Key Takeaways

-

Learn how LP software simplifies fund management for venture capital investors by centralizing reporting, analytics, and communication in one platform.

-

Discover the key benefits of LP software, including improved transparency, faster decision-making, and scalable portfolio oversight.

-

Explore the types of LP software available and find which solution fits your firm’s needs using resources like the best lp software pdf and types of lp software pdf.

-

Understand how to evaluate and implement lp software free or lp software free download options to test functionality before full deployment.

-

Stay ahead of industry trends by seeing how LP software is shaping the future of venture capital through automation, data insights, and smarter fund management.

What Is LP Software and Why It Matters for Venture Capital Investors

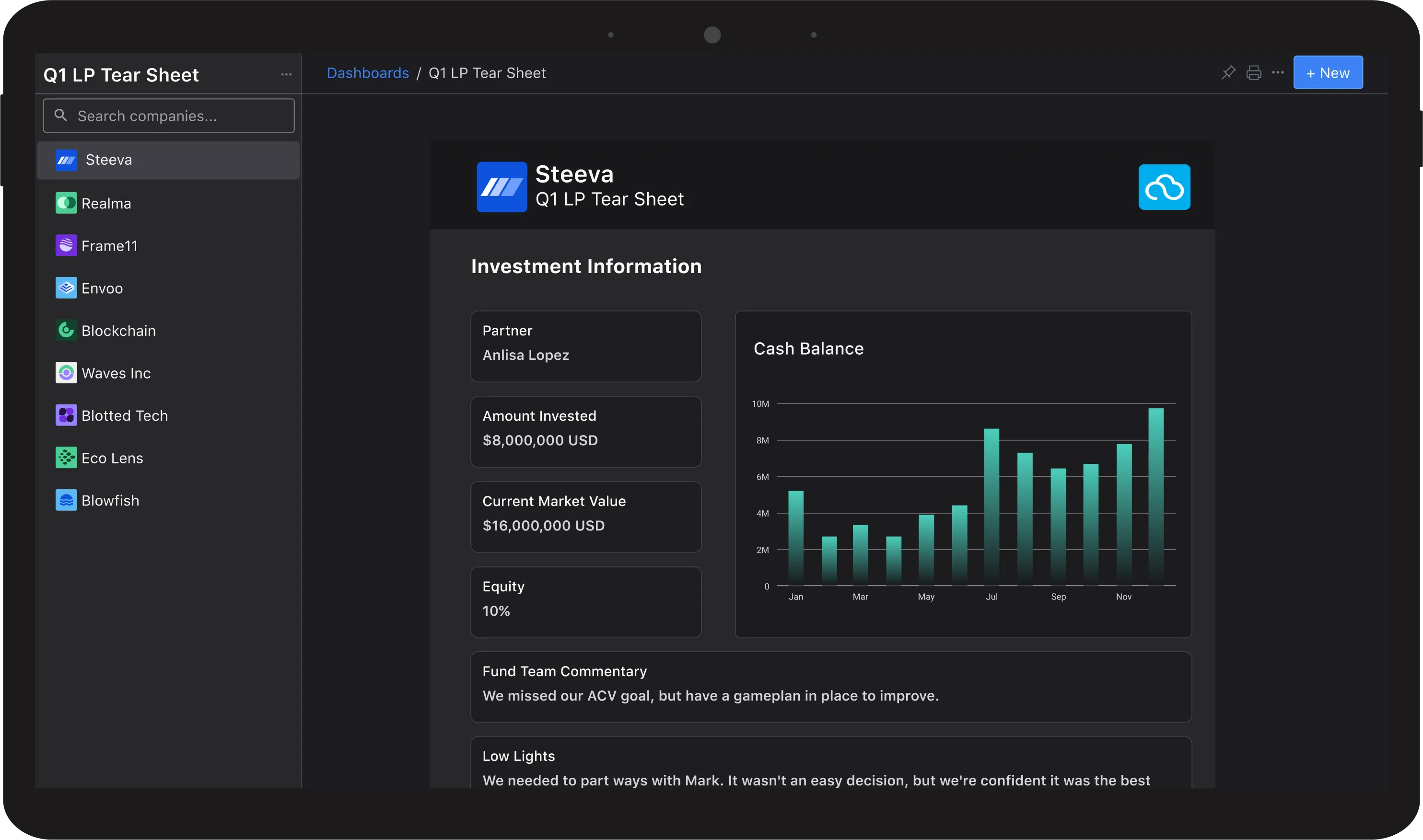

LP software, or Limited Partner software, helps investors manage their relationships, track fund performance, and improve transparency with portfolio data. For venture capital investors, managing multiple funds and investor relationships can quickly become complex. LP software brings structure to that process by centralizing reporting, automating data management, and giving investors visibility into the metrics that matter most.

The best LP software pdf resources often highlight how the right platform can simplify communication between Limited Partners (LPs) and General Partners (GPs). These tools enable investors to focus more on strategy and performance insights rather than manual tracking or fragmented spreadsheets.

How LP Software Enhances Efficiency and Transparency

LP software creates a more transparent investment process by giving investors direct access to real-time portfolio information. It replaces the outdated method of managing data across disconnected documents and emails with a single system that updates automatically.

For venture capital firms, this efficiency means better decision-making and fewer administrative burdens. Many providers offer LP software free options or trials, giving investors a chance to test core features before committing to a full version. Some firms even provide LP software free download resources so users can explore functionality offline or share them with their teams for review.

Key Benefits of LP Software for Venture Capital Firms

LP software improves nearly every aspect of investor relations and fund operations. Investors use it to track performance metrics, analyze fund results, and streamline reporting to stakeholders. The main benefits include centralized reporting and analytics that save time and improve accuracy, better investor communication and data sharing, enhanced compliance and record-keeping for audits, and scalable data management as funds grow and diversify.

When evaluating the advantages, investors can find detailed comparisons in LP software pdf guides that outline each benefit and its impact on fund management.

Types of LP Software and Their Core Features

There are several types of LP software available, each with its own focus area. Some tools specialize in fund reporting, while others center on relationship management or performance tracking. Venture capital firms can choose between solutions that emphasize reporting and analytics, investor communication and CRM (customer relationship management), fund accounting and compliance, or data visualization and portfolio benchmarking.

Educational resources, such as types of LP software pdf documents, can help investors understand which software type fits their needs best.

How to Choose the Best LP Software for Your Firm

Selecting the right LP software begins with identifying the core challenges a firm wants to solve. Investors should consider factors such as reporting complexity, the number of investors, and integration requirements with existing systems. A good starting point is to evaluate software that aligns with specific fund sizes and investment structures.

Firms can also use a best LP software pdf checklist to compare solutions side by side. This approach helps decision-makers document essential features, pricing, and support levels before making a final selection.

Getting Started with LP Software

Once a venture capital firm has selected its LP software, the next step is implementation. This process includes setting up user accounts, importing existing fund data, and configuring custom reports. For teams new to these systems, onboarding guides and tutorials are invaluable.

Many providers offer LP software pdf download or LP software pdf free download resources that explain setup processes, data migration, and best practices. Testing a demo or free version first allows teams to gain confidence before deploying it fully.

Future of LP Software in the Venture Capital Ecosystem

As the venture capital landscape evolves, LP software will continue to play a central role in how investors operate. New advancements are making these tools more intuitive, data-driven, and collaborative. Investors can expect to see features such as predictive analytics, automated compliance tracking, and enhanced integrations with other financial systems.

In a world where speed and accuracy matter, LP software enables investors to stay ahead by transforming raw data into actionable insights. Its ability to centralize reporting and foster transparency ensures long-term value for both investors and fund managers.

Investing in LP Software for Smarter Fund Management

For venture capital investors, LP software is no longer a luxury. It is a necessity for managing growing portfolios and investor relationships. From improving efficiency and compliance to strengthening transparency, the right software can transform how funds operate.

Investors looking to dive deeper can explore LP software pdf guides and best LP software pdf comparisons to better understand their options. Whether accessing a LP software free download to test functionality or reviewing a LP software pdf free download for team education, there are resources available to help firms make informed decisions.

Ultimately, adopting LP software positions investors for smarter fund management and better long-term results.

- AI Portfolio Management Software

- Best Fund Management Software

- Bottom Up Market Sizing

- Financial Ratios Cheat Sheet

- LP Pitch Deck Template

- VC Fund Management Software

- Venture Capital Carry

- Venture Capital Fund Administration Software

- Venture Capital Fund Metrics 101

- Venture Capital Portfolio Management Software

Frequently Asked Questions

What is LP software and how does it help venture capital investors?

LP software (Limited Partner software) enables venture capital investors to manage fund data, perform reporting, and communicate with investors. It centralizes information in one place, making it easier to track investments, improve transparency, and automate reporting for better decision-making and fund oversight.

What are the main benefits of using LP software?

The key benefits of LP software include streamlined data management, faster investor reporting, improved compliance tracking, and enhanced communication between Limited Partners (LPs) and General Partners (GPs). These tools help investors save time, reduce manual errors, and gain real-time visibility into fund performance.

Are there different types of LP software available?

Yes. There are several types of LP software, including reporting-focused systems, relationship management tools, fund accounting software, and portfolio analytics platforms. Each type serves a specific need, and resources like types of LP software pdf can help investors identify the best solution for their firm.

Can I find LP software free or as a free download?

Some providers offer LP software free trials or LP software free download versions to help investors explore basic features before purchasing. These trial options allow users to test performance reporting, investor dashboards, and data management capabilities before committing to a paid plan.

What should I look for when choosing the best LP software?

When selecting LP software, investors should prioritize ease of use, data security, integration with existing systems, and quality of customer support. Using a best LP software pdf checklist or guide can help compare platforms based on features, pricing, and scalability to ensure the right fit for the firm.

How can LP software improve transparency and investor relations?

LP software enhances transparency by providing investors and fund managers with access to consistent, real-time data. Automated reports, performance dashboards, and centralized documentation facilitate the sharing of accurate insights with stakeholders, thereby strengthening trust and enhancing long-term investor relationships.