For venture-backed startups, managing investor relations, fundraising, and mergers and acquisitions (M&A) requires seamless organization and security. A virtual data room offers startups a structured way to store and share confidential documents with investors, ensuring transparency and efficiency. Many founders search for the best data room providers in the USA to find a secure and compliant solution that meets investor expectations. Others look for guidance on structuring their documents, often seeking a data room for investors example to understand how their virtual data room should be organized.

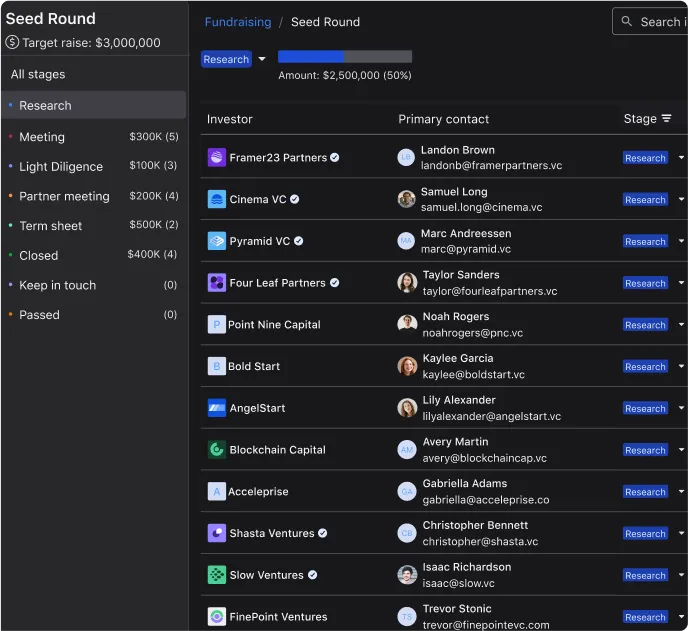

A well-structured data room for investors plays a critical role in due diligence, giving potential backers a clear view of a company’s financials, legal agreements, and strategic plans. For startups considering an exit, M&A data room providers in the USA ensure smooth document sharing with buyers and legal teams. This guide explores how to choose the best virtual data room for startups, what features to look for, and how to use a startup data room checklist to prepare for investor scrutiny.

What is a Virtual Data Room and How Does It Work?

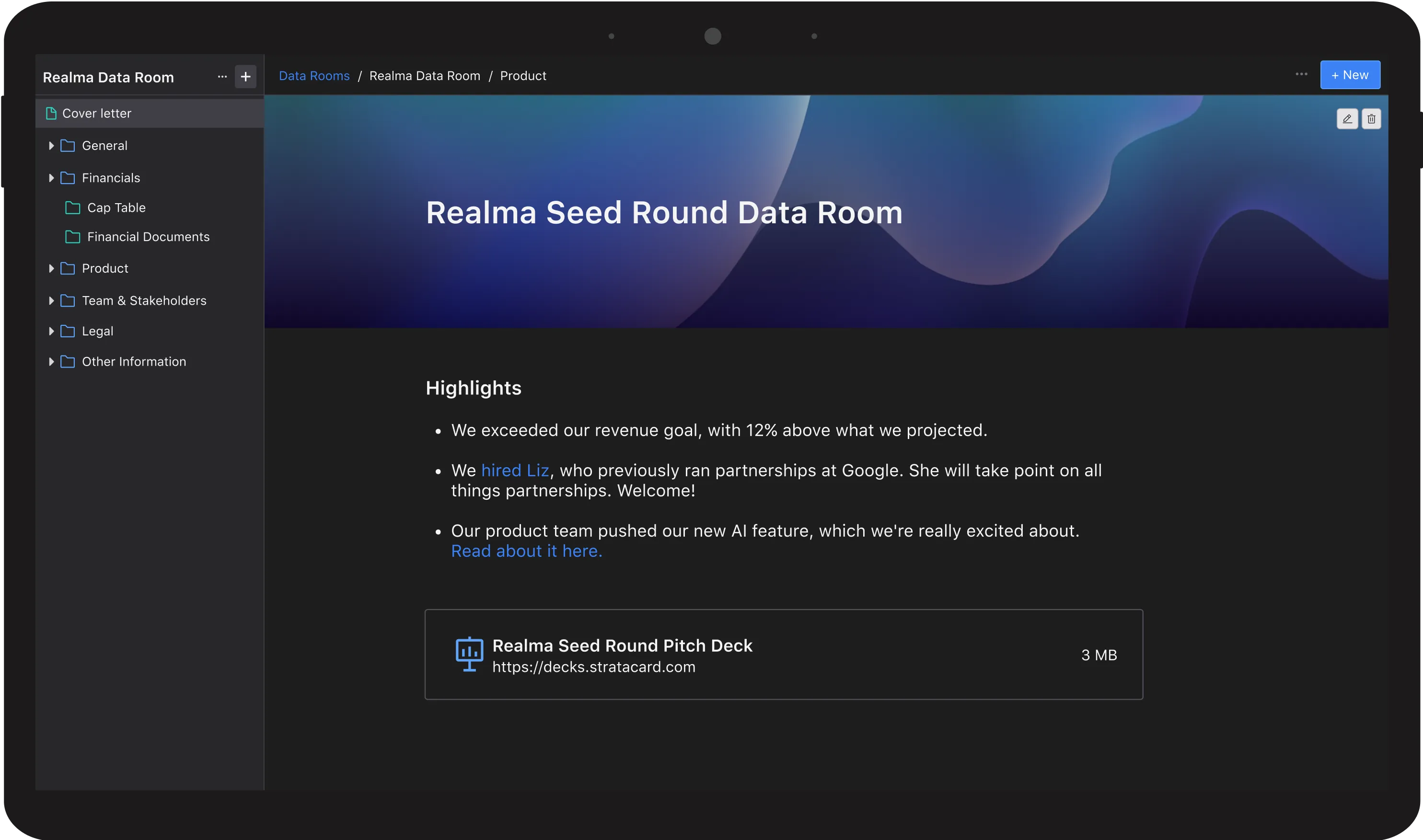

A virtual data room (VDR) is a secure online repository where startups store sensitive documents for fundraising, M&A, and investor relations. Unlike general cloud storage platforms, virtual data room providers offer enhanced security features such as encrypted file access, permission settings, and audit logs. These tools help startups manage confidential information efficiently while ensuring compliance with investor expectations and regulatory requirements.

There are various virtual data room examples that demonstrate their use across different stages of a startup’s growth. A pre-seed data room might contain an early-stage financial model, founder agreements, and a pitch deck to present to angel investors and pre-seed funds. As a startup progresses to a Series A or later round, a data room for investors example might include in-depth financial projections, customer contracts, and legal compliance documents to address due diligence requirements. Startups pursuing acquisitions or partnerships typically set up an M&A data room, where potential buyers can access revenue breakdowns, market expansion plans, and intellectual property filings securely.

Key Benefits of Using a Data Room for Startups

A well-organized data room for investors allows startups to present information clearly and securely, reducing the back-and-forth communication often required to satisfy due diligence requirements. A pre-seed data room can streamline fundraising by allowing investors to quickly access essential documents, reducing delays in securing commitments.

For companies further along, a startup data room checklist ensures all necessary documents are in place for due diligence, eliminating confusion and making the process smoother. M&A data room providers in the USA offer additional advantages for companies looking to merge or sell, allowing multiple stakeholders to access the same set of documents securely without compromising sensitive information.

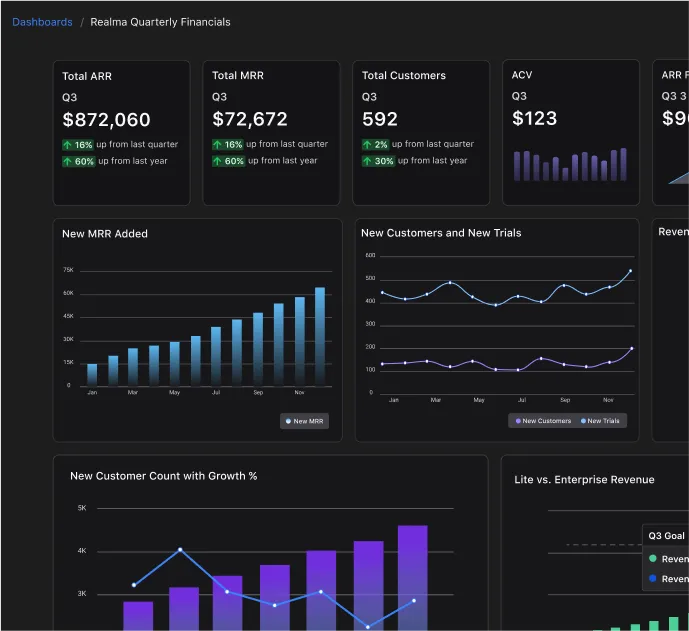

Another major benefit of using the best virtual data rooms is the ability to track investor engagement. Many best data room providers offer analytics that show which investors are viewing specific documents and how much time they are spending on them. This insight can help founders gauge investor interest and prioritize follow-ups.

The Best Virtual Data Room for Startups: Features to Look For

Choosing the best data room for startups requires evaluating key features such as security, usability, customization, and affordability. Security should be a top priority, with features like end-to-end encryption, two-factor authentication, and detailed access controls. Usability is equally important, as a complex system can slow down the fundraising process. Founders should look for a simple, intuitive interface that allows them to upload, organize, and share documents effortlessly.

Customization is another essential factor. A good data room should allow startups to create folders based on a data room for investors checklist, ensuring that information is well-structured and easy to access. Affordability is also a consideration, particularly for early-stage companies. While there are free data room for startups options available, they may lack advanced features. Many founders search for the best data room for startups free to determine whether a free version meets their needs before upgrading to a premium plan.

Data Room for Investors Checklist: What to Include

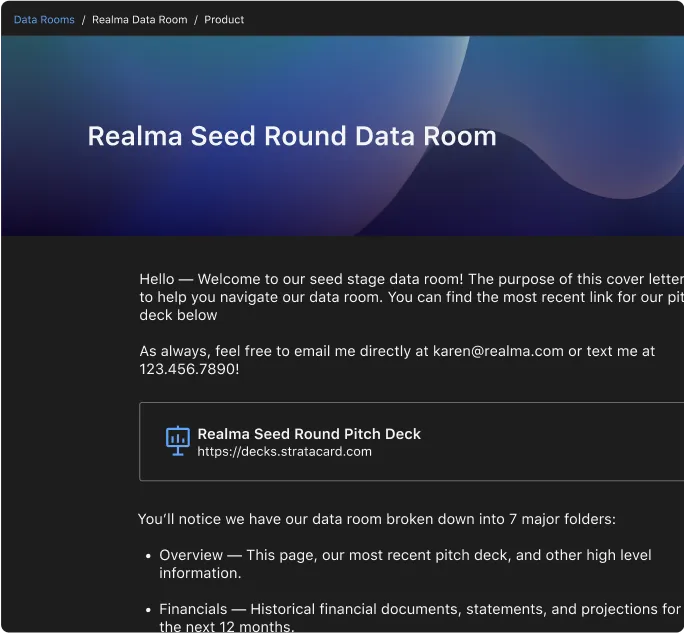

A well-prepared virtual data room for startups should include corporate documents, financial records, and legal agreements. Corporate documents might consist of a certificate of incorporation, founders’ agreements, and board meeting minutes. Financial records should include profit and loss statements, balance sheets, and revenue projections, offering investors a clear view of the company’s financial health.

Legal and compliance documents such as investor contracts, patents, intellectual property filings, and key employment agreements should also be included. A detailed startup data room checklist ensures nothing is overlooked, making due diligence smoother and more efficient.

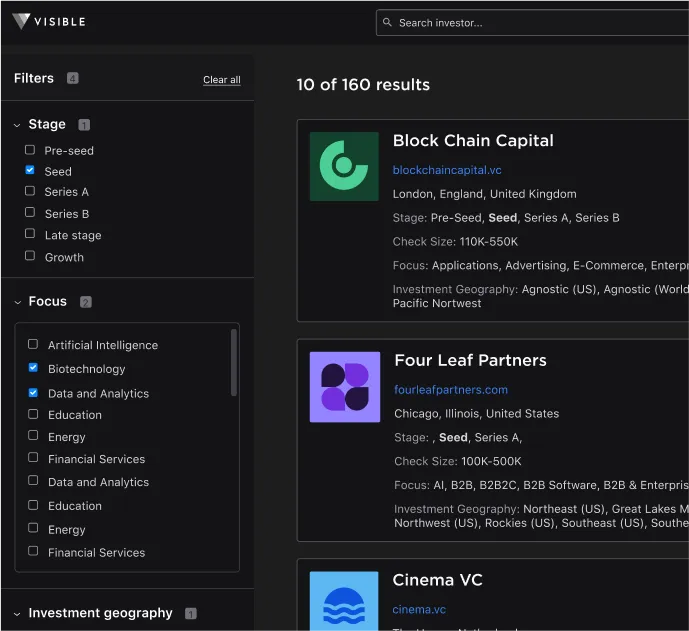

Choosing the Right Virtual Data Room Provider

Selecting the best virtual data room for startups depends on factors such as the stage of fundraising, investor expectations, and budget. A pre-seed data room requires fewer features than an M&A-level virtual data room, but security and organization remain critical at every stage. Some best data room providers in the USA cater specifically to venture-backed startups, offering features designed for investor relations and due diligence.

Budget-conscious founders may consider a free data room for startups, but it is essential to verify that security measures and compliance standards meet investor expectations. While a free solution may be sufficient for early-stage fundraising, a startup preparing for a Series A or an acquisition may need to upgrade to a more advanced platform.

Free and Affordable Virtual Data Room Options for Startups

For startups operating on a limited budget, exploring virtual data room free options can be a cost-effective way to organize investor materials. However, free plans often come with restrictions such as limited storage capacity, fewer security features, and a lack of investor tracking capabilities.

While a free data room for startups may work for pre-seed data room needs, companies should evaluate whether it can support growing data requirements as they scale. Many founders looking for the best data room for startups free eventually transition to a paid version to access more advanced features.

Virtual Data Rooms for M&A: What Startups Should Know

For startups pursuing mergers and acquisitions, an M&A data room is essential for ensuring smooth due diligence. The best M&A data room providers in the USA offer compliance with regulatory requirements, advanced access controls, and real-time document versioning. Using M&A data room providers in the USA ensures that sensitive financial and legal documents remain secure throughout the transaction.

Startups should prepare an M&A data room checklist that includes financial statements, legal contracts, intellectual property documentation, and key employee agreements. A well-organized virtual data room M&A allows potential buyers to review all necessary information efficiently, increasing the chances of a successful deal.

Setting Up Your Startup’s Data Room for Success

A well-structured virtual data room for startups is a valuable tool for managing investor relations, securing funding, and facilitating M&A transactions. By selecting the best data room providers, founders can present their business professionally and securely.

Before launching a startup data room, founders should follow a data room for investors checklist to ensure all necessary documents are included. Choosing the best virtual data room for startups depends on the company’s funding stage, security requirements, and budget. While some free data room for startups options are available, a paid version often provides the necessary features to support growth and investor engagement.

With the right virtual data room providers, startups can confidently engage with investors, secure funding, and position themselves for future success.