Key Takeaways

-

Learn how a top VC dashboard helps founders of venture-backed businesses track investor relationships, fundraising progress, and company performance with clarity and confidence.

-

Discover which metrics and features make top VC dashboards and venture capital portfolio management software essential for managing growth and investor communication.

-

Understand how leading investors, including top venture capital firms and famous venture capitalists, use data-driven dashboards to make faster, smarter decisions.

-

Get practical guidance on selecting the right VC fund software to streamline reporting, strengthen transparency, and align your team around measurable results.

-

Explore future trends in top VC dashboard technology that are transforming how founders and investors collaborate across the global startup ecosystem.

Understanding the Value of a Top VC Dashboard

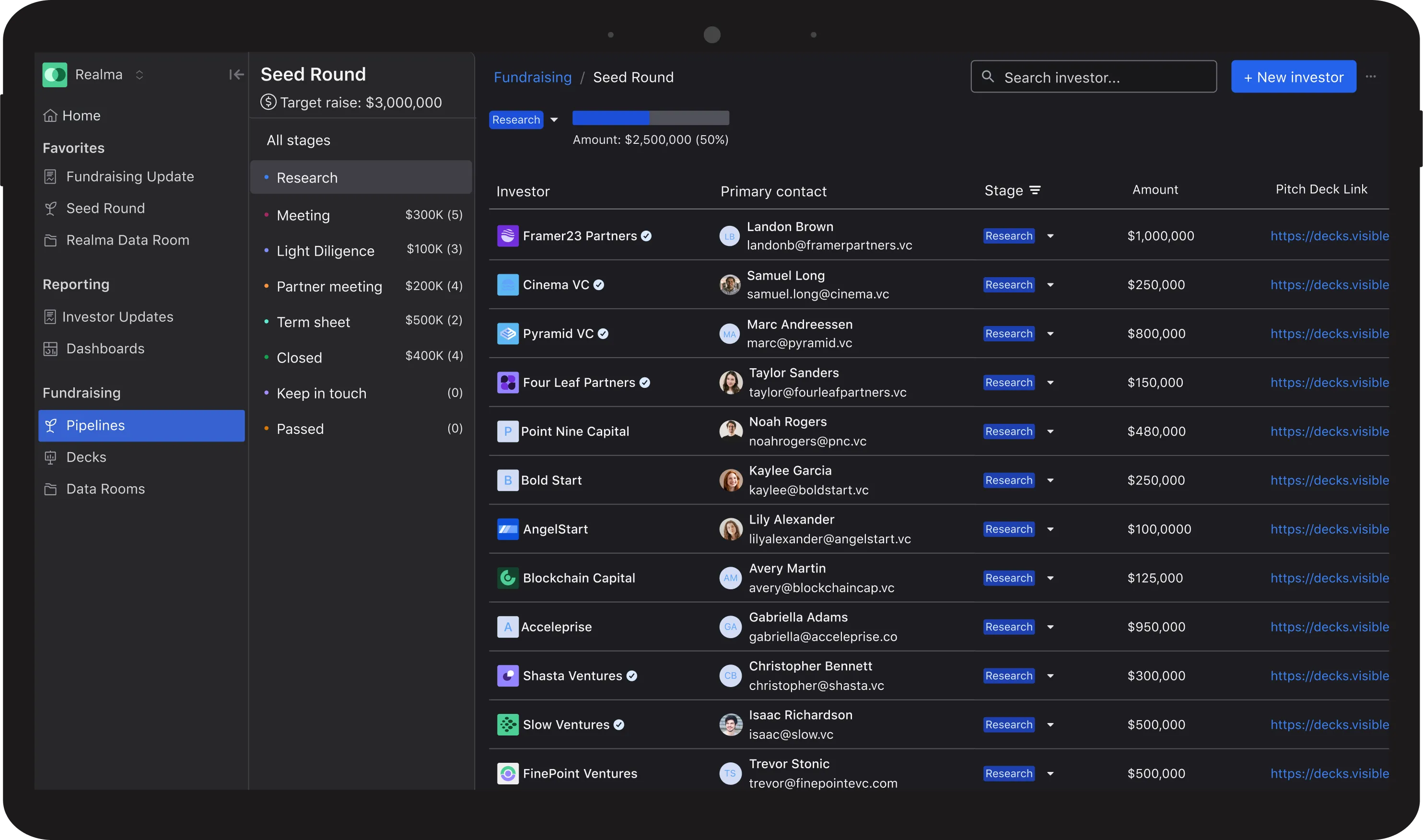

For founders managing relationships with investors, a top VC dashboard can make a significant difference in how information is tracked and shared. These dashboards help organize performance metrics, fundraising data, and key investor updates in one place. A strong system gives founders the visibility needed to make strategic decisions and build investor confidence. Founders who take the time to compare top VC dashboard reviews often discover new ways to save time and create transparency.

Beyond tracking performance, dashboards help founders focus on outcomes rather than guesswork. They provide data that helps founders understand how their company is performing across fundraising stages, customer acquisition, and product growth. This data allows founders to anticipate investor questions and address them proactively rather than reactively. By creating structure around information, founders can spend less time gathering numbers and more time communicating value.

What a Great VC Dashboard Includes

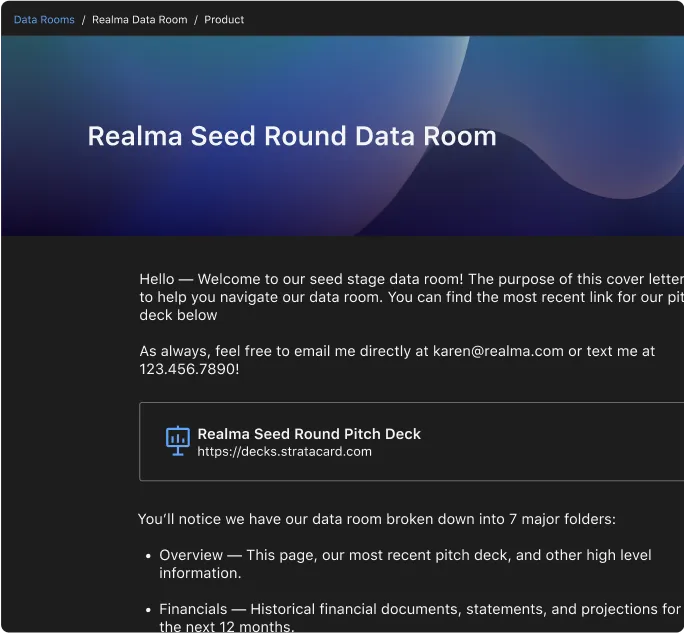

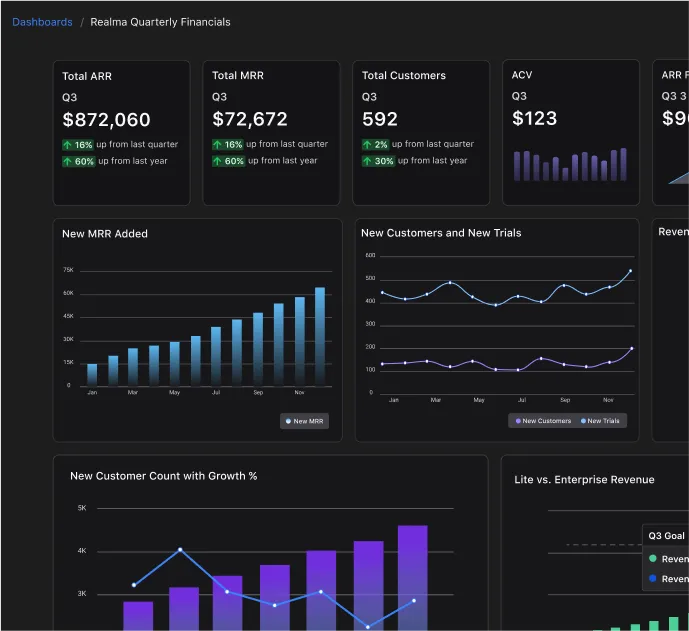

A great dashboard offers clear insights across financial performance, investor engagement, and portfolio health. Founders can monitor revenue growth, cash flow, and fundraising progress in a single view. Effective dashboards also integrate with other tools to automate data collection and reporting. Venture capital portfolio management software supports this by helping founders understand performance trends and communicate them clearly. Paired with powerful VC fund software, these dashboards make it easier to manage complex information with accuracy and speed.

An excellent dashboard allows founders to customize views to match their priorities. For example, a founder raising capital can focus on investor pipeline and traction metrics, while a later-stage founder may emphasize portfolio performance and profitability. This level of flexibility ensures that every update reflects the company’s story while presenting data investors can trust.

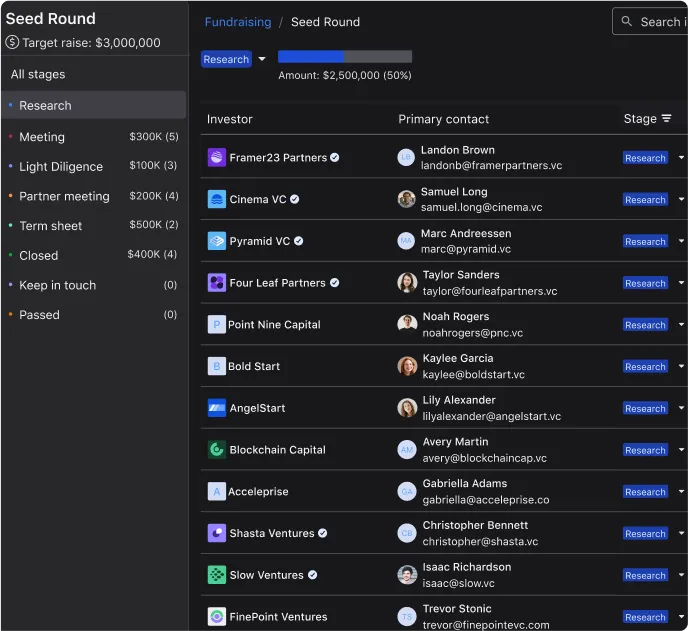

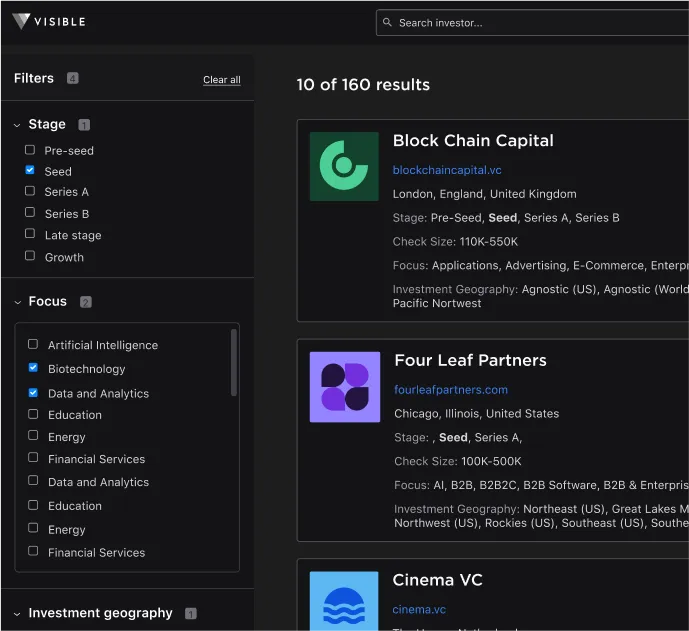

How Founders Use VC Dashboards to Build Investor Relationships

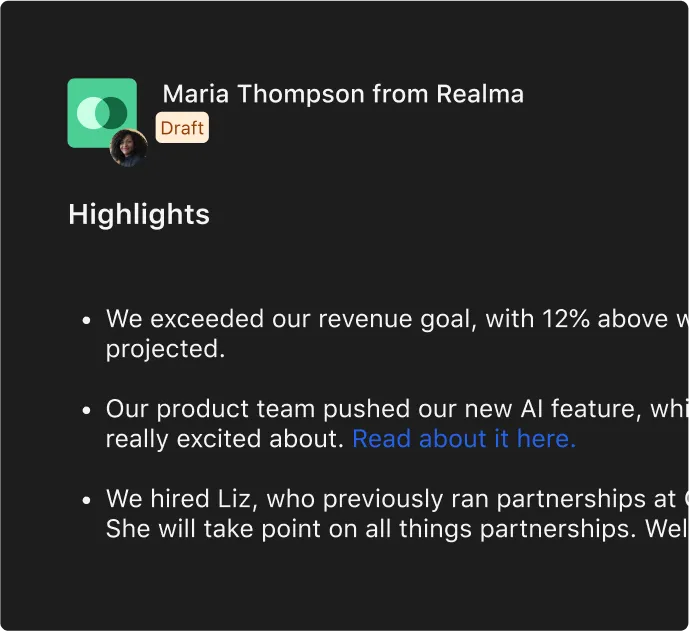

Dashboards are a key part of how founders maintain consistent, transparent relationships with investors. By presenting up-to-date performance data, founders build credibility and encourage investor trust. The ability to summarize progress across a list of venture capital firms gives founders a stronger understanding of their relationships and communication history. Dashboards help streamline the process of sharing updates with top VC firms and top venture capital firms, reducing manual work and improving investor satisfaction.

When founders send regular updates through their dashboards, they create a rhythm of accountability and communication. Investors who consistently receive data-driven insights are more likely to stay engaged and supportive. Founders can also track which investors engage most with updates, helping them identify strong relationships and those that may need more attention. Over time, this turns reporting into a relationship-building advantage.

Benchmarking Against the Best in Venture Capital

Understanding how investors track performance can help founders benchmark their own reporting. Some of the top 100 venture capital firms are recognized for using structured dashboards that give them real-time access to company performance data. By studying how the top 100 venture capital firms in the world operate, founders can learn what investors expect in reporting and communication. Even looking at the top 50 venture capital firms and the top 100 investors in the world can offer valuable insights into what sets industry leaders apart in their data-driven decision-making.

When founders adopt similar tools and frameworks, they position themselves to operate with the same precision as the best firms. These benchmarks allow founders to communicate on equal footing, showing investors that they value measurable performance and consistent transparency. This approach can improve investor confidence during both fundraising and ongoing portfolio management.

What Founders Can Learn from Famous Venture Capitalists

Successful founders can learn much from how experienced investors operate. Famous venture capitalists often emphasize the importance of data integrity, portfolio performance tracking, and consistent reporting. Founders who study practices used by groups such as Andreessen Horowitz and Sequoia Capital can adopt strategies that help them scale efficiently and stay accountable. Observing how these investors assess performance metrics gives founders a better understanding of what to prioritize when building trust with their own investor base.

These investors are known for identifying trends early, relying on accurate data to guide their decisions. Founders can take inspiration from this by building their dashboards around leading indicators, not just lagging metrics. Doing so allows them to stay proactive about growth and fundraising readiness.

Why VC Dashboards Matter for Growing Companies

As startups grow, data complexity increases. A VC dashboard helps founders translate data into insights that guide their next steps. It ensures that both the leadership team and investors remain aligned. Founders who aim to attract top tech VC firms can benefit from dashboards that visualize their traction and growth. As companies expand internationally, the expectations of top VC firms in the US, top VC firms in the world, and top VC firms in USA reinforce the need for accurate, transparent data management.

Growth creates pressure for efficiency, and dashboards serve as a central command center for managing that complexity. They bring together data from different systems, turning disconnected numbers into a coherent story. This alignment helps teams set priorities, anticipate cash flow needs, and demonstrate consistent performance to investors during each reporting cycle.

How to Choose the Right VC Dashboard for Your Business

Selecting the right dashboard depends on a company’s stage, goals, and data needs. Founders should look for tools that are simple to use, integrate well with existing systems, and offer flexible reporting features. Comparing top VC dashboard reviews can reveal the differences in usability, customization, and data accuracy. Founders should also consider the scalability of VC fund software and the depth of insights offered by venture capital portfolio management software before making a final decision.

Before adopting a new platform, founders should evaluate what problems they are trying to solve. If the goal is to improve investor communication, ease of sharing updates should be prioritized. If the focus is on internal data analysis, then integration with financial or product metrics tools is key. Founders who take time to define success criteria will choose dashboards that evolve with their needs rather than limit them.

The Future of Venture Capital Data and Dashboard Technology

The way investors and founders use data continues to evolve. The best dashboards are now powered by automation, predictive analytics, and machine learning. These technologies improve the quality of insights and speed of decision-making. As top venture capital firms in the world continue to invest in advanced tools, founders who adopt similar systems will gain a competitive advantage. Venture capital portfolio management software will play a major role in shaping how both sides of the table track performance and identify opportunities.

In the near future, founders can expect dashboards that anticipate their needs before they arise. Predictive alerts could highlight financial risks or potential fundraising milestones. Real-time collaboration features will continue to make investor relations more interactive and transparent. Founders who embrace these innovations early will be better positioned to navigate the complexities of fundraising and growth.

Bringing It All Together

A strong VC dashboard is more than a reporting tool. It is a system that helps founders maintain alignment with investors, manage growth effectively, and make informed decisions. By understanding what makes a top VC dashboard effective, founders can create clarity around performance and communicate confidently with their investors. The result is stronger relationships, better insights, and a foundation for long-term success.

The most successful founders treat their dashboards not as administrative tasks but as strategic assets. With accurate data and consistent communication, they can move faster, raise smarter, and keep investors engaged. For any founder managing a venture-backed business, adopting a structured, data-driven approach through a top VC dashboard is one of the most valuable steps toward building a sustainable and transparent company.

Frequently Asked Questions

What is a top VC dashboard and why is it important for founders?

A top VC dashboard helps founders track key metrics, fundraising activity, and investor relationships in one place. It streamlines communication with investors, improves data accuracy, and saves time by automatically organizing performance insights. This transparency strengthens investor confidence and supports smarter decision-making during growth and fundraising.

How do VC dashboards help manage investor relationships?

VC dashboards centralize company performance data, making it easy for founders to share consistent, up-to-date insights with investors. Regular reporting through a dashboard builds trust, reduces manual updates, and helps founders identify engaged investors. This structure turns investor communication into a scalable, data-driven process that supports long-term partnerships.

What features should I look for in a top VC dashboard?

Founders should prioritize features like customizable reporting, data integrations, real-time performance tracking, and portfolio management tools. A strong VC dashboard or venture capital portfolio management software should be simple to use, adaptable for growth, and capable of delivering investor-ready updates with minimal manual effort.

How do VC dashboards compare to VC fund software?

VC dashboards and VC fund software are closely related. Dashboards focus on performance tracking and investor updates, while fund software supports overall portfolio management and financial reporting. Founders benefit from using both to align investor expectations, monitor metrics, and ensure transparency across all fundraising and performance activities.

Can using a top VC Dashboard improve fundraising outcomes?

Yes. A top VC dashboard gives founders an organized, data-backed way to present traction and milestones to investors. By visualizing growth and progress clearly, founders demonstrate accountability and transparency, which increases investor trust and improves the chances of successful fundraising rounds.

What is the future of VC dashboards and portfolio management tools?

The future of VC dashboards includes automation, predictive analytics, and AI-driven insights. These advancements will allow founders to anticipate investor needs, identify performance trends earlier, and manage data in real time. As the venture ecosystem evolves, dashboards will become indispensable tools for founders and investors alike.