Raising capital for a business is hard. On top of building a fundable business, you need to find the right investors for your business. One of the aspects founders will look to first in an investor is their location.

Some investors (VCs and angel investors) will invest based on a company’s location. Finding a list of investors in your area can be a great way to start building a fundraising list (of course you’ll want to make sure the investor fits your other criteria too).

Related Resource: Venture Capitalist vs. Angel Investor

If you are a startup based in Miami or the surrounding area, check out the list of angel investors in the area below:

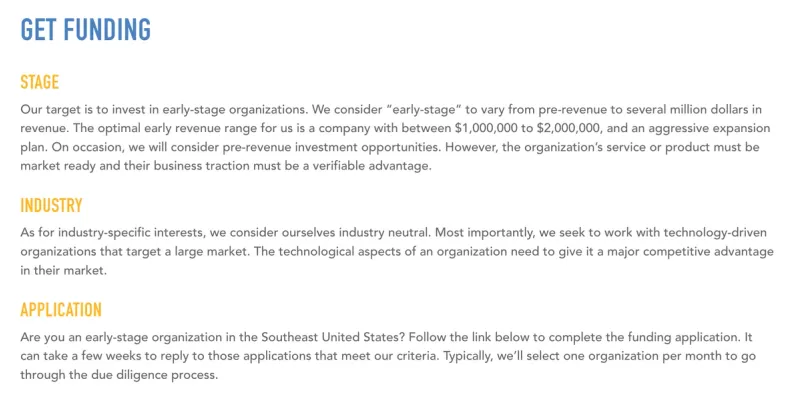

1. Gold Coast Angel Investors

As put by the team at Gold Coast Angel Investors, “Gold Coast Angel Investors is an early-stage investment group based in Miami, FL. We enjoy the process of mentoring and helping aspiring entrepreneurs while pursuing maximized returns…

If you’re a business that is ready to pitch to our angels, see more information about getting funding. We try to target South Florida for our investments but look for the best deal possible for our members, whether in Miami, Manhattan, or Menlo Park, CA.”

A bit more research on the Gold Coast Angel Investors site and you’ll find that when evaluating a company’s stage and industry, they’ll look for the following (visit the link directly here):

2. Black Angels Miami

As put by the team at Black Angels Miami, “We are connecting amazing members/investors and founders. Opening the door to the technology startups eco-system. Enabling access to top-notch investment opportunities across the country.

Changing the landscape of venture investing by leveraging the value of diversity.

BAM believes diverse perspectives improve investment outcomes. With this in mind, we intend to recruit members of all races, creeds, and orientations while proactively increasing participation by Black investors.”

Black Angels Miami does not make direct investment into companies but can make introductions to investors that are fit for your company. You can check out a few of the things they look for in potential candidates below (direct link here):

3. Miami Angels

As put by the team at Miami Angels, “Our group is comprised of over 150 angel investors, many of whom have been entrepreneurs themselves. Beyond providing capital, we collaborate with our founders to ensure they have access to talent and future funding…

Miami Angels’ broad and diverse membership base allows us to invest across multiple industry sectors at the post-launch Seed Stage. We look at companies where our expertise can have a real impact. We invest in US-based, post-launch SaaS-enabled companies.”

You can learn more about what Miami Angels looks for in an investment by using their investment criteria doc:

4. New World Angels

As put by the team at New World Angels, “New World Angels is a group of Florida business leaders who provide funding, knowledge, and guidance to entrepreneurs building early-stage companies. We seek entrepreneurs from diverse backgrounds and cultures. We seek to fund entrepreneurs and products that can create real impact in marketplaces and across our society.”

New World Angels allows you to apply for investment directly on their website. Before starting your application, you’ll want to make sure that you are fit for them. They lay out criteria below (or direct link here):

“New World Angel investors focus on early-stage companies, usually in Florida, that are seeking their first or second major outside investment. We typically make investments ranging from $250K through $2 Million. We can lead larger investment rounds in syndication with other investment firms. We typically focus on companies with valuations under $20MM.”

5. Access Silicon Valley Miami

As put by the team at Access Silicon Valley, “Access Silicon Valley is the “virtual bridge” to Silicon Valley, where startup entrepreneurs and serial entrepreneurs in real-time, get access to relevant content, and have the opportunity to interact with, angels, VCs and great entrepreneurs that they otherwise wouldn’t get the opportunity to see, hear or possibly connect with. In addition, we have put together valuable workshops to prepare startup entrepreneurs for the roller coaster ride of the startup world! We encourage you to join us.”

Access Silicon Valley does not make direct investment but they host virtual events and offer resources to help entrepreneurs find investors and angel investors in their community.

Related Resource: How to Effectively Find + Secure Angel Investors for Your Startup

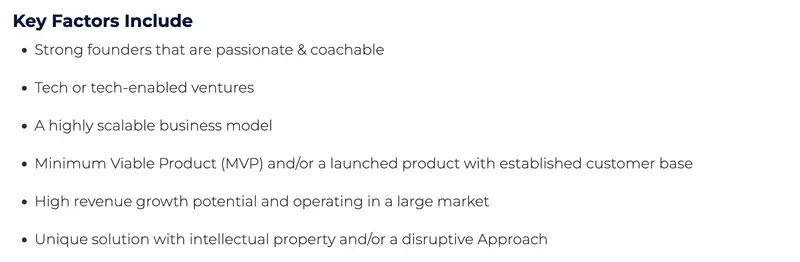

6. Florida Funders

As put by the team at Florida Funders, “Florida Funders is a hybrid between a venture capital fund and an angel investor network that discovers, funds and builds early-stage technology companies in Florida. We exist to evolve Florida from the Sunshine State to the Startup State by ensuring there is as little friction as possible in the ecosystem, that investors have access to meaningful deal flow and entrepreneurs have access to a wide range of accredited investors.”

Florida Funders has a thorough list of criteria, FAQ, and information for founders looking for investment (direct link here). You can check out their general criteria below:

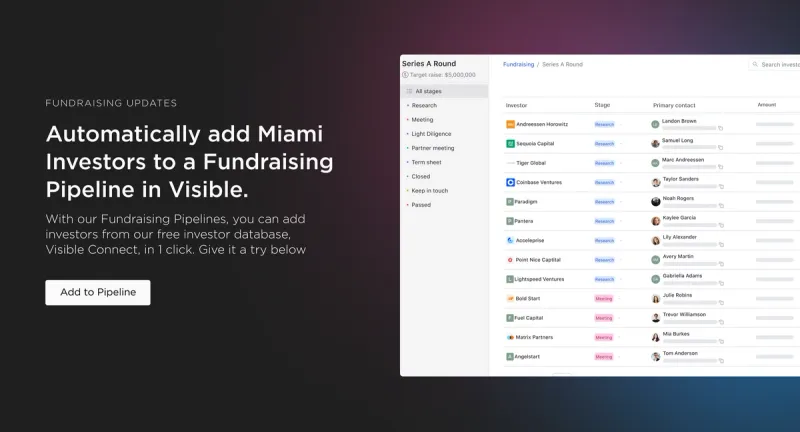

Visible Helps You Connect With Angel Investors in Miami

Finding the right investors for your business is only half the battle. With Visible, you can…

- Find the right investors for your startup with Visible Connect, our free investor database

- Manage and track the status of your raise with our Fundraising CRM

- Upload and share your pitch deck with investors in your pipeline

- Build and share your data room directly from Visible when working through due diligence and the final stages of your raise.

Manage every aspect of your raise all from one platform. Give Visible a free try for 14 days here.