Venture Capital Reporting Software

Solutions for Investors

Trusted by Leading VCs Globally

"Visible's AI Inbox has revolutionized our communication management at Fuel Ventures Ltd. Its seamless integration of AI provides invaluable insights, streamlining our workflow. A game-changer for any VC firm looking to stay ahead."

"Love the streamlined process design of engaging with portfolio companies on key metrics and reporting - this is not only benefiting investors in terms of automating the trend monitoring at company and portfolio level."

"Leveraging Visible has been a game changer for 01A. Its ability to automate metric collection, ensure compliance, and consolidate investor updates and reporting has not only streamlined communication and decision-making but also provided full transparency to the entire team."

"Visible has streamlined our data collection process, providing a centralized source for all portfolio information. The ability to export data directly to Google Sheets enables in-depth portfolio analysis and allows me to respond quickly to ah hoc request."

"Antler uses Visible with 750+ portfolio companies across 20 countries. The platform makes it manageable to stay on top of a large portfolio, and also benefits portfolio companies as we can provide them with benchmarking on portfolio metrics."

Reporting Software for Venture Capital

Venture capital reporting software is essential for VC-backed businesses and investors looking to manage their businesses and investments efficiently. These tools help track portfolio performance, generate reports, and maintain compliance with industry regulations. As venture capital firms grow and expand their portfolios, having the best venture capital reporting software becomes a necessity for transparency and informed decision-making.

Below, we’ll explore the key features, benefits, and selection criteria for venture capital software, along with how founders and investors can leverage these tools to streamline operations. We’ll also examine the latest trends in fund management software, and provide insights on selecting the best platform.

Why Venture Capital Reporting Software Matters

The Growing Complexity of Venture Capital Investments

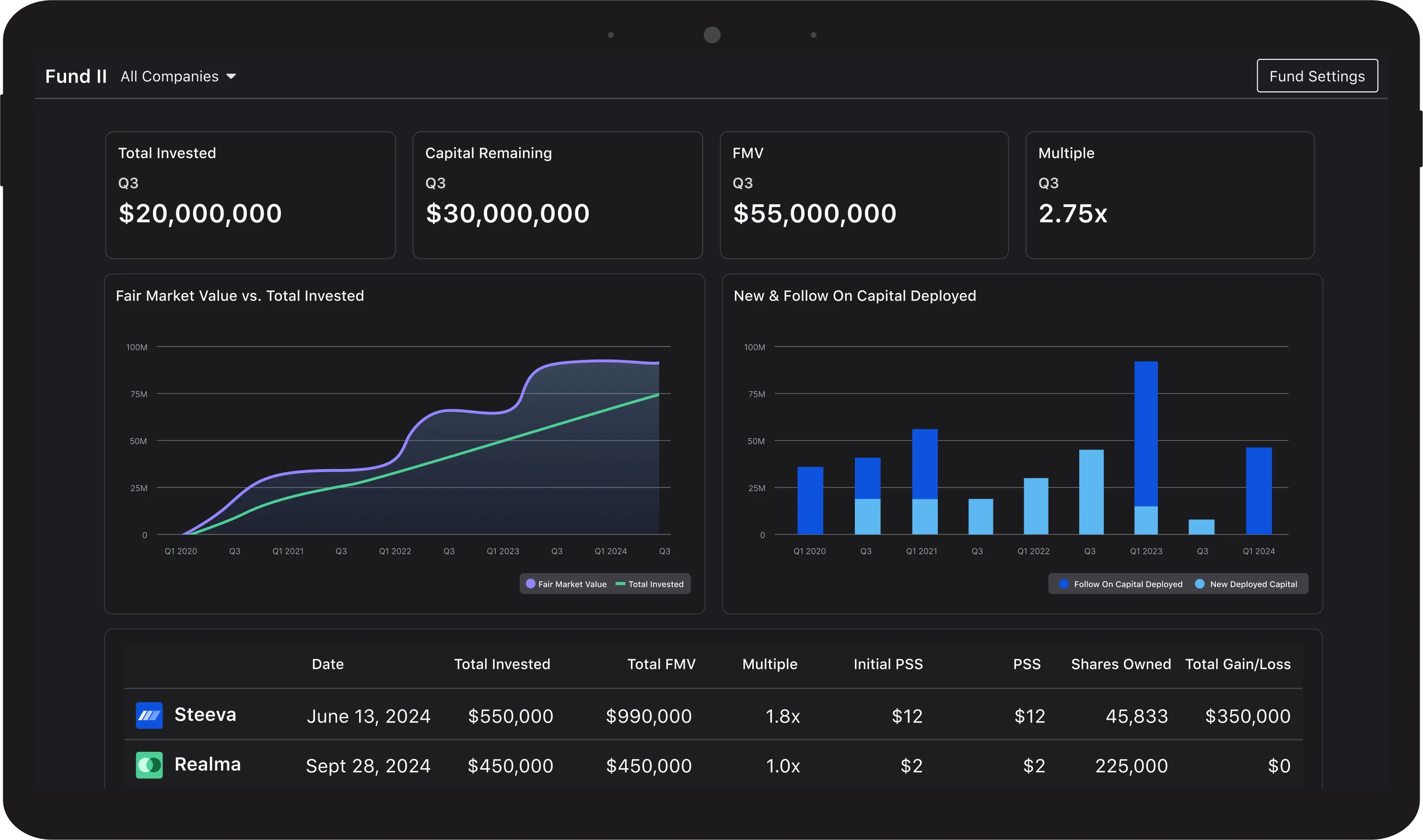

Managing venture capital investments involves handling complex data, monitoring portfolio companies, and keeping stakeholders informed. Venture capital portfolio management software simplifies these tasks, allowing investors to track performance metrics in real-time and founders to streamline investor relations.

Unlike traditional investment vehicles, venture capital requires real-time collaboration between investors, fund managers, and portfolio companies. Having a centralized venture capital software solution ensures data consistency, enhances reporting efficiency, and minimizes manual errors. Additionally, as regulatory and compliance demands increase, fund accounting software could play a critical role in ensuring financial transparency.

Benefits of Using Venture Capital Reporting Software

Using the right fund management software provides several benefits, including:

- Improved Financial Accuracy: Venture capital accounting software integrations automate calculations and reduces human error.

- Real-Time Portfolio Insights: Portfolio monitoring software allows investors to track the performance of their holdings at any moment.

- Efficient Investor Communication: A powerful VC CRM streamlines investor relations, making fundraising and reporting more effective.

- Compliance with Industry Regulations: Many alternative investment software platforms offer built-in compliance tools to meet SEC and other regulatory requirements.

- Data-Driven Decision-Making: With access to real-time financial metrics and predictive analytics, venture capital firms can make better investment decisions.

Core Features of the Best Venture Capital Reporting Software

When selecting venture capital software, it’s important to consider features that enhance usability and efficiency. The best tools in the market offer:

1. Financial Reporting & Compliance

- Automated financial statements and balance sheet tracking.

- Direct integration with venture capital accounting software for easier tax reporting and audits.

- Multi-currency support for global investments.

- Tools to assist with fund valuation and performance measurement.

2. Portfolio Performance Monitoring

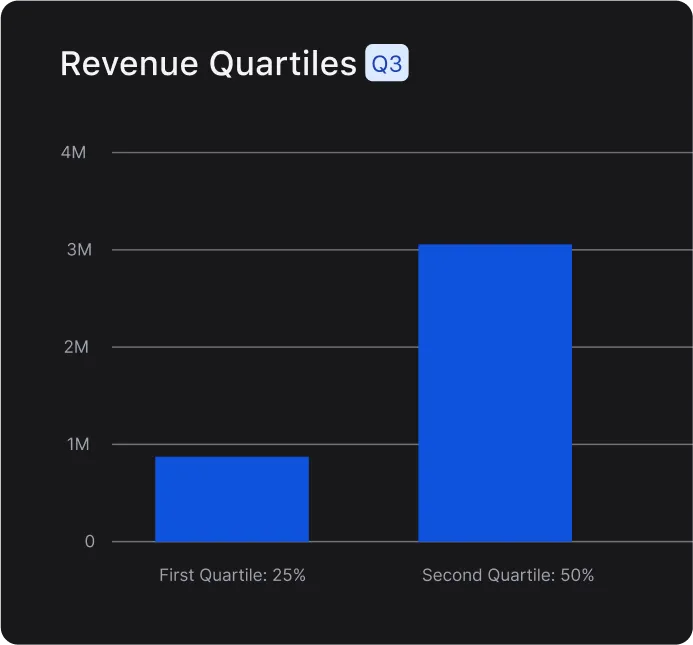

- Real-time data visualization and dashboards to track key performance indicators (KPIs).

- Historical trend analysis to identify investment patterns and risks.

- AI-powered forecasting tools to optimize future capital allocation.

3. Investor Relations Management

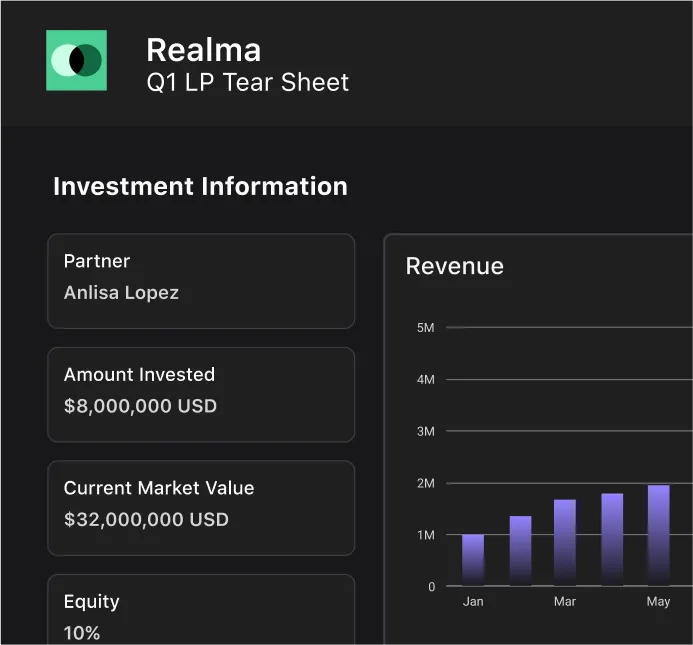

- Customizable LP reporting to improve transparency.

- Automated investor update emails through a VC CRM.

- Centralized document storage for easier due diligence and compliance audits.

4. Automation & Scalability

- AI-driven data categorization to reduce manual work.

- Scalable infrastructure that grows with your fund’s needs.

- API integration with major accounting, compliance, and CRM platforms.

How to Choose the Best Venture Capital Reporting Software

Not all venture capital platforms offer the same features, so it’s important to consider:

1. Customization & Scalability

- Does the software adapt to the specific reporting needs of your fund?

- Can it handle increasing data complexity as your portfolio grows?

- Does it allow for custom KPIs and dashboard configurations?

2. Integration with Existing Tools

- Ensure the software works with venture capital portfolio management software, fund management software, and VC CRM tools you already use.

- Look for plug-and-play solutions that integrate seamlessly with QuickBooks, Xero, or other accounting platforms.

3. Cost & Accessibility

- Compare pricing models and licensing options.

- Consider whether the platform offers best venture capital reporting software free trials or venture capital software free versions for early-stage firms.

- Look for transparent pricing with no hidden fees.

4. User Experience & Support

- An intuitive user interface reduces the learning curve.

- Look for 24/7 support and robust onboarding materials.

- Verify customer reviews and testimonials to gauge user satisfaction.

Comparing the Best Venture Capital Software Solutions

Venture capital firms have different needs based on the size of their portfolio and investment strategy. When comparing venture capital apps, consider that firms that prioritize financial tracking and regulatory compliance should seek out the best venture capital accounting software. If the focus is on monitoring investment performance, then the best venture capital portfolio management software is ideal. Startups and smaller firms that need cost-effective solutions can leverage the best free venture capital reporting software. Emerging firms can also take advantage of open-source or trial-based venture capital software to gain valuable insights and experience.

Implementation Best Practices for VC Firms & Founders

To successfully implement VC portfolio management software, follow these steps:

- Define Your Needs: Identify key requirements such as reporting, compliance, or investor relations.

- Select the Right Software: Compare the venture capital software list and test different options before committing.

- Integrate with Existing Systems: Ensure compatibility with your accounting, CRM, and analytics tools.

- Train Your Team: Encourage adoption by providing training on new venture capital platforms.

- Monitor & Optimize: Continuously evaluate the software’s performance and make necessary adjustments.

- Set Up Automated Workflows: Minimize manual data entry and reporting tasks.

- Review Performance Metrics Regularly: Use real-time dashboards to track fund performance and risk exposure.

The Future of Venture Capital Software & Emerging Trends

As the industry evolves, venture capital software is integrating cutting-edge technology to enhance efficiency. Key trends shaping the future include:

- AI & Automation: Automating repetitive tasks in fund management software to improve accuracy and speed.

- Real-Time Analytics: Enhancing decision-making with more precise forecasting tools.

- More Investor Engagement Features: Tools that enhance investor relations and transparency are the standard in top venture capital platforms.

Choosing the Right VC Reporting Software

Choosing the right venture capital reporting software is crucial for both investors and founders. Whether you’re managing a small portfolio or scaling a large fund, selecting the best venture capital software ensures efficiency, compliance, and better decision-making.

If you're exploring venture capital software free options, start by testing a venture capital software list that aligns with your firm's needs. By leveraging the right VC resources, investors and founders can enhance portfolio tracking, streamline reporting, and drive better outcomes.

As technology continues to advance, staying ahead with the latest venture capital apps will provide a competitive edge, making investment management smoother and more insightful.