Key Takeaways

-

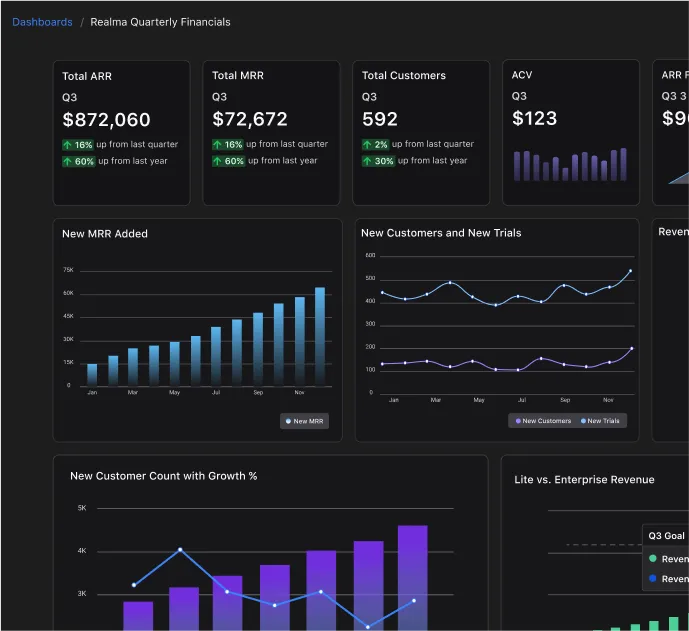

AI fundraising tools are transforming venture capital fundraising by helping founders automate investor research, streamline outreach, and improve decision-making, so you can spend less time on admin and more time building momentum.

-

Learn how AI supports the highest-leverage parts of fundraising, including identifying the right investors, optimizing pitch materials, and turning scattered insights into a clearer fundraising strategy for VC-backed startups.

-

Get a practical breakdown of AI-powered fundraising letters and templates, including what to include in a strong message and how to tailor outreach to investor interests without losing your voice.

-

Discover how to choose the right AI fundraising tool by prioritizing workflow fit, customization, and data-informed recommendations that improve investor targeting and engagement. screencapture-visible-vc-blog-a…

-

Understand how investors are using AI for deal sourcing, due diligence, and portfolio decision-making, so you can better align your pitch with what venture capital firms are paying attention to right now and what is coming next.

How AI Fundraising Tools are Transforming Venture Capital

Artificial intelligence (AI) is reshaping venture capital (VC) fundraising. Founders today have access to AI-driven tools that can enhance investor outreach, automate tedious tasks, and improve decision-making. Whether it's crafting a compelling fundraising letter, identifying the right investors, or streamlining pitch materials, AI is changing how startups secure capital.

Below, we’ll explore how AI fundraising tools can help founders of VC-backed startups raise capital more efficiently. We’ll also share insights on the best AI tools for venture capital, including free options, templates, and examples to maximize fundraising success.

The Role of AI in Venture Capital Fundraising

AI is becoming an indispensable asset in the fundraising process. It helps founders identify and connect with investors, generate data-driven insights, and optimize their pitches. AI for venture capital is not just about automation—it’s about intelligence, providing founders with strategic recommendations to improve their fundraising outcomes.

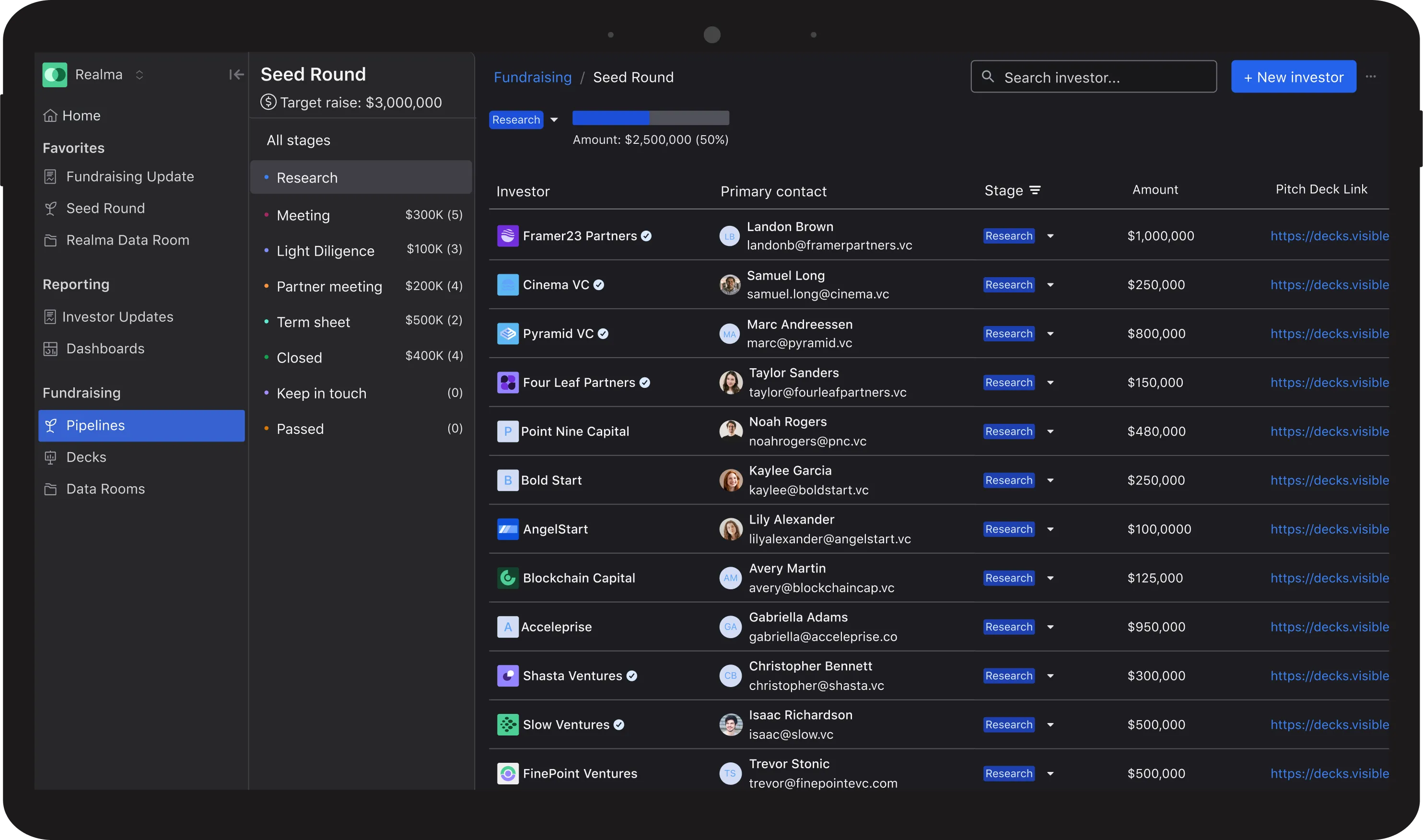

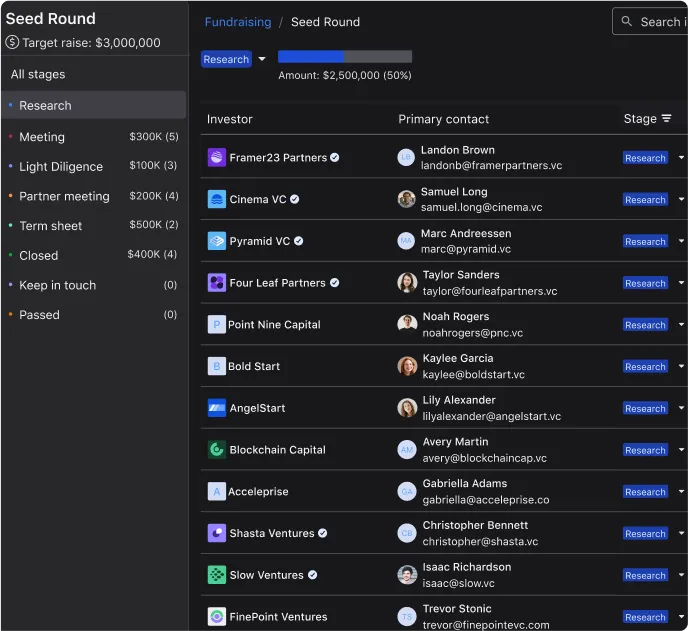

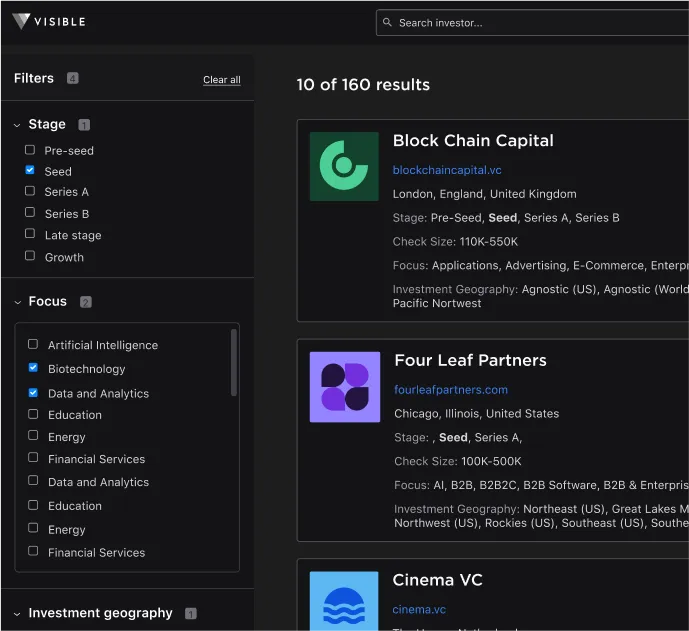

AI tools analyze investor data to match founders with the most relevant VCs. They streamline investor research, helping founders tailor pitches effectively. AI enhances pitch decks and fundraising letters for maximum impact. AI tools also provide insights into investor engagement, helping founders refine their approach. AI fundraising tools for VC-backed startups are now essential for optimizing the fundraising journey, making it easier for founders to reach the right investors with the right message.

Key Benefits of Using AI for Fundraising

AI fundraising tools bring efficiency, accuracy, and strategic insights to the capital-raising process. AI automates research and investor outreach, allowing founders to focus on growth. AI tailors fundraising letters based on investor preferences and past investments. AI analyzes fundraising trends to help founders refine their pitch strategies. AI tools allow startups to manage fundraising at scale, ensuring no investor opportunity is missed. By leveraging the best AI fundraising tools, founders can improve investor relations and secure funding more effectively.

AI-Powered Fundraising Letters and Templates

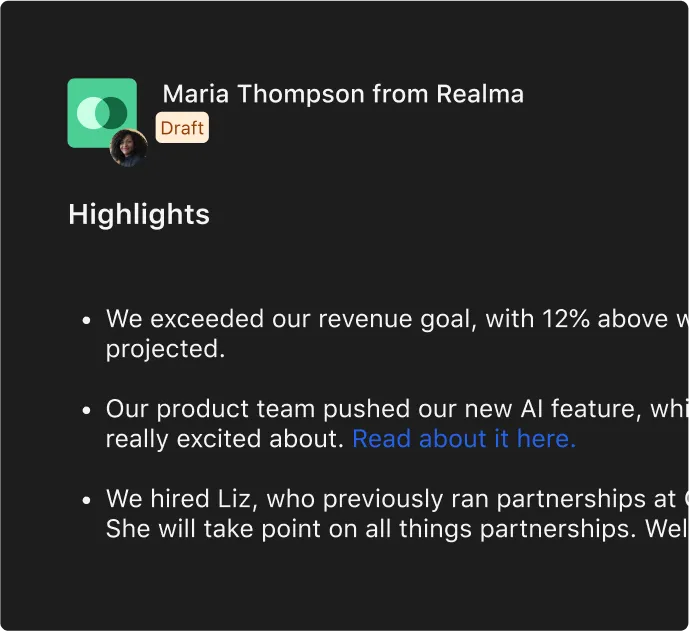

What is an AI fundraising letter? AI fundraising letters are automatically generated emails or proposals designed to engage potential investors. AI can craft persuasive messages by analyzing successful fundraising campaigns and investor preferences. Founders using AI fundraising tools can save significant time while increasing the effectiveness of their investor outreach. One idea to consider is leveraging templates for AI fundraising letters to save time. A well-structured AI fundraising letter typically includes a compelling subject line to capture investor attention, a personalized introduction addressing the investor’s interests, a clear value proposition highlighting the startup’s market opportunity, traction and metrics to build credibility, and a strong call to action encouraging further discussion. AI fundraising letter examples provide founders with structured guidelines to refine their outreach. AI fundraising letter templates and AI fundraising letter PDFs make it easier to craft investor communications quickly while maintaining personalization and professionalism.

The Best AI Fundraising Tools for VC-Backed Startups

AI Fundraising Tools

AI fundraising tools cover various functions, from investor research to automated outreach and analytics. Some AI tools assist with writing compelling fundraising letters, while others focus on identifying high-potential investors. Founders can use AI fundraising tools for VC free to gain insights into market trends, investor engagement, and deal sourcing. AI fundraising tools for VC free PDF resources provide structured templates and guides to help streamline the fundraising process.

Free AI Fundraising Tools for Startups

Many AI tools offer free versions, enabling founders to leverage AI without upfront costs. Some AI fundraising tools for VC are available for free download, including AI fundraising tools free PDFs that help structure outreach campaigns. Free AI fundraising tools can be found through AI-powered investor databases with free trial access, open-source AI fundraising tools lists featuring top-rated resources, and AI fundraising tools for VC Reddit threads with user recommendations. These resources help founders access best AI fundraising tools for VC free without needing a large budget.

How to Choose the Right AI Fundraising Tool

When selecting an AI fundraising tool, founders should consider ease of use, ensuring the tool integrates seamlessly with their existing workflow. Customization options allow for tailored investor outreach. Cost-effectiveness is also important, with many tools offering free or affordable options. Data-driven insights should be a priority to ensure the AI provides actionable fundraising recommendations. By exploring the best AI fundraising tools list for free, founders can identify the right AI solution for their fundraising needs.

AI for Venture Capital: How Investors Are Using AI

AI is not only transforming fundraising for founders but also changing how investors operate. Venture capitalists use AI for deal sourcing by scanning market trends and startup data to identify investment opportunities. AI-powered research speeds up the investor decision-making process during due diligence. AI also tracks startup performance and provides actionable insights for portfolio management. Founders should understand how investors use AI for venture capital review to better align their pitches with investor expectations. The best AI tools for venture capital provide data-driven strategies that help investors make informed decisions.

The Future of AI in Fundraising

AI’s role in fundraising is only set to grow, with new advancements in generative AI for venture capital shaping the industry. Enhanced AI personalization will lead to more tailored investor interactions. AI-powered financial modeling will help founders forecast fundraising needs. Integration with smart contracts will streamline investment transactions. The development of fundraising AI tools continues to improve accuracy and efficiency in fundraising campaigns. Additionally, fundraising AI certification programs are emerging to help professionals and founders understand how to implement AI effectively in fundraising.

Many founders and investors are now turning to fundraising AI podcasts to stay updated on AI-driven strategies, case studies, and emerging technologies. The demand for AI-driven fundraising solutions is growing, and fundraising AI reviews show that AI-powered tools are helping startups raise capital more efficiently than ever before. Fundraising AI examples highlight how AI has helped businesses refine their investor outreach, optimize fundraising campaigns, and secure capital at a faster rate. AI fundraising tools are revolutionizing how founders approach fundraising. By leveraging AI-powered insights, automation, and investor targeting, founders can save time, improve investor engagement, and optimize their fundraising strategies.

To take the next step, founders should explore AI fundraising tools for VC-backed startups, utilize AI-powered fundraising letter templates and examples, and stay informed on AI for venture capital trends. Founders who embrace AI will have a strategic advantage in today’s competitive fundraising landscape. As AI technology advances, tools will become even more powerful, offering founders deeper insights and more refined strategies for securing venture capital investment.

Frequently Asked Questions

What are AI fundraising tools for startups?

AI fundraising tools are software platforms that use automation and machine learning to support venture capital fundraising tasks like investor research, CRM hygiene, outreach drafting, pitch deck feedback, and follow-ups. For founders, they reduce manual work and help you run a more consistent, data-informed fundraising process.

Can AI fundraising tools write effective investor outreach emails?

AI fundraising tools can draft strong first-pass outreach emails, follow-ups, and short blurbs, but the best results come from founder-led personalization. Use AI to structure the message, tighten clarity, and tailor angles to an investor’s thesis, then add specific proof points like traction, metrics, and a clear ask.

Are AI fundraising tools safe to use with pitch decks and sensitive data?

AI fundraising tools can be safe, but it depends on the product’s data handling, permissions, and training policies. Limit what you paste into generic chat tools, prefer platforms with clear privacy terms and enterprise controls, and keep your data room access tightly permissioned. Treat AI as assistance, not a vault.

What is the best AI fundraising tool for VC-backed founders?

The best AI fundraising tool is the one that fits your workflow and stage. Early-stage founders often need investor discovery, outreach support, and a lightweight CRM. Later-stage teams prioritize pipeline reporting, stakeholder visibility, and collaboration. Evaluate tools based on accuracy of data, customization, and how well they integrate with your fundraising stack.

Do venture capital firms use AI fundraising tools too?

Yes, many venture capital firms use AI-powered tools for sourcing, triage, research, and due diligence. That means founders benefit from clear positioning and fast readability, including a crisp narrative, consistent metrics, and an obvious “why now.” AI can help you present information in a way that matches how investors process deals.

How should founders evaluate ROI from AI fundraising tools?

Founders should evaluate AI fundraising tools by measuring time saved and improvements in pipeline quality, not just email volume. Track metrics like qualified intro-to-meeting conversion, response rates by investor segment, follow-up consistency, and how quickly you iterate your narrative. The best ROI shows up as faster learning and better targeting.