At Visible, we believe that fundraising oftentimes mirrors a traditional B2B sales and marketing funnel.

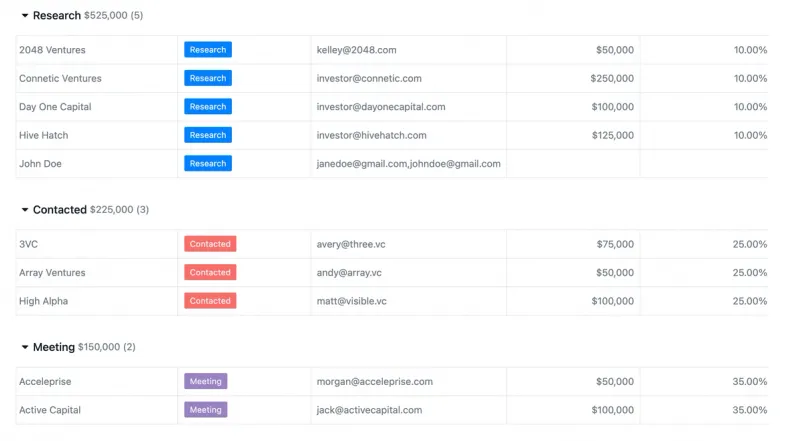

At the top of your “fundraising funnel” you are adding qualified investors (leads), moving them through the middle of your funnel with meetings, coffee chats, monthly updates, etc. with the goal of closing them as a new investor at the bottom of the ideal. From here, you are ideally delighting them with consistent communication.

Related Resource: An Essential Guide on Capital Raising Software

Just as a sales and marketing team has dedicated tools shouldn’t a founder have tools to manage their most expensive asset, equity? Learn more about how founders can use a CRM to improve and manage their investor relations below.

What is the Definition of a CRM?

As put by Salesforce, the original pioneer of CRMs, “Customer relationship management (CRM) is a technology for managing all your company’s relationships and interactions with customers and potential customers. The goal is simple: Improve business relationships to grow your business. A CRM system helps companies stay connected to customers, streamline processes, and improve profitability.”

However, this definition slightly changes when it comes to investor CRM or a dedicated CRM for fundraising. Whereas a traditional CRM is used to further your relationship with customers, an investor CRM is used to strengthen relationships with both current and potential investors.

Why is Customer Relationship Management (CRM) Important for Investor Relations?

As we previously mentioned, equity is the most expensive asset a startup founder has. Having a system in place to communicate and build relationships with the stakeholders on your cap table is a surefire way to improve your odds of raising capital in the future.

Investors are typically investing thousands to millions of dollars into businesses and they want to know their relationship is being taken seriously. Founders have the ability to stand out from their peers by having a strong system for communicating and building relationships with investors.

At Visible, we have found that companies that regularly communicate with their investors are 300% more likely to raise follow on funding down the road. On top of helping with follow on funding, founders can also leverage their investor’s network, experience, and resources.

Related Resource: Investor CRM: Seamlessly Manage Relationships and Finances

CRM Helps Startups Learn About Their Investors

Fundraising is relationship-based. On top of having a fundable business, investors will turn to founders to see how they communicate and lead their organization. By having a system and CRM in place, investors will be able to strengthen their relationships with portfolio companies.

This might not seem important when it comes to fundraising, it pays dividends down the road. At the end of the day, investors are human and will value a relationship and predictable communication.

CRM Encourages Organization

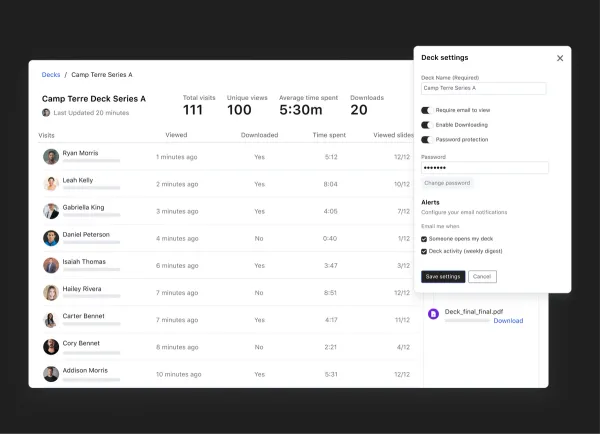

An investor CRM can also be a forcing function to have a fundraising strategy and game plan in place. A CRM will require you to be diligent about the investors are you adding to the top of your funnel and will help you best allocate your time (e.g. taking meetings with the right investors). Additionally, it will require you to have the right assets in place for when an investor inevitably asks for your pitch deck, metrics, references, etc.

Related Resource: All-Encompassing Startup Fundraising Guide

CRM Software Is Designed to Optimize Investor Interactions

Fundraising oftentimes turns into a full-time job for founders. By leveraging CRM and other tools, founders will be able to organize their process and spend more time on what truly matters, building their business. By having a CRM in place, founders will be able to focus their time on efforts on the right investors are the right time.

At Visible, we allow founders to share monthly Updates with different lists of investors. This is not only great for current investors but can also be used to nurture investors that might be at different stages of a fundraise.

For example, if an investor says your business is too early, you might want to send them a light monthly Update to keep them in the loop on the status of your business. This way when you are ready to seek future funding they will already be familiar with your business and will be eager to write a check.

How to Utilize CRM Software for Investor Relations

Raising capital for a business is extremely difficult. CRM software will not be a silver bullet to raising capital. You still need to have a fundable business and game plan in place to pitch and close potential investors. Having a CRM in place is a great way to help you spend more time on what truly matters, building your business.

Related Resource: Investor Relationship Management 101: How to Manage Your Startups Interactions with Investors

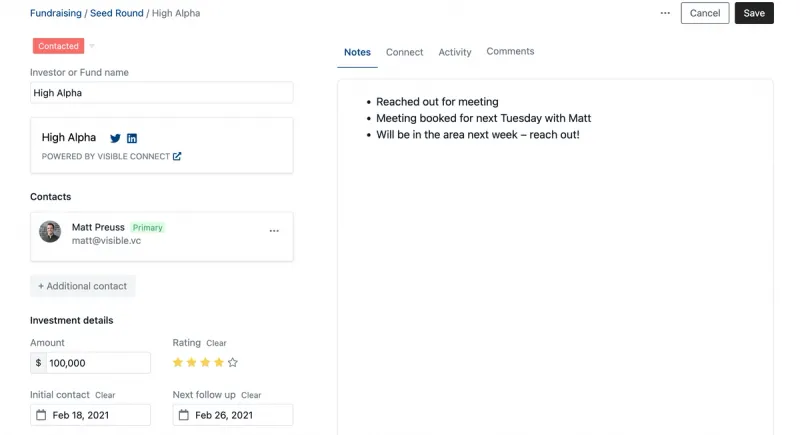

Setting up an investor CRM can be highly tailored to your business and can be customized by your stage, geography, market, etc. Check out an example of a Fundraising CRM in Visible here.

Manage Your Investor Relationships With Visible

Fundraising is a relationship-based game. By having the tools, game plan, and assets in place you’ll increase your odds of a speedy and successful fundraise. Find investors, share your pitch deck, send investor updates, and track your interactions in our investor CRM all from one platform. Try Visible for free for 14 days here.