Raise capital, update investors and engage your team from a single platform. Try Visible free for 14 days.

The cloud computing industry is a rapidly growing and innovative space attracting significant investment from venture capital firms worldwide. VCs are often attracted to cloud computing startups due to their potential for high returns, driven by factors such as the growing demand for cloud computing services and the scalability and innovation of the industry.

Accel estimates, “there is around $770 billion available to buy cloud companies, with $440 billion of cash on the balance sheets of strategic investors and $330 billion of dry powder from technology-focused private equity funds” Reuters reports.

Venture capitalist Ben Horowitz has also stated that the shift to cloud computing has created new opportunities for investment and innovation, similar to the shift from centralized mainframe computers to the current distributed model with the advent of personal computers. He predicts that cloud computing will result in a significant wave of technological innovation in areas such as networking infrastructure, storage, and servers.

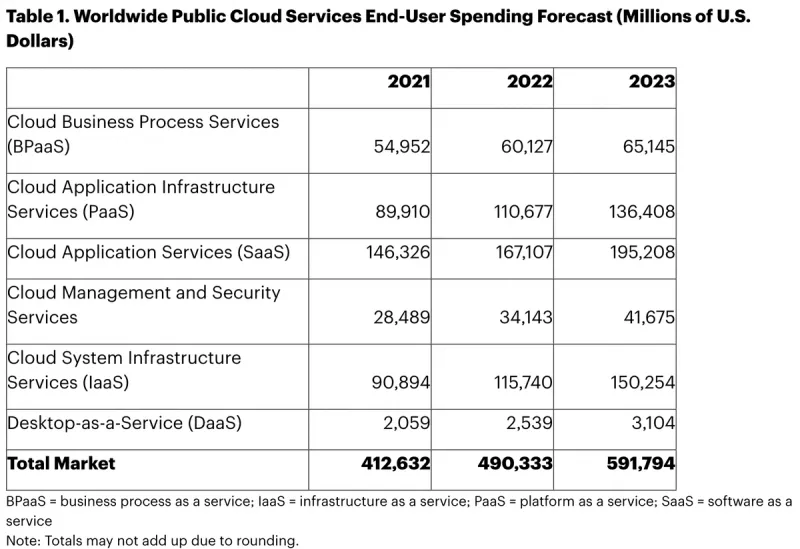

Gartner has forecasted that end-user spending on public cloud services will grow by 20.7% to reach $591.8 billion in 2023, up from $490.3 billion in 2022. The forecast indicates that infrastructure-as-a-service (IaaS) will experience the highest growth rate of 29.8% in 2023. Other segments like platform-as-a-service (PaaS), and software-as-a-service (SaaS) are also expected to see growth, with Gartner forecasting growth rates of 23.2% and 16.8% respectively for 2023. The forecast suggests that inflationary pressures and macroeconomic conditions will have a push and pull effect on cloud spending, while organizations will only spend what they have and cloud spending could decrease if overall IT budgets shrink.

Source: Gartner (October 2022)

What Makes Cloud Computing Interesting for Investors

Cloud computing startups are an attractive option for venture capitalists (VCs) due to their many advantages. One of the most significant advantages is their ability to scale services up or down as needed, which allows them to handle large amounts of traffic and data while also quickly adapting to changes in customer demand.

Another advantage is the high gross margin of cloud startups, which is driven by the low variable costs and high demand for cloud services. This means that a cloud startup can generate a high-profit margin even with a relatively small customer base, and with a subscription-based revenue model that provides a predictable and recurring revenue stream.

Cloud startups have a global reach, as they can serve customers all over the world, and can offer a wide range of services such as software as a service (SaaS), platform as a service (PaaS), and infrastructure as a service (IaaS), which allows them to target a diverse range of customers with different needs.

The exit opportunities for cloud startups are also quite attractive, including strategic acquisition and IPOs. Overall, the barrier to entry and operational costs for cloud startups are much lower than traditional software companies, making it relatively easy for them to get started with a small amount of capital and have a high earning potential.

Metrics Specific to Cloud Companies That Startups Should Be Tracking

Tracking vital metrics specific to cloud computing is crucial to ensure its success and growth. These metrics provide insight into the performance, scalability, and efficiency of your cloud services, and can help identify areas for improvement. For example, tracking metrics such as network traffic, storage usage, and server utilization can help a cloud company optimize their infrastructure and reduce costs.

Monitoring customer engagement metrics such as sign-ups, retention, and customer lifetime value can provide valuable insight into customer behavior and help inform product development and marketing strategies.

Additionally, tracking metrics related to security and compliance, such as data breaches and regulatory compliance, can help a cloud company ensure that they are meeting industry standards and protecting their customers’ data.

By tracking these vital metrics, cloud companies can make data-driven decisions, improve their services, and ultimately drive growth and profitability

- Network traffic: Measuring the amount of data that is transferred in and out of the cloud environment can help identify bottlenecks and optimize infrastructure.

- Throughput: The number of requests or data transfer per second that a cloud service can handle.

- Storage usage: Tracking how much storage space is being used can help identify areas where capacity needs to be increased or optimized.

- Server utilization: Measuring the utilization of servers can help identify underutilized resources and optimize the allocation of resources.

- Cloud resource costs: Monitoring the cost of resources such as compute, storage, and network can help cloud companies optimize their resource usage and reduce costs.

- Sign-ups and retention: Measuring the number of customers signing up for services and the rate of customer retention can provide valuable insight into customer behavior and help inform product development and marketing strategies.

- Customer lifetime value: Tracking the revenue generated by each customer over time can help cloud companies identify their most valuable customers and target their marketing efforts.

- Data breaches: Tracking incidents of data breaches can help cloud companies identify vulnerabilities in their security systems and take appropriate measures to protect customer data. The number of security incidents and the response time to them.

- Regulatory compliance: Monitoring compliance with industry regulations such as HIPAA, SOC2, and PCI-DSS can help cloud companies ensure that they are meeting industry standards and protecting customer data. As well as the number of compliance requirements that the company’s cloud service meets.

- Service availability: Measuring the availability of cloud services can help cloud companies identify and resolve issues affecting service uptime and availability to customers.

- Latency: The time it takes for data to be transferred to and from the cloud.

Painless Metric Tracking with Visible, try for free for 14 days here!

Future of Cloud Computing

The cloud computing industry is constantly evolving and the future is expected to bring some significant changes. One of the major trends that is expected to shape the cloud industry in the coming years is the increased adoption of multi-cloud and hybrid cloud strategies.

Organizations are increasingly recognizing the benefits of using a combination of public and private clouds to meet their specific needs. Multi-cloud and hybrid cloud strategies allow organizations to take advantage of the benefits of different cloud providers and to build more resilient and flexible IT infrastructure. This approach enables organizations to choose the right cloud for the right workload and to avoid vendor lock-in.

Another trend that is expected to shape the future of cloud computing is the emergence of edge computing. Edge computing is the practice of bringing computing power closer to the edge of the network, in order to reduce latency and improve performance. As organizations look to support new use cases such as IoT and real-time analytics, edge computing will become more prevalent.

As the adoption of cloud services continues to grow, there will be an increased emphasis on security and compliance. Organizations will be looking to protect their data and comply with industry regulations, which will drive innovation in areas such as identity and access management, data encryption, and threat detection and response.

Finally, advancements in artificial intelligence (AI) and machine learning (ML) will continue to shape the cloud industry in the future. Cloud providers will continue to invest in these technologies, making them more accessible and affordable for organizations. This will enable organizations to leverage these technologies to improve their operations, automate repetitive tasks and gain insights from data.

Resources for Cloud Startups

- Cloud industry groups like the Cloud Industry Forum (CIF) and the Cloud Security Alliance (CSA) provide information, resources, and networking opportunities for cloud startups. These groups offer information on industry standards, best practices, and regulatory compliance, and host events and webinars to connect startups with other industry professionals.

- Cloud-focused communities and forums: Cloud-focused communities and forums like Stack Overflow and Quora provide a platform for cloud startups to connect with other industry professionals and share information and resources.

- Professional services: Professional service providers like Deloitte, PwC, and KPMG offer advisory services and cloud computing consulting to startups. They can help startups with cloud strategy, cloud migration, and cloud optimization.

- Cloud providers: Cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) offer a wide range of services, tools, and resources for cloud startups. These providers offer various services such as storage, computing power, and databases that startups can use to build and run their applications.

VCs Investing in the Cloud Computing Space

Ignition Partners

Location: Washington, United States

About: Ignition Partners, a dedicated early-stage enterprise software venture capital firm, invests based on decades of operating experience and enterprise relationships. We have lived through the transitions from mainframe to mini to PC to cloud. We are the only firm operating with significant footprints in both Seattle and Silicon Valley, and our network has a global reach.

Investment Stages: Seed, Series A, Series B, Growth

Recent Investments:

- Snaplogic

- Archipelago

- Aviatrix

New Enterprise Associates

Location: Menlo Park, California, United States

About: New Enterprise Associates is a global venture capital firm investing in technology and healthcare.

Investment Stages: Pre-Seed, Seed, Series A, Series B, Series C, Growth

Recent Investments:

- Regression Games

- PixieBrix

- Timescale

Intel Capital

Location: Santa Clara, California, United States

About: Intel Capital is a force multiplier for early-stage startups – inspiring and investing in the future of compute via investments in Cloud, Silicon, Devices, and Frontier.

Investment Stages: Pre-Seed, Seed, Series A, Series B, Growth

Recent Investments:

- SaVia

- Medical Informatics

- Astera Labs

Mohr Davidow Ventures

Location: San Mateo, California, United States

About: For 30 years the Mohr Davidow Ventures (MDV) team has invested in early-stage technology-based startups that redefine or create large new markets. The firm partners with exceptional entrepreneurs to build companies where big data, applied analytics, and the reach and power of the web/mobile cloud can be leveraged to drive emerging opportunities in verticals ranging from social commerce to finance to online marketing to consumer-driven healthcare and cleantech IT.

Investment Stages: Seed, Series A, Series B

Recent Investments:

- Kabbage

- Aryaka

- Webscale

Battery Ventures

Location: Boston, Massachusetts, United States

About: Battery Ventures is a leading venture capital firm focused on investing in technology companies at all stages of growth. With a team of over 30 experienced investment professionals, Battery leverages its people, expertise and capital to actively guide companies to category dominance. The firm has invested in over 160 technology companies worldwide across the communications, software, infrastructure, and media and content industries.

Investment Stages: Pre-Seed, Seed, Series A, Series B

Recent Investments:

- Seek AI

- Mews

- Galileo

Aspect Ventures

Location: San Francisco, California, United States

About: Aspect Ventures is a venture capital firm investing in the emerging mobile marketplace.

Investment Stages: Seed, Series B, Growth

Recent Investments:

- Silverfort

- Future Family

- Vida Health

F-Prime Capital

Location: Cambridge, Massachusetts, United States

About: F-Prime grew from one of America’s great entrepreneurial success stories. Fidelity Investments was founded in 1946 and grew from a single mutual fund into one of the largest asset management firms in the world, with over $2 trillion under management. For the last fifty years, our independent venture capital group has had the privilege of backing other great entrepreneurs as they built ground-breaking companies, including Atari, Ironwood Pharmaceuticals and MCI.

Investment Stages: Seed, Series A, Series B

Recent Investments:

- Neumora Therapeutics

- Elicidata

- Ashby

Formation 8

Location: San Francisco, California, United States

About: Formation 8, a California-based technology investment firm, focuses on seed, early, and later stage venture investments.

Investment Stages: Seed, Series A, Series B, Growth

Recent Investments:

- Aviatrix

- Ascus Biosciences

- Fieldwire

Looking for Funding? We can help

We believe great outcomes happen when founders forge relationships with investors and potential investors. We created our Connect Investor Database to help you in the first step of this journey.

Instead of wasting time trying to figure out investor fit and profile for their given stage and industry, we created filters allowing you to find VCs and accelerators who are looking to invest in companies like yours. Check out all our investors here and filter as needed. To help craft that first email check out 5 Strategies for Cold Emailing Potential Investors.

Related Resource: All-Encompassing Startup Fundraising Guide

After finding the right Investor you can create a personalized investor database with Visible. Combine qualified investors from Visible Connect with your own investor lists to share targeted Updates, decks, and dashboards. Start your free trial here.