Key Takeaways

-

Learn how venture capital data solutions streamline portfolio management, improve decision-making, and drive higher fund performance through organized, reliable insights.

-

Discover how accurate venture capital funding data and investment trackers help investors identify opportunities, benchmark results, and manage risk more effectively.

-

Understand how software for investment management and portfolio monitoring software simplify reporting, compliance, and communication for venture capital and private equity firms.

-

Explore how a crm for venture capital and vc fund software enhance investor relations, automate workflows, and support seamless fundraising and relationship tracking.

-

See how leveraging vc sourcing tools and data-driven venture capital portfolio monitoring gives firms a competitive edge in identifying high-potential startups and maximizing returns.

Understanding Venture Capital Data Solutions

Venture capital data solutions are transforming how investors build, monitor, and optimize portfolios. These tools combine multiple data sources to provide fund managers with a clear picture of performance across every investment. When information is scattered in spreadsheets or emails, it slows decision-making and introduces risk. A well-designed data solution centralizes metrics, streamlines analysis, and ensures that every stakeholder is looking at the same information.

For venture capitalists, structured venture capital funding data delivers transparency across companies, sectors, and stages. By consolidating deal information, valuation changes, and performance indicators, funds can identify opportunities for follow-on investment and strategic support. Using a venture capital investment tracker adds further clarity, helping teams visualize results, spot trends, and prepare investor updates backed by reliable numbers.

The Role of Data in Venture Capital Decision-Making

Data plays a vital role in determining where and how to invest. Modern venture capital firms depend on up-to-date venture capital funding data to assess potential deals and manage risk. Having accurate data allows managers to compare historical performance, model returns, and build scenarios for future fundraising rounds.

A venture capital investment tracker helps investors stay organized across dozens or even hundreds of active deals. It allows teams to record progress, track financial milestones, and understand company health in real time. Rather than relying on manual updates or fragmented systems, a dedicated tracker simplifies communication and ensures data consistency.

With these insights, funds can analyze which strategies have historically driven the best outcomes. Over time, these patterns help improve future decisions and create a culture of continuous learning across the organization.

Building and Monitoring a Venture Capital Portfolio

The foundation of every successful investment strategy is thoughtful venture capital portfolio construction. Building a portfolio involves balancing industries, stages, and risk profiles to achieve long-term stability. Technology helps investors achieve this balance by organizing data on performance and growth potential.

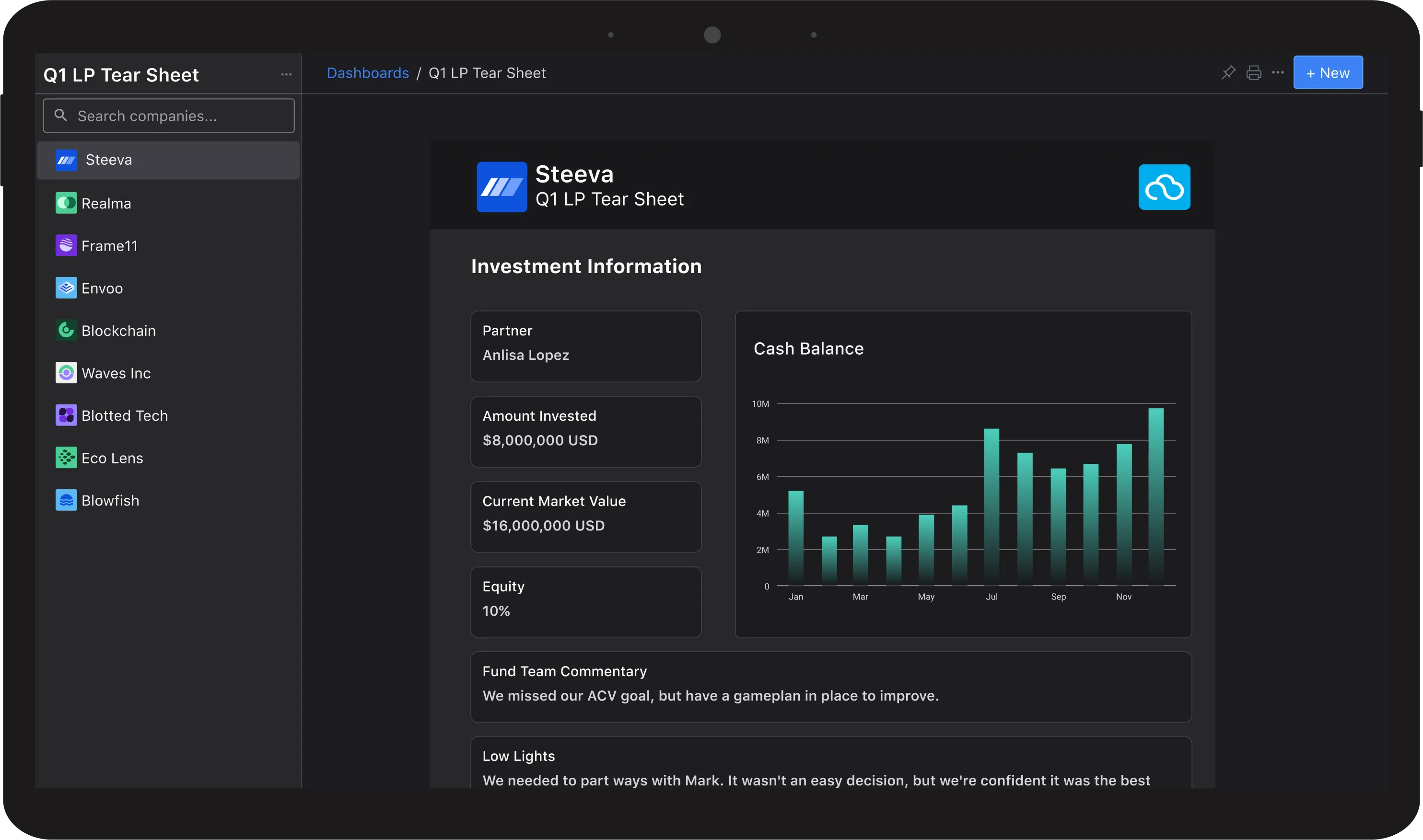

Once the portfolio is active, consistent venture capital portfolio monitoring is essential. A reliable system helps identify early warning signs, track valuation changes, and ensure alignment with fund objectives. A venture capital portfolio monitoring example might include visual dashboards that report on revenue, customer growth, and cash burn. For funds that want structure and uniformity, a venture capital portfolio monitoring template can simplify the process of collecting updates and distributing reports to limited partners.

By creating a rhythm of consistent reporting and analysis, investors maintain control of portfolio health and can respond quickly when intervention or additional funding is needed.

Streamlining Operations with Software for Investment Management

Software for investment management has become a key part of modern venture capital operations. It integrates critical functions such as reporting, communication, and compliance into one centralized platform. This consolidation allows investment professionals to spend less time gathering data and more time analyzing it.

Portfolio monitoring software provides real-time tracking of performance metrics, while portfolio management software for private equity extends similar benefits to adjacent asset classes. When combined, these systems improve data accuracy and reduce administrative burden. They also promote transparency across teams, which is increasingly important in investor reporting and audits.

CRM Tools for Investor Relations and Fundraising

Strong relationships remain at the heart of venture capital. The best crm for raising capital helps fund managers manage those relationships efficiently. It organizes communication records, tracks commitments, and ensures timely follow-ups during fundraising campaigns. A crm for raising capital makes it possible to deliver a personalized experience to every potential investor.

A crm for venture capital goes beyond relationship tracking by integrating portfolio data and communication workflows. This helps fund managers prepare for meetings, follow up with data-driven updates, and demonstrate accountability to stakeholders. Consistent communication builds trust, which in turn strengthens the likelihood of future commitments.

Improving Portfolio Oversight with VC Fund Software

As a firm grows, managing information across multiple portfolios becomes more complex. VC fund software simplifies that challenge by consolidating fund performance data, financial statements, and compliance documents into one accessible system. It enhances collaboration by providing real-time data visibility and eliminating manual reconciliations.

Using vc portfolio management software allows investors to see how each investment contributes to the overall fund. This clarity is essential for reporting to limited partners and identifying which companies are driving the most value. Smaller or emerging funds can experiment with a vc portfolio management software free version to understand how automation can improve their processes before committing to a larger solution.

Leveraging VC Sourcing Tools for Better Deal Flow

Finding quality investment opportunities is one of the most competitive aspects of venture capital. VC sourcing tools give investors a strategic advantage by helping them identify startups that align with their focus areas and fund strategy. These tools aggregate market data, founder profiles, and investment trends to help teams make faster, more informed sourcing decisions.

When combined with broader venture capital data solutions, sourcing tools turn scattered information into actionable insight. Deal pipelines become easier to manage, and due diligence becomes more data-driven. This ensures that each potential investment is evaluated based on consistent metrics and verified data sources.

The Future of Venture Capital Portfolio Management

The next evolution of venture capital portfolio management will rely heavily on automation, predictive analytics, and data integration. As markets grow more complex, the ability to process large volumes of data will determine which funds stay ahead. By using software for investment management and vc fund software, firms can forecast outcomes, identify risks earlier, and scale more efficiently.

Data-driven processes will continue to shape every part of venture capital. From venture capital portfolio construction to fundraising outreach, integrated tools enable faster, more accurate decision-making. Firms that embrace this shift will gain an advantage in transparency, investor confidence, and operational agility.

Ultimately, venture capital data solutions help investors move beyond intuition to insight. By combining technology with experience, funds can improve communication, strengthen relationships, and maximize performance across the entire portfolio. The result is a more resilient, informed, and forward-looking approach to investing in innovation.

Frequently Asked Questions

What are venture capital data solutions and why are they important?

Venture capital data solutions refer to platforms and tools that aggregate venture capital funding data, track investments, and monitor portfolios. These solutions help investors improve decision-making, manage risk, and streamline reporting. They shift firms from intuition-led investing to data-informed investment processes.

How does a venture capital investment tracker support fund performance?

A venture capital investment tracker allows you to log and evaluate every deal in one organized system. This simplifies tracking metrics like valuations, exit timelines, and company performance. With consistent tracking, you can identify patterns in winners and under-performers, refine strategy, and strengthen overall venture capital portfolio management.

What benefits do software for investment management and portfolio monitoring provide to venture firms?

Software for investment management and portfolio monitoring software centralize reporting, automate updates, and improve data accuracy. These solutions free teams from spreadsheets and manual tasks, enabling them to spend more time analyzing trends. This leads to more effective venture capital portfolio monitoring and better fund oversight.

When should a venture firm consider switching to a crm for raising capital or vc fund software?

If your firm struggles to track investor conversations, commitments, or portfolio updates, a crm for raising capital can help. When portfolio size or complexity grows, vc fund software supports fund operations, performance tracking, and investor reporting. Early adoption sets up stronger institutional workflows for venture capital portfolio management.

What role do vc sourcing tools play in deal flow and portfolio construction?

VC sourcing tools help identify high-potential startups, filter deal flow based on criteria, and maintain a pipeline that aligns with fund strategy. Incorporating these tools into your workflow strengthens venture capital portfolio construction and gives you a competitive edge in identifying quality opportunities ahead of peers.

Can early-stage funds use a vc portfolio management software free version, and what should they consider?

Yes. Smaller funds or new managers can start with a VC portfolio management software free tier to test capabilities early. They should evaluate features like data integration, reporting flexibility, and scaling potential. This trial period helps confirm whether the platform supports long-term venture capital portfolio management needs before committing fully.