For founders, managing investor relationships effectively is essential for long-term growth and sustainability. Whether you’re in the early stages of fundraising or scaling rapidly, keeping your investors informed, engaged, and confident in your progress can make a substantial difference. This guide explores the power of investor relationship management software, showing founders how the right tools can simplify complex tasks and strengthen communication, all while setting your company up for success.

What Is Investor Relationship Management Software?

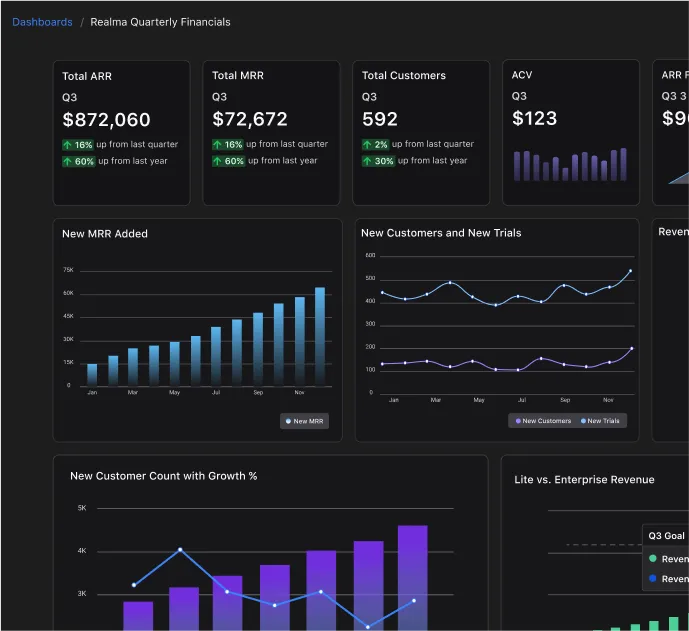

At its core, investor relationship management software is a specialized system designed to streamline how businesses manage their investor communications and data. Unlike general CRM tools that focus on customer interactions, this software caters specifically to the needs of investors, offering unique functionalities like capital tracking, automated updates, and performance reporting.

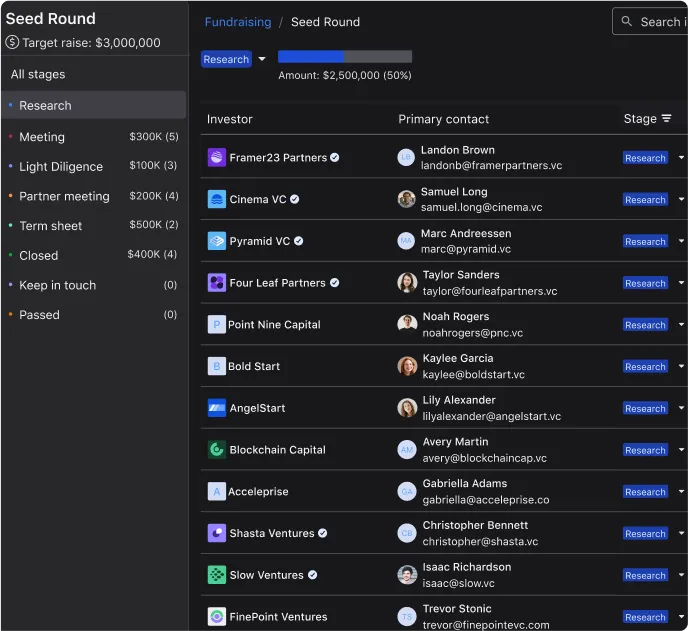

Many founders encounter terms like investor relations software, investor management software, and investor relations CRM as they explore their options. While these terms are often used interchangeably, they all center on a single goal: making investor engagement more efficient and organized. These platforms empower founders to maintain structured, up-to-date records, deliver reports with ease, and ensure every investor feels valued and informed.

Why Founders Need Investor Relationship Management Software

Managing investor relationships goes far beyond sending the occasional email update. Founders are expected to provide timely reports, respond to inquiries, and offer transparency on key business metrics. Without a reliable system, these tasks can quickly become overwhelming, especially during fundraising rounds when precision and clarity are crucial.

Investor management software helps address these challenges head-on. By centralizing data, automating regular updates, and offering visibility into investor preferences and communications, founders can save valuable time and avoid costly mistakes. Tools that include an investor crm template provide a strong starting point, helping founders standardize their reporting and communications.

Selecting the best crm for investor relations means ensuring the tool is designed for the long haul—supporting your efforts not just during active fundraising, but across the entire investor lifecycle.

Key Features to Look For in Investor Management Software

Not all investor relationship management software is created equal. Founders should prioritize software that offers robust, customizable features tailored to their business model and investor landscape. Some of the essential features include:

- Secure Data Management: Protecting sensitive investor data is non-negotiable. A trustworthy platform should have advanced security protocols to keep all records safe.

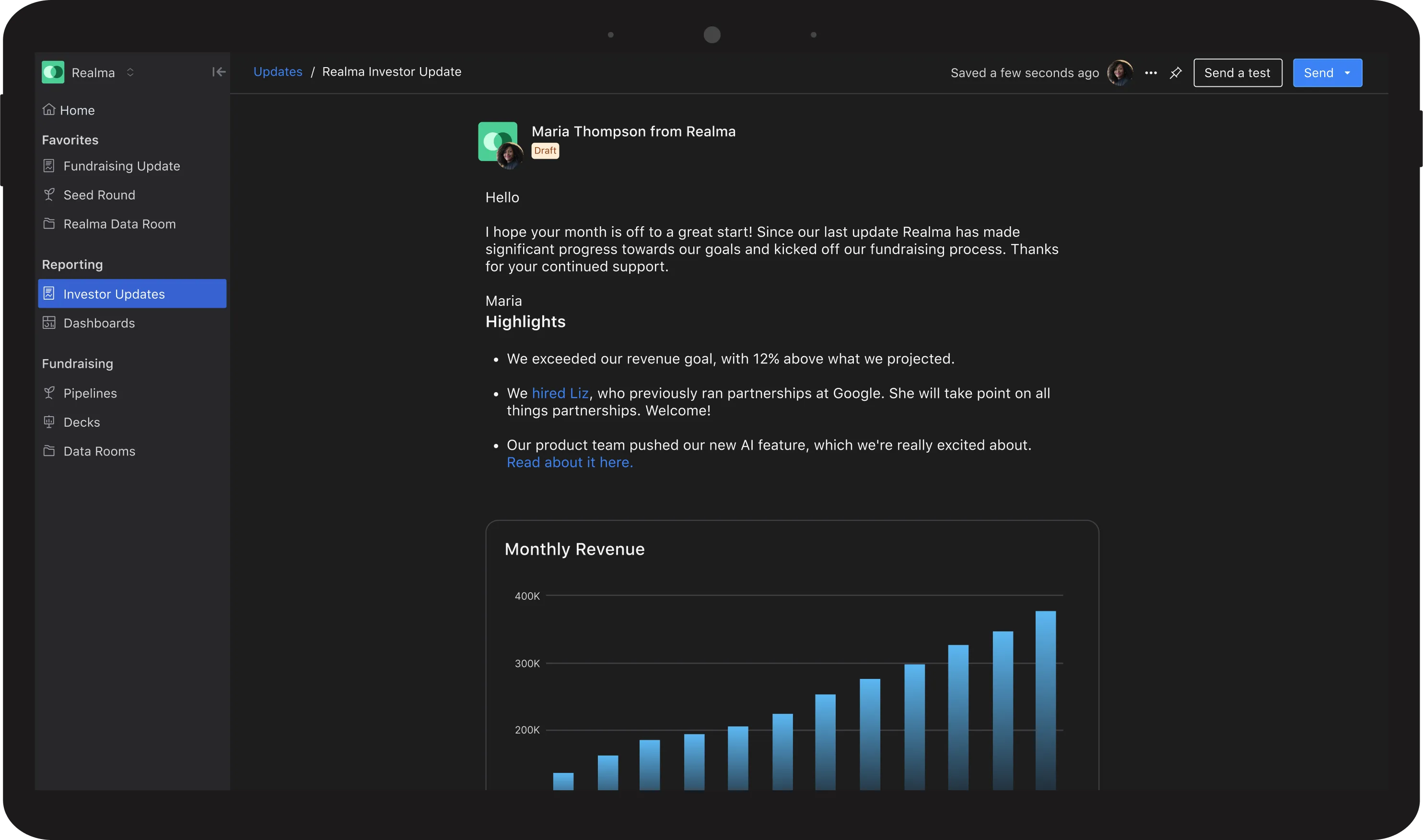

- Customizable Reporting: Investors often have unique reporting requirements. Software that allows you to tailor reports and deliver them automatically will keep your communications seamless.

- Automated Updates: Founders can benefit from tools that handle routine tasks like sending quarterly updates or performance summaries automatically.

- Template Availability: Access to an investor crm template free download ensures that founders have ready-made resources to jumpstart their communications.

For early-stage founders, tools offering a best investor relationship management software free option can provide much-needed functionality without adding financial strain. As your company grows, scaling into more comprehensive solutions becomes essential.

Free vs. Paid Investor Relationship Management Software: What Founders Should Know

Choosing between free and paid software options is a common crossroads for founders. Free versions of investor relationship management software can be incredibly useful, especially for startups operating on tight budgets. They typically offer essential functionalities such as basic reporting, contact management, and template downloads.

However, free tools often come with limitations—restricted user access, lower data storage, or fewer automation capabilities. For instance, while investor management software free versions might handle basic tasks, founders may need to upgrade to unlock advanced analytics or premium support. Founders should also assess tools labeled as the best crm for investor relations free carefully, ensuring they meet critical security and customization needs.

Understanding when to shift from a free tool to a paid plan is key. As your investor base grows and reporting becomes more complex, investing in a full-featured system can save time and enhance your professionalism.

How to Choose the Best Investor Relationship Management Software

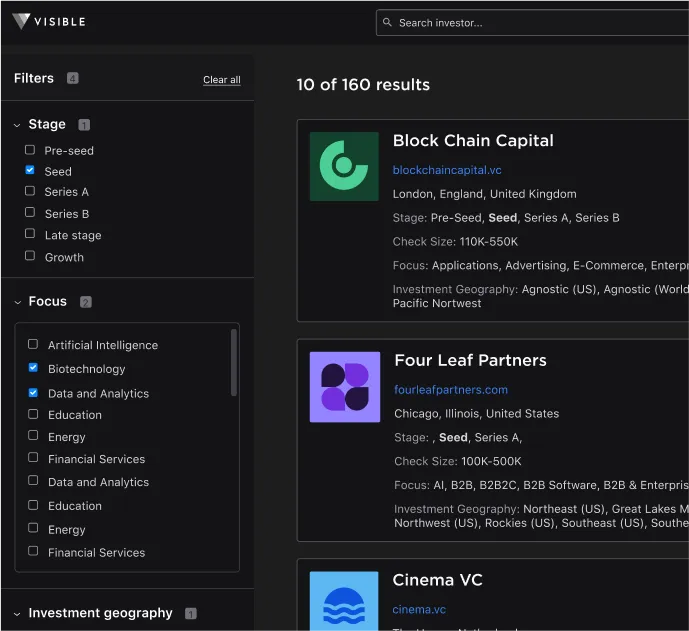

Selecting the right investor relationship management software requires a thoughtful approach. Start by mapping out your specific needs: How many investors do you have? What types of reports are required? How often do you communicate with your stakeholders?

When evaluating options, look for the following:

- Trial Versions: Many platforms offer trial periods where you can explore features before committing. Downloading a trial—whether it’s an investor relationship management software download or another tool—lets you test usability firsthand.

- Scalability: Ensure the tool can grow with you, supporting more investors and complex reporting as your company scales.

- Community Feedback: Reading reviews and founder testimonials can reveal valuable insights into usability and customer support.

If you’re seeking budget-friendly choices, tools offering an investor relationship management software download free can help you hit the ground running without upfront costs. However, always weigh long-term functionality against short-term savings.

Templates and Tools: Simplify Your Process

Templates are a founder’s best friend when it comes to efficient investor communications. Using an investor crm template free or a downloadable resource can significantly reduce the time it takes to prepare reports, investor updates, and fundraising documents.

These templates are usually customizable, allowing you to add your company’s branding, tailor messaging, and ensure consistency across all investor touchpoints. Founders can access an investor crm template free download to streamline reporting and stay organized, even during periods of rapid growth or intense fundraising efforts.

Top Picks: Best Investor Relationship Management Software for 2025

The landscape of investor management software continues to evolve, with new features and integrations making it easier than ever to maintain strong investor relations. While avoiding brand names, it’s important to highlight the types of tools that stand out:

The best investor relationship management software typically includes a combination of advanced analytics, automation, and robust security. Platforms that offer deep integration with other business systems (like accounting or project management tools) often provide a more seamless user experience.

If you’re hunting for a solution that balances cost and features, look for options branded as the best investor relationship management software free or the best crm for investor relations—these often provide a solid foundation for early-stage companies while allowing room to grow.

Getting Started: Tips for Smooth Implementation

Once you’ve chosen your preferred investor relationship management software, it’s time to roll it out effectively. Start by gathering all existing investor data—emails, notes, reports—and uploading it to the platform. Many systems allow a straightforward investor relationship management software download that simplifies the setup process.

Next, onboard your team. Ensure that key staff are trained on using the software, focusing on essential functions like reporting and automated updates. Using a reliable investor crm template during this stage helps standardize your communications right from the start.

Testing the system with a few pilot reports or updates allows you to spot any issues early and fine-tune your workflow before fully integrating it into your regular operations.

Conclusion: Building Stronger Investor Relationships with the Right Tools

Investor relationships are built on trust, transparency, and consistent communication. As a founder, choosing the right investor relationship management software is a strategic move that can strengthen these relationships and set your company on a path to sustained growth.

Whether you’re leveraging a robust paid platform or exploring investor management software free options, the key is to stay organized, proactive, and clear in your communications. Tools like an investor crm template free or a well-designed investor relationship management software download free can simplify your journey and free up time to focus on scaling your business.

In today’s fast-paced venture landscape, founders who prioritize investor engagement—and equip themselves with the best tools—gain a critical advantage in building lasting, successful partnerships.