Fundraising is difficult. We’ve helped thousands of founders raise capital and engage with their investors. Over time, we’ve learned that a traditional B2B sales & marketing process mirrors a venture capital fundraising process.

At the top of your “fundraising funnel” you are adding qualified investors (leads), nurturing them through the middle of your funnel with meetings, updates, coffee chats, etc., and ideally closing them as new investors at the bottom of your funnel.

Related Resource: All Encompassing Startup Fundraising Guide

Just as sales and marketing processes have dedicated tools, shouldn’t a fundraise? Learn more about fundraising software and how it can help you raise capital below:

What is Capital Raising Software?

First things first, what is capital-raising software? Capital raising software, or simply fundraising software, is a platform or tool that can help founders navigate a fundraise. This means having the tools to find investors, share assets during their raise, and a place to manage and track their ongoing conversations and relationships.

Related Resource: The Understandable Guide to Startup Funding Stages

Generally speaking, when a founder seeks funding it turns into their full-time job. By utilizing a software stack dedicated to their fundraise, founders will be able to speed up their fundraising process and spend more time on what truly matters — building their business. Learn more about capital raising software and what features to look for below:

Features to Look for in a Capital Raising Tool

There are few tools that are truly dedicated to the capital-raising process. In the past, founders might just use a hodgepodge of software and tools dedicated to other use cases. This can create a headache as it gets intermingled with day-to-day tasks (e.g. using your sales & marketing CRM for tracking a fundraise).

To help you find the tool that is right for you, we’ve laid out a couple of considerations and features to keep an eye out for below:

Easy-to-Use Connect With Potential Investor Portal

First things first, when seeking out a capital-raising tool, you will want to make sure that the ability to connect and engage with potential investors is there. At Visible, we find that companies that regularly send investor updates are 300% more likely to raise follow-on funding from their existing investors. One of the core ways to engage with potential and current investors is by sharing monthly Updates.

At Visible, we have a tool entirely dedicated to sending Updates to your investors. From here you can see how they are engaging with Updates and add potential investors to your lists along the way. Check out some of our most popular Update templates in our library here.

Personalized Investor Database

Just like any sales and marketing process starts by finding qualified leads and customers, so should a fundraise. Traditional venture capital funds invest in all sorts of geographies, markets, company sizes, etc. so it is important to make sure you are talking to the right people.

By having an investor database, you’ll be able to filter and find the right investors for your business.

Related Resource: Building Your Ideal Investor Persona

At Visible, we have a free investor database, Visible Connect, that allows you to filter investors by the properties we find most important to find potential investors

Related Resource: Debt vs Equity Financing

Monitors Investor Interactions

Any sales and marketing team will have a place to monitor their interactions with current and potential customers (typically a CRM like HubSpot or Salesforce). Having a place to monitor interactions with current and potential investors is a surefire way to improve your odds of funding success. It will also help in other areas where investors can lend a hand as well (e.g. hiring, strategy, promotion, etc.)

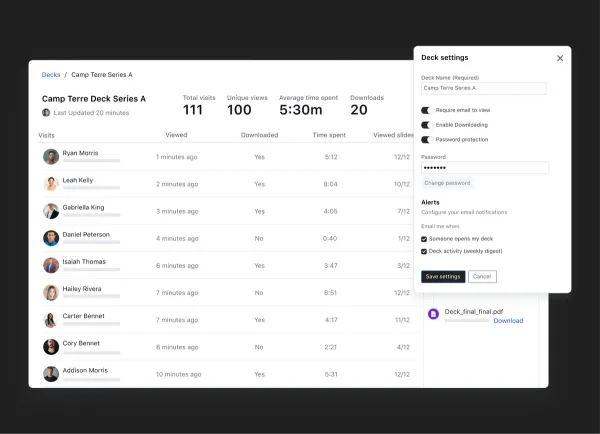

At Visible, we allow founders to use our Fundraising CRM to track interactions (Deck views, Update engagements, etc.) so they can properly follow up with the right investors at the right time. Learn more about our Fundraising CRM here.

Related Resource: Why a CRM is Essential for Investor Relations

Related Resource: Investor CRM: Seamlessly Manage Relationships and Finances

Host and Share Pitch Decks to Investors

While different investors have different preferences when it comes to how, when, and where to share a pitch deck, they will inevitably want to see some form of a pitch deck throughout the process.

Having a tool where you can share your pitch deck via link will help you understand how investors are engaging with your deck. Tie this in with the tools mentioned above and you have a platform that can help with every step of your fundraise.

Related Resource: Tips for Creating an Investor Pitch Deck

At Visible, we offer a tool to help founders share their pitch deck with your own domain and brand settings so you truly own every step of your funding journey. Learn more about sharing Decks with Visible here.

How to Utilize Capital Raising Software to Get Funding for Your Startup

Of course, software won’t be a silver bullet that magically makes your business fundable. You need to have a fundable business and a gameplan in place to go out and raise capital. Capital raising software is simply a tool that will make the job easier on you as a founder.

By finding a tool to help with your fundraise, you’ll be able to spend more time having meaningful conversations with investors, hiring top talent, and building your business.

Related Resource: How to Raise Capital Using RUVs

Find Investors and Build Relationships With Visible’s Capital Raising Software

At Visible, our mission is to help founders succeed. We’ve helped thousands of founders communicate with their current and potential investors. Find investors, share your pitch deck, update your investors, and track your relationships all from one place. Give Visible a free try for 14 days here.