At Visible, we oftentimes compare a venture fundraise to a traditional B2B sales and marketing funnel.

- At the top of the funnel, you are finding potential investors via cold outreach and warm introductions.

- In the middle of the funnel, you are nurturing potential investors with meetings, pitch decks, updates, and other communications.

- At the bottom of the funnel, you are working through due diligence and hopefully closing new investors.

Related Resource: The Understandable Guide to Startup Funding Stages

Just as a sales and marketing funnel starts by finding the right leads, the same is true for a fundraise. Founders raising venture capital should start by identifying the right investors for their businesses. If you’re a founder located in Brazil and are looking for venture capitalists in your area, check out our list below:

Related Resource: 7 Best Venture Capital Firms in Latin America

1. Bossanova Investimentos

As put by their team, “Bossanova is the most active VC in Latin America ; We invest in startups at the pre-seed stage; B2B or B2B2C companies with scalable and digital business models that are operating and making money.”

Location

Bossanova is headquartered in São Paulo and invests in companies across Latin America.

Company Stage

Bossanova is focused on pre-seed and seed stage companies. They invest between R$100k and R$1.5M. They look for companies with at least monthly income of R$20k

Preferred industries

Bossanova is focused on B2B or B2B2C companies.

Related Resource: 60+ Active Seed Stage SaaS Investors & Fundraising Tips

Portfolio Highlights

Some of Bossanova’s most popular investments include:

- FanBase

- GrowthHackers

- Nimbly

2. Redpoint Ventures

As put by their team, “Redpoint eventures is a venture capital firm based in São Paulo.

Our mission is to support Brazilian digital market entrepreneurs on their journey to create fast-growing companies. Together with its partners, prominent U.S.-based firms Redpoint Ventures and e.ventures, Redpoint eventures brings funding, Silicon Valley access and global best practices to promising startups. In addition to serving the companies in its portfolio, the fund’s team contributes to the development of the growing entrepreneurial ecosystem in Brazil.”

Location

Redpoint eventures is headquartered in São Paulo and invests in companies across Brazil.

Company Stage

Redpoint eventures does not publicly state what stage companies they invest in.

Preferred industries

Redpoint eventures does not publicly state what their focused industries are.

Portfolio Highlights

Some of Redpoint eventures most popular investments include:

- Gympass

- Pipefy

- Bossabox

3. Canary

As put by the team at Canary, “We are an operator fund: our partners are technology and investment entrepreneurs that have first-hand experience – and battle scars – from building and scaling products, teams, and organizations. Our approach is simple and supportive of founders.”

Location

Canary has office locations across Latin America and invests in companies across Latin America.

Related Resource: 7 Best Venture Capital Firms in Latin America

Company Stage

As put by their team, “We’ve invested in rounds as small as USD 250K and as large as USD 15M+. We prefer and typically lead the first round, investing the largest amount of capital and defining the legal terms.”

Preferred industries

Canary is industry and business model agnostic.

Portfolio Highlights

Some of Canary’s most popular investments include:

- Alice

- Buser

- Trybe

4. Monashees

As put by their team, “monashees is the pioneer venture capital firm in Latin America. It partners with outstanding founders who are revolutionizing large markets. The firm serves entrepreneurs starting with their very first movements, supporting their growth through its expansion funds.

With a human-values-first approach, monashees helps founders challenge the status quo and improve people’s lives through technology.”

Location

Monashees is headquartered in Brazil and invests in companies across Latin America.

Company Stage

Monashees does not publicly state what stage they focus on and what check size they write.

Preferred industries

Monashees is focused on investing in companies operating in large markets.

Portfolio Highlights

Some of Monashees most popular investments include:

- Clara

- Jokr

- Loggi

5. Quona Capital

As put by their team, “Quona Capital is a global venture firm focused on inclusive fintech. We invest in startups expanding access to financial services for consumers and growing businesses across India and Southeast Asia, Latin America, Africa and the Middle East. We focus on markets that are massively underserved by the legacy finance infrastructure, where we see the biggest opportunity for transformation into more equitable financial systems.”

Location

Quona invests in companies across the globe and have offices across the globe.

Company Stage

Quona is stage agnostic.

Preferred industries

Quona is focused on fintech companies across the globe.

Related Resource: FinTech Venture Capital Investors to Know

Portfolio Highlights

Some of Quona’s most popular investments include:

- Yoco

- Pillow

- Monkey

6. Valor Capital

As put by their team, “Valor was founded in 2011 as the pioneer cross-border venture capital firm bridging the US, Brazilian and international tech communities. We invest in early stage tech companies in Brazil and international companies looking to expand into Brazil and the region. We are stage and sector agnostic. We are full lifecycle investors. We invest in business models that are only possible through the use of technology and, most importantly, we partner with companies that we believe are best positioned to leverage our relationship-capital and cross-border playbook.”

Location

Valor Capital has office locations in New York City and Brazil.

Company Stage

Valor Capital does not publicly share the stage of the companies they focus on.

Preferred industries

Valor Capital is industry agnostic but has a focus on crypto companies.

Related Resource: 10 VC Firms Investing in Web3 Companies

Portfolio Highlights

Some of Valor Capital’s most popular investments include:

- Bitso

- BlockFi

- Coinbase

7. Astellas Venture Management

As put by the team at Astella, “We support missionary founders building the future by leveraging the possibilities around consumer internet, software-as-a-service, and marketplaces

We see ourselves as mentors. Our team brings a diverse, complementary and cohesive background around key growth disciplines

We understand founders have two main paths to exponential growth: sheer brute force or intelligence. We believe that the right mix of knowledge and capital provides the best route for fast and efficient growth.”

Location

Astella Investimentos is headquartered in Brazil and invests in companies in Brazil.

Company Stage

Astella Investimentos is focused on early-stage companies.

Preferred industries

Astella Investimentos is focused on consumer internet, SaaS, and marketplace companies.

Portfolio Highlights

Some of Astella’s most popular investments include:

- Birdie

- BossaBox

- Zygo

Elevate your investor outreach with Visible

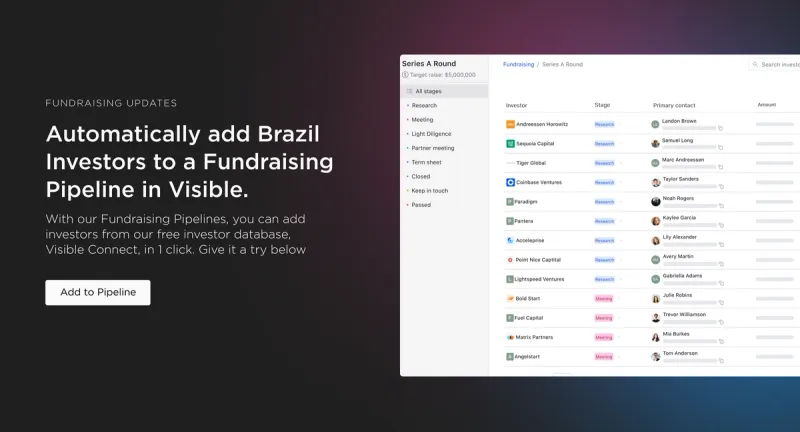

As we mentioned at the beginning of this post, a venture fundraise often mirrors a traditional B2B sales and marketing funnel.

Just as a sales and marketing team has dedicated tools, shouldn’t a founder that is managing their investors and fundraising efforts? Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free for 14 days.