The Benefits of Data Rooms for Due Diligence

Why Data Rooms Matter for VC-Backed Startups

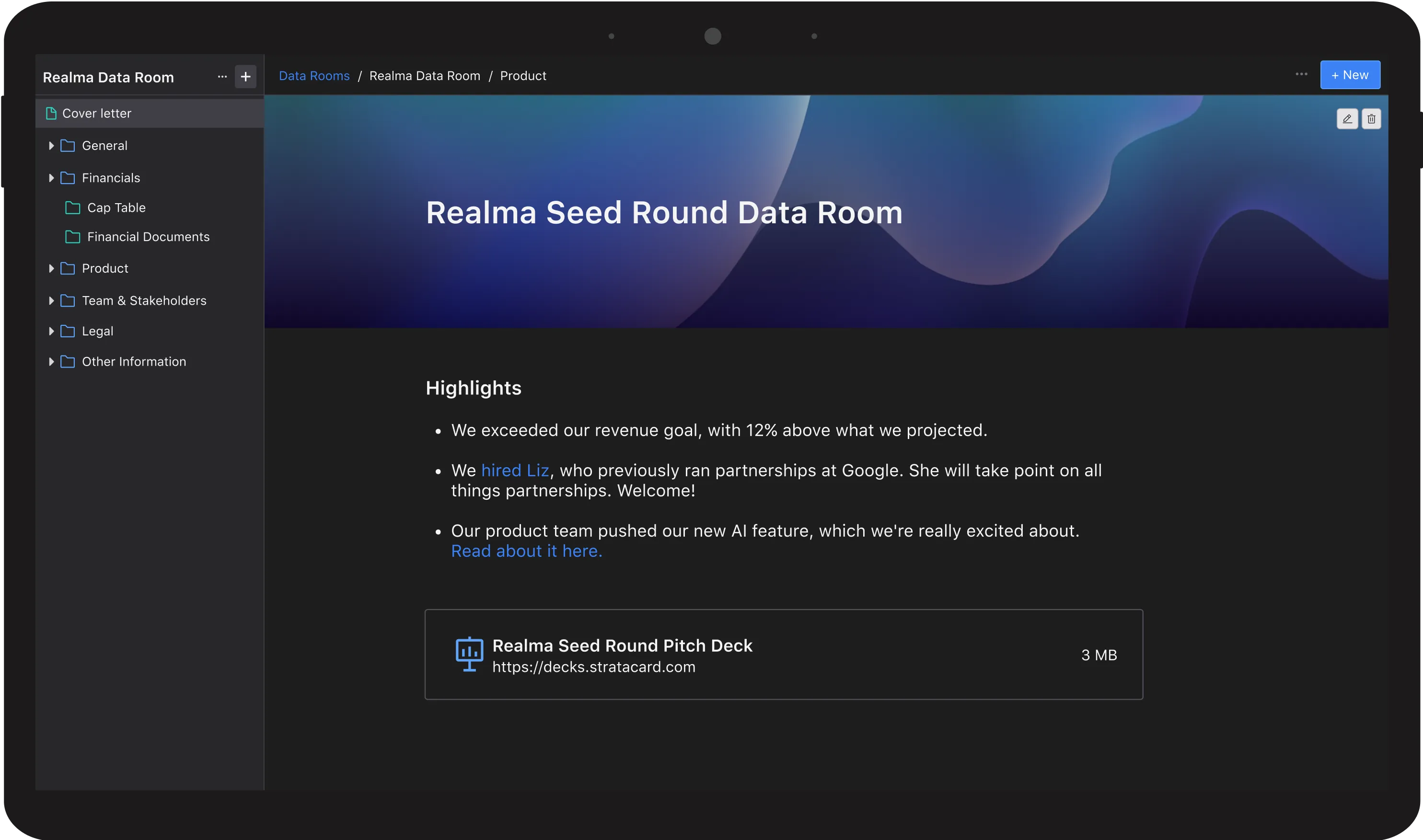

Raising venture capital comes with a rigorous due diligence process. Investors expect founders to present their company’s financials, legal documents, and growth metrics in an organized and transparent manner. A virtual data room (VDR) simplifies this process, allowing startups to securely store, manage, and share critical documents with potential investors. The best virtual data room providers offer solutions tailored for startups, ensuring secure collaboration and compliance.

In this guide, we’ll break down the benefits of using a data room, what to include in a data room due diligence checklist, and how to choose the best data room for startups. We’ll also cover options for free virtual data room providers, the cheapest data rooms, and M&A data room providers to help you make an informed decision.

What is a Data Room?

A data room is a secure online repository where startups store and share important documents during fundraising, M&A, and financial audits. Investors use data rooms to review a startup’s business model, financials, and legal structure before making an investment. A virtual data room (VDR) is a cloud-based alternative to traditional physical data rooms, offering encryption, access control, and tracking features. It helps startups organize due diligence materials, making it easier for investors to assess risk and make investment decisions. Virtual data rooms streamline access, reduce costs, and provide real-time collaboration—key advantages over traditional paper-based data rooms. Additionally, understanding VDR meaning in finance is critical, as these tools play an essential role in venture capital due diligence and M&A transactions.

Key Benefits of Using a Data Room for Due Diligence

1. Improved Investor Confidence & Transparency

A data room provides clear financial, legal, and operational insights. By making all necessary documents readily available, founders can minimize back-and-forth communication with investors. This transparency helps demonstrate an understanding of the due diligence process, which can increase investor confidence and accelerate fundraising timelines. For venture capital due diligence, having a well-structured data room due diligence checklist PDF in addition to your VDR can impact how investors perceive your startup.

2. Streamlined Fundraising Process

A well-organized data room allows for faster document retrieval, saving time for both founders and investors. Centralized document management reduces version control issues and ensures that fundraising remains an efficient process. By having everything in place, founders can stay proactive rather than reactive during fundraising and ensure compliance with venture capital due diligence checklist standards.

3. Stronger Security & Compliance

Data rooms offer encryption and secure access control to prevent unauthorized document sharing. Compliance-ready platforms help startups adhere to investor and legal requirements, ensuring that all sensitive information remains protected. Additionally, audit trails track who views, edits, and downloads documents, which is critical for M&A data room providers managing secure transactions. The best virtual data rooms for due diligence include security features like multi-factor authentication, watermarking, and permission settings to protect your startup’s information.

4. Efficient Collaboration & Access Control

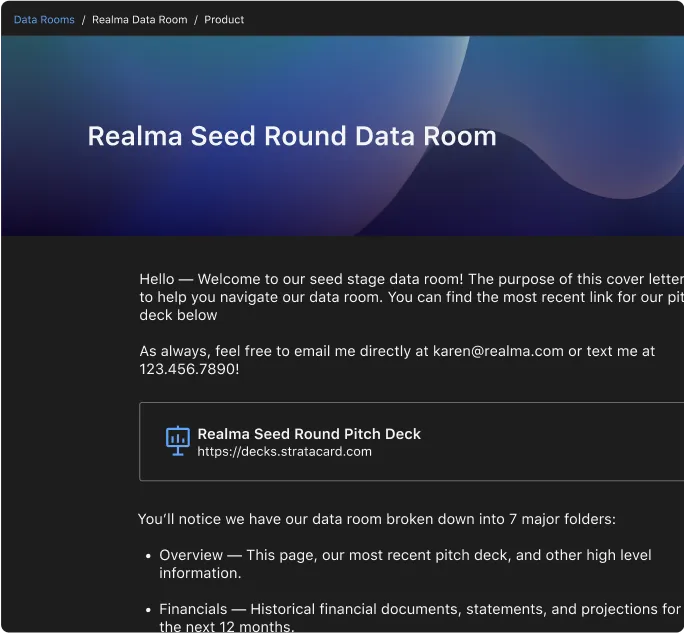

With a data room, startups can set permission levels such as view-only, download, or edit, ensuring that only authorized individuals access sensitive materials. Documents can be organized logically with folders for financials, legal, and HR materials. Furthermore, engagement tracking helps founders see which investors spend the most time reviewing documents, providing valuable insights during negotiations. Data room best practices include keeping documents updated, maintaining logical folder structures, and setting clear access permissions.

Data Room Due Diligence Checklist: What Founders Should Include

A structured data room should cover key areas investors review during due diligence.

1. Legal & Corporate Documents

Founders should include their cap table, shareholder agreements, incorporation documents, and board meeting minutes. Additionally, founder and employee contracts are crucial components that investors will review during the due diligence process. For M&A due diligence, using a data room due diligence checklist M&A template ensures you provide all required documents.

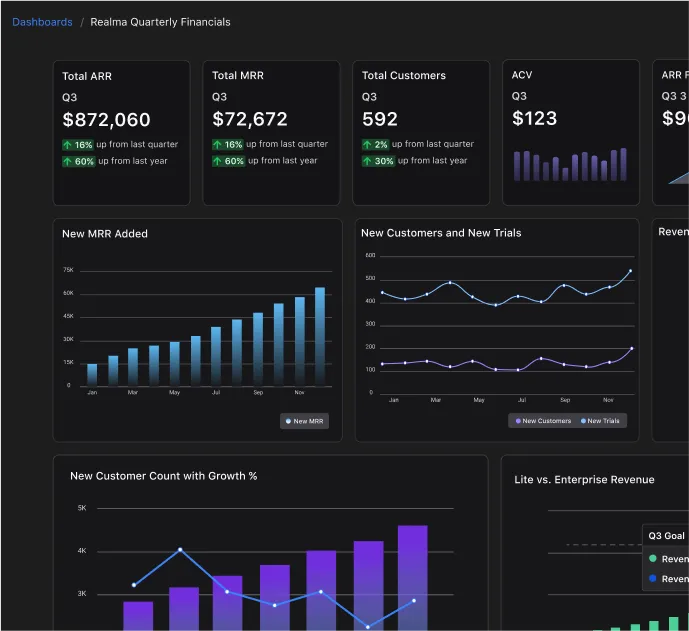

2. Financial Statements & Projections

Key financial statements such as profit & loss statements, balance sheets, and cash flow reports should be uploaded to the data room. Revenue projections, burn rate analysis, bank statements, and tax filings provide further financial transparency, making it essential for VDR finance and investor decision-making. A data room due diligence checklist in an Excel sheet can also help organize financial records for easier access.

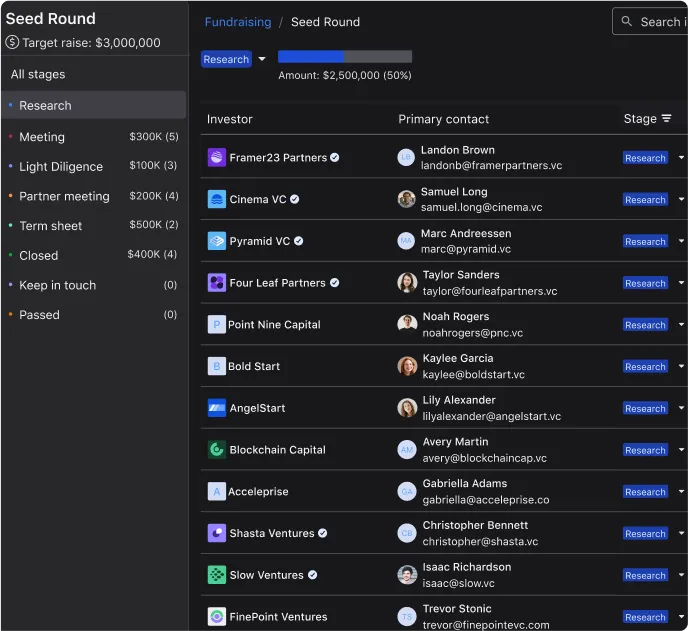

3. Investor & Fundraising Documents

A startup’s pitch deck, SAFE/convertible notes, and term sheets should be stored in the data room. Previous investor updates and fundraising history should also be included, as these materials form a critical part of a series A data room checklist and demonstrate how the company has performed over time.

4. Product, IP & Market Information

Documents related to patents, trademarks, and intellectual property ownership should be accessible in the data room. Additionally, market research and competitive landscape analysis help investors evaluate the startup’s position within its industry. Including these materials aligns with virtual data rooms for due diligence best practices.

5. Team & HR Documents

An organizational chart and key hire profiles give investors insight into the company’s leadership structure. Stock option agreements and employee compensation plans should also be included to showcase the startup’s approach to talent retention and team growth.

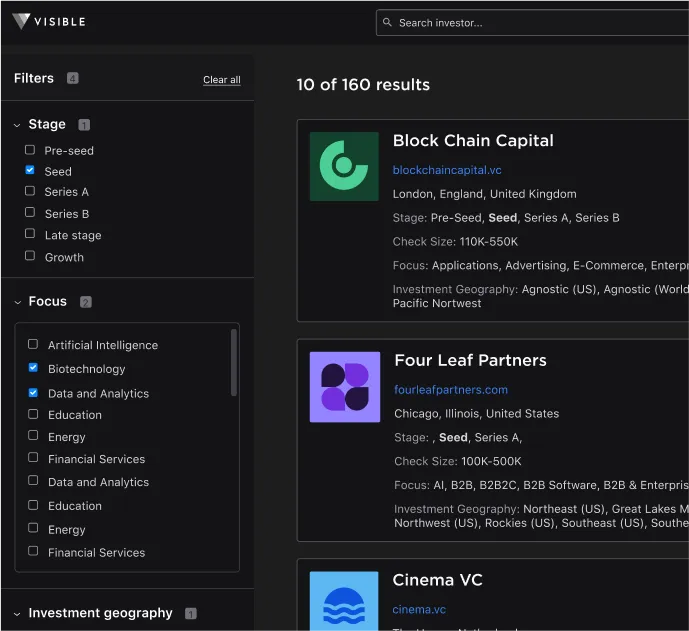

Choosing the Best Data Room for Startups

Startups need affordable, secure, and easy-to-use data rooms. Some founders opt for free data rooms for due diligence, which are useful for early-stage startups but often come with limited storage and features. The cheapest data rooms may be budget-friendly but could lack investor-friendly features such as tracking and compliance tools. Premium virtual data room providers offer full security, analytics, and collaboration tools, making them ideal for scaling startups. Founders should also compare virtual data room cost to ensure they choose an option that fits their budget while meeting security and usability needs.

Top Features to Look For

When selecting a data room, founders should consider secure storage with encryption, permission-based access controls, audit trails, investor tracking, and integration with fundraising tools. Firm room solutions may be beneficial for startups that require high-security needs, while virtual data room providers in the USA and around the world offer specialized features tailored to the needs of startups and M&A transactions.

Why Founders Should Invest in a Data Room Now

A well-organized data room can make or break a fundraising process. By using the best virtual data room for startups, founders save time, increase investor confidence, and secure funding faster. Having access to free virtual data rooms for due diligence or choosing from the best free data rooms for due diligence can provide a great starting point for early-stage startups.