Key Takeaways

-

The global travel and tourism market is experiencing strong post-pandemic growth, creating significant opportunities for innovative travel technology startups and investors.

-

Remote work and digital nomad lifestyles are driving demand for long-term rentals, coliving spaces, and destinations that cater to travelers who work while exploring new places.

-

Technology is reshaping the travel experience with AI-driven personalization, blockchain-secured bookings, and virtual reality previews that make planning and booking seamless.

-

Sustainable tourism is a priority for travelers, increasing the need for eco-friendly accommodations, carbon offset programs, and responsible travel solutions.

-

Leading venture capital firms are actively funding travel technology companies, offering founders access to strategic investment and partnerships in a rapidly evolving market.

The global travel and tourism industry has officially entered a new era of growth, with the latest World Travel and Tourism Council data showing the sector has surpassed all pre-pandemic records. As we enter 2026, the industry is defined by a rapid shift toward agentic AI booking tools and professionalized alternative accommodations. Founders in 2026 are focusing on connected ecosystems to capture a market of 1.6 billion international arrivals projected.

With remote work now a baseline for 12.6% of the global workforce, new opportunities for coworking and coliving have emerged. Modern travelers are moving away from traditional filters toward natural language discovery. Startups like Kindred are disrupting the space by offering members-only home exchange networks, enabling the community to share homes for a fraction of the cost of traditional lodging.

What is the projected travel market size in 2026?

The tourism sector reached a record 11.7 trillion dollars in 2025, contributing 10.3% to global GDP. This historic level of economic impact represents a return to long-term growth trends, officially moving the industry past all prior benchmarks. The sector now supports 371 million jobs, meaning one in ten roles worldwide is linked to travel.

International visitor spending also hit an unprecedented 2.1 trillion dollars in 2025. While growth has normalized from the immediate post pandemic surge, the 2026 outlook remains robust. Experts project a 3% to 4% increase in international arrivals this year as the Asia Pacific region reaches full recovery. Major upcoming events, including the FIFA World Cup 2026 and the Milano Cortina Winter Olympics, are already driving early booking demand in host regions.

For startup founders, the digital landscape is where the most significant gains are occurring. Total global travel gross bookings are projected to reach 1.67 trillion dollars in 2026. Online bookings exceeded 1 trillion dollars for the first time in 2025 and are expected to reach 1.2 trillion dollars by the end of 2026. By that time, nearly 65% of all global travel bookings will be made through digital channels, highlighting the critical need for mobile first, AI integrated platforms.

Top VCs Investing in Travel and Tourism in 2026

Journey Ventures

- Location: Israel

- About: Journey Ventures is a multi-stage VC dedicated to the booming Travel Tech industry. Travel is one of the world’s fastest-growing sectors. Travel startups of the last few years have already disrupted some of the largest sectors in our industry, a momentum we expect to continue. This large market of ever-increasing Travel Tech offerings is ready for smart investments, and Journey Ventures is an expert in the field.

- Thesis: Our goal is to develop a portfolio of Israeli and international companies specializing in the fields of tourism, travel Tech and the hotel industry that have reached an advanced stage of technological development.

- Investment Stages: Pre-seed, Seed, Series A, Series B, Series C

- Recent Investments:

- Wenrix

- UpStay

- Roomerang LTD

Related Resource: 9 Active Venture Capital Firms in Israel

MairDuMont Ventures

- Location: Stuttgart, Germany

- About: MAIRDUMONT VENTURES is the venture capital arm of the MAIRDUMONT Group and has been supporting digital travel companies in their future growth since 2015. MAIRDUMONT VENTURES uses its unique sector focus “Travel” to dive deeply into different business models and to evaluate potentials together with our portfolio companies. We have extensive know-how and can leverage the huge network of the MAIRDUMONT Group – with well-known brands such as Marco Polo, DuMont, Baedeker, Kompass or Falk – to offer our portfolio companies not only financial resources, but also strategic and operational support. We invest in fast-growing, early-stage and innovative companies that revolutionize travel. These can be solutions for end customers (B2C) as well as business customers (B2B).

- Recent Investments:

- zizoo

- holidu

- Paul Camper

Related Resource: 8 Active Venture Capital Firms in Germany

JetBlue Technology Ventures

- Location: San Carlos, California, United States

- About: JetBlue Technology Ventures invests in and partners with early stage technology startups improving the future of travel and hospitality.

- Thesis: We invest in and partner with early stage startups improving travel and hospitality.

- Investment Stages: Seed, Series A, Series B, Growth

- Recent Investments:

- NLX

- FLYR Labs

- Bizly

500 Startups

- Location: Mountain View, California, United States

- About: 500 Startups is a global venture capital firm with a network of startup programs headquartered in Silicon Valley.

- Thesis: Uplifting people and economies through entrepreneurship

- Investment Stages: Seed, Series A

- Recent Investments:

- Tripoto

- Wandero

- Flightfox

Fifth Wall

- Location: Venice, California, United States

- About: At Fifth Wall we are pioneering an advisory-based approach to venture capital. Full-service, integrated, operationally aligned. We are the first and largest venture capital firm advising corporates on and investing in Built World technology. Our strategic focus, multidisciplinary expertise, and global network provide unique insights and unparalleled access to transformational opportunities.

- Investment Stages: Seed, Series A, Series B

- Recent Investments:

- Loft

- Flyhomes

- Smart Rent

Thayer Ventures

- Location: Valencia, California, United States

- About: Thayer Ventures invests in Travel Technology.

- Thesis: We invest in early-stage travel and transportation technology.

- Investment Stages: Seed, Series A

- Recent Investments:

- Beekeeper

- Snapcommerce

- Swiftmile

Structure Capital

- Location: San Francisco, California, United States

- About: Structure Capital help passionate teams build great companies by investing seed-stage capital, time, experience and relationships.

- Investment Stages: Seed, Series A, Series B, Growth

- Recent Investments:

- Sonder

- CANOPY

- Unbabel

Portugal Ventures

- Location: Porto, Lisboa, Portugal

- About: Portugal Ventures is a venture capital firm that invests in seed rounds of Portuguese startups in tech, life sciences, and tourism.

- Thesis: We invest in companies in the seed and early stages operating in the digital, engineering & manufacturing, life sciences and tourism sectors.

- Investment Stages: Pre-Seed, Seed, Series A

- Recent Investments:

- DefinedCrowd

- Relive

- Sleep & Nature

aws Gründerfonds

- Location: Vienna, Wien, Austria

- About: Venture Capital for Ideas and Innovations aws Founders Fund invests venture capital during the start-up and early growth phase of Austrian start-ups. We offer support for your future (financial) plans as a long-term investor and partner and believe in the additional value of co-investments.

- Investment Stages: Seed, Series A, Series B

- Recent Investments:

- Innerspace

- Rendity

- CheckYeti.com

VentureFriends

- Location: Athens, Attiki, Greece

- About: VC fund based in Athens but investing across Europe, we focus on FinTech, Travel, PropTech, B2C & Marketplaces. We are entrepreneurial investors, with strong experience, network and track record. We have been entrepreneurs, founders, worked at startups or angel investors in early stages and have a founder first & value driven approach

- Thesis: We are entrepreneurial investors who love to support startups and help them become impactful companies with a worldwide presence.

- Investment Stages: Seed, Series A, Series B, Series C, Growth

- Recent Investments:

- Blueground

- Home Made

- Welcome Pickups

Travel Impact Lab

- Location: Utrecht, Netherlands

- About: Travel Impact Lab helps start-ups to get started and sets existing travel organizations in motion.

- Investment Stages: Accelerator

Travel Capitalist Ventures

- Location: Irvine, California, United States

- About: Travel focused Venture Capital and Private Equity Investor.

- Thesis: We identify, invest and help travel companies rapidly and sustainably expand.

- Investment Stages: Seed, Series A, Growth

- Recent Investments:

- Jetsmart

- Voopter

- Guiddoo

Alstin Capital

- Location: Munich, Bayern, Germany

- About: Alstin Capital is an independent venture capital fund based in Munich. We invest in rapidly growing technology companies that have the potential to leverage the significant market potential of the future and become market leaders. We not only invest in convincing technology, but above all in the entrepreneurs behind the technology. We support our entrepreneurs with capital and know-how so that they can grow faster and more successfully. Our investment is based on the conviction that entrepreneurial know-how, many years of transaction experience, international networks and sales excellence are the success factors for sustainable growth. Our team brings a variety of complementary strengths to help make any investment a success.

- Investment Stages: Seed, Series A, Series B

- Recent Investments:

- Pilant

- Neodigital

- Circula

TruVenturo

- Location: Hamburg, Germany

- About: We believe venture capital will make the best returns if you invest in the big future markets. Therefore we are strong believers in Tech (managed by Norbert Beck), Brain Computer Interface (managed by Florian Haupt) and pharma to prevent age related disease and prolong healthy human lifespan managed by Nils Regge with the investment vehicle Apollo.vc.

- Investment Stages: Seed, Series A, Series B

- Recent Investments:

- Dreamlines

- HAPPYCAR

- DreamCheaper

Howzat Partners

- Location: London, England, United Kingdom

- About: We are looking to invest in and build internet businesses that have a “HOWZAT” factor. This may sound a little trite; but we see major changes caused by the internet and the opportunities are genuinely exciting. The right idea; the right business; the right time; should generate the “HOWZAT” feeling. David felt it when he came across Cheapflights and was involved in acquiring the Company in 2000. We are seeking the same feeling again in the investments we make.

- Investment Stages: Seed, Series A

- Recent Investments:

- Trivago

- LODGIFY

- otelz.com

Slow Ventures

- Location: San Francisco, California, United States

- About :Slow Ventures invests in companies central to the technology industry and those on the edges of science, society, and culture.

- Thesis: Slow Ventures invests in companies central to the technology industry and those on the edges of science, society, and culture.

- Investment Stages: Seed, Series A

- Recent Investments:

- Scout

- Vamo

- Hipcamp

Hangar 51

- Location: London, England, United Kingdom

- About: We are the innovation team at International Airlines Group, one of the world’s largest airline groups and home to iconic brands in the UK, Spain and Ireland. We are on a mission to transform aviation, helping test and scale high impact emerging technologies across our group. We scout for and partner with leading entrepreneurs to fund, support and scale solutions with the potential to transform the way we do things.

- Investment Stages: Pre-Seed, Seed, Series A, Series B

- Recent Investments:

- ZeroAvia

- Monese

- Esplorio

How is the 2026 M&A landscape affecting travel tech exits?

The bottleneck on exits is starting to loosen as we enter 2026, but the IPO window remains disciplined, favoring companies with clear profitability. Founders should prepare for a year defined by strategic consolidation and a surge in secondary market activity.

- Strategic B2B Acquisitions: Large incumbents like Expedia, Booking Holdings, and Amadeus are shifting their M&A focus toward "agent-ready" B2B services. They are no longer buying broad AI exposure; they are acquiring startups that can plug into the next generation of autonomous distribution and white-label fintech.

- Secondary Market Liquidity: Secondary transactions have gone mainstream in 2026, with global volumes projected to exceed 210 billion dollars. This allows early employees and founders to find liquidity through employee tender offers and continuation vehicles without waiting for a traditional IPO.

- Sovereign AI and Regional Moats: In Europe and the Middle East, “Tech Sovereignty" has become a central investment theme for 2026. Startups that meet local data residency and security requirements are being reassessed at higher valuations as regional governments become key strategic partners and customers.

How will Agentic AI and Blockchain shape travel tech in 2026?

The next generation of travel technology is moving toward an invisible infrastructure where automation handles complex logistics. For startups, success in 2026 depends on integrating with these two core technologies:

Agentic Artificial Intelligence

Artificial Intelligence has evolved from a research assistant into a proactive agent. According to recent 2026 industry forecasts, agentic AI can now read a traveler's calendar, identify gaps for leisure, and execute bookings based on historical preferences.

- Hyper-Personalization: 78% of travelers who use AI-driven tools have booked trips primarily based on an AI recommendation.

- Operational Gains: For travel businesses, AI-driven dynamic pricing and inventory management have reduced operating costs by up to 25%.

Blockchain and Decentralized Identity

Blockchain is no longer just about payments; it is the foundation for secure, document-free travel. By 2026, the focus has shifted to verifiable credentials and decentralized marketplaces.

- Decentralized Marketplaces: While early pioneers like Winding Tree paved the way, current leaders like Travala are proving the model by allowing travelers to connect directly with suppliers, bypassing traditional commission-heavy intermediaries.

- Inventory Management: Large-scale operators like TUI Group now use private blockchain systems to manage hotel bed-swap inventories in real-time, allowing them to shift capacity across global markets in seconds without central bottlenecks.

- Identity Verification: Cryptographic handshakes" now allow travelers to move through security and check-in using a single biometric profile, eliminating the need to present physical passports multiple times.

Immersive Reality and IoT

The "try before you buy" model has become a standard conversion tool. Virtual destination tours were a top trend in 2025, but in 2026, they are being complemented by Augmented Reality (AR) that provides interactive, real-time translations and historical overlays for travelers on the ground. Simultaneously, the Internet of Things (IoT) has professionalized the Smart Hotel experience, where rooms automatically adjust to a guest’s preferred temperature and lighting settings upon arrival.

How is consumer behavior changing travel in 2026?

The shift in how people approach travel has moved beyond flexibility toward intentionality. As we enter 2026, the industry is seeing a Travel Mixology trend where consumers flit between social media for inspiration and agentic AI for execution. Here are the five key trends currently defining the market:

- The Rise of Whycations: Travelers now begin with an emotional goal, such as burnout recovery or cultural reconnection, rather than a specific city. 74% of travelers now prioritize brands they trust to facilitate these purpose-driven journeys.

- Climate Adaptation: Due to rising daytime temperatures, travelers in some regions are choosing after-dark activities. This has birthed a boom in stargazing safaris, night-time museum tours, and nocturnal city exploration.

- The Rail Revival and Slow Travel: Overland travel has seen a massive resurgence. Explore Worldwide reports a 77% spike in rail journey bookings, as travelers choose scenic, low-carbon train routes across Europe and the Balkans over short-haul flights.

- Social Discovery vs. Traditional Search: Traditional search is no longer the primary entry point. Gen Z and Millennials now use social platforms and Reddit at rates comparable to search engines, with r/travel seeing a 31% year-on-year jump in active users seeking authentic peer advice.

- The Pawprint Economy: Pet travel has been professionalized. With 56% of people now owning pets, the industry is responding with long-haul in-cabin flights and AI-powered health monitoring for animals, turning "pet-friendly" into a core requirement for 67 billion dollars in projected spending.

Start Your Next Round with Visible

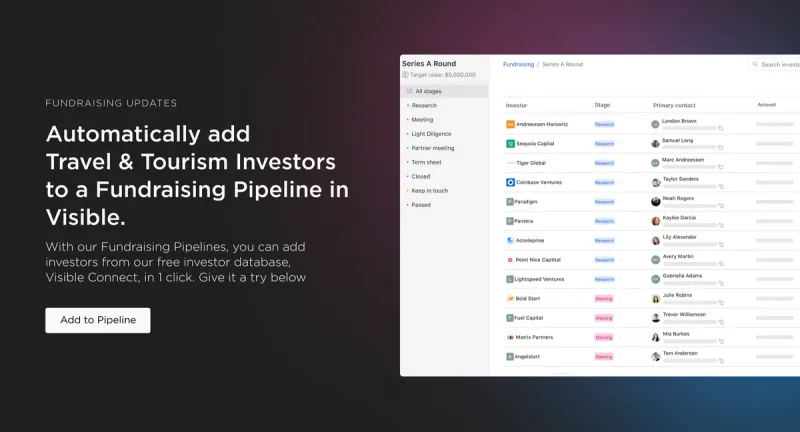

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VC’s and accelerators who are looking to invest in companies like you. Check out all our Travel and Tourism investors here.

After learning more about them with the profile information and resources given you can reach out to them with a tailored email. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors.

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here.

Frequently Asked Questions

What are travel and tourism venture capital investors looking for in startups?

Travel and tourism VC investors seek scalable business models, strong market demand, and innovative technology. Startups offering solutions in sustainable travel, digital booking, or AI-driven personalization often attract funding. Clear growth potential, a capable team, and defensible competitive advantages are critical for securing investment in this expanding industry.

How can a travel technology startup attract venture capital funding?

A travel technology startup can attract VC funding by demonstrating market traction, a clear revenue model, and innovative solutions that address emerging travel trends. Showing customer adoption, highlighting unique technology such as AI or blockchain, and presenting a strong founding team with industry expertise can significantly increase investor interest.

Why is the travel and tourism market attractive to venture capital firms?

The travel and tourism market is attractive to VC firms due to its rapid post-pandemic recovery, increasing consumer demand, and expanding digital adoption. Opportunities exist in areas like remote work travel, sustainable tourism, and technology-driven experiences, all of which offer strong growth potential and the chance for investors to achieve high returns.

Which travel trends are driving venture capital investment today?

Key trends driving venture capital investment include digital nomadism, sustainable tourism, and technology innovations such as AI-powered booking tools and blockchain-secured transactions. Startups that enable personalized travel experiences or integrate virtual reality and Internet of Things solutions are especially appealing to investors looking for scalable, future-focused opportunities in the travel sector.

What role does technology play in travel and tourism VC investments?

Technology is central to travel and tourism VC investments. Investors prioritize startups using AI, blockchain, virtual reality, and IoT to enhance traveler experiences and streamline operations. Solutions that improve personalization, security, and booking efficiency stand out to venture capitalists seeking high-growth opportunities in the evolving travel technology market.

How important is sustainability for travel and tourism venture capital funding?

Sustainability is increasingly important for travel and tourism venture capital funding. Investors are drawn to startups offering eco-friendly accommodations, carbon offset programs, and responsible travel solutions. With travelers prioritizing sustainable options, businesses that embed environmental responsibility into their models can differentiate themselves and appeal to investors focused on long-term growth.