Key Takeaways

-

Discover the latest venture capital trends driving the booming media and entertainment industry, from AI breakthroughs to creator-led platforms.

-

Learn how AI transforms content creation and distribution, giving startups a competitive edge in production quality, personalization, and audience engagement.

-

Explore proven strategies for founders to leverage the creator economy, from influencer collaborations to building monetization tools and services.

-

Get an inside look at top media and entertainment VC firms such as, Baseline Ventures, Lerer Hippeau, Founders Fund, and what they seek in high-growth startups.

-

Gain actionable investor insights, including how to craft a compelling pitch, showcase traction, and highlight emerging technologies like VR, AR, and blockchain.

The media and entertainment industry has profoundly transformed over the past few years. What was once dominated by large corporations and conglomerates now sees individual creators and innovative startups taking the lead, thanks to technological advancements and the democratization of content creation and distribution. This evolution has been significantly driven by AI and other cutting-edge technologies, reshaping how content is produced, consumed, and monetized.

AI has become a cornerstone in modern media, enabling creators to enhance production quality, streamline operations, and personalize content for diverse audiences. From automating complex tasks to providing deep insights through data analytics, AI empowers founders to stay ahead of the curve and meet the ever-evolving demands of consumers. As a result, venture capital (VC) firms increasingly recognize the potential of startups in this dynamic sector, offering substantial investments to fuel innovation and growth.

In this article, we explore the evolving landscape of media and entertainment, the pivotal role of AI, and highlight the top VC firms investing in this space. We also provide practical advice for founders of media and entertainment startups, helping them navigate the challenges and seize the opportunities in this exciting industry. Whether you're a seasoned entrepreneur or a new entrant, understanding these trends and insights will be crucial for securing investment and driving success.

Leveraging AI for Success in Media & Entertainment Startups

AI is at the forefront of the media and entertainment revolution, offering transformative benefits that are reshaping content creation, distribution, and audience engagement. For founders in this industry, AI is not just a tool but a strategic asset that can propel your media and entertainment startup to new heights. Embrace these technologies to build a more resilient, agile, and successful business in the ever-evolving media landscape.

To fully harness the power of AI, consider the following strategies for your media and entertainment startup:

- Invest in AI-driven Tools: Integrate AI technologies into your content creation and distribution workflows to enhance efficiency and quality. Tools that automate video editing, special effects, and content generation can save time and resources.

- Focus on Data Collection: Continuously gather and analyze user data to refine your personalization algorithms and improve audience engagement. The more data you collect, the better your AI can tailor experiences to individual users.

- Leverage AI for Market Research: Use predictive analytics to stay informed about emerging trends and audience preferences. This will help you make proactive business decisions and stay ahead of the competition.

- Collaborate with AI Experts: Partner with AI specialists and firms to stay updated on the latest advancements and best practices in AI technology. This will ensure you are leveraging AI to its fullest potential.

Related resource: An Overview of 20 Promising AI Startups

The Impact of Creators on the Media and Entertainment Industry

The rise of individual creators has significantly reshaped the media and entertainment industry. No longer reliant on traditional media gatekeepers, creators can produce, distribute, and monetize their content directly through various platforms. This democratization has led to a more diverse range of content, catering to niche audiences and fostering strong community engagement.

As a founder, leveraging the power of creators can be a game-changer for your startup. Consider these strategies to harness the influence of creators:

- Collaborating with Influencers: Companies are partnering with popular creators to amplify their brand’s reach and credibility. Influencers have dedicated followings and can provide authentic endorsements that resonate with their audiences.

- Develop Creator-Focused Platforms: Build platforms that empower creators by offering tools for content creation, distribution, and monetization. By providing valuable resources and support, you can attract top talent to your platform and foster a thriving creator ecosystem.

- Facilitate Community Building: Encourage community engagement by enabling creators to interact directly with their audiences. Features like live streaming, chat functions, and social media integration can enhance the sense of community and loyalty around your platform.

Companies such as GRIN, Afluencer, and Upfluence are some of the top influencer marketing platforms.

Related Resource: Top VCs Investing in the $100 Billion Creator Economy

Opportunities For Founders within the Media & Creator Industry

The shift in Media and Entertainment has left several areas of potential high yield for founders willing to provide services to this rapidly expanding industry.

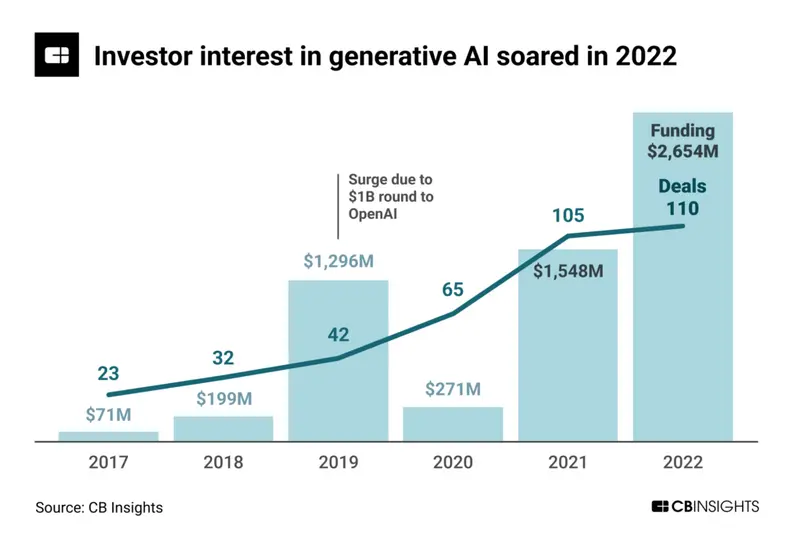

CBInsights reported the year’s largest rounds:

- Anthropic, an AI model developer and research outfit ($580M Series B)

- Inflection AI, which focuses on human-computer interfaces ($225M Series A)

- Cohere, a developer-focused NLP toolkit

And so far these are the 6 companies that have reached unicorn status (valued at $1B+), including:

Areas that founders can develop to help creators monetize and produce:

- Platform Development: Founders can build platforms that empower creators, providing them with the tools they need to create, distribute, and monetize their content.

- Some companies include Circle for paid communities, ConvertKit a marketing hub for creators that helps you grow and monetize your audience, and OnlyFans an internet content subscription service.

- Creator Tools: Creators are always looking for tools that can make their work easier, whether that’s content creation software like Canva, analytics platforms, scheduling tools like Later, or collaboration software like figma.

- Creator Services: Founders can offer services aimed at helping creators grow and manage their businesses, such as analytics, marketing, legal services, or financial management. Companies like Pex (music rights management) and Jellysmack (video optimization) are already doing this.

Creators As Customers

Creators’ willingness to spend money on tools and services, is also associated with the kind of creator that is viewing their work as a business. They understand that investing in high-quality tools and services can help improve the quality of their content, expand their reach, and ultimately increase their income. The key for founders is to ensure that the value provided by their product or service is clear and that it meets a real need in the creator community.

Ultimately, the potential for profitability in the creator economy is significant, but success requires an understanding of the unique needs and challenges of creators. Founders looking to serve this industry must focus on delivering real value to creators, whether that’s by making the content creation process easier, helping creators reach a wider audience, or providing new ways for creators to monetize their work.

Resources

- Wellfound’s — Top Entertainment Industry Startups

- TechCrunch — “Imagine Impact, a content accelerator that launched two years ago under production powerhouse Imagine Entertainment to impart a “Y Combinator” approach to sourcing new work and connecting it with production opportunities”

- IBC— Accelerator Media Innovation Programme

- Deloitte’s Media and Entertainment Industry Outlook)

Top Media and Entertainment VC Firms to Consider

Securing investment is a critical step for any startup, especially in the competitive media and entertainment industry. To help founders navigate this process, it's essential to understand which VC firms are leading in this space, what they look for in potential investments, and how you can impress them.

Overview of Leading VC Firms

Here are some of the top VC firms known for their investments in media and entertainment startups:

Baseline Ventures

About: Baseline Ventures is the investment firm of renowned angel investor Ron Conway. Recently ranked #6 in Forbes’ “Midas List” of top dealmakers, Conway was previously the founder and managing partner of the Angel Investors funds. That fund’s investments included a few names you may have heard of: Google, Ask Jeeves and PayPal.

Sweetspot check size: $ 1M

Lerer Hippeau

About: Lerer Hippeau is a seed and early-stage venture capital fund based in New York City.

Sweetspot check size: $ 5M

Thesis: Lerer Hippeau is an early-stage venture capital fund founded and operated in New York City. We invest in good people with great ideas who redefine categories — and create new ones entirely.

Flat6Labs

About: Flat6Labs is Sawari Ventures’ dedicated startup accelerator for seed stage investments.

Sweetspot check size: $ 70K

Thesis: Flat6Labs in Tunisia is the leading seed and early stage venture capital firm investing in sector agnostic startups based in tunisia.

Mercuri

About: We lead seed stage funding rounds for UK companies at the intersection of the media and technology sectors We are actively deploying our second fund

Sweetspot check size: $1.50M

Thesis: We lead seed stage funding rounds for UK companies at the intersection of the media and technology sectors

Muse Capital

About: Muse Capital is a seed-stage fund that focuses on investing in entrepreneurs who are disrupting the consumer space.Check size: $ 100K – $ 500K

Founders Fund

About: Founders Fund is a San Francisco based venture capital firm investing in companies building revolutionary technologies.

Sweetspot check size: $ 40M

Thesis: We invest in smart people solving difficult problems.

Lightspeed Venture Partners

About: Lightspeed Venture Partners is a venture capital firm that is engaged in the consumer, enterprise, technology, and cleantech markets.

Thesis: The future isn’t built by dreamers. It’s built today, by doers.

Betaworks

About: Betaworks is a startup studio that builds and invests in next generation internet companies.

Sweetspot check size: $ 250K

Sinai

About: Sinai Ventures invests in internet and software founders at all stages.Sweetspot check size: $ 2M

Thesis: Sinai Ventures invests in internet and software founders at all stages.

Sweet Capital

About: Sweet Capital is the King (Candy Crush) founders’ fund, focused on backing ambitious founders of early-stage, consumer tech companies with positive impact

Precursor

About: An early-stage venture firm focused on classic seed investing.

Sweetspot check size: $ 250K

Thesis: We invest in people over product at the earliest stage of the entrepreneurial journey.

GV

About: The VC arm of Alphabet (Google’s parent) investing in the fields of life science, healthcare, artificial intelligence, robotics, transportation, cyber security, and agriculture. It was the most active CVC in 2017.

Sweetspot check size: $ 3M

What VCs Look for in Media Startups

Understanding what VC firms are looking for can significantly improve your chances of securing investment. Here are some key factors VCs consider when evaluating media and entertainment startups:

- Innovative Technology:

- VCs are interested in startups that leverage cutting-edge technologies such as AI, VR, AR, and blockchain to create unique and engaging media experiences.

- Scalability:

- Your startup should have the potential to scale rapidly. VCs look for business models that can grow and adapt to increasing demand without proportionally increasing costs.

- Strong Market Potential:

- VCs want to invest in markets with significant growth potential. Demonstrating a clear understanding of your target audience and the market landscape is crucial.

- Unique Value Proposition:

- Your startup should offer something distinct that sets it apart from competitors. This could be an innovative product, a unique service, or a groundbreaking approach to media and entertainment.

- Experienced Team:

- A strong, experienced team with a proven track record in the industry can instill confidence in investors. Highlight your team's expertise and past successes.

Tips for Impressing Investors

To make a compelling case to VCs, follow these tips:

- Craft a Clear and Compelling Pitch:

- Your pitch should clearly communicate your startup's vision, the problem you’re solving, and how your solution is unique. Use data and real-world examples to support your claims.

Related resources: 10 Required Slides in a Pitch Deck and 6 Types of Pitch Decks and When You’ll Need Them

- Demonstrate Traction:

- Show that your startup has gained traction, whether through user growth, revenue, partnerships, or other metrics. Evidence of early success can significantly boost investor confidence.

- Highlight Your Market Opportunity:

- Provide a thorough analysis of your market, including size, growth potential, and key trends. Explain how your startup is positioned to capitalize on these opportunities.

- Showcase Your Technology:

- If your startup leverages advanced technology, ensure you can explain it clearly and demonstrate its practical applications. Investors need to understand how your technology provides a competitive edge.

- Prepare for Due Diligence:

- Be ready for in-depth questions about your business model, financials, and growth strategy. Transparency and preparedness can make a positive impression.

- Build Relationships:

- Networking and building relationships with potential investors can provide valuable insights and increase your chances of securing funding. Attend industry events and engage with the investment community.

The Future of Media and Entertainment

The future of media and entertainment is bright and filled with opportunities for innovative startups to make their mark. By understanding the key trends and technological advancements shaping the industry, founders can position their businesses for success. Embracing AI, VR, AR, blockchain, and other emerging technologies will enable you to create compelling content, engage audiences, and drive growth. Stay adaptable, invest in innovation, and focus on delivering exceptional user experiences to thrive in the evolving media landscape.

- Increased Integration of AI:

- AI will become even more integrated into content production and distribution processes. Expect to see more AI-generated content and advanced personalization algorithms that deliver highly customized media experiences. Startups that leverage AI effectively will have a significant competitive advantage.

- Expansion of VR and AR Applications:

- The use of VR and AR will expand beyond gaming and entertainment to include education, training, and virtual tourism. These technologies will become more accessible and widely adopted, offering startups new avenues for innovation and audience engagement.

Related resource: 15 Venture Capital Firms Investing in VR in 2024

- Rise of Decentralized Platforms:

- Decentralized platforms powered by blockchain technology will gain prominence, providing creators with more control over their content and revenue streams. These platforms will offer transparent and fair compensation models, attracting creators seeking better financial arrangements.

Related resource: 15 VC Firms Investing in Web3 Companies

- Growth of Multi-Platform Experiences:

- Content will increasingly be designed for multi-platform experiences, ensuring seamless integration across various devices and channels. This trend will cater to the growing demand for flexibility in how audiences consume media. Startups that develop versatile content strategies will thrive.

- Emergence of New Monetization Models:

- Innovative monetization models will emerge, driven by technologies like NFTs and blockchain. Creators will explore new ways to monetize their work, from digital collectibles to exclusive content access. Startups that support these models will be well-positioned for growth.

- Sustainability and Ethical Practices:

- There will be a greater emphasis on sustainability and ethical practices in media production and distribution. Consumers are increasingly conscious of environmental and social issues, and startups that prioritize these values will appeal to a broader audience.

Additional Considerations for Founders

- Adapt to Consumer Behavior:

- Stay attuned to changing consumer behaviors and preferences. Flexibility and agility in responding to market shifts will be crucial for staying relevant and competitive.

- Invest in Talent and Technology:

- Invest in acquiring top talent and cutting-edge technology to drive innovation. A skilled team and advanced tools are essential for creating high-quality, engaging content.

- Focus on User Experience:

- Prioritize user experience in all aspects of your product or service. A seamless, enjoyable experience will build loyalty and differentiate your startup in a crowded market.

- Build Strategic Partnerships:

- Form strategic partnerships with other startups, technology providers, and established companies. Collaboration can provide access to new technologies, audiences, and resources.

Looking for Investors? Try Visible Today!

For founders looking to streamline their fundraising efforts and accelerate their startup growth, Visible offers a powerful platform to help manage investor relations and track key metrics.

Visible enables you to create detailed, professional updates for your investors, keeping them informed and engaged with your progress.

By leveraging Visible’s tools for fundraising, reporting, and performance tracking, you can build stronger relationships with your investors and make data-driven decisions to drive your startup’s success. Try Visible free for 14 days.

Related Resource: Media and Entertainment Investor connect profiles in our Fundraising CRM

Frequently Asked Questions

What do media and entertainment VCs look for in startups?

Media and entertainment VCs seek scalable business models, strong market potential, and innovative technologies such as AI, VR, or blockchain. They prioritize startups with a clear value proposition, experienced teams, and early traction, such as user growth or revenue. Demonstrating a unique competitive edge greatly improves funding chances.

How can AI help a media and entertainment startup attract venture capital?

AI enhances content creation, personalization, and data-driven decision-making, making startups more attractive to venture capital firms. Founders who integrate AI for audience analytics, automated production, or predictive trends can show scalability and innovation, two key factors investors value in the fast-growing media and entertainment market.

Which venture capital firms invest in media and entertainment companies?

Top venture capital firms funding media and entertainment startups include Baseline Ventures, Lerer Hippeau, Founders Fund, Lightspeed Venture Partners, and GV. These investors focus on innovative companies that use technology to transform content creation, distribution, and monetization. Research each firm’s portfolio to match your startup’s stage and sector focus.

How can a creator-focused startup secure media and entertainment VC funding?

Creator-focused startups should showcase strong audience engagement, clear monetization strategies, and tools that empower creators to scale their businesses. Highlighting community-building features, recurring revenue streams, and partnerships with influencers can demonstrate market demand and long-term growth potential, which are key factors for venture capital investment.

What trends are shaping media and entertainment venture capital?

Media and entertainment venture capital is driven by AI integration, the rise of decentralized platforms, VR and AR applications, and new monetization models like NFTs. Startups leveraging these trends while focusing on sustainability and ethical practices will capture investor interest and gain a competitive edge in the evolving market.