The Benefits of Annual Report Preparation Software for Better Financial Insights

Why Annual Report Preparation Software Matters for Small Businesses and Investors

Annual report preparation software helps businesses and investors simplify the often complex process of compiling financial data. For small businesses, annual reports provide clarity on performance and growth opportunities. For venture capital investors, these reports build confidence by offering transparency and consistency. By leveraging annual report preparation software, businesses save time, improve accuracy, and strengthen trust with stakeholders.

When it comes to choosing the best annual report preparation software, it is important to consider usability, scalability, and how well the tool integrates with existing processes. For investors reviewing multiple portfolio companies, these tools can streamline the evaluation process while providing reliable, standardized data.

Key Benefits of Annual Report Preparation Software

The main advantage of annual report preparation software is efficiency. Instead of manually compiling reports, businesses can automate data collection and reduce human error. This saves hours of administrative work and improves compliance with regulations.

Automation is especially helpful for small businesses with limited staff, where the finance team may also wear many other hats. By centralizing reporting functions in one place, companies reduce the likelihood of missing critical data points and improve decision-making with real-time updates.

For founders seeking funding, showcasing clear and consistent reports is vital. The best annual report preparation software supports not only compliance but also strategic decision-making. Investors are more likely to back companies that present accurate numbers in an organized format.

Free and Accessible Options for Small Businesses

Best Free Annual Report Preparation Software Options

Startups and small businesses often look for cost-effective solutions. The best annual report preparation software free options can help growing teams manage finances without large upfront costs. These tools provide simplified reporting features that allow small businesses to focus on growth while keeping financial records organized.

For example, a startup founder preparing for their first investor pitch may rely on such free tools to create professional-looking reports without hiring external accountants. The result is an affordable yet effective way to demonstrate financial responsibility.

Free Annual Report Preparation Software for Small Business

Free annual report preparation software for small business users often includes essential templates and dashboards. These features are designed to meet the needs of early-stage companies without requiring extensive accounting knowledge. They give founders the ability to produce professional reports that meet investor expectations.

In addition, free software helps small teams become familiar with structured reporting before they invest in more advanced tools later in their growth journey. This gradual adoption reduces the risk of overwhelming employees who may have little financial background.

Free Annual Report Preparation Software Free Download

In some cases, teams prefer to work offline. Free annual report preparation software free download options can be particularly useful for businesses with limited internet access. Having a downloadable program ensures that reports can be prepared and shared without depending on cloud-based systems.

This is particularly valuable for companies in regions with inconsistent connectivity or for organizations that prioritize local data storage due to compliance or security considerations.

Lifetime Free Accounting Software

Some businesses may also consider lifetime free accounting software as a cost-saving alternative. While these tools are not always as robust as paid solutions, they provide long-term access without subscription fees. This option is attractive for small companies trying to maximize every dollar.

For founders, this approach helps keep recurring costs low while still supporting essential reporting and compliance needs. However, businesses should weigh whether lifetime free accounting software can scale with their future reporting requirements.

Beyond Annual Reports — Exploring Management Reporting Software

Annual reports provide a snapshot of performance, but businesses and investors often need more frequent updates. This is where management reporting software becomes essential. These tools go beyond yearly reporting, offering real-time insights and analytics to guide decision-making.

Best Management Reporting Software for Growing Businesses

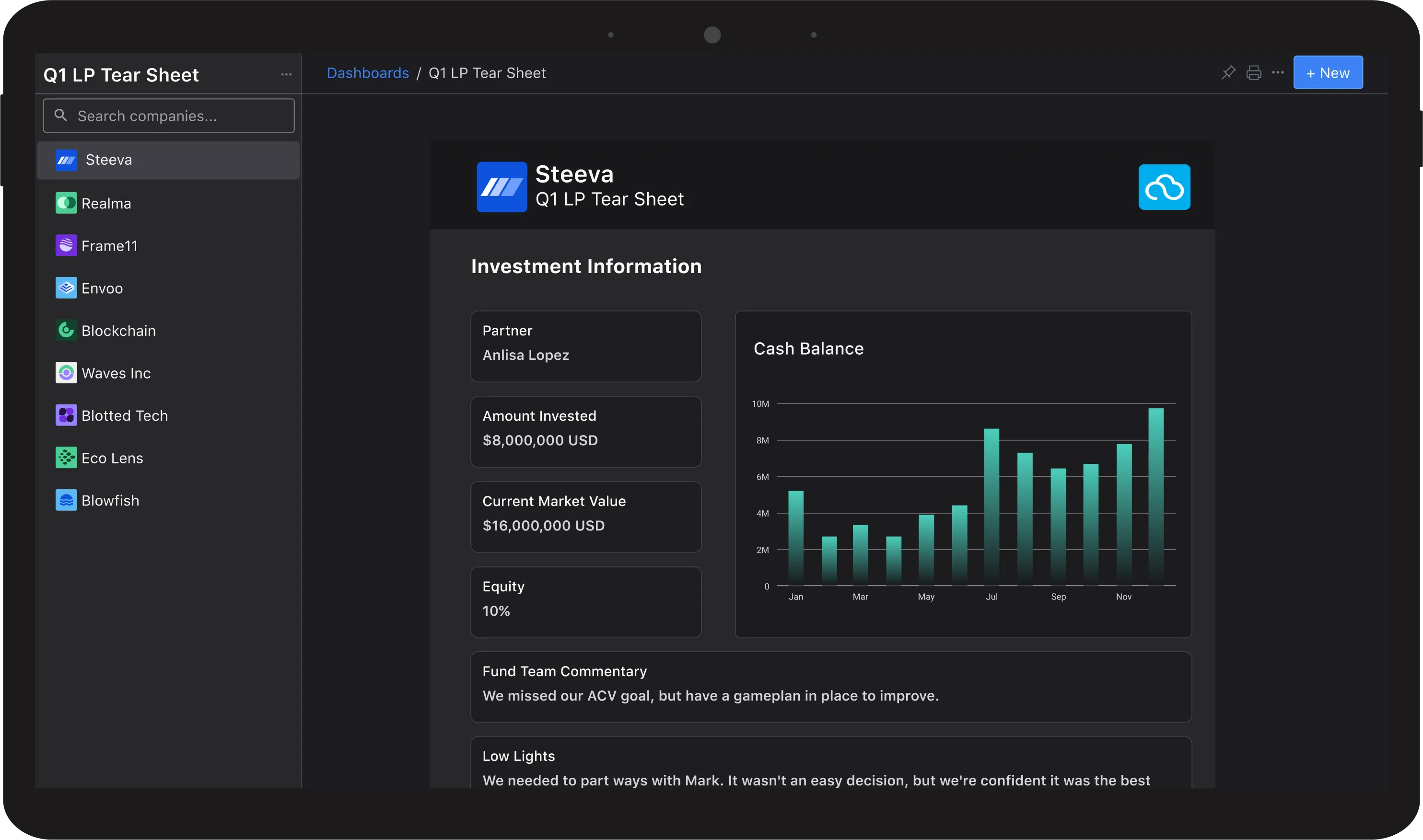

The best management reporting software typically offers customizable dashboards, integration with financial systems, and clear KPI tracking. For small companies, these features support both day-to-day operations and long-term strategy. Management reporting software for small business use cases is especially valuable for early-stage ventures preparing to raise capital.

For example, a founder tracking monthly recurring revenue or customer acquisition cost can easily present metrics that resonate with investors. By aligning management reports with investor expectations, businesses build trust and credibility.

Report Management for Strategic Insights

Report management is about more than producing documents — it is about centralizing data and making it actionable. With strong report management practices, companies can analyze trends, identify risks, and highlight opportunities before year-end reporting.

Investors benefit too, as standardized reporting across portfolio companies helps them spot industry patterns and make more informed funding decisions.

Financial Reporting Software: The Backbone of Investor Confidence

Financial reporting software plays a crucial role in investor relations. By automating reports, businesses reduce errors and improve credibility. For investors, consistent reporting ensures better comparisons across portfolio companies and stronger decision-making.

Financial Reporting Software Examples

Common financial reporting software examples include tools that generate profit and loss statements, balance sheets, and cash flow reports. Some solutions also allow forecasting, which helps investors and founders plan for the future with more confidence.

For instance, being able to quickly run a forecast on future cash flow can help founders decide when to seek additional funding or when to invest in expansion.

Financial Reporting Tools Excel and Beyond

Many businesses start with financial reporting tools Excel templates. While Excel remains a familiar option, it can become limiting as businesses grow. Transitioning to more advanced platforms ensures scalability, collaboration, and reduced manual effort.

Investors may expect businesses to move beyond Excel once operations scale, as manual spreadsheets carry higher risks of error and lack the automation needed for timely insights.

Financial Reporting Tools List

When evaluating options, small businesses should create a financial reporting tools list to compare features like automation, user-friendliness, and integration. A clear comparison helps in selecting the right tool for long-term growth.

This evaluation also ensures that businesses choose software aligned with their reporting needs instead of overinvesting in features they will not use.

Ranking the Top Financial Reporting Software Tools

Finding the right solution means balancing functionality with affordability. The top financial reporting software typically offers automation, compliance support, and scalability. For small businesses and investors alike, referencing independent comparisons of the top 10 reporting tools can help narrow down the choices.

Rather than focusing only on price, companies should consider long-term scalability, integration with accounting systems, and ease of use. These factors ensure that the chosen software will continue to serve their needs as the business expands.

Finding the Best Fit for Your Business

Whether you are a small business preparing your first annual report or an investor reviewing portfolio performance, annual report preparation software and related financial tools provide efficiency, accuracy, and transparency. By exploring free options, management reporting software, and comprehensive financial reporting software, businesses can find solutions that meet their needs today while preparing for future growth.

The best annual report preparation software, combined with strong report management and financial reporting software, ensures that both businesses and investors can make confident, data-driven decisions. Expanding beyond traditional spreadsheets and adopting modern financial tools allows organizations to reduce errors, save time, and focus on strategic priorities. For investors, this level of organization signals maturity and builds trust in the companies they support.

For businesses considering their next steps, the most effective approach is to start small with free or affordable tools, then expand to more advanced solutions as reporting needs become more complex. This staged adoption allows companies to remain agile while still building reliable reporting practices. Over time, these investments in structured reporting contribute directly to improved investor relations, smoother fundraising rounds, and stronger financial sustainability.