The Extended reality (XR) industry which includes Agumentented Reality (AR), Virtual reality (VR), and mixed reality (MR) is changing the way we experience the world by creating an immersive experience in a virtual world (VR) or merging the real and virtual worlds together (AR).

Immersive technologies has become a focus for some of the largest tech companies and investors alike thanks to rapid advancements of AR and VR technology, increased popularity within gaming, and new innovations such as the introduction of the metaverse. These technologies are also now being developed for a wide range of uses, such as industrial, communication, training exercises, and gaming.

Statista forcasted the global AR, VR, and mixed reality (MR) market to reach 30.7 billion U.S. dollars in 2021, rising to close to 300 billion U.S. dollars by 2024.

There’s never been a better time for AR and VR, spiking the interest of startups as well as investors looking to take advantage of the market.

Visible looks to help connect founders with investors all over the world. Below, we highlight 15 of our favorite AR/VR venture capitalists. Search through these investors and 13,000+ more on Visible’s Connect platform.

Related Resource: 14 Gaming and Esports Investors You Should Know

Bloomberg Beta

- Location: San Fransisco & New York City, California, United States

- About: Invests in powerful ideas that bring transparency to markets, achieve global scale, with strong, open cultures that embrace technology.

- Thesis: We believe work must be more productive, fulfilling, inclusive, and available to as many people as possible. Our waking hours must engage the best in us and provide for our needs and wants — and the world we live in too often fails to offer that. We believe technology startups play an essential role in delivering a better future. We can speed the arrival of that future by investing in the best startups that share these intentions.

- Investment Stages: Pre-Seed, Seed, Early Stage

- Recent Investments:

- Fiddler AI

- Chef Robotics

- Weights and Biases

- Tonic

- Ware

Related Resource: The 11 Best Venture Capitals in San Francisco

Dune Ventures

- Location: New York, New York, United States

- About: An early stage venture firm backing the founders shaping interactive content.

- Thesis: Dune Ventures: a new early stage venture firm investing in gaming, esports, and interactive technology. We invest globally and back founders building content studios, social platforms and infrastructure that will define the next generation of entertainment.

- Investment Stages: Pre-Seed, Seed, Series A, Series B

- Recent Investments:

- Starform

- Ramen VR

- Medal

- DreamCraft

- IndiGG

HCVC

- Location: San Francisco, California, United States

- About: HCVC is the first global venture capital fund dedicated to full-stack and hardtech startups.

- Thesis: We are looking for outstanding founders, building game-changing products or technologies and targeting large potential markets

- Investment Stages: Pre-Seed, Seed, Series A

- Recent Investments:

- Anello Photonics

- Augmenta

- Giraffe360

- Span

- Full Speed Automation

Intel Capital

- Location: Santa Clara, California, United States

- About: Intel Capital is a force multiplier for early-stage startups – inspiring and investing in the future of compute via investments in Cloud, Silicon, Devices, and Frontier.

- Investment Stages: Pre-Seed, Seed, Series A, Series B, Growth

- Recent Investments:

- 3D Glass Solutions

- Grip Security

- Landing AI

- Astera Labs

- Untether AI

7 Percent Ventures

- Location: London, England, United Kingdom

- About: Early stage tech investing in UK, EU & US. Seeking the most ambitious founders with deeptech or transformative moonshot ideas to change the world for the better

- Thesis: We invest in early stage tech startups which represent billion dollar opportunities.

- Investment Stages: Pre-Seed, Seed, Series A

- Recent Investments:

- Vauban

- Dent Reality

- Breeze

- Humanity

- Safely You

Related Resource: 15 Venture Capital Firms in London Fueling Startup Growth

Type One Ventures

- Location: Los Angeles, California, United States

- About: We are a venture capital fund investing in Seed and Series A startups with operational expertise, capital, and industry resources. The startups we invest in have dynamic teams and are building technical products with the capability to progress humanity forward. At Type One, we help founders harness their superpowers so they can change the world.

- Thesis: Progressing humanity towards a type one civilization

- Investment Stages: Pre-Seed, Seed, Series A, Growth

- Recent Investments:

- Emerge

- RoboTire

- Emerge

- Gravitics

- Radian

GFR Fund

- Location: San Francisco, California, United States

- About: GFR Fund is a venture capital fund that invests in early-stage startups that are disrupting the consumer entertainment industry

- Investment Stages: Pre-Seed, Seed, Series A

- Recent Investments:

- Phiar Technologies

- Omeda Studios

- ProGuides

Boost VC

- Location: San Mateo, California, United States

- About: Boost VC is a family of founders making Sci-Fi a Reality. Twice a year Boost VC invests in 20+ startups. The three month accelerator program includes housing and office space in Silicon Valley. Portfolio consists of 150+ companies, who have raised over $200M after joining Boost VC.

- Investment Stages: Accelerator, Pre-Seed, Seed, Series A

- Recent Investments:

- FitXR

- Alta

- Sidequest

- JigSpace

- Giblib

- Tvori

- Tribe

WXR Fund

- Location: Marina del Rey, California, United States

- About: The WXR Fund invests in gender diverse seed stage companies that are transforming business and human interaction with spatial computing (VR/AR) and artificial intelligence (AI). We are the only venture firm at the intersection of the next wave of computing and female founders.

- Thesis: The WXR Fund invests in two of the greatest opportunities of our time: the next wave of computing + female entrepreneurs.

- Investment Stages: Accelerator, Pre-Seed, Seed

- Recent Investments:

- Obsess

- mpathic.ai

- Scatter

- Prisms of Reality

- Embodied Labs

The Venture Reality Fund

- Location: San Francisco, California, United States

- About: The Venture Reality Fund drives innovation and investment at the intersection of immersive, spatial, and intelligent computing for consumer and enterprise sectors

- Thesis: Investing in Early Stage VR and AR Startups

- Investment Stages: Series A, Series B

- Recent Investments:

- Phiar Technologies

- Obsess

- Doorstead

Lux Capital

- Location: Silicon Valley, California, United States

- About: VC based in NYC and Menlo Park investing in counter-conventional, early-stage science and tech ventures, with $2.4B AUM across 8 funds.

- Thesis: Lux Capital invests in emerging science and technology ventures at the outermost edges of what is possible.

- Investment Stages: Seed, Series A, Series B

- Recent Investments:

- Runway

- Clarafi

- A-Alpha Bio

- Benchling

- Plexium

OCA Ventures

- Location: Chicago, Illinois, United States

- About: OCA Ventures is a venture capital firm focused on equity investments in companies with dramatic growth potential, primarily in technology

- Investment Stages: Seed, Series A, Series B

- Recent Investments:

- GrayMatter Robotics

- Balto

- Osso VR

- Placer.ai

- VeriSIM Life

Ludlow Ventures

- Location: text

- About: VC is a customer service business. Whether it’s testing product, pushing pixels, leveraging our network, or forcing people to download your app, we’re here to help. You make our dream jobs possible and we’re forever thankful for that.

- Thesis: We believe in VC without ego. We invest with insane conviction and love backing the right teams when others think it’s too early.

- Investment Stages: Seed, Series A

- Recent Investments:

- Point One Navigation

- Headout

- Notarize

- Lev

- Density

Craft Ventures

- Location: San Francisco, California, United States

- About: Craft Ventures is an early-stage venture fund specializing in the craft of building great companies.

- Thesis: We invest in outstanding teams that are creating market-defining products.

- Investment Stages: Seed, Series A, Series B

- Recent Investments:

- Trusted

- AgentSync

- TryNow

- Voiceflow

- ClickUp

Creandum

- Location: Stockholm, Stockholms Lan, United States

- About: Creandum is a leading European early-stage venture capital firm investing in innovative and fast-growing technology companies.

- Thesis: We are a venture capital advisory firm powering innovation from Stockholm, Berlin, and San Francisco.

- Investment Stages: Pre-Seed, Seed, Series A, Series B

- Recent Investments:

- Lokalise

- Pleo

- Meditopia

- Seon

- Craft Docs

Related Resource: Atlanta’s Hottest Venture Capital Firms: Our Top 9 Picks

Start Your Next Round with Visible

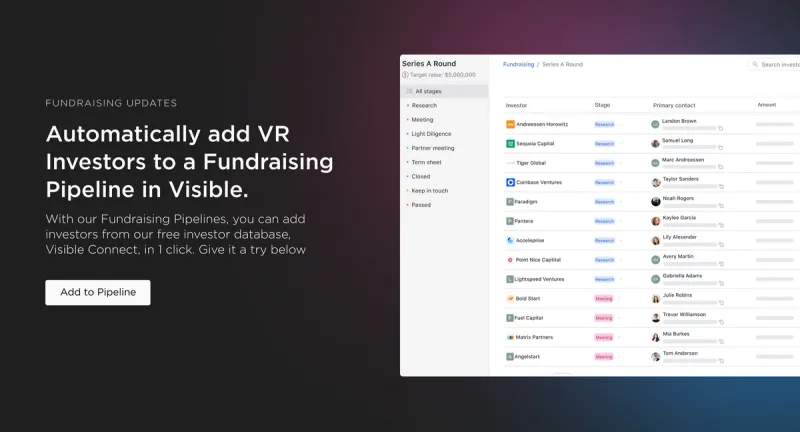

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VC’s and accelerators who are looking to invest in companies like you. Check out all our AR/ VR investors here.

After learning more about them with the profile information and resources given you can reach out to them with a tailored email. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors.

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here.