Key Takeaways

-

Get a clear, data-informed overview of how to raise venture capital in San Francisco, one of the world’s most competitive and opportunity-rich startup ecosystems.

-

Learn how to build a focused investor pipeline by matching San Francisco VC firms to your stage, sector, traction, and fundraising strategy.

-

Understand what top Bay Area investors look for in a pitch so you can stand out in a market shaped by AI, developer tools, and founder-led innovation.

-

Navigate the full landscape of San Francisco accelerators, incubators, studios, and founder communities to strengthen your network and secure warm introductions.

-

Anticipate the unique challenges of fundraising in San Francisco and use actionable strategies to differentiate your story, minimize signal risk, and run a structured, high-signal process.

Raising venture capital in San Francisco means stepping into one of the world's densest startup ecosystems.

Within a few square miles, you’ll find multistage firms that can back you from pre‑seed through IPO, specialist funds focused on AI or fintech, active angels, and accelerators that have launched many of today’s category leaders. For a founder, that’s both the upside and the challenge: almost everyone you might need is here, but so is everyone else.

If you’re building in or around the Bay Area, success isn’t about “meeting SF investors” in the abstract. It’s about:

- Knowing which firms actually fit your stage, sector, and check size

- Understanding what specific partners look for in a pitch

- And running a structured, trackable process instead of a scattershot set of conversations

This article will be a practical guide for founders raising capital in San Francisco today.

You’ll find:

- Detailed profiles of key Bay Area–connected firms, including their focus areas, typical check sizes, ideal founder profiles, and what they look for in a pitch.

- Key resources to help you navigate this complex landscape

The goal isn’t just to show you who the major players are; it’s to help you turn San Francisco’s investor landscape into a focused, actionable pipeline for your next raise.

Top San Francisco Venture Capital Firms Actively Investing

1. Accel

As put by their team, “Accel is a leading venture capital firm that invests in people and their companies from the earliest days through all phases of private company growth.”

Focus and industry: Accel is industry agnostic

Funding stage: Accel invests across many stages — from pre-seed to series B and beyond

Accel is synonymous with venture capital in San Francisco. Accel was founded in 1983 and has since funded 1,500+ companies. They have funds across the globe and invest in founders across many geographies, industries, and stages. Some of their most popular investments include:

- Slack

- Spotify

Location: Palo Alto, CA

2. Greylock Partners

As put by their team, “At Greylock, our mission is to help realize rare potential. To do this well, we believe it’s essential to be trusted partners to entrepreneurs at every stage — from idea to IPO.

The entrepreneurs we back have the vision to build something huge that hasn’t existed before. They are paranoid about what could go wrong — but are obsessed with what can go right. They are mission-driven, intellectually honest and infinite learners. They have raw ambition, bravery, and grit. They don’t give up, ever. And they are unique in their ability to lead and inspire others to join their journey.”

Focus and industry: Greylock is focused on enterprise, consumer, and crypto software

Related Resource: FinTech Venture Capital Investors to Know

Funding stage: Greylock invest from pre-seed to series B and beyond

As put by their team, “We focus on enterprise, consumer, and crypto software at Seed and Series A, and also make new company investments in Series B and beyond. We support entrepreneurs throughout their journey from idea to IPO and onwards.” Some of their most popular investments include:

- Airbnb

- Figma

Location: Menlo Park, CA

3. Menlo Ventures

As put by their team, “Genuinely, actively invested. Invested in your success, but also your struggles. Your questions, your concerns, your highs, your lows. We don’t just invest our dollars, we invest our dedication, our drive. Our tested advice and trusted support. That’s because, when we find an idea we believe in, we’re all engaged. When we’re in, we’re ALL IN.”

Focus and industry: Menlo Ventures focuses on the following industries:

- Consumer

- Cloud Infrastructure

- Cybersecurity

- Fintech

- Healthcare

- SaaS

- Supply Chain and Automation

Related Resource: 15 Cybersecurity VCs You Should Know

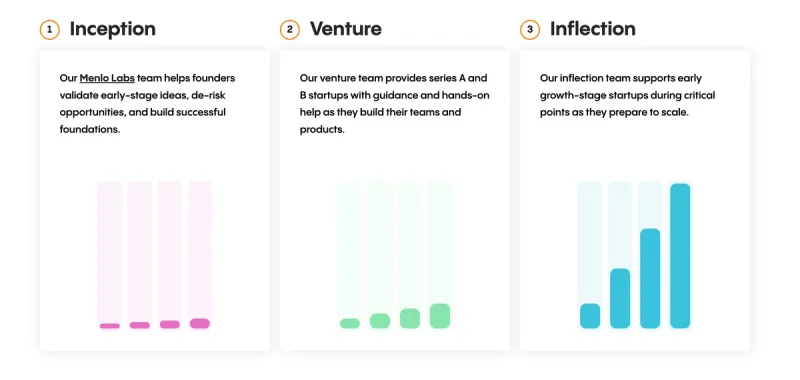

Funding stage: Menlo Ventures across stages from inception to series B and beyond

As put by their team, “We are investors and company builders—we know what it takes to turn a budding idea into a scalable business. We work with early-stage founders to find product-market fit, develop go-to-market strategies, scale their organizations, and support them as they grow.” Some of their most popular investments include:

- Affinity

- Minted

- Roku

Location: Menlo Park, CA

4. Spark Capital

As put by their team, “We are Spark Capital, investors in products we love by creators we admire, including Affirm, Carta, Cruise, Discord, Oculus, Plaid, Postmates, Slack, Twitter, and Wayfair. We know there are no playbooks or formulas for success and are here to help founders win their own way. We invest across all sectors and stages, and work out of San Francisco, Boston, and New York City.”

Focus and industry: Spark Capital invests across all industries

Funding stage: Spark Capital invests across all stages

Like many of the funds on this list, Spark Capital has been investing across all industries and all stages for decades. Some of their most popular investments include:

- Slack

- Affirm

Location: San Francisco – Boston – New York

Related Resource: The 12 Best VC Funds You Should Know About

5. Bessemer Venture Partners

As put by their team, “Bessemer Venture Partners is the world’s most experienced early-stage venture capital firm. With a portfolio of more than 200 companies, Bessemer helps visionary entrepreneurs lay strong foundations to create companies that matter, and supports them through every stage of their growth.”

Focus and industry: BVP invests across many industries

Funding stage: BVP invests in early-stage companies

BVP has become a leader in early-stage investments. They focus on companies across the globe and have backed some of the most famous companies to date. Some of their most popular investments include:

- Shopify

- Yelp

Location: San Francisco, CA

6. Altos Ventures

As put by their team, “Altos Ventures was founded in 1996, to exclusively address the needs of promising, young technology companies and entrepreneurs. Because of their focus on entrepreneurs – along with their network of co-investors, partners, and industry experts—they know how to build viable business models so companies can move on to the next stage of growth.”

Focus and industry: List the focus, industry, or types of companies this VC typically invests in.

Funding stage: Altos Ventures is focused on early-stage companies

Altos Ventures is a purpose-driven investment fund that is focused on the fundamentals. Some of their most popular investments include:

- Bench

- Outdoorsy

- Roblox

Location: Menlo Park, CA

7. Andreessen Horowitz

As put by their team, “Andreessen Horowitz was established in June 2009 by entrepreneurs and engineers Marc Andreessen and Ben Horowitz, based on their vision for a new, modern VC firm designed to support today’s entrepreneurs. Andreessen and Horowitz have a track record of investing in, building and scaling highly successful businesses.”

Focus and industry: Andreessen Horowitz invests across many industries, including:

- Bio + Health

- Cultural Leadership

- Consumer

- Crypto

- Enterprise

- Fintech

- Games

Related Resource: 15 Venture Capital Firms Investing in VR

Funding stage: Andreessen Horowitz invests across all stages.

As put by their team, “a16z is defined by respect for the entrepreneur and the company building process; we know what it’s like to be in the founder’s shoes. The firm is led by general partners, many of whom are former founders/operators, CEOs, or CTOs of successful technology companies, and who have domain expertise ranging from biology to crypto to distributed systems to security to marketplaces to financial services.” Some of their most popular investments include:

- Affirm

- Airbnb

- Coinbase

Location: Menlo Park, CA

8. Expa

As put by their team, “Expa is where the best startups find support and funding to scale. Collectively, we’ve launched dozens of companies, supported 50+ founders, and reached hundreds of millions of users. Our community of builders includes the founders and leaders of Uber, Virgin Galactic, Twitter, Current, and more.”

Focus and industry: Expa invests across many industries

Funding stage: Expa focuses on early-stage investments

As put by their team, “Expa was created by Uber co-founder Garrett Camp to support the next generation of founders. The partners at Expa are builders and operators themselves, who can provide founders with practical advice in product design, branding, engineering, operations, and recruiting.” Some of their most popular investments include:

- Aero

- Drip

- Radar

Location: San Francisco, CA

9. Benchmark Venture Capital

As put on their Visible Connect profile, “Benchmark Capital is focused on one, and only one, mission: to help talented entrepreneurs build great technology companies. That’s what drives them and everything they do – from how they organize their firm to their investment strategy.”

Focus and industry: Benchmark is focused on social, mobile, local, and cloud companies.

Funding stage: According to their Visible Connect profile, “Their investments range in size from as little as $100,000 to as much as $10 or $15 million. Typically, they invest $3 to $5 million initially and expect to invest $5 to $15 million over the life of a company.”

Benchmark has raised 6 funds that span 2 decades. Some of Benchmark’s most popular investments include:

- Asana

- Dropbox

- Zillow

Location: San Francisco, CA

10. First Round Venture Capital

As put by their team, “We’re focused on being the world’s best partner for founders at the very first stages of company creation — so we’ve designed the firm to do just that. When you work with First Round, you get super active partners (most of whom are former founders themselves) working side-by-side with you on your biggest and smallest challenges.”

Focus and industry: First Round invests across all industries

Funding stage: First Round likes to be the first check in a company, regardless of stage. As put by their team, “Typically, our initial investment in a startup ranges from $1 million to $5 million, but we’ve gone higher and lower in some cases. Currently, our average initial investment is right around $3 million.”

Some of First Round’s most popular investments include:

- Notion

- The Black Tux

- Uber

Location: San Francisco – New York – Philadelphia

11. Y Combinator

Y Combinator is synonymous with accelerators. As put by their team, “Y Combinator (YC) is a startup fund and program. Since 2005, YC has invested in nearly 3,000 companies including Airbnb, DoorDash, Stripe, Instacart, Dropbox, and Coinbase. The combined valuation of YC companies is over $300B. YC has programs and resources that support founders throughout the life of their company.”

Focus and industry: Y Combinator invests across all industries.

Funding stage: Y Combinator helps companies launch with a $500k check.

Since its inception in 2005, Y Combinator has been accredited for helping launch, fund, and grow some of the most prolific startups. Some of their most popular investments include:

- Airbnb

- DoorDash

- Stripe

Location: San Francisco, CA

Accelerators, Incubators, Studios, and Founder Communities In San Francisco

Founder-Focused Accelerators and Incubators

Accelerators remain a core part of the SF fundraising funnel, especially from pre-seed to seed. The right program can give you a first institutional check, structured feedback, and warm introductions to SF-based funds.

Some of the most relevant programs with a footprint in San Francisco and the broader Bay Area are:

- Y Combinator: Y Combinator runs its flagship accelerator program from the Bay Area and has helped launch companies like Airbnb, DoorDash, Stripe, and Coinbase. Typical details:

- Stage: Pre-seed and seed.

- Model: Batch-based, with a standard deal that includes a $500k investment via two instruments (one on standard terms and one MFN).

- Value: Intros to a wide network of SF and global VCs, weekly office hours, and a well-attended Demo Day.

- 500 Global: 500 Global has historic roots in San Francisco, having run accelerators and seed programs out of the city for more than a decade. Typical details:

- Stage: Pre-seed and seed.

- Model: Cohort-based accelerator programs that combine capital, mentorship, and a structured curriculum.

- Value: Strong network across U.S. and international markets, plus a long list of alumni who have raised from SF-based VCs.

- Alchemist Accelerator: an enterprise-focused accelerator that works with B2B startups and has a strong Bay Area presence. Typical details:

- Stage: Seed and early revenue B2B companies.

- Focus: Enterprise software, developer tools, industrial IoT, and infrastructure.

- Value: Deep connections into enterprise customers and B2B-focused investors, including many with SF offices.

- AngelPad: AngelPad is a seed-stage accelerator that has operated out of San Francisco and New York, focusing on software and internet startups. Typical details:

- Stage: Seed.

- Focus: SaaS, marketplaces, and software products.

- Value: Small cohorts, close partner time, and support in refining the product and go-to-market before a seed or Series A raise.

These are not the only options. Check out Visible’s Connect Investor Database for a filtered view of other accelerators and incubators that accept SF-based startups and run programs both in person and online.

Local Incubators, Studios, and Founder Communities

In addition to accelerators, several studios and incubators help form and grow companies that later raise from SF investors.

- Expa: Expa is a startup studio and early-stage fund founded by Garrett Camp, co-founder of Uber, with a San Francisco presence Expa.

- Model: Company creation and early investment, often partnering closely with founders on product, design, and operations.

- Focus: Broad tech focus, including consumer apps, fintech, and platforms.

- Relevance: Helpful if you are at idea or very early prototype stage and want to build alongside experienced operators.

- NFX: NFX, headquartered in San Francisco and Palo Alto, runs both a fund and a strong founder community with a focus on network-effect businesses.

- Model: Early-stage investment plus access to a network of founders and operators.

- Focus: Marketplaces, SaaS, fintech, games, and tools with strong network dynamics.

- Relevance: Useful for founders who want both capital and community feedback on product loops and growth.

- University-linked incubators While not all are strictly inside San Francisco city limits, SF founders often plug into:

- UC Berkeley SkyDeck, a startup accelerator and incubator run by UC Berkeley that accepts startups from across the region.

- Stanford StartX, a founder community for Stanford-affiliated entrepreneurs that connects to many SF-based investors.

The Fundraising Landscape in San Francisco

What Makes Fundraising In San Francisco Unique

The density of experienced founders and operators shapes fundraising in San Francisco. Many investors are former founders themselves, or they back repeat teams and hire operators as venture partners. This raises expectations on clarity and speed. San Francisco investors expect you to know your user, your market wedge, and your early metrics, and to communicate them without jargon or fluff.

The city’s tilt toward AI and developer-focused companies also shapes how investors think. Mapping tools and investor rankings highlight AI, infrastructure, and technical products as core themes for many San Francisco funds today. For founders building in these spaces, that can mean deeper technical conversations in partner meetings and more focus on defensibility, data, and long-term moats.

Another trait of the San Francisco market is the mix of formal and informal capital. Alongside established venture firms, there is an active layer of angels, operator-led micro funds, syndicates, and scout programs that often write the first institutional or institutional-like checks.

Many of these investors rely on referrals from founders, operators, and accelerator networks. For you as a founder, that means the quality of your network and warm introductions can matter as much as the strength of your deck.

In practice, raising in San Francisco rewards preparation and focus. Founders who do well here tend to build a tight investor list, understand which funds match their stage and sector, and use the local ecosystem of events, accelerators, and co-working spaces to get in front of the right partners.

Strengths Of The San Francisco Ecosystem

One strength of the San Francisco ecosystem is density. Mapping tools show hundreds of active investors with San Francisco offices or a clear focus on San Francisco deals, across seed, Series A, and growth. That means more chances to find a fund that fits your stage, sector, and style.

Talent is another factor. San Francisco remains a hub for engineers, designers, and product leaders, with many who have worked at fast-scaling startups or major tech companies. This is helpful both for building your team and for gaining credibility with investors who know these talent pools. It is especially true in AI, dev tools, and deep tech, where San Francisco and the broader Bay Area have a long history.

The city also has a strong culture of sharing. Many funds with San Francisco offices publish detailed content on fundraising and company building. There are regular meetups, office hours, and informal gatherings that make it easier to learn from other founders and investors if you show up consistently.

Challenges And How To Navigate Them

The flip side of this strength is competition. San Francisco investors see many teams in similar spaces, sometimes with similar backgrounds and ideas. This raises the bar on differentiation. You need a clear wedge into your market, proof that users care, and a story that sounds different from the last three pitches the partner heard this week.

Operating in San Francisco is expensive. Salaries, rent, and services cost more than in many other hubs. Some founders address this by keeping a small core team in San Francisco and building the rest of the team elsewhere, or by using co-working spaces rather than signing long-term leases. Many San Francisco investors are comfortable with hybrid and distributed teams as long as you can show strong execution and communication.

Signal risk is another challenge. When many funds pass or when a round fills with many small checks and no clear lead, future investors may read that as a negative signal. To manage this, founders often work to secure a strong lead early, set clear timelines, and limit the number of small checks they accept before a lead is in place. A structured process helps you avoid drifting into a weak party round.

Find Top Investors in San Francisco and the Bay Area With Visible

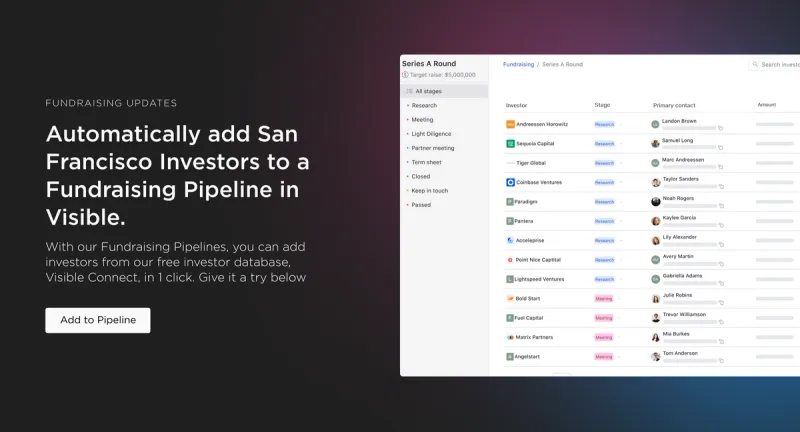

A venture fundraise often mirrors a traditional B2B sales and marketing funnel.

Just as a sales and marketing team has dedicated tools, shouldn’t a founder that is managing their investors and fundraising efforts? Use Visible to manage every part of your fundraising funnel with investor updates, fundraising pipelines, pitch deck sharing, and data rooms.

Raise capital, update investors, and engage your team from a single platform. Try Visible free.

Frequently Asked Questions

What is the best way to raise venture capital in San Francisco?

The best way to raise venture capital in San Francisco is to build a targeted investor list aligned with your stage and sector, secure warm introductions, and run a structured outreach process. SF investors expect clarity, early traction, and a well-defined market wedge, so preparation and focus are essential.

Which venture capital firms are most active in San Francisco?

Some of the most active venture capital firms in San Francisco include Accel, Greylock, Menlo Ventures, Spark Capital, Bessemer Venture Partners, a16z, and Benchmark. These firms invest across stages and industries, giving founders a wide range of options depending on traction, check size, and technical depth.

How do I choose the right San Francisco VC for my startup?

Choose a San Francisco VC by assessing the firm’s typical check size, stage focus, sector expertise, and relevant partner interests. Founders should map each firm to their traction and fundraising goals, then prioritize investors with a history of backing similar companies or models. Fit matters more than quantity.

Are there accelerators in San Francisco that help founders raise capital?

Yes. San Francisco has several strong accelerators that help founders raise capital, including Y Combinator, 500 Global, Alchemist Accelerator, and AngelPad. These programs provide early funding, mentorship, and direct introductions to SF-based VCs, making them valuable for pre-seed and seed-stage founders preparing for institutional rounds.

Why is fundraising in San Francisco more competitive than other markets?

Fundraising in San Francisco is more competitive because investors see a high volume of startups, especially in AI, developer tools, and deep tech. This density raises the bar on differentiation, traction, and storytelling. Founders need clear proof of demand, a unique wedge, and a tight process to stand out.

What challenges should founders expect when raising venture capital in San Francisco?

Founders in San Francisco should expect high competition, higher operating costs, and signal risk when rounds lack a strong lead. To navigate these challenges, teams often run a well-defined process, prioritize fit over volume, and leverage local networks, co-working spaces, and founder communities to access warm introductions.