What is debt financing?

Startups are in a constant competition for 2 resources; capital and talent. When it comes to raising capital for your startup there are quite a few options. Outside of bootstrapping, debt and equity financing are 2 of the most popular options.

According to Investopedia, “Debt financing occurs when a firm raises money for working capital or capital expenditures by selling debt instruments to individuals and/or institutional investors. In return for lending the money, the individuals or institutions become creditors and receive a promise that the principal and interest on the debt will be repaid.”

On the other hand, there is equity financing.

How does debt financing work?

A lender is generally evaluating if and when a business can be repaid. A team of lenders will generally evaluate a few things, this generally starts with past performance and future projections. A few keys to understand when approaching a lender or bank for debt financing:

- Complete financial statements and documents. Poor or incomplete financial statements can put doubt in the mind of a debt-provider. Most debt-providers will look as far back as 2-3 years. For example, Lighter Capital will occasionally make investments with ~6 months of solid financials.

- Understand your business. Have a deep understanding of where your customers, how you’re acquiring them, and why they are churning.

- Revenue Growth. You don’t have to be a profitable company to receive funding from Lighter Capital but should have a clear plan and pathway to profitability.

- Downside Scenarios. As mentioned above, debt-providers are focused on repayment as opposed to extreme upside. Make sure you lay out downside scenarios to show you can navigate down periods.

- High Gross Margins. Going hand in hand with “downside scenarios” show debt-providers you have high gross margins and can limit the downside as much as possible.

- Story matches the numbers. If you’re telling a great narrative and the data/financials are not matching up with the story chances are that will cause doubt in the mind of the providers.

- Plan for New Capital. Show you have a plan in place for how you will allocate your new capital. Allen of Lighter Capital has seen a clear connection between a company coming to them with a solid plan and their future growth.

Pros of debt financing

Every financing option will come with its own set of pros and cons. Check out a few of the key pros of debt financing below:

- Maintain ownership — debt financing does not require founders to give up equity or ownership in their business

- Efficient growth — taking on debt can allow companies to buy the resources and hire the talent they need to fuel growth

- Tax benefits — As the team at Lightspeed put it, “A strong advantage of debt financing is the tax deductions. Classified as a business expense, the principal and interest payment on that debt may be deducted from your business income taxes.”

Cons of debt financing

On the flip side, there are cons to debt financing. Check out a few examples below:

- Repayment — of course, you’ll need to repay the debt. This requires a predictable business model.

- Collateral — debt also requires collateral. This can be limited to early-stage companies.

Types of debt financing

There are different types of debt financing that startups can leverage. Check out a few types of debt financing below:

- Bank Lending — The most traditional form of debt financing requires taking a loan from a traditional bank or institution.

- Recurring Revenue — There are specific lenders dedicated to recurring revenue business models (SaaS).

- Family or Friend Lending — Startup founders can also take on debt or loans from family members or friends.

What is equity financing?

According to Investopedia, “Equity financing is the process of raising capital through the sale of shares. Companies raise money because they might have a short-term need to pay bills or they might have a long-term goal and require funds to invest in their growth. By selling shares, they sell ownership in their company in return for cash, like stock financing.”

When thinking of equity financing in terms of startups we generally think of venture capital and angel investors. When a startup goes out to raise a funding round, they are selling shares (AKA equity in the company) for a set amount of capital.

How does equity financing work

When raising equity financing or venture capital it often follows a process. This involves the founder focusing on the fundraise.

Finding the Right Investors

To start a fundraise, you first need to understand what investors you should be talking to. A venture fundraise is time intensive so it is important to make sure you’re spending your time with the right people. Check out our investor database to find the right investors for your business here.

Related Resource: An Essential Guide on Capital Raising Software

Pitching Your Company

Once you land a meeting with a potential investor you will need to pitch your business and make it a point for them to invest. As we wrote in our Fundraising Guide, “If you’ve done your research and asked the right questions, you’ll be armed with the information you need to effectively pitch your company. At the end of the day, pitching is storytelling and it is your job to figure out how each potential investor fits into the narrative. If done correctly, you’ll be able to control the conversation and better your chances of setting future meetings.”

Due Diligence

If you are fortunate enough to gain interest from a venture capitalist they will perform due diligence to confirm what you’ve been pitching is true. This means they will be calling on customers, other investors, and combing through historical data to confirm they’d like to make the investment.

Pros of equity financing

Like debt financing, equity financing comes with its own set of pros and cons. Check out a few of the pros of equity financing below:

- No Loan Repayment — With equity financing, the burden of repayment does not fall on the shoulders of a founder. In turn for giving up ownership, they are giving up the burden of repaying debt.

- Resources — Many equity financers, like venture capitalists, come with resources to help startups grow and scale their operations.

Cons of equity financing

On the flip side, there are also cons that come with equity financing. Check out a couple of examples of the cons of raising equity financing below:

- Loss of ownership — Giving up equity means that founders are giving up ownership and potentially decision-making powers.

- Expectations — When adding on new shareholders, chances are they will have requirements and expectations that may not align with your own.

Types of equity financing

Equity financing, and the individuals/firms that support it, come in different shapes and sizes. Check out a few examples of equity financing below:

- Venture Capital — dedicated firms built to invest in high-growth startups

- Angel Investors — high net worth individuals that use startup investing as a way to diversify their investment portfolio

- Private Equity — Professional investment firms dedicated to helping operate and scale large startups.

Related Resources:

- How to Find Investors

- How to Effectively Find + Secure Angel Investors for Your Startup

- Private Equity vs Venture Capital: Critical Differences

Debt vs equity financing for startups

When evaluating debt and equity financing there are a few key major differences that a startup and founder have to evaluate.

The Cost

The major difference when evaluating debt and equity financing is the cost to your business. On one hand, you can take debt financing and will need to pay back the interest rate and principle at a later date. This generally assumes that your business is bringing in some type of predictable revenue. There is a clear cost associated with paying this back.

On the flip side, is the cost of equity financing. While there is not a set amount of capital you will need to pay back you will eventually need to pay the cost of the shares at a later date. This can be expensive if the business turns out to be worth a large amount.

The Business Model

When understanding debt vs. equity financing you need to understand the impact your business model will have on each as well. When raising debt financing, the lender will want your business to have predictable revenue and clear projections so they know that they will be repaid.

On the other hand, equity financing allows small businesses to pursue a new market where they may have little to no data. This is because someone buying equity, especially a venture capitalists, are investing in the future value of the company and the ability for the team to execute on the vision.

When to seek out debt vs equity financing

As we’ve discussed earlier in this post you need to understand the costs associated with both equity and debt financing.

Securing Debt Financing

For those who aren’t growing at 300% but rather 150% or 200% a good option would be to look into debt financing. While there are countless types of debt financing, Lighter Capital focuses on “revenue-based financing”. There are several factors that Lighter Capital looks into when evaluating a potential investment but as Allen Johnson of Lighter Capital puts it, “At the end of the day they’re assessing the risk to get repaid”.

Securing Equity Financing

To kick off the webinar, Mike discussed experiences from Visible’s own fundraising efforts and what we’ve seen from our partners and countless companies using Visible for investor relations.

The biggest takeaway from raising equity financing? It is very much a process and can be very time consuming. Raising equity financing is essentially a full time job for the CEO or founding team. It is not something that can be done lightly and viewed as a “side project”. You need to build relationships and a pipeline of investors, show momentum, generate inbound interests, etc.

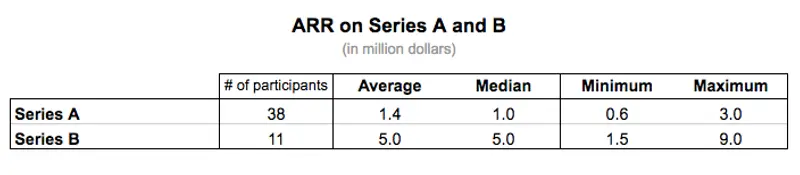

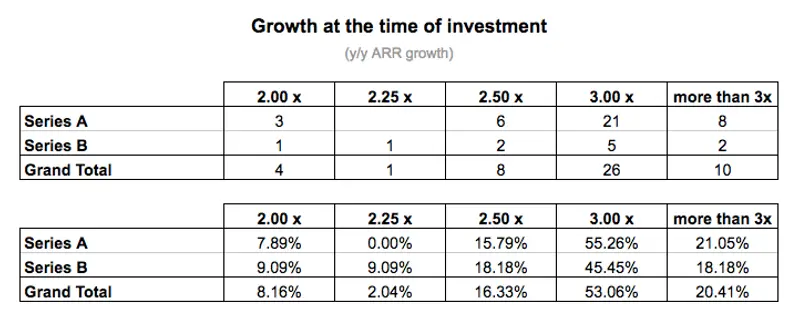

Equity financing allows pre-revenue companies with a strong vision and adjustable market an opportunity to secure capital and pursue their vision. Investors are expecting a return and are often in pursuit of an “extreme upside”. As you can see below, Christoph Janz of Point Nine Capital breaks down what it takes to raise a Series A in SaaS below:

Basic Info and Docs You’ll Need While Raising Venture Capital:

As part of the process of raising venture capital, VCs will need to understand your past business performance. Venture capitalists are generally investing in a highly experienced team, intriguing and emerging market, and/or a world class product.

Related Reading: Building A Startup Financial Model That Works

With that being said, they will generally need a few of the info and docs below to evaluate their investment decision:

Legal Docs, Cap Table, Financials, etc.

A venture capitalist will want to see who owns the business and how it is structured. They will want to see the cap table to understand this. They will also want to get a look into historical financials to understand how the business is burning cash and handling their finances. In the wake of recent VC failures, it is especially important to have cash burn and financing under control.

Trends over time

VCs are largely investing in the founder and the team if there is little to no revenue or historical data. It is important that the founder and team takes the relationship and transparency seriously. A regular cadence and rapport leading up to the investment. Investors won’t make an investment in a single point of time.

Customer Acquisition Model

VCs will also want to understand your customer acquisition model and the sustainability of it moving forward. If it costs more to acquire a customer than they are paying, it is likely not a feasible business. To learn more about customer acquisition models, check out this post.

Total Addressable Market and Sensitivity analysis

If a business has little to no historical data, a VC may want to better understand the market they are investing. If a market has the opportunity to be large and the investment has the opportunity to penetrate a large percentage of the market, it may be an interesting investment. You can learn more about modeling this and sharing TAM with investors here.

Both debt financing and equity financing are solid options depending on your stage, metrics, and financials. Each has its pros and cons for each company. It is ultimately up to the founder to have a deep understanding of their business to make sure they are making the right decision for their business.

The Visible newsletter brings you weekly, curated fundraising news, articles, and events

Every Thursday we deliver curated insights to help founders raise capital, update investors, and track their key metrics in our newsletter, the Visible Weekly. Subscribe to the Visible Weekly and stay in the loop with fundraising data and insights here.