Every first-time founder hits the point in their company-building journey where they need to make a decision about fundraising. Once a founder decides that fundraising is the right move, the decision about who to raise money from comes into question. If you’re an early or first-time founder, or a first-time-to-fundraising founder, it can be tricky to understand the difference between venture capitalists and angel investors and even trickier to understand when to pitch to each type of investor. Read on to learn about Venture Capitalists vs. Angel Investors.

What are Venture Capitalists?

Venture Capitalists are private equity investors. Typically, VC funds are formed as limited partnerships, or LPs, where the partners invest into the fund. VCs are high-wealth individuals that choose to invest into a private fund and trust the fund (VC firm) to handle the decision making around what investments to pour that money into. If a fund makes money on an investment, they may choose to re-invest that money earned back into the fund.

Venture Capital endeavors as a whole are risky because there is no certainty that investing in young, unproven companies will pay off. However, the advantage might be that having a team managing the fund full-time, assessing risk, and conducting market research may lead to smarter investments overall. It typically takes 3-7 years (at least, usually more) to get any potential returns back to the investors in a VC.

The first Venture Capitalist firms started appearing in the U.S. in the mid 1900s. They have been especially popular in the technology sector.

What are Angel Investors?

Angel Investors are high-wealth individuals that use their own money to invest directly into a startup or early-stage company or founder. Often, angel investors may invest in friends or family starting a business and ultimately make their investment decisions themselves vs. trusting a managed, private fund to do so. Due to the high-risk nature of investing in startups or early-stage companies, investors will typically not allow angel investing to make up more than 10% of their investment portfolio.

The term “angel” originated from Broadway, where wealthy individuals would pay large sums of money to see productions moved forward. These investors were the “Angels” of Broadway.

In order to successfully pull-off a fundraise, early-stage founders need to understand not only the difference between Venture Capitalists and Angel Investors but also when it might be wise to raise from each.

Related Resource: Top 6 Angel Investors in Miami

When to Pitch Venture Capitalists

Diving a bit deeper into the structure of a Venture Capital firm, it’s important to understand the general partner vs. limited partner split. The General Partner is typically the VC fund itself, with the partners of that firm managing the assets of the firm. The wealthy individuals, insurance companies, pension funds, foundations, and corporate pension funds that may pool money together into the fund are the limited partners. They have a stake but they don’t make the funding decisions.

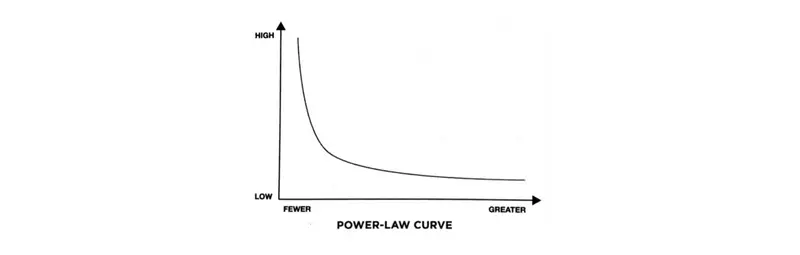

VCs are looking to make investments that put them in the most optimal spot on the Power Law Curve. Instead of normal distribution, they follow the power law curve which is when the distribution of returns is heavily skewed – a small % of firms capture a large % of industry returns. Firms, of course, want to be in that winning percentage. VCs are looking for a unicorn. A unicorn is a startup with a value over 1 billion. This of course is rare, but those rarities are what VCs believe will drive them to the better part of the Power Law Curve.

When deciding to pitch to a VC, its important to understand what they are looking for. VCs are looking for a strong combination of product, market, and team.

Product is important to VCs. They want to see that a product is different enough to stand-out, and has enough potential to grow and be used heavily in it’s space. Your product should feel like a need to have NOT a nice to have.

Market matters to VCs too. The larger the potential market and the less crowded the space, the better If the market opportunity potential is huge for early-founders startups, that combined with a potential leading product in a space can be a powerful combination. Although, too untapped of a market (for example, if you’re the first in your space) might be too much risk for a VC.

A killer Team may be the differentiator for a startup where the market is average and the product needs work. VCs are taking big risks investing in startups, therefore if they know the startup is led by seasoned industry veterans or previously-successful founders, they may be willing to take more of a risk on you in order to work with those individuals and have more trust that the work will get done.

If you’re a startup founder that is confident in your product, the market you’re looking to disrupt, and the team at the helm of your company – Pitching a VC might be the right move for your company.

When to Pitch Angel Investors

While VCs are looking for that perfect mix of Market, Product, and Team and always searching for the elusive unicorn to double or triple their money, Angels may be a better bet if you’re extremely small and looking to get started vs. scale rapidly. Typically, angels offer better terms for investment. Angels of course still look for returns. However, they may also invest because they are passionate about the space, and because it’s their money directly, are more open to investing in an idea that will potentially just make them their money back in order to help a new entrepreneur get off the ground. Funding rounds with angel investors are often called “friends and family” rounds because its much more common for individuals to invest in those they care about and believe in vs. the biggest and best ideas.

Angel investors are better to pitch to when your company is extremely early stage. When starting the company look to close friends, family, and professionals that can make a small investment and when you’re ready to scale quickly and take more risk after you’ve proven your concept a bit more, turn to VCs.

Recommended Reading: The Understandable Guide to Startup Funding Stages