Investor CRM: Seamlessly Manage Relationships and Finances

Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

At Visible, we compare a venture fundraise to a traditional B2B sales and marketing funnel. At the top of your “fundraising funnel” you are bringing in qualified investors (leads), moving them through the middle of your funnel with meetings, pitches, monthly updates, etc., and hopefully closing them at the bottom of the funnel as a new investor. Ideally, once you close a new investor you’ll delight them with regular communication.

Related Reading: An Essential Guide on Capital Raising Software

Just as a sales and marketing team have dedicated tools, shouldnt a fundraise? By implementing an investor CRM, you will be able to stay on top of your communication and relationships with both current and potential investors.

What is an Investor CRM?

As put by the originator of the CRM, Salesforce, “Customer relationship management (CRM) is a technology for managing all your company’s relationships and interactions with customers and potential customers. The goal is simple: Improve business relationships to grow your business. A CRM system helps companies stay connected to customers, streamline processes, and improve profitability.”

However, an investor CRM is slightly different. Whereas a traditional CRM is focused on current and potential customer, an investor CRM stays focused on your current and potential investors.

Related Resource: Why a CRM is Essential for Investor Relations

This means tools to send updates, share pitch decks, monitor conversations, track status, etc. Learn more about the benefits of using a CRM for your investor relations below:

Benefits of a CRM Tool for Startups

Fundraising is a difficult. Implementing an investor CRM will not be a silver bullet that will close a round of funding for your business. It will help you build a system and organization into your process to improve your odds of success and allow you to focus on what truly matters, building your business.

Learn more about the benefits of using an investor CRM for your investor relations below:

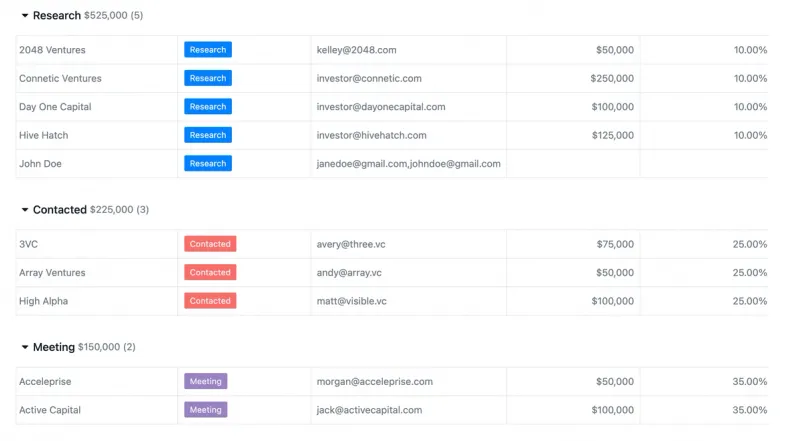

1) CRM Gives Real-Time Insight on Your Pipeline

Any sales team wants to know the status of their pipeline. The same is true for a founder and a fundraise. Over the course of a venture fundraise, you will likely talk to anywhere between 50 and 100 investors.

To give you an accurate idea of the status of your round, founders should have a CRM in place to give you an idea of your current pipeline. For example, for new “leads” a sales & marketing team might give them a 10% chance to become a customer. You can set up the same idea for a fundraise. A new investor might be a 10% chance, an investor after a successful meeting might be 25%, etc.

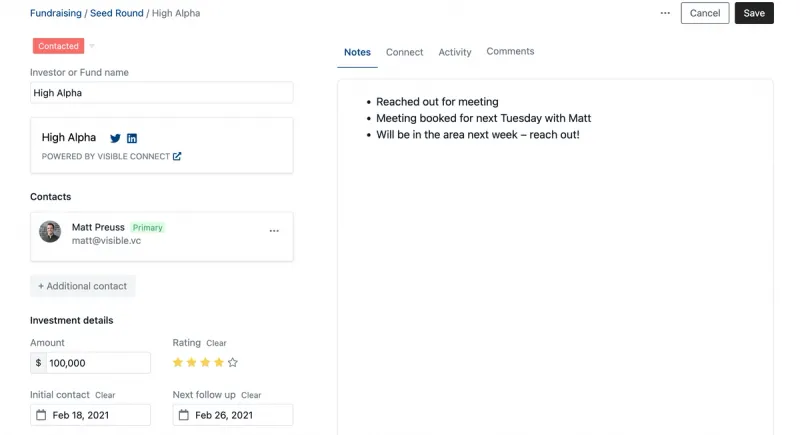

2) All Investor Interactions and Conversations are Tracked

The sheer number of conversations during a fundraise should not be overlooked. As we mentioned, you will likely be talking to 50-100 investors. An investor CRM, will allow you to stay on top of your conversations.

Inevitably during the course of a fundraise, investors will pass for different reasons, request you follow up later, etc. A CRM is a surefire way to stay on top of these conversations and notes that will arise during a raise.

3) CRM Ensures You’ll Never Miss a Follow-Up

Follow ups and communication are vital to a successful sales & marketing process. The same can be said for a fundraise. Of course, there are companies that be so intriguing to investors that they’ll be ready to write a check after 1 meeting. However, for the majority of companies they will need to run a process for following up with investors.

At the end of the day, your job is to create FOMO with your potential investors so they are motivated to move quickly.

4) Seamlessly Monitors Fundraising

As we’ve alluded to throughout the post, an investor CRM is the best way to monitor the overall status of your fundraise. Using different stages and properties, you’ll be able to closely monitor the status of your raise.

This is not only beneficial to yourself but also your stakeholders. You can share the status of your fundraise with existing investors and advisors so they can help make introductions to potential investors and move you closer to a successful round.

5) Improves Relationships With Investors

One of the best benefits of using an investor CRM is that it strengthens your relationships with current investors. We have found that companies that regularly communicate with your investors are 300% more likely to raise follow on funding.

By having a system in place to communicate with your current investors you will not only improve your odds of raising follow on funding but you’ll be able to leverage their network, experience, and resources.

As a starting point, we recommend founders send a monthly update to their investors. To get the ball rolling, check out a few of our favorite monthly update templates here.

Related Resource: Investor Relationship Management 101: How to Manage Your Startups Interactions with Investors

Features to Look for in an Investor CRM

Most CRMs are tailored to sales and marketing teams. When seeking out an investor specific CRM, look for some of the following details:

Seamless Collaboration and Data Sharing

Typically, investor relations relies solely on the founder and maybe a handful of other leaders. However, there are opportunities for collaboration when communicating and working with investors.

By having a CRM that allows for collaboration and data sharing, you’ll be able to quickly uncover insights about your fundraise and the state of your fundraise.

Ability to Integrate with Other Tools

A major benefit of using a CRM is that it helps automate tedious aspects of investor relations. Look for a tool that will allow you to connect with other tools and help create more efficient investor relations.

At Visible, our CRM directly integrates with a few tools:

- Our free investor database, Visible Connect

- Our investor updates tool

- Our pitch deck sharing tool

- Zapier

Easily Customizable

Every fundraise is different. Stage, geography, check sizes, etc. will all dictate how you wan to set up your investor CRM.

Look for a tool that allows you to easily customize your fundraise so it is molded to the specifics of your fundraise.

Track Communication

A key aspect of building trust with current and potential investors is with regular communication. A CRM should be a place where you can keep an eye on how your investors are engaging with your emails, updates, pitch decks, etc.

Manage Your Investor Relationships With Visible

Find investors, share your pitch deck, send investors updates, and track your investor conversations all from one place. Try Visible for free for 14 days here.