At Visible, we typically compare a venture fundraise to a traditional B2B sales and marketing funnel.

- At the top of the funnel, you are finding potential investors via cold outreach and warm introductions.

- In the middle of the funnel, you are nurturing potential investors with meetings, pitch decks, updates, and other communications.

- At the bottom of the funnel, you are working through due diligence and hopefully closing new investors.

Related Resource: The 12 Best VC Funds You Should Know About

Like sales, a healthy fundraising funnel starts by finding the right investors. This can be based on geography, check size, focus areas, etc. For founders looking for investors in the San Francisco area, check out our list below:

1. Accel

As put by their team, “Accel is a leading venture capital firm that invests in people and their companies from the earliest days through all phases of private company growth.”

Focus and industry: Accel is industry agnostic

Funding stage: Accel invests across many stages — from pre-seed to series B and beyond

Accel is synonymous with venture capital in San Francisco. Accel was founded in 1983 and has since funded 1,500+ companies. They have funds across the globe and invest in founders across many geographies, industries, and stages. Some of their most popular investments include:

- Slack

- Spotify

Location: Palo Alto, CA

2. Greylock Partners

As put by their team, “At Greylock, our mission is to help realize rare potential. To do this well, we believe it’s essential to be trusted partners to entrepreneurs at every stage — from idea to IPO.

The entrepreneurs we back have the vision to build something huge that hasn’t existed before. They are paranoid about what could go wrong — but are obsessed with what can go right. They are mission-driven, intellectually honest and infinite learners. They have raw ambition, bravery, and grit. They don’t give up, ever. And they are unique in their ability to lead and inspire others to join their journey.”

Focus and industry: Greylock is focused on enterprise, consumer, and crypto software

Related Resource: FinTech Venture Capital Investors to Know

Funding stage: Greylock invest from pre-seed to series B and beyond

As put by their team, “We focus on enterprise, consumer, and crypto software at Seed and Series A, and also make new company investments in Series B and beyond. We support entrepreneurs throughout their journey from idea to IPO and onwards.” Some of their most popular investments include:

- Airbnb

- Figma

Location: Menlo Park, CA

3. Menlo Ventures

As put by their team, “Genuinely, actively invested. Invested in your success, but also your struggles. Your questions, your concerns, your highs, your lows. We don’t just invest our dollars, we invest our dedication, our drive. Our tested advice and trusted support. That’s because, when we find an idea we believe in, we’re all engaged. When we’re in, we’re ALL IN.”

Focus and industry: Menlo Ventures focuses on the following industries:

- Consumer

- Cloud Infrastructure

- Cybersecurity

- Fintech

- Healthcare

- SaaS

- Supply Chain and Automation

Related Resource: 15 Cybersecurity VCs You Should Know

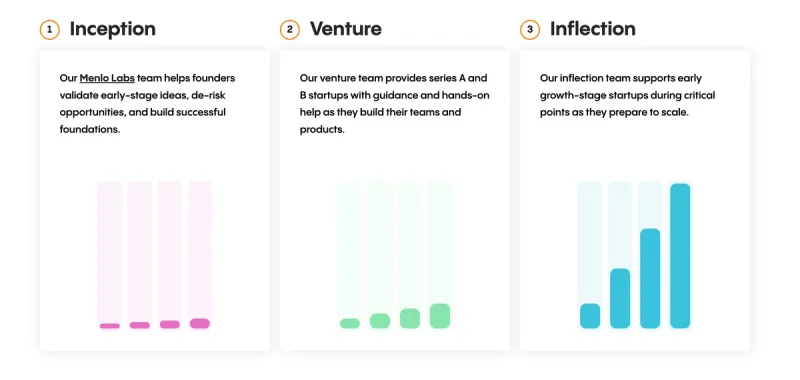

Funding stage: Menlo Ventures across stages from inception to series B and beyond

As put by their team, “We are investors and company builders—we know what it takes to turn a budding idea into a scalable business. We work with early-stage founders to find product-market fit, develop go-to-market strategies, scale their organizations, and support them as they grow.” Some of their most popular investments include:

- Affinity

- Minted

- Roku

Location: Menlo Park, CA

4. Spark Capital

As put by their team, “We are Spark Capital, investors in products we love by creators we admire, including Affirm, Carta, Cruise, Discord, Oculus, Plaid, Postmates, Slack, Twitter, and Wayfair. We know there are no playbooks or formulas for success and are here to help founders win their own way. We invest across all sectors and stages, and work out of San Francisco, Boston, and New York City.”

Focus and industry: Spark Capital invests across all industries

Funding stage: Spark Capital invests across all stages

Like many of the funds on this list, Spark Capital has been investing across all industries and all stages for decades. Some of their most popular investments include:

- Slack

- Affirm

Location: San Francisco – Boston – New York

5. Bessemer Venture Partners

As put by their team, “Bessemer Venture Partners is the world’s most experienced early-stage venture capital firm. With a portfolio of more than 200 companies, Bessemer helps visionary entrepreneurs lay strong foundations to create companies that matter, and supports them through every stage of their growth.”

Focus and industry: BVP invests across many industries

Funding stage: BVP invests in early-stage companies

BVP has become a leader in early-stage investments. They focus on companies across the globe and have backed some of the most famous companies to date. Some of their most popular investments include:

- Shopify

- Yelp

Location: San Francisco, CA

6. Altos Ventures

As put by their team, “Altos Ventures was founded in 1996, to exclusively address the needs of promising, young technology companies and entrepreneurs. Because of their focus on entrepreneurs – along with their network of co-investors, partners, and industry experts—they know how to build viable business models so companies can move on to the next stage of growth.”

Focus and industry: List the focus, industry, or types of companies this VC typically invests in.

Funding stage: Altos Ventures is focused on early-stage companies

Altos Ventures is a purpose-driven investment fund that is focused on the fundamentals. Some of their most popular investments include:

- Bench

- Outdoorsy

- Roblox

Location: Menlo Park, CA

7. Andreessen Horowitz

As put by their team, “Andreessen Horowitz was established in June 2009 by entrepreneurs and engineers Marc Andreessen and Ben Horowitz, based on their vision for a new, modern VC firm designed to support today’s entrepreneurs. Andreessen and Horowitz have a track record of investing in, building and scaling highly successful businesses.”

Focus and industry: Andreessen Horowitz invests across many industries, including:

- Bio + Health

- Cultural Leadership

- Consumer

- Crypto

- Enterprise

- Fintech

- Games

Related Resource: 15 Venture Capital Firms Investing in VR

Funding stage: Andreessen Horowitz invests across all stages.

As put by their team, “a16z is defined by respect for the entrepreneur and the company building process; we know what it’s like to be in the founder’s shoes. The firm is led by general partners, many of whom are former founders/operators, CEOs, or CTOs of successful technology companies, and who have domain expertise ranging from biology to crypto to distributed systems to security to marketplaces to financial services.” Some of their most popular investments include:

- Affirm

- Airbnb

- Coinbase

Location: Menlo Park, CA

8. Expa

As put by their team, “Expa is where the best startups find support and funding to scale. Collectively, we’ve launched dozens of companies, supported 50+ founders, and reached hundreds of millions of users. Our community of builders includes the founders and leaders of Uber, Virgin Galactic, Twitter, Current, and more.”

Focus and industry: Expa invests across many industries

Funding stage: Expa focuses on early-stage investments

As put by their team, “Expa was created by Uber co-founder Garrett Camp to support the next generation of founders. The partners at Expa are builders and operators themselves, who can provide founders with practical advice in product design, branding, engineering, operations, and recruiting.” Some of their most popular investments include:

- Aero

- Drip

- Radar

Location: San Francisco, CA

9. Benchmark Venture Capital

As put on their Visible Connect profile, “Benchmark Capital is focused on one, and only one, mission: to help talented entrepreneurs build great technology companies. That’s what drives them and everything they do – from how they organize their firm to their investment strategy.”

Focus and industry: Benchmark is focused on social, mobile, local, and cloud companies.

Funding stage: According to their Visible Connect profile, “Their investments range in size from as little as $100,000 to as much as $10 or $15 million. Typically, they invest $3 to $5 million initially and expect to invest $5 to $15 million over the life of a company.”

Benchmark has raised 6 funds that span 2 decades. Some of Benchmark’s most popular investments include:

- Asana

- Dropbox

- Zillow

Location: San Francisco, CA

10. First Round Venture Capital

As put by their team, “We’re focused on being the world’s best partner for founders at the very first stages of company creation — so we’ve designed the firm to do just that. When you work with First Round, you get super active partners (most of whom are former founders themselves) working side-by-side with you on your biggest and smallest challenges.”

Focus and industry: First Round invests across all industries

Funding stage: First Round likes to be the first check in a company, regardless of stage. As put by their team, “Typically, our initial investment in a startup ranges from $1 million to $5 million, but we’ve gone higher and lower in some cases. Currently, our average initial investment is right around $3 million.”

Some of First Round’s most popular investments include:

- Notion

- The Black Tux

- Uber

Location: San Francisco – New York – Philadelphia

11. Y Combinator

Y Combinator is synonymous with accelerators. As put by their team, “Y Combinator (YC) is a startup fund and program. Since 2005, YC has invested in nearly 3,000 companies including Airbnb, DoorDash, Stripe, Instacart, Dropbox, and Coinbase. The combined valuation of YC companies is over $300B. YC has programs and resources that support founders throughout the life of their company.”

Focus and industry: Y Combinator invests across all industries.

Funding stage: Y Combinator helps companies launch with a $500k check.

Since its inception in 2005, Y Combinator has been accredited for helping launch, fund, and grow some of the most prolific startups. Some of their most popular investments include:

- Airbnb

- DoorDash

- Stripe

Location: San Francisco, CA

Find top investors in the Bay Area with Visible

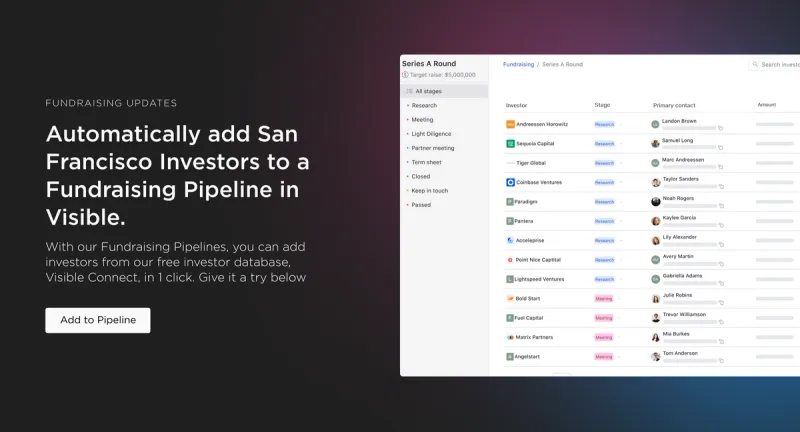

As we mentioned at the beginning of this post, a venture fundraise often mirrors a traditional B2B sales and marketing funnel.

Just as a sales and marketing team has dedicated tools, shouldn’t a founder that is managing their investors and fundraising efforts? Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.