What is IRR in the Context of Venture Capital

Internal rate of return (IRR) for VCs is the expected annualized return a fund will generate based on a series of cash flows over the duration of the fund, which is typically ten years. Unlike fund metrics such as RVPI, TVPI, and DPI which are based on multiples, IRR takes into account the time value of money. IRR can be used to measure both fund performance and the performance of an individual investment.

Related Resource → VC Fund Metrics 101

What makes IRR hard to predict in a fund context is cash flows happen at irregular periods because capital calls are made by funds on an as-needed basis. As an example, a fund calls capital only after the investment committee concludes their diligence in a startup company and is ready to actually invest. This is because funds don’t need all the capital from their limited partners at once and it actually helps a fund improve their IRR to call capital only when needed. When funds have too much cash on their balance sheet it hurts returns and is known as a “cash drag”.

How is IRR used by LPs

IRR is used by LPs in Venture Capital to benchmark a fund’s performance against relevant peer goups. LPs will take into account the time since the initial cash outflow of a fund and compare it against the timeline of similar funds in the same asset class.

Cambridge Associates publishes quarterly benchmarks and statistics compiling data from 2,300 fund managers and their over 9,400 funds. You can check out their reports here on the Cambridge Associates website.

Defining VC Fund Cash Flows

Since IRR is largely based on timing of cash flows it’s important to understand how cash flows are defined for a VC fund. Below you can find the definition of cash flows from the perspective of the LPs. An outflow is when LP gives money to the VC fund and an inflow is when capital is returned to LPs. Returning funds sooner and calling capital later can have a huge impact on the fund’s IRR.

Cash Outflow Examples

- Capital Calls – the money funds request from LPs on an as needed basis to invest in companies

- Fees – the most common is the fund management fee which is paid annually and covers GP compensation and can cover things like salaries, insurance, and travel. (Read more about different types of VC fees)

- Expenses – Fund expenses can include items such as ongoing administrative and legal expenses and the VC’s tech stack.

Cash Inflows Examples

- Distributions – the value of the cash and stock that the fund has given back (distributed) to the LPs usually after a liquidity event (when a portfolio company exits the VC portfolio through an acquisition, merger, or IPO).

- Distributions are typically low early in a fund’s life, ramping up over time as investments are exited.

- It’s important to note that IRR models can include interim returns which are just assumptions (best guesses) of when a return will be made to an LP. However, these assumptions are often incorrect and therefore can put the reliability of IRR projections into question. (Read more about interim vs final returns at the bottom of this article)

Gross vs Net IRR and Unrealized vs Realized IRR

There are several ways to evaluate IRR to get a comprehensive understanding of a fund’s performance. When reporting IRR to your LPs, it’s important to clarify how you’re defining IRR.

Gross IRR vs Net IRR

The difference between Gross and Net IRR is that the latter value is the annualized return after the deduction of management fees, fund expenses, and/or carried interest. Typically fees for a VC fund include a management fee which is usually 2% of the assets in the fund in addition to 20% of any of the profits.

Unrealized vs Realized IRR

Unrealized IRR is often opportunistic and for that reason can be incorrect. Unrealized IRR includes actual profits as well as theoretical profits based on private market valuation estimates. On the flip side, realized IRR includes only the actual cash flows that have been passed through to investors, also known as final returns.

Want to learn more about tracking key fund metrics in Visible?

How is IRR Calculated for Venture Capital Funds

Wrapping your head around the IRR formula can quickly put your brain in a pretzel so it’s recommended to use Excel, Google Sheets, or a platform like Visible.vc to calculate IRR.

In the IRR equation below, we’re solving for the discount rate (or the expected compound annual rate of return) that makes the net present value of an investment zero.

IRR is calculated by solving for the rate of return (“r”) of a series of cashflows (“C”) over a period of time (“n” to the total number of periods “N”):

Check out this article for an example calculation of IRR within the fund context.

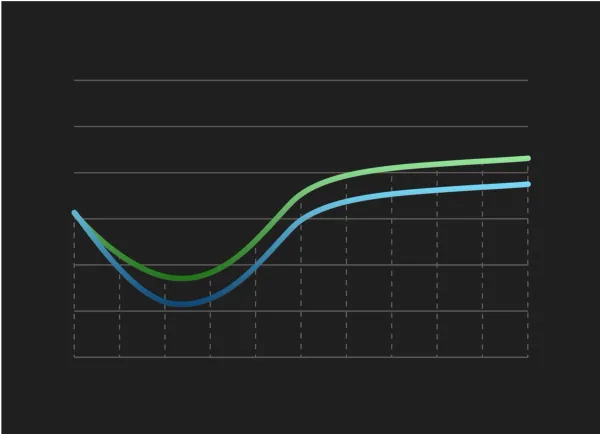

The IRR J-CURVE

The IRR of funds typically follow what is called a J-Curve because of the shape IRR takes when it’s mapped on a timeline. For most funds, IRR declines in the first couple of years because that’s when initial cash outflows (investments and expenses) are made. Then, as time progresses and initial investments liquidate through exits or IPO’s, the cash inflows increase. Returning funds sooner and calling capital later can have a huge impact on the fund’s IRR. (Read more in the J-Curve and IRR).

Putting IRR in Vintage Context

It’s important to also consider a fund’s IRR in the context of its vintage, also known as the first year the fund started deploying capital. The reason is that a negative IRR is expected within the first 4-5 years of fund’s existence so it’s not that meaningful of a metric. It’s important to remember that IRR becomes more meaningful as a fund matures. Only when a fund matures and real return values are available is the unrealized IRR (comprised of best guesses) put to the test.

Concluding Thoughts

IRR is an important metric used by VCs and LPs to evaluate fund performance and benchmark it against other funds in the same peer group. Unlike other fund performance metrics based on multiples, IRR takes into account the time value of money which makes it both a useful indicator of performance and also challenging to calculate on your own. IRR is most meaningful once a fund has existed for 4-5 years.

Tracking IRR in Visible

Visible lets you track and visualize over 35+ key fund metrics including IRR in one place. Get started with calculating your IRR by leveraging Visible's investment data features. Track the round details for your direct investments and follow on rounds.