Raising capital as a startup founder is difficult. On top of building a product, hiring a team, and scaling revenue, founders need to make sure that their business is funded for success.

If you are a founder starting to raise your seed round, check out our guide below:

What is Seed Funding?

Seed funding is capital that a company raises in its earliest stages — typically the earliest form of outside capital. Seed funding is integral to getting ideas off the ground and giving a potential company and idea life.

After a seed round, startups go on to raise future rounds of capital — e.g. Series A, Series B, Series C, etc.

You can learn more about seed fundraising and future rounds in our post, The Ultimate Guide to Startup Funding Stages.

What is the Purpose of Seed Funding?

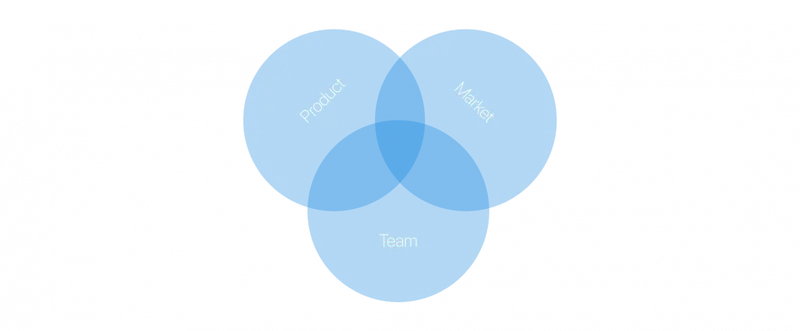

The purpose of seed funding is simple. It is intended to give a founding team enough capital to pursue a certain idea or market to prove if the concept works. Different investors may have different requirements for a seed-stage company but generally, they are pursuing “product-market fit.” As Marc Andreessen, Founder of Andreessen Horowitz, defines it, “Product/market fit means being in a good market with a product that can satisfy that market.”

Seed size rounds are exploding in size and the purpose may be vary quite a bit from company to company and investor to investor.

When is it the Right Time to Raise Seed Funding?

The timing to raise seed funding for a startup can be tricky. First and foremost you should approach seed investors when you believe you have a strong enough product, market, or team (or combination of those) to build a company that deserves to be venture-backed. This means that you can scale and grow to the valuations where an investor can generate a solid return on your company.

As the team at Y Combinator writes, “Founders should raise money when they have figured out what the market opportunity is and who the customer is, and when they have delivered a product that matches their needs and is being adopted at an interestingly rapid rate. How rapid is interesting? This depends, but a rate of 10% per week for several weeks is impressive. And to raise money founders need to impress. For founders who can convince investors without these things, congratulations. For everyone else, work on your product and talk to your users.”

If you believe that your business has what it takes to generate massive returns for an investor, it is likely time to start your fundraising process.

Related Resource: What is Pre-Revenue Funding?

How to Raise Seed Funding for Startups

The key to successfully raising a seed round is to have a system and process in place to raise capital. Just as you have a systematic approach to your sales and marketing funnel the same should be done for your fundraising efforts.

Regarding fundraising, we like to think of it as similar to a traditional sales and marketing funnel for a B2B enterprise business. In its simplest form, a traditional sales & marketing process can be broken into 3 steps:

- Attracting and adding qualified leads to your top of the funnel on a regular basis.

- Nurturing and moving the leads from through the funnel with the goal of closing them as a customer. (aka get them into a buying process)

- Serving customers and creating a great experience until they become evangelists or promoters.

You can convert those same ideas into a “Fundraising Funnel” that looks something like this:

- Filling the top of your funnel with qualified potential investors. These investors generally come from cold outreach, warm introductions, or inbound interest. You want to make sure these fit your “ideal investor persona” — right sector, stage, geography, check size, etc.

- Nurturing and moving investors through your funnel. While you may not be actively trying to close new investors and add capital you should constantly be working the top of your funnel. Staying fresh on the mind of potential investors 365 days a year using traditional marketing tactics will pay dividends when it’s time to pull the string on a new round of capital. Pro tip: send them a lite version of your quarterly investor update.

- Building relationships and communicating with your current investors. Customer success is key to maintaining a strong relationship with customers once they reach the bottom of the funnel. The same can be said for your investor funnel. As a founder, one of the first places to look for capital is current investors. One of the first places a new investor will look to for guidance will also be your current investors. At the end of the day your current investors should be the ultimate evangelist for your business.

Related Resource: Startup Mentoring: The Benefits of a Mentor and How to Find One

Just like a standard B2B sales process, you need to have “leads” (read: investors) coming to the top of your funnel so you can move them through the funnel to ultimately close them (read: close your round).

To get started, you need to understand who the right investor is for your business and how you fit into their greater vision and can be of benefit to them (more on this below).

We sat down with Jonathan Gandolf, CEO of The Juice, to uncover his learnings and thoughts from his seed raise. Give episode 1 a listen below:

How Much Seed Funding Should You Raise?

The average round of seed funding has gradually grown since 2014. However, the last few years have been a turbulent time in the venture world, and have seen the average seed round size level out since 2021.

Deciding how much seed funding you should raise is entirely up to you, the founder. As a general rule of thumb, you should raise enough to reach profitability or to the point where you can easily reach your next “funding milestone.” This can be a revenue number, user benchmark, etc. but generally speaking, should be within 12-18 months.

To model this you need to have a thorough understanding of how your business functions and what it will take to get to the next milestone. Understand how much it cost to acquire a new customer, retain a customer, how much an engineer costs, salesperson, etc. To help, you can check out our popular financial modeling tools here.

Related Reading: Building A Startup Financial Model That Works

Types of Seed Funding for Startups

There are a few types of seed funding. For the sake of this post we will mostly talk about raising venture capital but to cover off on a few other options:

Friends & Family

One of the most common sources of seed funding comes from friends and families. This often follows a similar approach to the funnel discussed above but likely less intensive as you, the founder, likely have an existing relationship with this group. Keep in mind that you are investing their capital in a highly risky asset class and they need to be made aware of this situation.

Crowdfunding

Another form of “seed funding” that is becoming more popular is crowd funding. Sites like Republic and StartEngine allow startups to raise equity rounds from individuals so check sizes can be as little as $100.

Non-Traditional Firms

More firms are coming out with new financial instruments to offer as an alternative to venture capital. Earnest Capital is one of our favorites. Earnest Capital provides early-stage funding, resources and a network of experienced advisors to founders building sustainable profitable businesses. Earnest Capital uses their own financing instrument called a Shared Earnings Agreement (SEAL). Check out other non-traditional investment funds here.

Related Resource: Advisory Shares Explained: Empowering Entrepreneurs and Investors

Incubators

As put by the team at TopMBA, “A startup incubator is a collaborative program designed to help new startups succeed. Incubators help entrepreneurs solve some of the problems commonly associated with running a startup by providing workspace, seed funding, mentoring, and training. The sole purpose of a startup incubator is to help entrepreneurs grow their business.”

Incubators are hit or miss if they come with capital. Some will include a small injection of capital while others are solely resources to help founders get their business off the ground.

Check out our list of incubators and startup studios here.

Related resource: 10 Top Incubators for Startups in 2024

Accelerators

As put by the team at Silicon Valley Bank, “Private startup accelerators do provide funding and the money helps cover early-stage business expenses, as well as travel and living expenses for the three-month residency at the in-person startup accelerators. However, the funds and guidance come at a price. Just like any other equity funding, signing an accelerator agreement typically means giving up a slice of your company. Startup accelerators generally take between 5% and 10% of your equity in exchange for training and a relatively small amount of funding.”

Check out our list of active accelerators here.

Angel Investors

Angel investors are a great starting point for any founder. Similar to friends and family investors, an angel investor is an individual that is looking to diversify their investment portfolio and back intriguing startups. However, angel investors tend to be more seasoned professionals and generally have an understanding of the risks of investing in a startup.

Related Resource: How to Effectively Find + Secure Angel Investors for Your Startup

Corporate Seed Funding

A newer form of seed funding is corporate venture arms and funds. As large corporations continue to seek innovation and new revenue streams, the development of corporate venture funds have become popular. Corporations generally partner with a proven VC (or launch a fund internally) and deploy capital across seed-stage companies that fit into the company's thesis or growth plans.

How Long Does it Take to Raise Seed Capital

Raising seed capital for a startup can be a burdensome process for founders. Brett Brohl of Bread & Butter Ventures, suggests five months to raise capital. It can be broken down into the following rules (which Brett calls the 1-3-1):

- One Month — Building investor lists and getting documents ready

- Three Months — Actively pitching and taking meetings with potential investors

- One Month — Closing investors and going through due diligence

Brett's 1-3-1 rule is a great starting point. Other peers and investors will suggest a similar timeline — we typically see founders raise seed capital anywhere between three and nine months.

Financing Options for Seed Rounds

The different finance instruments and options available to founders raising a seed round can feel intimidating. There are countless options and different legal meanings that make things complicated. Seed round financing options can be broken into two buckets — convertible debt or SAFEs and equity.

Convertible Debt & SAFEs

Convertible debt and SAFEs have become the norm in the venture world over the last decade. YC popularizes SAFEs and has made templates available for startups across the globe. You can learn more about SAFEs in our post, "The Startup's Handbook to SAFE: Simplifying Future Equity Agreements."

Equity

Pure equity financing has become less common in the venture world since the emergence of SAFEs. Equity financing means setting a valuation and stock prices and selling new shares to investors.

As always, we recommend consulting with a lawyer when determining the financing options that are best for your business.

Related resource: Navigating Pro Rata Rights: Essential Insights for Startup Entrepreneurs

How to Build Your Seed Round Pitch Deck

Fundraising is very much a process. Along the way, there are tools and resources that founders can leverage to better tell their story. One of those tools is the pitch deck.

Pitch decks are a powerful tool that can help you tell that story. Different investors will have different opinions about pitch decks. Some investors might want to receive them before a meeting, some might only want them sent via PDF or link, and some investors might not care if you have a pitch deck at all.

A pitch deck is about the content that you are sharing. However, there is a fine line between beauty and functionality when building your seed stage pitch deck. Investors will likely have feedback that will require changes but you do want to display it in a meaningful way.

To learn more about crafting the perfect pitch deck for your seed round check out our post, Our Favorite Seed Round Pitch Deck Template (and Why It Works).

The 5 Most Important Elements of a Successful Pitch Deck

There is no prescriptive pitch deck template that will work for every startup, but there are a few things investors generally want to and expect to see in a pitch deck:

- Concise & Compelling — you want your pitch deck to give investors the information they need in a concise and straightforward way. This includes your problem and solution. Related: How to Write a Problem Statement [Startup Edition]

- The Market — investors want to understand the market you are operating in and why you have an opportunity to seize a large percentage of the market and become a large company. Related: How to Model Total Addressable Market (Template Included)

- Acquisition Model — going hand-in-hand with the market is your acquisition model. You want to demonstrate to investors that you have a clear and scalable way to attract new customers. Related: Pitch Deck 101: The Go-to-Market and Customer Acquisition Slide

- Financials — Some investors will want to see financial projections and others might not care at the seed stage because they are typically wrong. So why include them? Investors want to see how you think about your future and are thinking through metrics and models correctly. Related: Building A Startup Financial Model That Works

- Traction — While it might be limited at the seed stage, investors want to see what you’ve done to date. What product have you built, customers, attracted, and more.

Use Visible to share your pitch deck. Once you’ve built out your target list of investors, you can start sharing your pitch deck with them directly from Visible. You can customize your sharing settings (like email-gated, password-gated, etc.) and even add your domain. Give it a try here.

How to Choose Investors for Seed Funding

Once you have defined what your ideal investor looks like it is time to start researching, finding, and contacting them. To find the right investors we suggest browsing different databases and networks to find your perfect fit.

You may already have investors in mind or have networked with investors in the past — awesome start! If you want to continue to find investors, Visible Connect is our free database built by founders, for founders. Visible Connect allows founders to find active investors using the fields we have found most valuable (like check size, geography, traction metrics, etc.).

As you begin to browse and find investors for your startup, we suggest keeping tabs on them. You most likely have an involved CRM or process to keep tabs on your current and potential customers. Should the same be true for your investors? This can be in the Visible Fundraising CRM (you can add investors directly from Connect into the CRM) or a simple Google Sheet. No matter what you decide, make sure you have a system in place to track and monitor conversations to make your life easier moving forward.

Related Reading: How To Find Private Investors For Startups

Building Your Investor List

As you start to build your list of potential investors — we suggest breaking it down into 3 “tiers” — Tier 1, Tier 2, and Tier 3. Tier 1 are the firms you believe to be most qualified, followed by tier 2 and 3.

We highly encourage taking on these investors in “sets.” This means grouping investors in sets of ~5 (suggest trying to keep sets to 5 investors or less) so you have the opportunity to better evaluate and tailor your pitch as you move through your sets.

As a rule of thumb, you’ll want to make sure you mix in Tier 1, 2, and 3 investors in each “set.” For example, if you pitch all of the Tier 1 investors in the first set, you’ll potentially miss an opportunity to tailor your pitch and only be left with less qualified (Tier 2 and 3) investors.

Related Reading: What is an Incubator?

What is the Difference Between Seed vs. Series A Funding?

Series A funding is the next jump in a company’s funding lifecycle. In a seed round is the first capital into a business, a “Series A” is generally the next round of capital. As we defined in our Startup Funding Stages post, Series A funding is:

“When a company is first founded, stock options are generally sold to the company’s founders, those close to them, and angel investors. After this, a preferred stock can be sold to investors in the form of a Series A. Series A allows investors to get in early with a business that they truly believe in. It’s a mutually beneficial relationship for both the company and the future stock holders.”

When a company reaches their “Series A” they likely have product-market fit and are ready to scale their business to a $1M or more in revenue. At Series A you likely have solid revenue in place and a scaleable plan to bring on more customer sand revenue whereas at the seed round you may have little to no revenue.

A seed round is used to demonstrate your product, service, or team can seize a market. A series A round is used to scale the product, service, or team to attack and scale in your market (or a new market).

Additional Seed Funding Resources

There are hundreds of resources out there to help you raise your seed round. At the end of the day the more entrepreneurs that raise capital the better the startup ecosystem does as a whole. At Visible, we do our best to curate and write the best resources to improve a founders chances of success.

Here are a few of our favorite resources to help founders improve their odds of raising venture capital:

Everything a Startup Founder NEEDS to Know about Pro Rata Rights

Check out our guide and tips for handling pro rata rights during an early stage fundraise and negotiation.

Our Favorite Seed Round Pitch Deck Template (and Why It Works)

In our guide, we share a step-by-step guide to help build your seed round pitch deck. Plus, we offer a direct download to the template so you can get started immediately.

Our Startup Funding Stages Guide

Our in-depth guide covering all things related to the startup funding lifecycle. Understand what it takes to go from seed stage funding to Series A and later.

Building A Startup Financial Model That Works

Templates and resources to help you build your first financial model for your startup. In order to improve your odds of raising capital you need to understand the ins and outs of your business.

Our Guide to Sending Your First Investor Update

Tips and best practices for using investor updates to leverage your current and potential investors to help with fundraising, hiring, and strategic decision-making.

Visible Connect: Our Investor Database

Browse our investor database that is hand curated by the team at Visible. We include the fields and filters we find most important when searching for new investors.

Visible Lite: Pre-Traction Template

This template is intended for companies that are pre-traction/revenue. Even if it is simple, sending Updates from day 1 is a great way to stay top of your investors mind’s moving forward.

We hope this guide is helpful to you as you kick off your seed round. To get your fundraise started check out Visible Connect, our investor database. Automatically add your investors into a pipeline to manage conversation and engagements so you can focus on building your business.

Related resource: Top Creator Economy Startups and the VCs That Fund Them

Kick Off Your Seed Round With Visible

We believe a VC fundraise mirrors a B2B sales motion. The fundraising process starts by finding qualified investors (top of the funnel) and building relationships (middle of the funnel) with the goal of them writing a check (bottom of the funnel).

Just as a sales team has dedicated tools for their day-to-day, founders need dedicated tools for managing the most expensive asset they have, equity. Our community can now find investors, track a fundraise, and share a pitch deck, directly from Visible. Give Visible a free try for 14 days here.