15 VC Firms Investing in Web3 Companies

In the evolving landscape of the internet, Web3 stands out as the next significant leap, offering a decentralized, blockchain-powered framework. Coined by Ethereum's co-founder, Gavin Wood, in 2014, Web3 embodies a trustless, permissionless internet that fundamentally alters digital interactions and transactions.

This transformational technology has captured the attention of investors globally, as it heralds a new era of internet use where users regain control over their data and digital identities. For investors, Web3 companies represent a frontier in technological innovation, combining the promise of high-growth potential with the opportunity to shape the future of online experiences.

Below we highlight 15 leading VC firms that are actively investing in this exciting new sector.

Related Resource: 13 Generative AI Startups to Look out for

1. a16z/ Andreessen Horowitz

- Location: Menlo Park, California, United States

- About: Andreessen Horowitz was established in June 2009 by entrepreneurs and engineers Marc Andreessen and Ben Horowitz, based on their vision for a new, modern VC firm designed to support today’s entrepreneurs. Andreessen and Horowitz have a track record of investing in, building and scaling highly successful businesses.

- Thesis: Historically, new models of computing have tended to emerge every 10–15 years: mainframes in the 60s, PCs in the late 70s, the internet in the early 90s, and smartphones in the late 2000s. Each computing model enabled new classes of applications that built on the unique strengths of the platform. For example, smartphones were the first truly personal computers with built-in sensors like GPS and high-resolution cameras. Applications like Instagram, Snapchat, and Uber/Lyft took advantage of these unique capabilities and are now used by billions of people.

- Investment Stages: Pre-Seed, Seed, Series A, Series B, Growth

- Recent Investments:

- Dapper

- OpenSea

- Ripple

2. Sequoia Capital

- Location: Menlo Park, California, United States

- About: Sequoia is a VC firm focused on energy, financial, enterprise, healthcare, internet, and mobile startups.

- Thesis: We partner early. We’re comfortable with the rough imperfection of a new venture. We help founders from day zero, when the DNA of their businesses first takes shape.

- Investment Stages: Seed, Series A, Series B, Growth

- Recent Investments:

- Polygon

- Binance

- Bitmain

3. Tiger Global

- Location: New York, New York, United States

- About: Tiger Global Management is an investment firm that deploys capital globally in both public and private markets.

- Investment Stages: Pre-Seed, Seed, Series A, Series B, Growth

- Recent Investments:

- PDAX | Philippine Digital Asset Exchange

- Devron

- Novi Connect

Related Resource: 12 New York City Angel Investors to Maximize Your Funding Potential

4. Coinbase Ventures

- Location: San Francisco, California, United States

- About: Coinbase Ventures is an investment arm of Coinbase that aims to invest in early-stage cryptocurrency and blockchain startups.

- Thesis: At Coinbase, we’re committed to creating an open financial system for the world. We can’t do it alone, and we’re eagerly rooting for the brightest minds in the crypto ecosystem to build empowering products for everyone.

We provide financing to promising early stage companies that have the teams and ideas that can move the space forward in a positive, meaningful way.

- Investment Stages: Pre-Seed, Seed, Series A, Series B

- Recent Investments:

- Compound

- BlockFi

- Dharma

5. Paradigm

- Location: San Francisco, California, United States

- About: Paradigm primarily invests in crypto-assets and businesses from the earliest stages of idea formation through to maturity.

- Thesis: Paradigm is an investment firm focused on supporting the great crypto/Web3 companies and protocols of tomorrow. Our approach is flexible, long term, multi-stage, and global. We often get involved at the earliest stages of formation and support our portfolio with additional capital over time.

We take a deeply hands-on approach to help projects reach their full potential, from the technical (mechanism design, smart contract security, engineering) to the operational (recruiting, regulatory strategy).

- Investment Stages: Pre-Seed, Seed, Series A, Series B, Series C, Growth

- Recent Investments:

- Chainalysis

- matrixport

- Fireblocks

6. Pantera Capital

- Location: Menlo Park, California

- About: Pantera Capital is the first institutional investment firm focused exclusively on bitcoin, other digital currencies, and companies in the blockchain tech ecosystem.

- Investment Stages: Seed, Series A, Pre-Seed, Early Stage, Series B, Series C, Growth

- Recent Investments:

- Ancient8

- Stader Labs

- Offchain Labs

7. Ribbit Capital

- Location: Palo Alto, California, United States

- About: Ribbit Capital is a Silicon Valley-based venture capital firm that invests globally in unique individuals and brands who aim to disrupt the financial services industry. Founded in 2012 by Meyer “Micky” Malka, Ribbit believes the category is profoundly under-innovated and intends to support entrepreneurs who have already launched the businesses of the future. Ribbit has raised an inaugural $100M fund that will be aimed at driving innovation in lending, payments, insurance, accounting, tax preparation and personal financial management. Ribbit targets disruptive, early stage companies that leverage technology to reimagine and reinvent what financial services can be for people and businesses. The firm will mainly focus on investments in the U.S., Canada, Brazil, the United Kingdom, Germany, Italy, Spain, South Africa and Turkey.

- Investment Stages: Seed, Series A, Series B, Series C, Growth

- Recent Investments:

- Genesis Digital Assets

- Kavak

- Chipper Cash

Related Resource: 8 Active Venture Capital Firms in Germany

8. Blockchain Capital

- Location: San Francisco, California, United States

- About: Blockchain Capital is a pioneer and the premier venture capital firm investing in Blockchain enabled technology companies.

- Investment Stages: Seed, Series A, Series B

- Recent Investments:

- Abra

- Securitize

- Anchorage

9. Digital Currency Group

- Location: New York City, New York, United States

- About: At Digital Currency Group, we build and support bitcoin and blockchain companies by leveraging our insights, network, and access to capital.

- Thesis: We invest in companies that are accelerating the creation and adoption of a better financial system using blockchain technology and cryptocurrency

- Investment Stages: Seed, Series A, Series B

- Recent Investments:

- Trust Machines

- Livepeer

- Elliptic

10. DWF Labs

- Location: Singapore

- About: DWF Labs is the global digital asset market maker and multi-stage web3 investment firm, one of the world's largest high-frequency cryptocurrency trading entities, which trades spot and derivatives markets on over 60 top exchanges.

- Investment Stages: Early Stage Venture, Initial Coin Offering, Late Stage Venture, Non Equity Assistance, Secondary Market, Seed.

- Recent investments:

- TRON

- Algorand Foundation

- Conflux

11. CMT Digital

- Location: Chicago, Illinois.

- About: CMT Digital is a venture capital firm engaging in the crypto asset and Blockchain technology industry. The firm focuses on asset trading, blockchain technology investments, and legal and policy.

- Investment Stages: Pre-Seed

- Recent investments:

- CFX Labs

- ZetaChain

- Trident Digital Group

12. NGC Ventures

- Location: Singapore

- About: NGC Ventures invests in early stage, web 3.0 infrastructure startups and projects. We identify projects with innovative ideas to today’s blockchain problems and work with them from ideation to strategy and market adoption.

- Thesis: We identify projects with disruptive innovation, aiming to solve problems with solutions that are characterized by simplicity, cost affordability, speed, uniqueness and a compelling product market fit.

- Investment Stages: Seed, Series A

- Recent investments:

- Polybase

- Smooth Labs

- Chainsafe

13. Bixin Ventures

- Location: Beijing, Chaoyang

- About: Bixin Ventures invests in early-stage infrastructure projects that cultivate and facilitate mass adoption of open finance through permissionless and decentralized networks.

- Thesis: Bixin Ventures’ mission is to invest in and build crucial infrastructure that enables the future of open finance through permissionless and decentralized networks. Our investment team works alongside founders to provide guidance and expertise for growth in Asia. These actions reflect our priority to transform open finance into a truly global ecosystem.

- Investment Stages: Pre-Seed, Seed

- Recent investments:

- Sei

- Earn Network

- zCloak Network

14. Spartan Group

- Location: Singapore and Hong Kong.

- About: Founded in 2017, Spartan Group is a leading player in the Web3 space. We are one of the most active venture investors and have backed some of the leading crypto companies and networks. We are also a leader in Web3 M&A deals and capital raises, leveraging our track record of working with world-class teams, deep expertise of the crypto industry, and unparalleled network to create collective value with exceptional founders.

- Investment Stages: Seed

- Recent investments:

- Wind

- Brine Fi

- DFlow

15. Alchemy Ventures

- Location: San Francisco, California

- About: Alchemy is a developer platform that empowers companies to build scalable and reliable decentralized applications without the hassle of managing blockchain infrastructure in-house. It is currently faster, more reliable, and more scalable than any other existing solution, and is incredibly easy to integrate!

- Thesis: At Alchemy, our mission is to provide developers with the fundamental building blocks they need to create the future of technology. Through Alchemy Ventures, we'll be accelerating this mission by dedicating financing and resources to the most promising teams growing the Web3 ecosystem.

- Investment Stages: Pre-Seed, Seed, Series A, Series B, Series C

- Recent investments:

- Acctual

- Bastion

- Unstoppable Domains

Web3 Resources

- Web3 Report Q3 2021 – ConsenSys: The DeFi data, context, NFTs, tools, and trends that defined Web3 in Summer 2021.

- Coinbase Cloud is announcing a community for Web3 developers. Their forum for developers is live, searchable, and indexable.

- The Architecture of a Web 3.0 application

- WEB2 vs WEB3

- Twitter thread on Why Web3 Matters and What’s Next in Web3

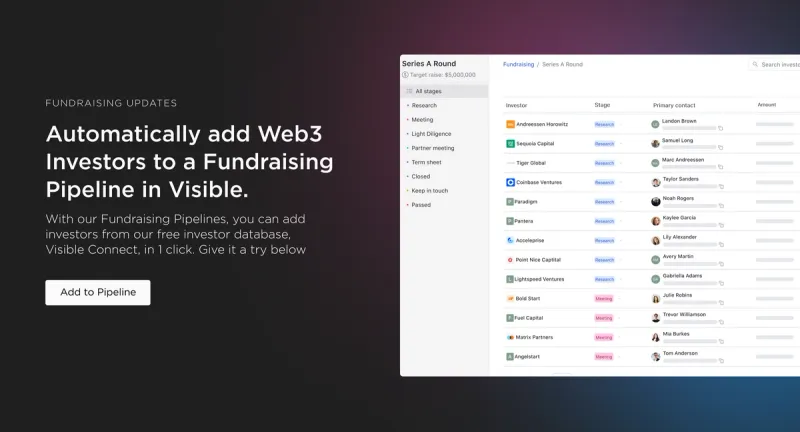

Start Your Next Round with Visible

These firms are not only financing the future of the internet but are also shaping the landscape of digital innovation. As the Web3 ecosystem continues to grow, staying on top of your business and connecting is key.

Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Check out all our web3 investors here.

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here.

To help craft that first email check out 5 Strategies for Cold Emailing Potential.

Related resource: 14 Gaming and Esports Investors You Should Know

Related Resource: 14 Venture Capital Firms in Silicon Valley Driving Startup Growth

Related Resource: 10 Venture Capital Firms in Canada Leading the Future of Innovation

Related Resource: 7 Prominent Venture Capital Firms in Brazil