ready to move quickly when the right opportunity arises.

Founders who invest the effort up front often find that the fundraising process runs more smoothly, freeing up more time to focus on building their business. In the end, a thoughtful approach to your data room is not just about raising capital — it is about setting the foundation for long-term relationships with your investors.

Even after a fundraising round closes, your data room can remain a valuable asset. It can serve as an ongoing hub for board updates, financial reporting, or future financing rounds. By maintaining your data room consistently, you set yourself up for faster processes in the future and create a culture of transparency that investors will appreciate long after the initial deal is done.