Key Takeaways

-

Discover how the best CRM for venture capital helps founders build and manage long-term investor relationships from first pitch to follow-on funding.

-

Learn why a CRM tailored for investor relations, tracking deal flow, pipeline stages, and key metrics, is critical for successful fundraising.

-

Explore essential features like automated follow-ups, investor reporting, and secure data management to keep every interaction organized.

-

Compare free investor CRM templates with full-scale platforms and understand when to upgrade for scalability and automation.

-

Get step-by-step tips on setting up, optimizing, and leveraging a CRM to improve investor communication and fundraising results.

The Best CRM for Venture Capital and Managing Investor Relationships

Raising venture capital is more than just pitching investors—it’s about building and maintaining long-term relationships. Whether you're raising your first round or managing a growing portfolio of investors, keeping track of conversations, commitments, and updates is essential.

A CRM (customer relationship management) system tailored for investor relations can streamline this process, ensuring no opportunity slips through the cracks. Founders use CRMs to track startup fundraising efforts, automate investor communications, and manage data—all critical to securing and maintaining venture capital. Choosing the best CRM for capital raising can make the difference between an organized, successful round and missed opportunities.

This guide explores the best CRM solutions for startups raising capital, highlighting key features and strategies to optimize investor relationship management. For those looking for free solutions, a CRM for startup fundraising free option can help founders keep track of their investor outreach efficiently.

Why Founders Need a CRM for Investor Relations & Fundraising

Founders managing a capital raise must balance investor outreach, due diligence, and follow-ups—often across dozens or even hundreds of investor contacts. Without a structured system, it’s easy to lose track of conversations, leading to missed funding opportunities.

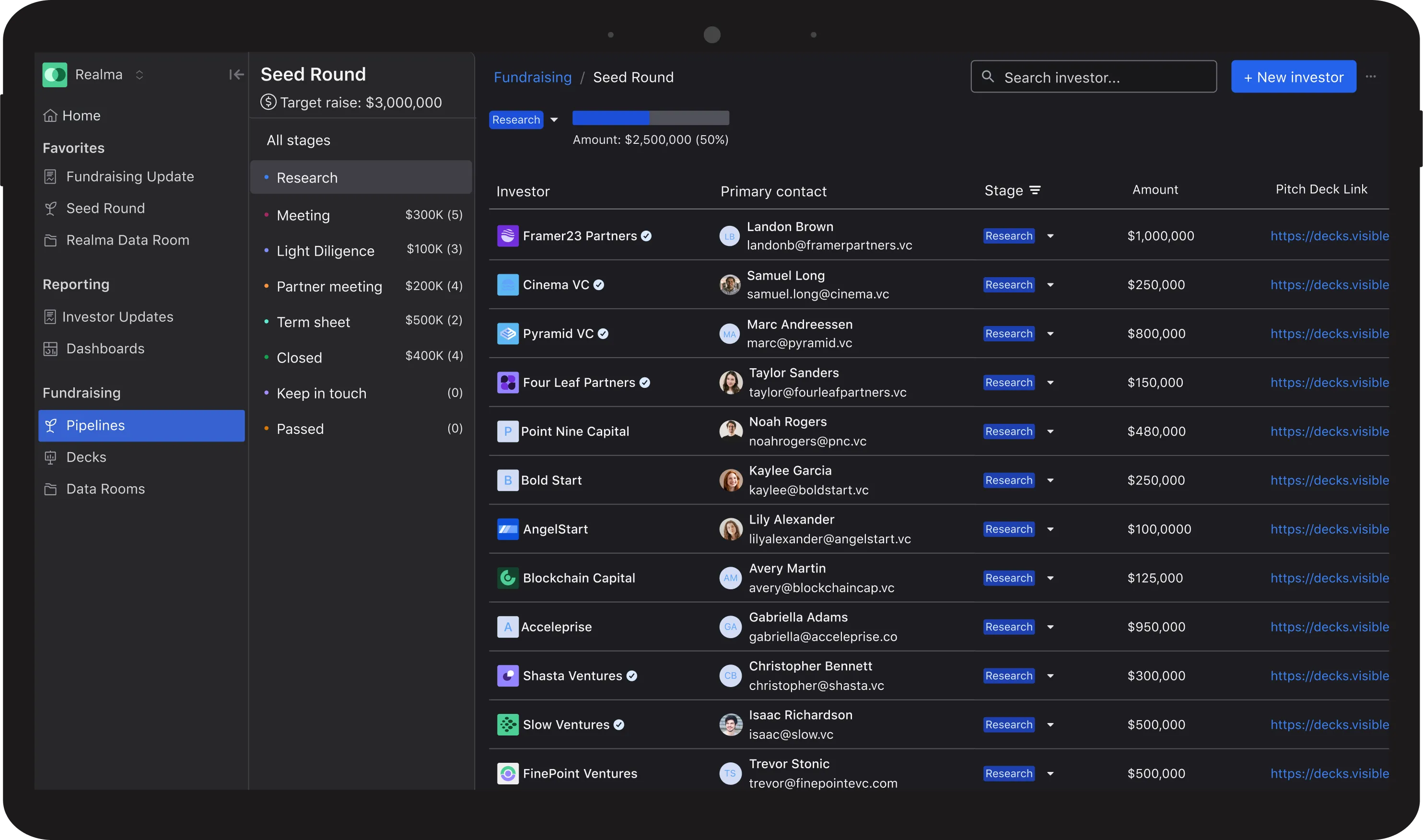

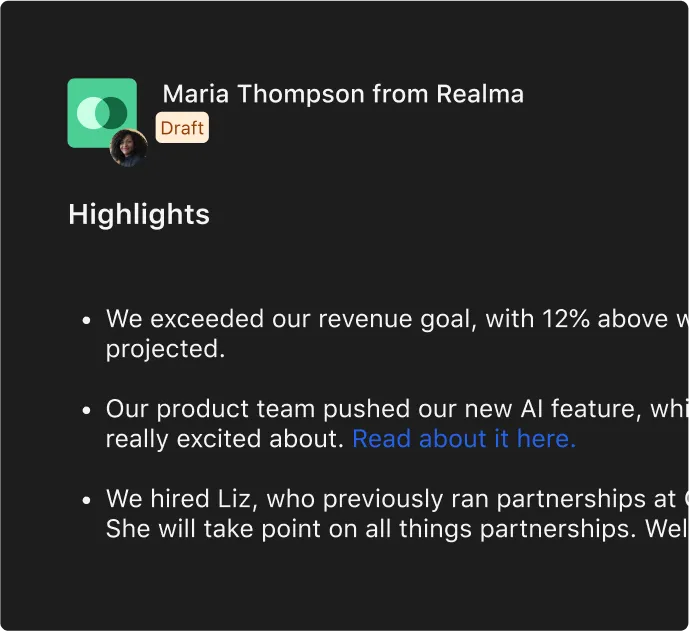

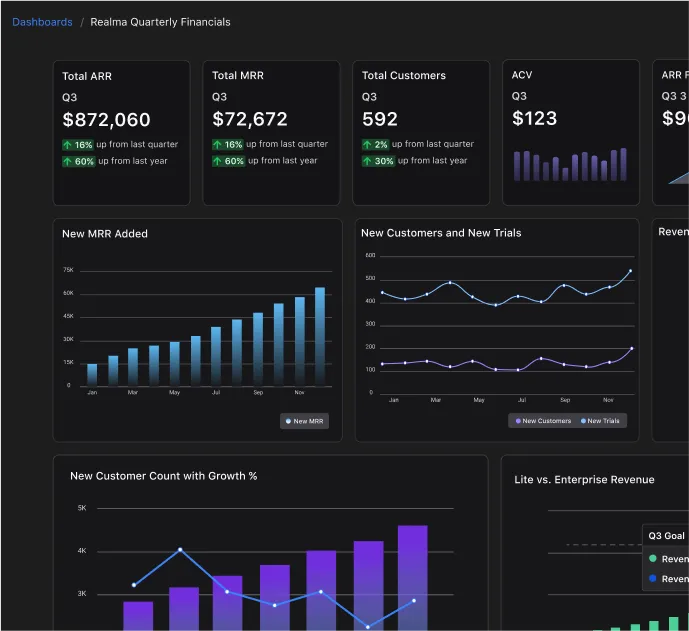

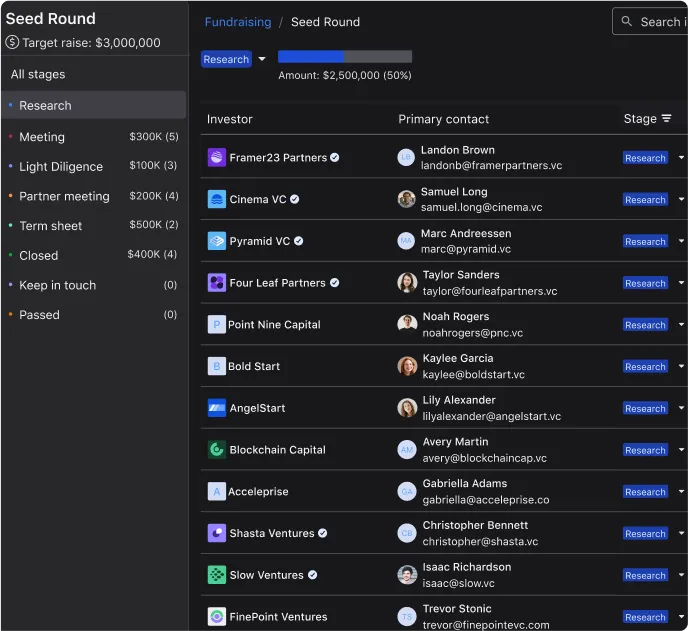

The best CRM for startup fundraising helps by organizing investors by stage, interest level, and engagement history. It also automates follow-ups, reminders, and investor reports, ensuring clear documentation of commitments, legal agreements, and terms. Additionally, it provides a centralized platform for tracking investor interactions over multiple fundraising rounds.

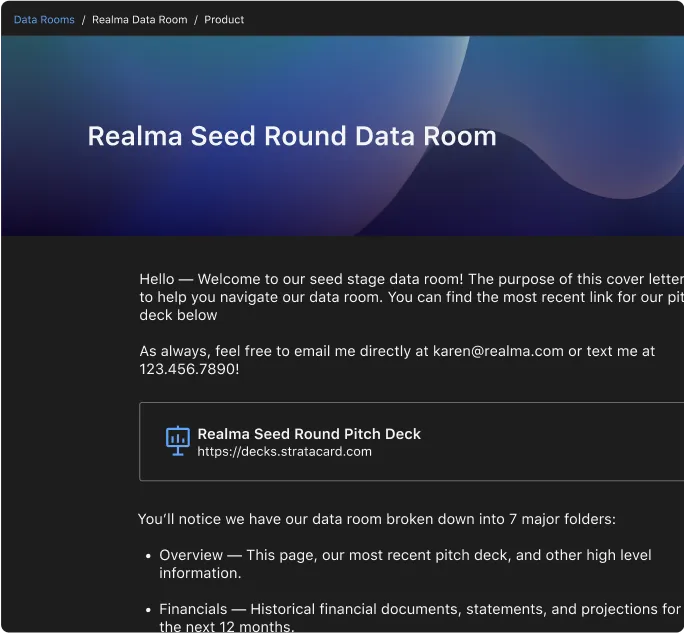

For startups with venture backing, a CRM for investor relations simplifies post-fundraising tasks, including regular investor updates, tracking key metrics, and maintaining compliance. Founders looking for the best CRM for investor relations free can explore software solutions that offer essential features without additional costs. A well-designed investor relationship management software download can provide robust tools for maintaining transparency and engagement with stakeholders.

“Companies that regularly communicate with their investors are 300% more likely to raise follow-on funding down the road.” Why a CRM is Essential for Investor Relations

Key Features to Look for in an Investor-Focused CRM

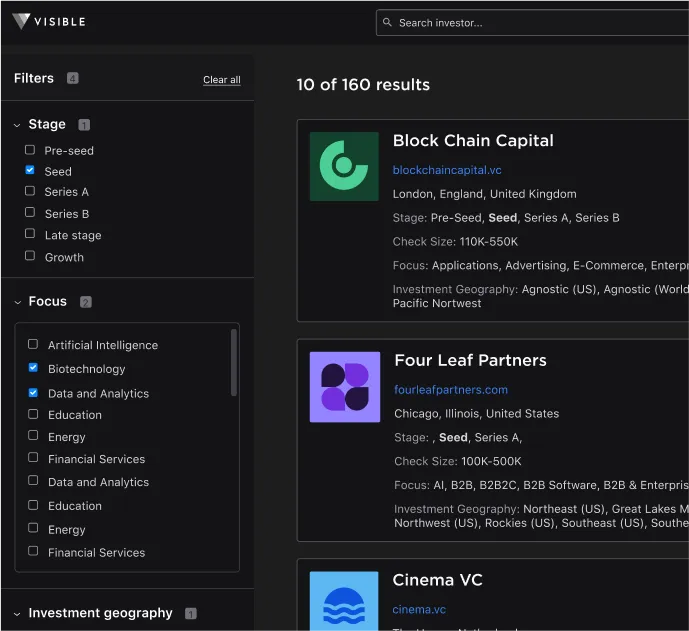

Not all CRMs are built for managing investor relationships. Founders should prioritize solutions with features tailored for fundraising and investor communications.

A CRM for investor relations should include deal flow and pipeline management, allowing categorization of investors based on fundraising stage, tracking interactions, follow-ups, and pending commitments. The best CRM for startups will also provide investor communication tools, including automated emails, reminders for meetings, and investor report generation. Data and performance tracking capabilities should monitor investor engagement through email opens and response tracking while also tracking startup KPIs. Integration with email, calendar, and analytics tools makes a CRM for startup fundraising even more valuable. Security and compliance features ensure investor data protection and regulatory adherence.

CRM Options for Startup Fundraising

Full-Scale CRM Solutions

For founders managing multiple investors across different rounds, a dedicated CRM for venture capital provides robust pipeline tracking, automation, and analytics. These tools are ideal for scaling investor relations and securing follow-on investments. Some founders also look for recommendations on the best CRM for venture capital Reddit discussions, where startup leaders share real-world insights.

Free CRM & Investor Templates for Startups

Early-stage founders or those testing different investor tracking methods may benefit from a free investor CRM template in Excel, Google Sheets, or downloadable formats. A well-structured investor CRM template can help track contacts, funding status, and interactions without the complexity of full-scale software.

Common investor CRM templates include an investor CRM template in Excel, which offers a simple way to track investor relationships. Many founders also look for an investor CRM template free download to find ready-made structures for organizing investor contacts. Some prefer a startup fundraising software free solution, such as lightweight tools that provide the essentials of investor tracking without financial commitment. However, all of these free options will pale in comparison to a purpose-built investor CRM.

How to Choose the Best CRM for Your Startup

With multiple options available, selecting the best CRM for venture capital depends on your team’s needs and fundraising goals.

Consider how many investors you are managing, whether automation is necessary or a simple investor CRM template free option is sufficient, and if the CRM will scale with future fundraising rounds. Also, evaluate whether it integrates with your current workflow.

For early-stage founders, a lightweight CRM for startup fundraising or a free startup fundraising platform might suffice. However, as your investor network grows, transitioning to a more comprehensive investor relationship management software free solution becomes essential.

Setting Up & Optimizing Your Investor CRM

Once you've chosen a CRM, setting it up correctly will maximize its value. Start by importing investor data and segmenting contacts by round, engagement level, and decision status. Automate follow-ups and investor reports using reminders and pre-scheduled updates. Tracking interactions and feedback is also essential, so log all investor meetings, emails, and responses for future reference. Utilize analytics and reporting tools to measure investor interest and adjust your fundraising strategies accordingly.

Leveraging the Right CRM for Your Next Round

Managing investor relationships effectively can be the difference between a successful capital raise and a missed opportunity. A CRM for venture capital simplifies investor tracking, follow-ups, and reporting, ensuring founders stay organized throughout their fundraising journey.

A CRM helps founders track investor interactions, fundraising stages, and commitments. The best CRM for investor relations will include pipeline management, investor communication, and automation features. Early-stage startups can use free CRM templates, while growth-stage companies benefit from full-scale investor relationship management software. Selecting the right startup fundraising software depends on fundraising stage, investor volume, and long-term needs.

Next steps include assessing your current investor management process, downloading an investor CRM template free or exploring CRM software options, and optimizing your CRM for better investor communication and fundraising success.

By leveraging the right CRM for startup fundraising, founders can maintain strong investor relationships, stay organized, and increase their chances of securing venture capital.

Frequently Asked Questions

What is the best CRM for venture capital fundraising?

A truly effective CRM for venture capital fundraising keeps every investor interaction organized from first outreach to final close. It should track deal flow, manage your pipeline, automate follow-ups, and deliver clear investor reports so nothing falls through the cracks. All of these features are built into the Visible platform.

Why should founders use a CRM for venture capital relationships?

A CRM centralizes investor data, tracks conversations, and automates follow-ups, ensuring no opportunity is missed. For venture capital fundraising, this organization helps founders maintain clear communication, document commitments, and manage ongoing investor updates, critical for both initial raises and follow-on funding.

Are there free CRM options for venture capital fundraising?

A truly effective CRM for venture capital fundraising goes beyond basic contact tracking. Free options and templates can help you get started by storing investor names and notes, but they quickly reach their limits when managing multiple rounds or complex follow-ups. To consistently secure funding, founders need a comprehensive platform that combines deal flow tracking, pipeline management, automated follow-ups, and detailed investor reporting, all of which are available in an integrated solution like Visible, which is available to founders at no cost.

How does a CRM for VC differ from a standard CRM?

A venture-focused CRM is built for managing investor relationships, not customer sales. It provides deal pipeline tracking to follow each stage of fundraising, integrated investor communication tools for updates and follow-ups, secure data management to maintain compliance, and detailed analytics to track investor engagement.

What key features should a CRM for fundraising include?

Essential features include deal flow and pipeline management to track every investor conversation, automated email updates and follow-ups to save time, investor reporting and update tools for transparency, seamless integration with email and calendars to keep outreach coordinated, and strong data security to protect sensitive information.

Can a startup begin with a free investor CRM template?

Yes. Early-stage startups can start with free investor CRM templates, such as simple spreadsheets, to track contacts, funding status, and meeting notes. This is a budget-friendly first step, but these tools quickly become limiting. To scale investor relationships and add automation, founders eventually need a dedicated platform that’s built for growth. Visible allows you to use these advanced features for free as you grow.

What is the best CRM for VC companies managing multiple funds?

Venture capital firms managing multiple funds need a CRM that offers advanced pipeline management, detailed analytics, and seamless team collaboration. The right platform should also support investor reporting and secure data sharing for limited partners. Visible provides all these capabilities in one place, making it well-suited for firms overseeing complex portfolios and multiple funding rounds.