How Venture Capital CRM Software Streamlines Capital Raising and Investor Relations

Managing investor relationships and fundraising efforts can be overwhelming for founders of VC-backed businesses. A well-structured venture capital CRM software helps streamline these processes, ensuring that investor communications, deal flow, and portfolio management are handled efficiently. This article explores the benefits of using investor CRM software, the key features to look for, and how free and paid options compare.

Why Founders Need Venture Capital CRM Software

Raising capital and managing investor relationships require organization and strategic follow-ups. Without the right system, founders risk missing key touchpoints with investors, losing track of conversations, or struggling to present their startup’s performance effectively.

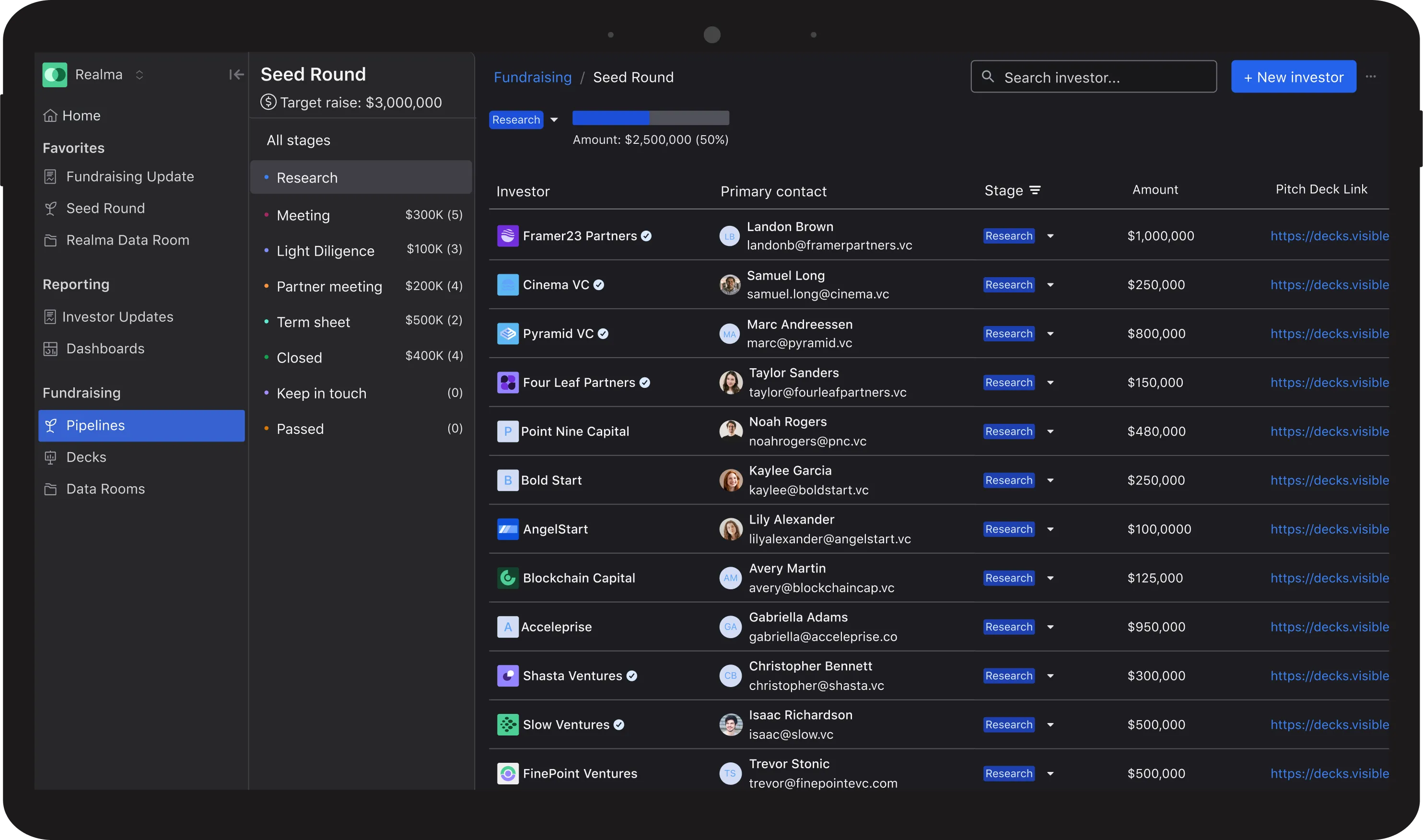

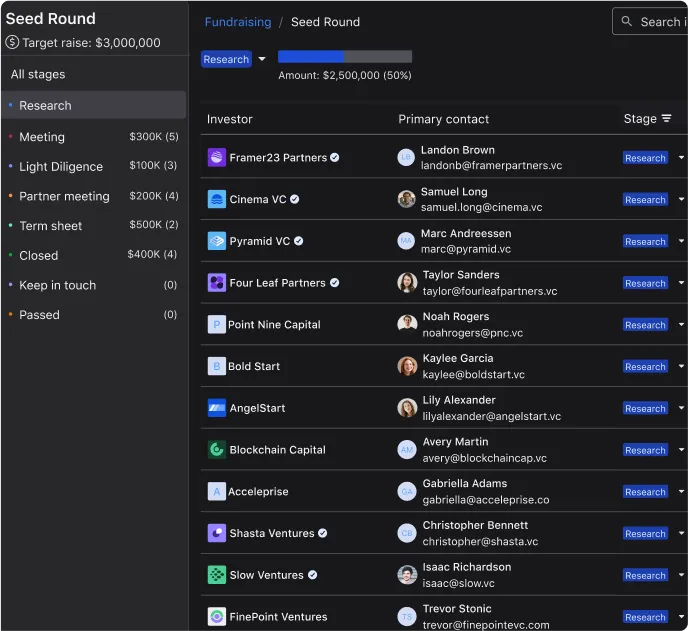

A CRM for venture capital allows founders to track investor interactions to ensure follow-ups happen at the right time. It helps manage investor pipelines with a structured view of who they’ve spoken to and the next steps. It also improves investor relations by providing clear, data-backed updates.

Venture-backed businesses, especially those scaling rapidly, need a system to manage investor expectations, track key performance indicators, and communicate updates efficiently. A structured investor CRM software provides the framework to ensure investor relations remain smooth and organized, reducing the likelihood of missing critical fundraising opportunities.

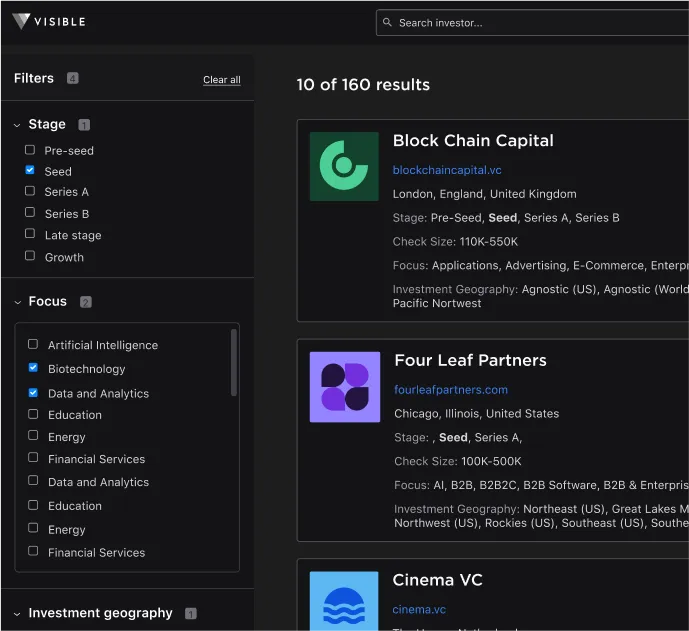

Additionally, as companies grow, so does their investor base. Managing multiple investors at different stages, whether angel investors, seed investors, or institutional venture capitalists, requires a system that ensures timely engagement. A venture capital CRM software helps keep track of different investor types and their unique preferences, ensuring that communication remains relevant and personalized.

Beyond just tracking investors, CRM software helps founders anticipate future funding needs. By analyzing investor activity and engagement, founders can identify which investors may be interested in participating in follow-on rounds, saving time when the next fundraising cycle begins.

Key Benefits of Using a CRM for Capital Raising

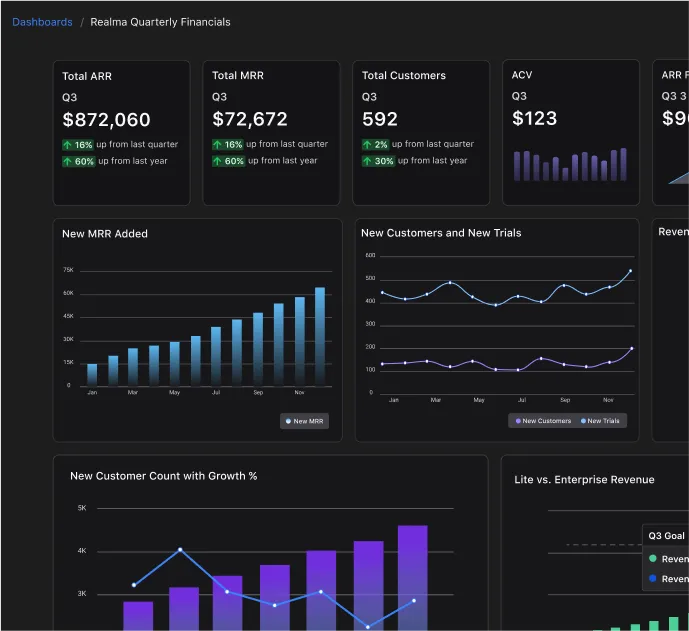

A venture capital CRM software serves as a central hub for managing fundraising efforts and investor relationships.

Centralized investor data ensures that all investor details, interactions, and notes are stored in one place, reducing the risk of losing critical information. Automated follow-ups help founders nurture relationships with investors over time, and many of the best investor CRM software options include automated reminders.

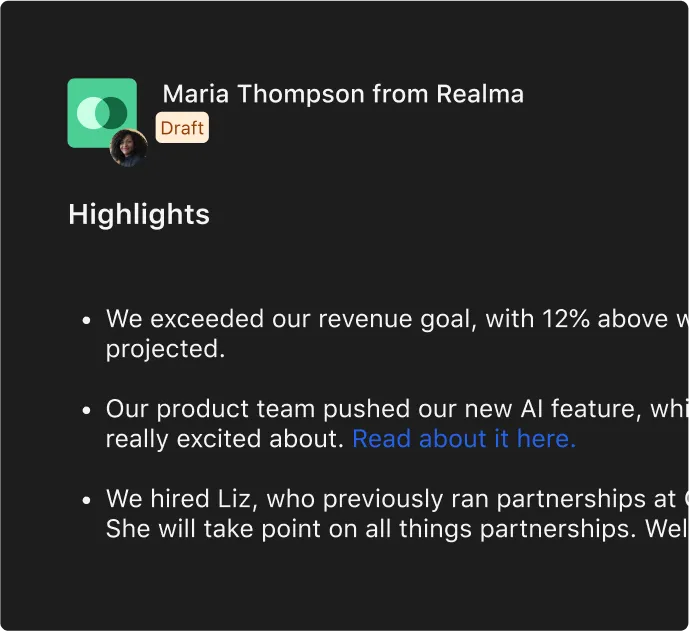

Data-driven decision-making allows founders to analyze investor interactions and responses, adjusting their fundraising strategy based on what’s working. A structured investor pipeline template also helps visualize progress. Improved investor updates make it easier to share updates with investors, reinforcing trust and increasing transparency. Founders can leverage an investor CRM template to create standardized reports.

Beyond these direct benefits, a well-implemented CRM also saves time by reducing manual data entry, improving collaboration across teams, and providing deep insights into investor engagement. Some CRM solutions integrate with data sources such as financial dashboards, legal documents, and email platforms, making investor communication seamless.

A CRM also helps identify warm investor leads. By tracking which investors engage with updates, emails, or pitch materials, founders can prioritize their outreach to those who show the most interest. This targeted approach improves fundraising efficiency and increases the likelihood of securing investment.

Essential Features of the Best Venture Capital CRM Software

Not all CRM tools are created equal. When selecting the best venture capital CRM software, founders should look for several key features.

Investor pipeline management provides a built-in investor pipeline template to help track each stage of the fundraising process. Automated workflows reduce manual tasks, saving time and increasing efficiency. Data and performance tracking enable founders to analyze investment performance over time, ensuring clear reporting. Customization options allow the use of an investor CRM template, ensuring founders can tailor the software to their needs.

A venture capital CRM should also integrate with financial reporting tools, investor update platforms, and cap table management solutions. Founders who are raising funds across multiple rounds need a scalable CRM that can evolve with their fundraising efforts. Some of the best venture capital CRM software free options provide entry-level features that allow early-stage startups to stay organized before upgrading to a more advanced tool.

For larger companies, more advanced CRMs provide investor segmentation tools, allowing founders to categorize investors based on stage, sector focus, or level of engagement. This segmentation ensures highly targeted communications, making investor relations more effective.

Comparing Free vs. Paid CRM Options for Venture Capital

Many founders wonder whether they should invest in a paid CRM or use a free alternative. Free CRMs typically include basic investor tracking and limited customization, while paid CRMs offer automation, advanced reporting, and full customization options.

For startups in their early stages, free investor CRM software can be a useful way to get organized before making a financial commitment. However, a free CRM may not provide enough flexibility as startups scale and engage with more investors. Limited reporting capabilities, manual data entry requirements, and restricted automation are common limitations in free CRM options.

A founder raising a pre-seed or seed round might find that an investor CRM template free download is sufficient for managing a small pipeline. However, for companies that have gone through multiple funding rounds, a robust investor CRM software download with automation features may be necessary to handle increasing complexity.

Free CRMs also tend to have limited integration options. For founders who need their CRM to sync with accounting software, investor dashboards, or legal documentation tools, a paid CRM may offer more value.

How CRM Software Supports Venture Capital Portfolio Management

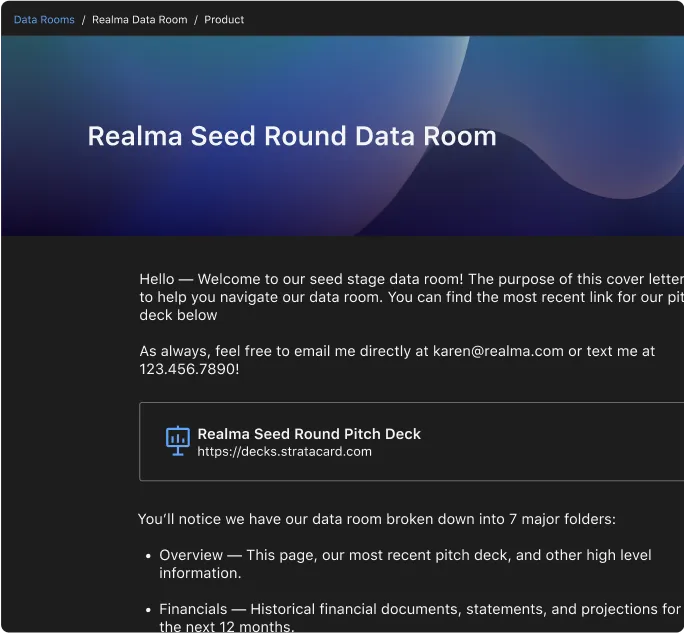

Beyond fundraising, a venture capital CRM software is useful for tracking investments and maintaining investor relations post-funding. A venture capital portfolio management software helps founders monitor investor engagement and maintain long-term relationships. It tracks investment milestones and ensures proper reporting. It also helps organize data for board meetings and investor updates.

Founders can use venture capital portfolio management software to track investor contributions, commitments, and equity stakes. Additionally, it helps align investors with future funding opportunities and keeps a historical record of their involvement.

Venture capital firms often use these tools to monitor startup performance across multiple portfolio companies. By providing key insights into investment outcomes, these platforms help investors and founders stay aligned. Some venture capital portfolio management software free options offer limited functionality but can still be valuable for early-stage startups.

CRM tools can also help streamline investor reporting by automating the creation of investor update emails, quarterly reports, and other key communications. Instead of manually assembling updates, founders can use a CRM to generate reports based on real-time data.

Finding the Right Investor CRM Software for Your Startup

Choosing the right investor CRM software depends on the stage of your startup and your fundraising goals.

Founders should start by assessing their needs. If they require only basic tracking, an investor CRM template may be sufficient, while those seeking automation should consider a full-featured CRM. Testing free options such as an investor CRM template free or an investor pipeline template can help founders determine what works best before making a financial commitment. Scalability is important, as the best CRM for capital raising free should allow for upgrades as the startup grows. Founders should also ensure compatibility with their existing VC stack for seamless workflow management.

Startups engaging with multiple investors, such as institutional venture capital firms or private equity firms, should prioritize a CRM with advanced reporting capabilities. Those looking for a structured yet flexible approach may begin with an investor CRM template download to organize their investor data before committing to a paid system.

A Smarter Way to Manage Investors and Capital Raising

A venture capital CRM software is essential for founders looking to manage investor relationships, track fundraising progress, and streamline capital raising. Whether using an investor CRM template free download or investing in full-scale venture capital portfolio management software, having a structured system in place makes a difference.

By leveraging the best CRM for investor relations, founders can improve their chances of securing funding and maintaining strong investor relationships over time. As startups scale, upgrading to a comprehensive venture capital portfolio management software free or paid option can provide deeper insights, improve investor communication, and streamline the entire fundraising process.

Ultimately, a well-managed CRM enables founders to focus on what truly matters—building a successful company while maintaining strong relationships with investors. Having the right system in place can make the difference between an efficient, well-organized fundraising process and a scattered, inefficient approach that leads to missed opportunities.