London’s venture capital scene has grown into a powerhouse of innovation and investment, making it an ideal city for founders seeking funding. With its thriving tech and finance sectors, as well as a rich network of experienced investors, London offers a compelling ecosystem for startups across industries. From fintech and artificial intelligence to clean energy and health tech, London-based VCs are actively funding ventures that push boundaries and shape the future. This guide will provide insight into London’s vibrant VC landscape, what investors look for, and how founders can maximize their chances of securing funding in one of the world’s leading financial hubs.

The London Venture Capital Landscape

London stands out as Europe’s financial powerhouse and a top destination for venture capital, attracting startups from around the globe. In 2023, the city’s startup ecosystem raised approximately $12.9 billion across various sectors, underscoring London’s ability to maintain investment appeal amidst challenging economic conditions. A strong focus on high-growth areas like climate tech, AI, life sciences, and fintech primarily drives this steady influx of capital. Climate tech alone saw record-breaking investment, accounting for 29% of all VC funds in the UK, as both local and international VCs recognize the demand for sustainable solutions in areas like electric mobility and green energy infrastructure.

London’s position as an international financial hub is crucial in its venture capital resilience. The city has become a magnet for global VC firms, with many, such as Andreessen Horowitz and Octopus Ventures, establishing a presence here. London’s regulatory environment, which often favors innovation and its rich talent pool, positions it as a fertile ground for startups aiming to expand their reach beyond the UK. The recent uptick in AI and green tech funding reflects the city’s commitment to supporting industries that address some of today’s most pressing challenges, from reducing emissions to developing cutting-edge machine learning technologies.

Why London is Ideal for Startup Fundraising

London has solidified its position as a premier destination for startups aiming to raise capital, due to its unique advantages, including unmatched access to international markets, a highly skilled talent pool, and an innovation-friendly regulatory environment. As a global financial hub, London offers startups a gateway to markets across Europe and beyond, with more than 2,000 fintech companies alone benefiting from this strategic access. Many of the world’s largest tech firms, like Google and Microsoft, have established their European headquarters in the city, further boosting networking opportunities and creating a vibrant business ecosystem that attracts top-tier investors and talent alike.

London also boasts a diverse talent pool, drawing professionals from around the globe due to its international appeal and cultural richness. The city is home to a high proportion of AI engineering talent, and it attracts a significant number of graduates from prestigious universities like Imperial College London, which contributes to its reputation as Europe’s tech capital. This continuous influx of talent provides startups with the skilled workforce necessary to scale effectively and to innovate across fields like fintech, climate tech, and AI.

Additionally, London’s supportive infrastructure for startups extends to government-backed initiatives such as the Seed Enterprise Investment Scheme (SEIS) and the Enterprise Investment Scheme (EIS). These incentives encourage investments by offering tax reliefs to investors, making it more appealing to fund UK-based startups. London also hosts numerous accelerators and incubators, such as Seraphim Space, and Seedcamp, which offer early-stage support, mentorship, and resources to help startups accelerate growth and access funding more effectively.

Challenges to Consider When Raising Venture Capital in London

While London offers significant opportunities for venture capital, founders face unique challenges, including high competition, high operating costs, and navigating post-Brexit regulations. Recognizing these hurdles and strategizing to address them can help founders enhance their appeal to investors and succeed.

1. High Competition for Investment

London’s reputation as a global tech and financial hub attracts a substantial volume of startups, increasing competition for funding. With thousands of tech firms and numerous high-growth startups, founders face stiff competition for limited VC attention. A practical approach to stand out includes emphasizing clear, scalable growth plans in popular sectors such as fintech, AI, and climate tech—fields that resonate strongly with London investors. Founders should also network effectively, leveraging London’s extensive startup events and co-working spaces to make connections with potential investors.

2. Rising Operational and Living Costs

London’s high cost of living and operating expenses pose a significant challenge for early-stage companies, especially as inflation and rising energy costs continue to impact business expenses. Startups can mitigate these financial pressures by seeking funding through schemes like the Seed Enterprise Investment Scheme (SEIS) or Enterprise Investment Scheme (EIS), which attract investors with tax incentives. Additionally, many London-based accelerators, like Techstars and Seedcamp, provide resources and support that can help offset early-stage costs while offering mentorship and investor access.

3. Navigating Post-Brexit Regulatory Changes

Brexit has introduced new complexities for UK startups, especially around regulatory compliance, data protection, and accessing EU markets. The loss of EU “passporting” rights, which previously allowed financial services firms to operate freely across the EU, means startups targeting European clients may need to establish a presence in the EU or adapt to different national regulations. Startups can overcome these barriers by diversifying their market strategy beyond Europe to regions like the Asia-Pacific and U.S. markets. Additionally, remaining agile and informed about UK-specific regulatory updates can aid in maintaining compliance and market competitiveness.

Related Resource: The 12 Best VC Funds You Should Know About

VC Firms in London Investing in Startups 2024

1. Seedcamp

Focus and industry: The team at Seedcamp focuses on Software, Fintech, SaaS companies.

Related Resource: FinTech Venture Capital Investors to Know

Funding stage: Seedcamp focuses on pre-seed, seed, and series A investments.

As put by the team at Seedcamp, “We invest early in world-class founders attacking large, global markets and solving real problems using technology. We are running our Investment Forum process entirely online and are proactively investing in European companies across pre-seed and seed who are building the breakout businesses of tomorrow.”

While Seedcamp is located in London, they will invest in companies across the globe.

2. Index Ventures

Focus and industry: The team at Index invests in companies across every sector.

Funding stage: Index Ventures invests in stages from seed through growth.

As put by the team at Index Ventures, “Other firms invest in deals, Index invests in people. A deal is transactional. Relationships endure, and ours are based on curiosity, thoughtfulness, and deep conviction.” The team at Index invests in companies across the globe, across every stage and sector.

3. Accel Partners

Focus and industry: The team at Accel invests is agnostic in their industry focus.

Funding stage: Accel invests in every stage from seed to growth stage.

As put by their team, “Accel is a leading venture capital firm that invests in people and their companies from the earliest days through all phases of private company growth. Atlassian, Braintree, Cloudera, CrowdStrike, DJI, Dropbox, Dropcam, Etsy, Facebook, Flipkart, FreshWorks, Jet, Qualtrics, Slack, Spotify, Supercell, UiPath and Vox Media are among the companies the firm has backed over the past 35 years.”

4. Balderton Capital

Focus and industry: Balderton Capital is agnostic in their industry focus.

Funding stage: The team at Balderton invests in companies from seed to growth stage.

As put by their team, “Balderton Capital is an early-stage venture firm that’s based on the principles of teamwork and an intense dedication to building companies of lasting value. They provide superior service to entrepreneurs through a unique, team-oriented partnership. This team approach not only makes it more fun for them to come to work everyday, but more importantly, it benefits their portfolio companies. Instead of competing for resources, they share ideas, contacts and resources.”

5. Ascension

Focus and industry: The team at Ascension looks for, “a compelling business model capable of rolling out globally.”

Funding stage: Ascension funds seed and series A companies.

As put by their team, “Ascension is an early-stage VC built by exited entrepreneurs to back the next generation of tech and impact founders.”

The team at Ascension primarily invests in companies that are building in the UK.

6. MMC Ventures

Focus and industry: Fintech, Data-driven Health/Digital Health, Deep Tech, AI, Software, SaaS, Data Infrastructure.

MMC Ventures is one of the most active early-stage tech investors in Europe. Focusing on enterprise AI, fintech, data-driven health, data infrastructure & cloud, we back founders from Series A and Seed stages. During the past two decades, we have formed a unique understanding of what it takes for a start-up to scale. We distinguish ourselves through our commitment of going deeper – on the technologies we invest in, and the partnerships we build with founders.

Related Resource: 15 Venture Capital Firms Investing in VR

Funding stage: The team at MCC primarily invests from Seed-stage through Series A

“We conduct in-house research, providing us with a differentiated understanding of emerging technologies and sector dynamics to identify the areas and themes that have the potential to create the next multi-billion European success stories. Our portfolio spans enterprise AI, fintech, data-driven health, cloud and data infrastructure, with notable investments such as Snowplow, Copper, YuLife, Peak AI, Synthesia, Recycleye, MindsDB, Ably and Signal AI.” –MCC Ventures

Learn more about MMC Ventures by checking out their Visible Connect Profile here →

<h2=”Octopus Ventures”>7) Octopus Ventures

Focus and industry: According to their website, “Our teams are sector experts focusing on six exciting and meaningful areas: B2B Software, Climate, Consumer, Deep Tech, Fintech and Health.”

Funding stage: The team at Octopus invests from seed to series B.

As put by their team, “We back founders who are changing the world for the better. We invest where we can make the greatest positive impact, getting behind businesses that put people, community and the environment first.”

7. LocalGlobe

Focus and industry: LocalGlobe is agnostic in their industry focus.

Funding stage: The team at LocalGlobe primarily focuses on seed stage investments.

LocalGlobe is a venture capital firm that focuses on seed and impact investments. The team at LocalGlobe primarily focuses on companies located in the UK and Europe.

8. Connect Ventures

Focus and industry: List the focus, industry, or types of companies this VC typically invests in.

Funding stage: Give the funding stages this VC typically invests in.

As put by their team, “We’ve been investing in pre-seed and seed stage product companies since 2012, from our home in London. We’re a partner-only, Europe-wide, low volume, high conviction investment team.” The team at Connect Ventures primarily focuses on companies located in the UK and Europe.

9. Downing Ventures

Focus and industry: Downing Ventures is focused on healthcare businesses.

Funding stage: Downing Ventures does not publicly state what stage companies they traditionally fund.

As put by their team, “We offer investors the opportunity to invest in leading UK early-stage healthtech businesses. Your investment will support companies that develop evidence-based, tech-enabled clinical solutions that significantly improve access to high-quality care, improve clinical outcomes for patients, but also reduce the cost of delivery.”

10. Passion Capital

Focus and industry: Passion Capital is focused on digital media/technology companies.

Funding stage: Passion Capital is focused on early stage companies.

As put by their team, “Passion Capital is a partnership of entrepreneurs and operators who are applying our experiences to helping founders and early-stage teams build great digital media/technology companies.

We are committed to fostering an ecosystem of technology, collaboration and executional excellence in Europe, and we believe that the critical differentiator and key asset of a successful business is the passion and ability of its founders. We take pride in the caliber and success of all of our founders and teams including but nowhere near limited to GoCardless, Tray.io, Mendeley, Digital Shadows, urban, Adzuna, Smarkets, Ravelin, Nested, Tide, Spill, Marshmallow, Butternut Box,, PolyAI, Lendable and Monzo Bank.”

11. Notion Capital

Focus and industry: As put by their team, “We focus on B2B SaaS, using data/ML and tech to disrupt an industry. Industry agnostic.”

Funding stage: Notion Capital is focused on companies from seed to series B.

As put by their team, “Notion Capital is a VC firm focused on European SaaS and Cloud.

We’re here to support exceptional founders on their extraordinary journeys.”

12. Playfair Capital

Focus and industry: Playfair Capital is sector agnostic.

Funding stage: Playfair Capital focuses on pre-seed and seed stage investments.

As put by the team at Playfair Capital, “We’ve been helping ambitious and exceptional entrepreneurs build brilliant technology businesses since 2013. We’ve backed the founders of more than 60 companies including Mapillary (acq. Facebook), CryptoFacilities (acq. Kraken), Omnipresent, Orca AI, Ravelin, sprout.ai, Thought Machine, Trouva and Vinehealth.”

13. Fuel Ventures

Focus and industry: Fuel primarily invests in SaaS and marketplace companies.

Funding stage: The team at Fuel is focused on early stage investments.

As put by their team, “Fuel Ventures was founded by a successful entrepreneur who built his own company and scaled it to a £55m exit. We know how hard building fast growth companies is and use all our operational expertise and experienced network to help companies grow. We enjoy rolling our sleeves up and building companies alongside the founders and their teams.”

14. Beringea

Focus and industry: The team at Beringea backs both B2B and B2C businesses.

Funding stage: Primarily focused on Series A and Series B companies

As put by the team at Beringea, “When looking at businesses, we primarily look for a good business with a good busienss model. We aren’t in the unicorn hunting business, but rather look for sound investments that will generate sound returns. We back both B2B and B2C businesses.” The team at Beringea invests in companies in both the US and UK, with slightly different offers for each location:

15. RTP Global

Focus and industry: The team at RTP focuses on B2B and B2C Technology. According to their website, this includes "AI, B2B SaaS, DevOps, fintech, e-commerce and retail, health, tech, climate, and transport."

Funding stage: RTP Global invests in companies ranging from seed to Series B.

Learn more about RTP Global and check out their Visible Connect Profile below:

16. Kinetic Investments

Focus and industry: The team at Kinetic Investments focuses on AI, Crypto, Ecommerce, Marketplace, Media, SaaS.

Funding stage: Pre-Seed, Seed.

"We predominantly invest in AI-driven B2C solutions for traditional business models within the digital landscape, i.e. SaaS, eCommerce, marketplaces, and AIaaS."

17. Concept Ventures

About: Concept is the UKs dedicated pre-seed fund with a deep focus on people and entrepreneurial founding triats. They lead rounds of up to $2.5m, and work closely with teams through the first 12-18 months of their journeys - helping to lay the best foundations for the scaling to come.

Focus and industry: Concept Ventures is a generalist, pre-seed fund in London dedicated to first-cheque investing in Europe.

Funding stage: Concept only does initial cheques, but reserves capital for follow-on.

Connect with Investors in London With Visible

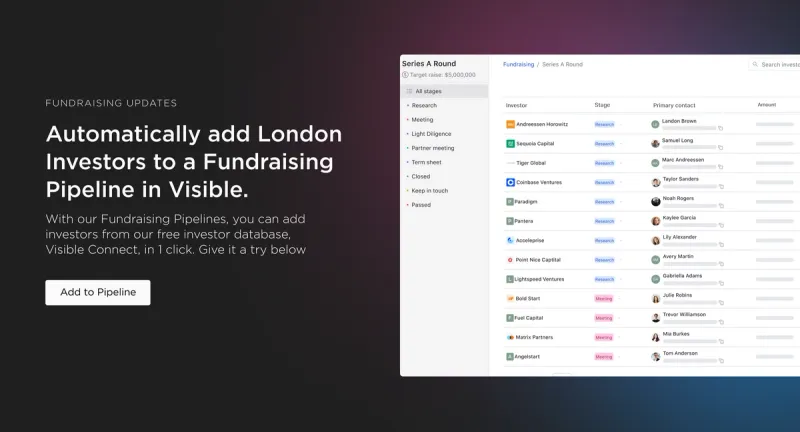

At Visible, we oftentimes compare a fundraise to a B2B sales and marketing funnel. At the top of your funnel, you are finding new investors. In the middle, you are nurturing and pitching potential investors. At the bottom of the funnel, you are working through diligence and ideally closing new investors.

Related Resource: A Quick Overview on VC Fund Structure

With the introduction of data rooms, you can now manage every aspect of your fundraising funnel with Visible.

- Find investors at the top of your funnel with our free investor database, Visible Connect

- Track your conversations and move them through your funnel with our Fundraising CRM

- Share your pitch deck and monthly updates with potential investors

- Organize and share your most vital fundraising documents with data rooms

Manage your fundraise from start to finish with Visible. Give it a free try for 14 days here.