Key Takeaways

-

Due diligence questionnaire software helps investors streamline data collection, improve accuracy, and maintain transparency across multiple portfolio companies. Using structured tools reduces manual errors and accelerates decision-making.

-

Financial due diligence software enables venture capital investors to evaluate revenue, cash flow, and growth projections efficiently. Platforms designed for M&A provide scenario analysis and trend visualization for faster, more informed decisions.

-

Legal due diligence software ensures regulatory compliance and thorough contract review. Automation allows teams to track changes, maintain audit trails, and reduce risk without slowing the investment process.

-

Third-party risk management software and vendor due diligence software give investors insights into operational stability, security risks, and supplier performance. Monitoring these relationships protects portfolio value and mitigates potential disruptions.

-

Using software due diligence checklists and templates standardizes evaluation across deals. Investors can start with free due diligence software options and scale to advanced tools to ensure consistent, data-driven assessments.

Understanding the Role of Due Diligence Questionnaire Software

Due diligence questionnaire software helps investors gather, organize, and assess critical information from potential portfolio companies. Using these tools simplifies the evaluation process, reduces manual work, and ensures that no important details are missed. Investors can standardize the way they collect financial, legal, and operational data while keeping the process transparent for all stakeholders. For firms looking to improve accuracy and efficiency, these platforms offer a structured approach to managing complex information. Keywords such as due diligence questionnaire software, best due diligence questionnaire software, and due diligence questionnaire software free are commonly searched by investors evaluating their options.

The software often includes prebuilt questionnaires that cover key areas such as management experience, intellectual property, regulatory compliance, and financial performance. This allows investors to quickly assess critical factors without creating documents from scratch. For smaller firms or first-time investors, using due diligence questionnaire software free versions provides a risk-free way to test functionality before committing to a paid solution. Integrating these tools into the investment process early ensures consistency across deals and reduces the likelihood of overlooking key issues.

Why Investors Are Turning to Software for Due Diligence

Many investors are moving away from spreadsheets and email chains because due diligence software accelerates workflows and minimizes errors. The software allows teams to collaborate, track progress, and maintain clear documentation throughout the investment process. By automating repetitive tasks, investors can focus on analyzing data and making informed decisions rather than organizing it manually. Using these tools has become a standard practice for venture capital firms seeking to stay competitive. Keywords such as best due diligence software, free due diligence software, and financial due diligence software are naturally included when describing the benefits and adoption trends.

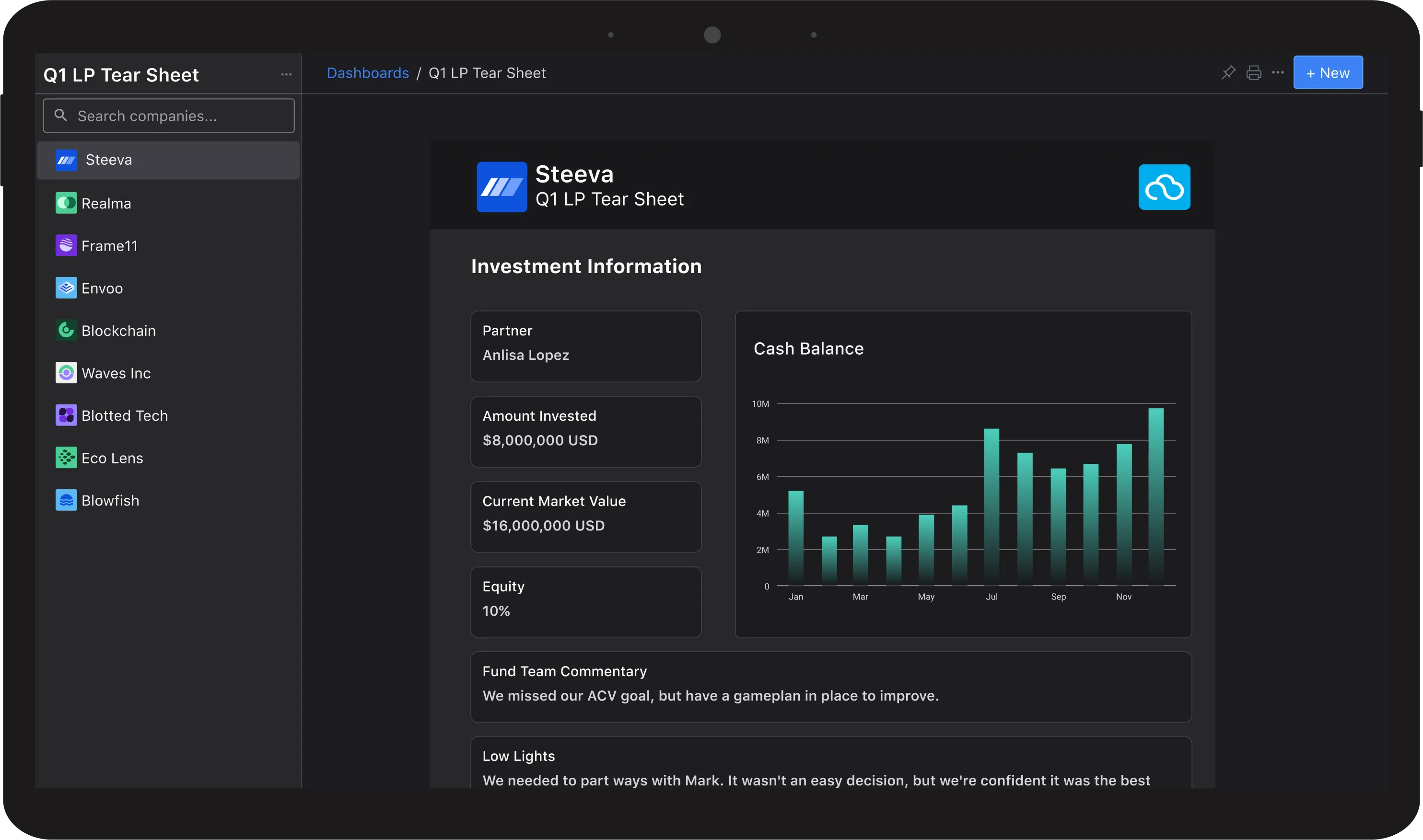

Investors benefit from dashboards that summarize the status of each deal and highlight missing or incomplete information. These features reduce the back-and-forth between teams and portfolio companies. Additionally, alerts and reminders help ensure that deadlines are met and nothing is overlooked. For firms that handle multiple deals simultaneously, the efficiency gained can translate into faster investment decisions and more competitive offers.

The Benefits of Financial Due Diligence Software in Venture Capital

Financial due diligence software provides investors with tools to evaluate a company’s financial health, including revenue, cash flow, and expenses. These platforms are especially helpful during mergers and acquisitions, where accurate financial assessment is critical. Investors can identify potential risks, forecast growth, and validate assumptions more efficiently. Cost-effective options are available, including free due diligence software M&A solutions that allow smaller firms to start without a significant upfront investment. Keywords such as financial due diligence software, financial due diligence software M&A, best financial due diligence software, and free due diligence software M&A are naturally included in context with financial evaluation and M&A scenarios.

The software often includes features such as scenario analysis, ratio calculations, and trend visualization. These tools help investors identify potential warning signs such as declining margins, cash flow issues, or excessive debt. Integrating financial due diligence software into the investment process also helps standardize reporting, allowing teams to compare multiple targets with consistent criteria. For M&A transactions, this consistency is particularly important to quickly identify opportunities and risks across a large number of potential acquisitions.

Legal and Compliance Advantages of Using Due Diligence Tools

Legal due diligence software helps investors review contracts, intellectual property, and regulatory compliance quickly and accurately. Using these platforms reduces the risk of overlooking important legal obligations or potential liabilities. Automation streamlines document review and allows teams to collaborate without missing deadlines. This approach saves time and enhances the thoroughness of every investment review. Keywords such as legal due diligence software and best legal due diligence software are naturally included when describing legal risk management and compliance benefits.

Investors can also use these tools to track changes in key agreements over time, ensuring that they are aware of amendments or renewals that could affect the business. Legal due diligence software often integrates with document storage systems, making it easier to maintain an audit trail. This transparency is particularly valuable for investors who need to report findings to partners, boards, or regulatory authorities. Using technology to support legal review allows investors to mitigate risk while maintaining speed and efficiency in deal execution.

Managing Third-Party and Vendor Risks with Software

Investors increasingly rely on third-party risk management software to evaluate suppliers, partners, and vendors associated with portfolio companies. Vendor due diligence software provides insights into operational stability, reputation, and security risks. These tools allow investors to track third-party relationships systematically and mitigate potential issues before they impact investments. Using this software ensures that risk assessment extends beyond internal company data. Keywords such as third-party risk management software, vendor due diligence software, and best vendor due diligence software are naturally included while discussing risk management benefits.

These platforms can also provide scoring systems or risk ratings for vendors, which allow investors to prioritize resources toward the highest-risk relationships. In addition, automated reminders for contract renewals or compliance deadlines help investors maintain continuous oversight without adding administrative burden. By combining vendor and third-party risk assessments with broader due diligence processes, investors can make more informed decisions and protect the long-term value of their investments.

How M&A Teams Use Due Diligence Software to Drive Efficiency

During mergers and acquisitions, due diligence software centralizes data, coordinates teams, and tracks deal progress. Investors can share documents, monitor tasks, and keep stakeholders informed through a single platform. These solutions increase collaboration and reduce the risk of miscommunication or missed deadlines. Using software in M&A processes allows teams to move quickly while maintaining thorough evaluations. Keywords such as best due diligence software M&A, free due diligence software M&A, and software due diligence checklist M&A are naturally included in context with M&A workflows.

Software often includes templates and workflows specifically designed for M&A transactions. These templates can cover financial, legal, operational, and technological areas, ensuring that all relevant information is reviewed. Teams can also track approvals and assign responsibilities, providing clarity about who is responsible for each aspect of the process. By using due diligence software during M&A, investors can execute deals faster while maintaining the depth of analysis needed for confident decision-making.

Creating a Software Due Diligence Checklist for Investors

A software due diligence checklist helps investors systematically assess technology platforms and other critical tools. Key areas include security, scalability, vendor contracts, and product stability. Using a template ensures consistency and completeness across multiple deals. Investors can start with free tools or templates and scale to more comprehensive options as needed. Keywords such as software due diligence checklist, software due diligence checklist template, and software due diligence checklist M&A are included naturally. Best free due diligence software is referenced as an accessible starting point for small firms.

Checklists also allow investors to benchmark target companies against best practices or industry standards. For example, a checklist can include criteria such as adherence to data privacy regulations, the robustness of IT infrastructure, or the quality of customer support. Standardizing evaluations ensures that key risks are not overlooked and that investors can make comparisons across multiple companies efficiently. This structured approach saves time while maintaining thoroughness in every evaluation.

Choosing the Best Due Diligence Questionnaire Software for Your Firm

Selecting the right due diligence questionnaire software depends on firm size, workflow needs, and budget. Investors should evaluate usability, reporting features, integration capabilities, and support options. The best software improves accuracy, compliance, and decision-making while saving time on repetitive tasks. Free and paid options exist, allowing firms of all sizes to benefit from these tools. Keywords such as best due diligence questionnaire software, best due diligence questionnaire software free, and best due diligence software conclude the article while reinforcing value for investors.

When evaluating options, it is important to consider the learning curve for your team and whether the platform supports customization to match your firm’s unique workflow. Investors should also assess the level of security and access controls provided by the software, particularly when handling sensitive financial and legal data. Choosing a solution that scales with the firm’s growth ensures that due diligence processes remain effective as deal volume increases. Investing in the right software ultimately provides a foundation for faster, safer, and more informed investment decisions.

Frequently Asked Questions

What is due diligence questionnaire software and how does it help investors?

Due diligence questionnaire software helps investors collect and organize financial, legal, and operational information from potential portfolio companies. It streamlines workflows, reduces manual errors, and provides standardized reporting, allowing venture capital firms to make faster, data-driven investment decisions with greater transparency.

What are the best financial due diligence software options for M&A?

The best financial due diligence software for M&A allows investors to evaluate revenue, cash flow, and key performance metrics efficiently. These platforms often include scenario analysis, trend visualization, and automated reporting, helping teams assess potential risks and opportunities quickly during mergers, acquisitions, or portfolio monitoring.

How does legal due diligence software improve compliance?

Legal due diligence software helps investors review contracts, intellectual property, and regulatory obligations accurately. By automating document tracking and audit trails, it reduces the risk of missed legal issues, ensures regulatory compliance, and enables teams to focus on strategic evaluation instead of manual document management.

Why should investors use a software due diligence checklist?

A software due diligence checklist ensures that all critical areas, such as security, scalability, vendor contracts, and financial health, are systematically reviewed. Using templates standardizes evaluations across deals, reduces oversight, and allows investors to compare multiple companies efficiently, saving time and improving decision-making.

What is the benefit of vendor due diligence software?

Vendor due diligence software provides insights into third-party relationships, operational stability, and potential risks. Investors can monitor suppliers, partners, and vendors consistently, identify high-risk areas, and mitigate issues before they impact portfolio performance, ensuring long-term value and stronger oversight of external dependencies.

Are there free due diligence software options for small investment firms?

Yes, free due diligence software options exist for investors and small firms who want to standardize data collection and evaluation without upfront costs. These tools typically provide basic financial, legal, and operational questionnaires, allowing firms to test workflows and scale to advanced paid solutions as their investment activity grows.