Key Takeaways

-

Discover how AI portfolio management software helps venture capital investors automate reporting, track performance, and make smarter, data-driven investment decisions.

-

Learn why modern investors are adopting AI portfolio management apps to save time, reduce manual errors, and uncover predictive insights across multiple startup holdings.

-

Explore free and professional options for AI portfolio analysis tools, including how to test automation features before scaling to enterprise-level use.

-

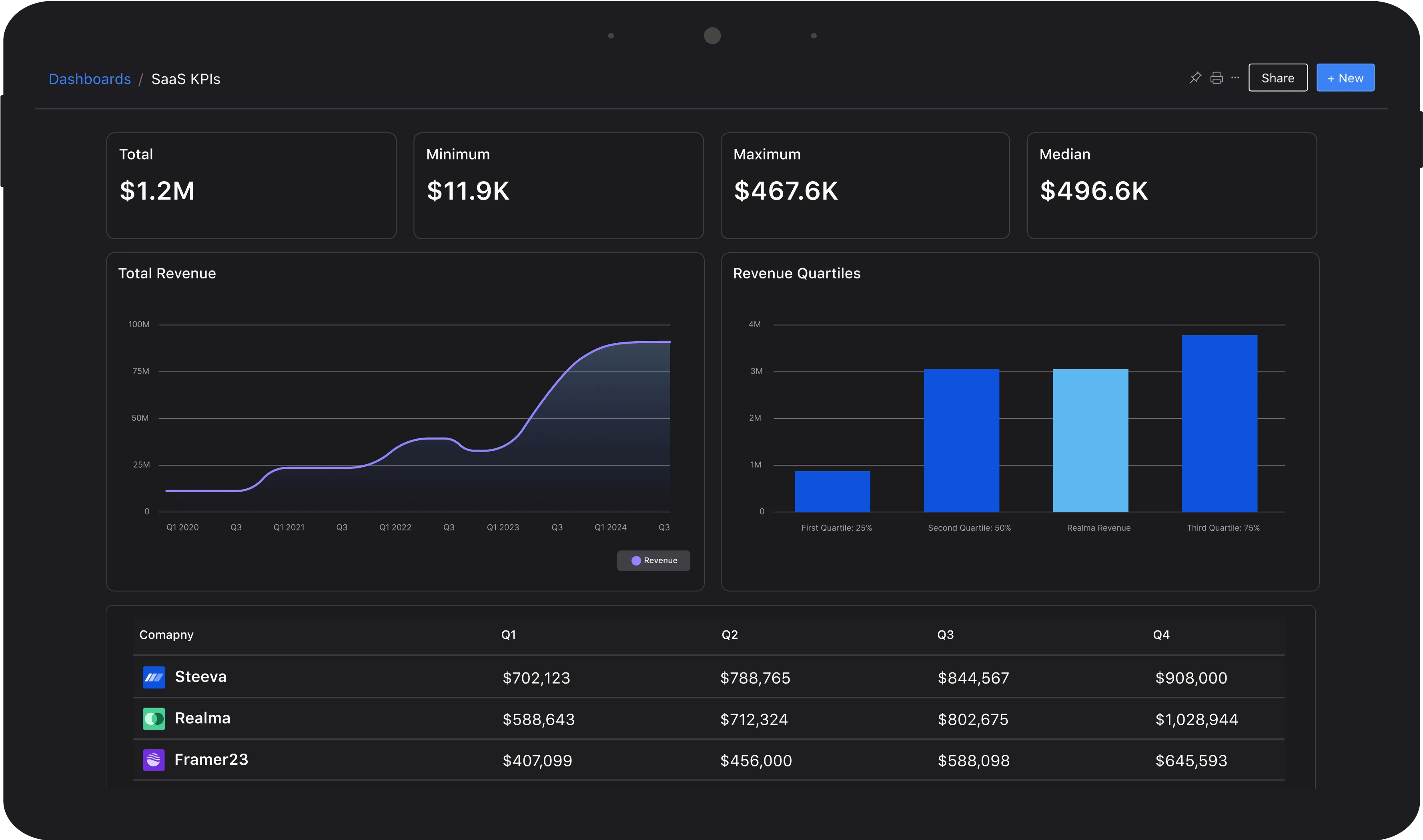

Understand the key features of the best AI portfolio management software, from real-time dashboards to machine learning forecasts that optimize fund performance.

-

Gain actionable steps to implement AI tools securely and effectively, improving portfolio visibility, investor relations, and long-term capital strategy.

Understanding AI Portfolio Management Software

Artificial intelligence (AI) is transforming the way investors manage and analyze their portfolios. AI portfolio management software brings automation, predictive analytics, and real-time insights to investment decisions, capabilities that were once reserved for large financial institutions. Today, even early-stage venture capital investors can leverage these tools to track fund performance, identify risk exposure, and optimize asset allocation.

For those just exploring options, many versions of AI portfolio management software free or lightweight AI portfolio management app tools, offer an accessible entry point to understanding how AI can enhance portfolio visibility. These entry-level versions provide a foundation for learning how algorithms interpret financial data, helping investors better understand their holdings before scaling up to paid or enterprise-grade systems. The flexibility and accessibility of these tools make them a low-risk starting point for investors curious about modernizing their workflow.

Why AI Portfolio Management Software Matters for Venture Capital Investors

Venture investors deal with complex data sets across multiple startups and sectors. AI portfolio management software helps reduce manual data entry and enables a deeper understanding of performance trends. These systems utilize machine learning to identify inefficiencies, recommend rebalancing, and forecast potential returns.

When exploring the best AI portfolio management software, many investors turn to discussions on AI portfolio management Reddit to learn from other professionals’ experiences. Similarly, comparisons between the best AI portfolio manager tools help investors choose platforms that fit their strategy and scale. For venture capitalists managing portfolios with dozens of early-stage companies, these tools can quickly identify which investments are trending positively and which might require more strategic involvement or follow-on funding.

AI doesn’t just provide clarity, it adds speed and scale. What once required hours of manual data manipulation can now be done in minutes. This shift allows investors to spend more time on strategic decisions, such as sourcing new opportunities, building stronger relationships with founders, or refining investment theses based on data-driven insights.

Core Features That Set AI Portfolio Management Tools Apart

AI tools go beyond spreadsheets by providing advanced analytics. Predictive modeling, sentiment analysis, and automated alerts enable investors to stay ahead of changes that may impact their holdings. By continuously learning from new data inputs, AI algorithms become more accurate over time, improving forecasts for future portfolio performance.

Some investors experiment with AI portfolio analysis free tools or trial versions to test capabilities before committing. Conversations on AI portfolio analysis free Reddit often mention the value of automation in identifying underperforming assets. For those evaluating options, some platforms even offer AI portfolio management software free download options to explore features firsthand. Investors can start small, gain familiarity, and then scale into more complex systems that support greater customization and integration across data sources.

Choosing the Best AI Portfolio Management App

Selecting the best AI portfolio management app depends on usability, analytical depth, and integration with existing workflows. For venture capital investors, tools that allow customized dashboards, scenario modeling, and team collaboration deliver the most value. A well-designed AI system should not only visualize performance metrics but also provide actionable insights that can be easily shared across a partnership.

Investors testing the best AI portfolio management software free versions can assess accuracy, reporting, and interface design before upgrading. Even a best AI portfolio manager free trial can reveal how automation improves decision-making efficiency. Ease of use is critical, AI should simplify, not complicate, the investment process. A strong app experience ensures that even teams without deep technical backgrounds can extract meaningful insights from the data.

Free Tools and Resources for Smarter Portfolio Analysis

Free tools can be a great starting point for investors curious about AI-driven insights. A free portfolio analysis tool or the best free portfolio analyzer helps investors identify portfolio strengths and weaknesses at no cost. These tools often provide a simplified version of more advanced analytics, enabling users to experiment with features such as risk assessment or performance benchmarking.

Online discussions on AI portfolio management software free reddit often highlight that while AI portfolio management software free versions are valuable for testing, professional-grade tools offer more robust data integrations and deeper analytics, both critical for venture-scale investing. As investors grow more comfortable with AI systems, they can transition from simple evaluations to more comprehensive portfolio visualization and prediction models.

How AI Supports Financial Advisors and Analysts

Beyond portfolio monitoring, AI also supports advisors, analysts, and fund managers. The best ai tools for financial advisors streamline performance reporting, reduce human error, and uncover data-driven insights that enhance client communication. These systems allow advisors to personalize reporting and tailor their recommendations to each client’s specific risk tolerance and long-term goals.

Using an advanced portfolio visualizer, advisors can model different scenarios, track sector exposure, and align investment strategies with fund goals. This level of automation gives professionals more time to focus on strategy instead of administration. Over time, AI systems learn from an advisor’s past decisions, helping surface smarter suggestions based on prior success patterns or market behavior.

Getting Started with AI Portfolio Management

Adopting AI doesn’t require a complete overhaul. Start by identifying your portfolio’s key performance metrics and syncing them into an AI portfolio management app or AI portfolio management software. Over time, investors can expand capabilities, adding forecasting tools, benchmark comparisons, and automated reporting. Successful implementation often starts small, focusing on a single use case before scaling.

Testing with a best AI portfolio manager or trial app allows investors to gradually build confidence in data-driven investing before scaling their usage. The key is consistency, feeding accurate, up-to-date data into the system ensures that machine learning algorithms continue to refine their accuracy and predictive capabilities. Many investors find that once the initial learning curve is overcome, AI becomes a seamless part of their investment process, quietly improving efficiency and decision quality in the background.

Implementation Best Practices and Data Security Considerations

When adopting AI portfolio management systems, investors should pay close attention to data privacy and governance. These tools rely on sensitive financial data, so maintaining secure integrations and access permissions is essential. Regular audits, encryption, and secure APIs protect portfolio data from potential breaches.

Another important step involves aligning the software with your firm’s existing tech stack. Seamless integration with accounting, CRM, and analytics platforms ensures that the AI engine has access to the most complete data possible. For venture investors, this integration can lead to clearer fund-level insights and more accurate reporting to limited partners. Over time, these integrations allow teams to compare real-time data with historical benchmarks, making it easier to spot emerging patterns that could affect long-term portfolio health.

Customization and Long-Term Scalability

Not all investors operate the same way, and the best AI portfolio management app will adapt to the specific needs of each fund. Some prefer a minimalist dashboard showing top-performing investments, while others require detailed, metric-driven reports with drill-down capabilities. Customization ensures the system aligns with an investor’s workflow and provides insights that are both relevant and actionable.

Scalability is equally important. As portfolios grow, AI tools should handle larger datasets, integrate more APIs, and continue to perform efficiently. Choosing a platform that supports modular upgrades ensures that the technology evolves with your investment practice rather than becoming obsolete as data demands increase. As AI becomes embedded in more financial tools, investors will be able to seamlessly connect their portfolio software to broader ecosystems, from data visualization platforms to capital-raising CRMs.

The Future of AI-Driven Portfolio Management

The future of portfolio management will be shaped by continuous learning and automation. As AI models improve, investors will gain more predictive insight into risk, diversification, and long-term performance. These systems are already evolving to include natural language processing, which allows investors to query portfolio data conversationally and receive instant answers.

From best AI portfolio management app tools that automate reporting to powerful best AI portfolio manager systems that forecast market trends, technology is making smarter investing more accessible. AI portfolio management software isn’t just a convenience; it’s becoming a competitive advantage for venture investors who want to make faster, more informed decisions. As AI continues to evolve, those who integrate these systems early will gain a significant edge in efficiency, transparency, and performance management. Investors who adopt data-driven tools today are positioning themselves for long-term success in an increasingly analytical and fast-paced market.

Frequently Asked Questions

What is AI portfolio management software and how does it work?

AI portfolio management software uses machine learning and automation to analyze investments, track performance, and suggest data-driven decisions. It continuously learns from financial and market data, helping investors identify trends, forecast returns, and optimize asset allocation across multiple companies or funds.

How can AI portfolio management software benefit venture capital investors?

Venture capital investors use AI portfolio management software to simplify reporting, monitor portfolio performance in real time, and uncover insights that drive better investment decisions. It reduces manual data entry, highlights risk exposure, and improves transparency when communicating performance to partners or limited partners.

Is there free AI portfolio management software available for testing?

Yes. Many platforms offer AI portfolio management software free versions or trial options that allow investors to test features like performance tracking and portfolio analysis. While free versions are ideal for experimentation, professional tools provide deeper analytics and integrations essential for managing larger venture portfolios.

What features should investors look for in the best AI portfolio management app?

Investors should look for customization, predictive analytics, and seamless integration with other financial tools. The best AI portfolio management app provides real-time dashboards, automated alerts, and data visualization that simplify decision-making while scaling efficiently as a portfolio or fund grows.

How does AI improve portfolio analysis compared to traditional tools?

AI-driven analysis goes beyond static spreadsheets. AI portfolio management software processes data continuously, detects performance patterns, and provides predictive insights about future outcomes. This helps investors move from reactive to proactive decision-making and enables more accurate forecasting of portfolio growth or risk.

Are AI portfolio management tools secure for financial data?

Yes, most AI portfolio management software includes strong security measures such as encryption, access controls, and API-level safeguards. However, investors should verify compliance with data protection standards and ensure integrations with existing systems are properly secured to maintain confidentiality and accuracy in reporting.